Difference Between Stock vs Equities

- Equity. Equity means the value of a business after all the liabilities are paid off. ...

- Stocks. Stock means the value of capital raised by a company by going public i.e. ...

- Head to Head Comparison between Stock vs Equities (Infographics)

- Key Differences between Stock vs Equities. ...

- Stock vs Equities Comparison Table. ...

- Conclusion. ...

- Recommended Articles. ...

Full Answer

What is common equity or common stock?

Jul 15, 2015 · Stock owners share in a company's success via dividend payments or price growth or both. Equity market is a broad term for many stock exchanges around the world that match buyers and sellers of...

What is “equity” in stock market?

While equity describes ownership, a stock describes a single unit of that ownership share. The more stock you buy, the more your equity. Put simply, a stock is the means with which you can engage in company equity transactions.

How to find common stockholders equity?

Dec 12, 2017 · So what’s the difference between equity and stock? Equity is the difference between the total value of an asset and the value of its liabilities of something that is owed. The stock of a business or corporation is composed of the equity stock of the owners. This means that equity and stock are essentially the same.

What are some examples of equity investments?

Nov 22, 2019 · The difference between equity and stock is that stock is only one form of equity. Stock represents the shareholders' stake in a company. Corporate equity includes that plus profits the company keeps in its coffers. Partnerships and sole proprietorships have owners' equity but don't issue stock.

Is equity and stock the same thing?

Stocks and equity are same, as both represent the ownership in an entity (company) and are traded on the stock exchanges. Equity by definition means ownership of assets after the debt is paid off. Stock generally refers to traded equity.Jul 10, 2017

Does stock mean equity?

Stock is a type of equity. This means that all stocks are equity, but not all equity is stocks. Equity refers to a portion of a company that is owned by its investors. Most common type of equity is shares of stock that can be bought and sold on the stock market.Jun 17, 2020

What are the 4 types of stocks?

What Are The Different Types Of Stock?Common Stock. When investment professionals talk about stock, they almost always mean common stock. ... Preferred Stock. ... Class A Stock and Class B Stock. ... Large-Cap Stocks. ... Mid-Cap Stocks. ... Small-Cap Stocks. ... Growth Stocks. ... Value Stocks.More items...•Feb 10, 2022

Are stocks equity or assets?

Stocks are financial assets, not real assets. A financial asset is a liquid asset that gets its value from a contractual right or ownership claim.

What is a share of stock?

A share of stock represents an equity interest in a company. That is, the investor is buying an ownership stake in the company in the expectation of receiving a share of the profits in the form of dividends, or benefiting from the growth of its stock price, or both.

What are the two types of stock?

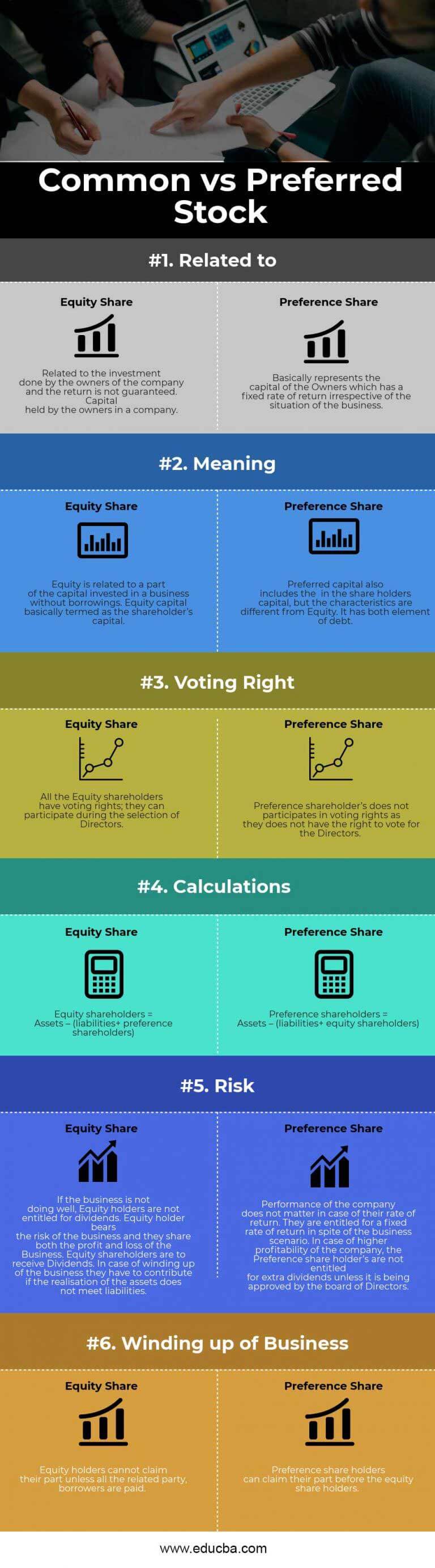

There are two primary types of stock that companies issue: common stock and preferred stock. The trade in common stock is far more active, and when a stock price is quoted it always refers to the price of a single share of common stock.

What is the purpose of selling shares in a company?

To a company, selling shares is a way to raise cash to expand the business.

What is preferred stock?

Preferred stock shares are viewed as a hybrid of a stock and a bond. An alternative for a company in search of financing is issuing bonds. A bond is a form of debt that is repaid over time with interest. Most public companies over time issue both stock shares and bonds.

What does it mean to sell shares?

To a company, selling shares is a way to raise cash to expand the business. In order to do so, it lists its stock on one of the stock exchanges, such as the New York Stock Exchange, the Nasdaq, or the London Stock Exchange.

Do preferred stock holders have voting rights?

Preferred stock owners do not usually have voting rights. However, preferred stock shares are issued with a guaranteed payment at regular intervals of larger dividends than common stockholders receive. Shares of preferred stocks do not tend to rise or fall in price as sharply as common shares over time.

Do preferred stocks rise or fall?

Shares of preferred stocks do not tend to rise or fall in price as sharply as common shares over time. Investors value them for their dividends, not for their potential for growth. That makes preferred stock shares a kind of hybrid of a stock and a bond.

What is the difference between equity and stock?

While equity describes ownership, a stock describes a single unit of that ownership share. The more stock you buy, the more your equity. Put simply, a stock is the means with which you can engage in company equity transactions. Stocks are generally a tradable form of equity that was created to facilitate the exchange of ownership value in an open ...

What is the difference between stocks and equities?

The main difference is that while equities represent a stake in a company, tradable or not, stocks are generally tradable equity shares of a company that can be issued to the general public through stock exchanges.

Why do people invest in stocks?

Investing in stocks gives you an equity stake in a company and it’s viewed as one of the best ways of potentially making long-term capital gains in the financial markets. It allows you to share in a company’s tangible profits while not being personally liable if anything untoward happens to the company.

Why is equity riskier than stocks?

Equity is comparatively riskier because it involves more than just stocks. While stockholders are only liable for amounts up to the value of the stocks they own, equity holders directly face all the complexities faced by a business entity.

What is the purpose of buying stocks?

Buying stocks is an equity investment in a company and in addition to the potential long-term profits, an investor also hopes to make some gains from dividend payments. Before buying a company’s stock and getting an ownership stake in the company, an investor has to look at several factors such as:

What happens when you buy stock?

When you buy stocks, you are buying equity in a company from someone selling part of or all of their ownership stake in the company. When you sell stocks, you are selling your equity to someone who wants to buy art of or all of your ownership stake. There are two main types of stock that companies issue:

What is equity investment?

An equity investment is typically purchased with the expectation that the value of the investment will increase over time. For instance, when you have equity in a business, you expect the value of the business to increase in value so that you can benefit from your stake in the business.

What is equity in a company?

An equity of a company as distributed among its shareholders is represented by a shareholders’ equity (i .e. stockholders’ equity or shareholders’ capital). Equity may also refer to a corporation’s capital stock. The value of a company’s capital stock is determined by the company’s future economic plans. A company that is liquidating its assets will ...

What is owner's equity?

owner’s equity) is referred to as the difference between the asset’s total value and the total value of the liabilities of something that is owed. It is expressed in this simple equation: Equity = Assets – Liabilities.

What is stock in liquidation?

Stocks are residual assets of the company during liquidation after the company’s liabilities have been settled. In fact, the word “stock” is a general term that refers to shares and equities; thus, they can be used interchangeably.

How is capital stock determined?

The value of a company’s capital stock is determined by the company’s future economic plans. A company that is liquidating its assets will only determine its equity once all its liabilities have been paid off. Owners fund the business to get it off the ground and finance each facet of its operation.

What is a convertible preferred stock?

A type of preferred stock called “convertible preferred stock” offers holders the option to convert the preferred stock into a fixed number of common shares, typically after an agreed-upon time. Shares of this kind are known as “convertible preferred shares.”.

What is capital stock?

The stock of a business (i.e. capital stock) is compose d of the equity stock of the owners of the business. A share of the stock represents a fraction of ownership of the corporation which is dependent on the total number of shares.

Is a private limited company a separate entity?

In a private limited company, the business is a separate entity as with its owners. Thus, the business owes its owners its funding in the form of share capital. Throughout the life of the business, its equity will be the difference between its assets and its liabilities (debts).

What is the difference between equity and stock?

The difference between equity and stock is that while all stock is a type of equity, there are several types of equity that are not stock. Equity in a business consists of everything the owners have invested plus any earnings the company retains. Common and preferred stocks are just one way that owners can establish an equity stake in a company.

What is corporate equity?

Equity is the owners' stake in the business. On the balance sheet, it's what's left after you subtract company liabilities from the value of company assets. Analysts compare the amount of equity and the amount of debt to figure a company's strength. Corporate equity includes: Common stock. This gives you an ownership stake in the company.

What happens to stockholders in a bankruptcy?

In the event of a corporate bankruptcy, stockholders don't have to worry about losing more than they invest. However, their equity stake is vulnerable. Owners are at the end of the line to get paid after vendors and lenders. Even if the company emerges from bankruptcy, your shares may end up worthless. References.

What is common stock?

Common stock. This gives you an ownership stake in the company. You have a vote in how the company is governed unless you own nonvoting stock. If the company issues a dividend out of its annual profits, you receive some of the money. Preferred stock.

Can you collect equity if a business closes?

Even though equity and stock both represent an ownership stake in the business, it's possible you won't be able to collect if the business closes. In a partnership or sole proprietorship, you have to pay off all your business debts, so everything you invest is at risk.

Do sole proprietors have equity?

Like partners, sole proprietors have equity in their business but not in stock form. Equity consists of whatever capital they invest in the company. If, for instance, you put $10,000 into your new business when you start it up, that's your total equity. Any assets you buy with the money remain part of your equity.

Is non stock equity retained earnings?

In a corporation, most non-stock equity is in the form of retained earnings. If the company is a partnership or a sole proprietorship, the owners' stake in the business is still equity, but it doesn't involve stock. For example, suppose two landscapers join forces in a partnership. Each partner has equity in the business, ...

What is equity vs stock option?

Equity vs Stock Option -. Equity can mean stock or shares. It is often used to refer to stock options as well, give you the right to buy a certain number of shares. Home.

Why do you buy equity?

You buy equity when the stocks trade at a certain valuation , hoping the valuation will increase and your ownership position will become more valuable. A Share of stock represents a small ownership piece of business. Most publicly traded businesses are organized as corporations, which issues a certain number of shares of common stock, ...

Why was tradable equity invented?

The reason tradable equity was invented because different people believe different things about the present and future value of a given company. Stock allows them to trade with each other based upon those different opinions and goals. The price at which the employes can purchase shares is known as the exercise price.

How to get equity in a startup?

Although there are a variety of ways to get equity as a startup employee the most common way is through stock options. A stock option is the guarantee of an employee to be able to purchase a set amount of stock at a set price regardless of future increases in value. The price at which the shares are offered is referred to as the “strike price” and when you purchase the shares at that price, you are “exercising” your options.#N#Exercising stock options is a fairly common transaction, but there are some additional rules among startups that could present problems.#N#“There’s a rule that if you leave a company your options expire in 30 or 60 days if you can’t buy them right then and there.”#N#Outside of stock options, a growing trend is the issuing of restricted stock units (RSU). These stock units are generally awarded directly to the employee with no purchase required.

Why are stock options called options?

They are called ‘options’ for a reason, as stock options don’t actually imply ownership in the company, but rather the option to purchase the specified numbers of shares. Different Types. Equity, at its basic level, is an ownership share in a company.

How to get equity as a startup employee?

Working Manners. Although there are a variety of ways to get equity as a startup employee the most common way is through stock options. A stock option is the guarantee of an employee to be able to purchase a set amount of stock at a set price regardless of future increases in value.

What does "equity" mean on Twitter?

Share on linkedin. Share on twitter. Share on email. The term Equity can mean stock or shares. It is often used to refer to stock options as well. Stock options give you the right to buy a certain number of shares at a certain price after a certain amount of time.

What is equity in a corporation?

Equity = the ownership interest of shareholders in a corporation. Share = any of the equal portions into which the capital stock of a corporation is divided and ownership of which is evidenced by a stock certificate; “he bought 100 shares of IBM at the market price”.

What is equity in stock certificates?

As Tan family and other investors own the shares of the company’s stock, they own the equity. Equity is the ownership of the share of a business; shares are units of the equity or stock. You can say that equity is more general than stock.

What is the difference between a bond and a money market?

Bond and Money Market. Bond = a certificate of debt (usually interest-bearing or discounted) that is issued by a government or corporation in order to raise money; the issuer is required to pay a fixed sum annually until maturity and then a fixed sum to repay the principal. Money Market = the market for short-term debt securities, ...

What is money market?

Money Market = the market for short-term debt securities, such as commercial paper, certificates of deposit and Treasury bills, with a maturity of one year or less. Typically, these are safe, highly liquid investments. For money market, the term is very short (less than a year).

Why should equity be listed as stockholders equity?

The equity of a corporation owned by one individual should also be listed as stockholder's equity because one person owns 100 percent of the stock. Shareholders' equity is the net amount of a company's total assets and total liabilities, which are listed on a company's balance sheet. In part, shareholders' equity shows how much ...

What is shareholder equity?

Shareholders' equity is the net amount of a company's total assets and total liabilities as listed on the company's balance sheet. Shareholders' equity is an important metric for investors.

What is ROE ratio?

ROE is the result of a company's net income divided by shareholders' equity, and the ratio is used to measure how well a company's management is using its equity from investors to generate profit .

Why is shareholder equity important?

Shareholders' equity is an important metric because it shows the return generated from the total amount invested by equity investors.

What is equity in a house?

Equity could also refer to the extent of ownership of an asset. For example, an owner of a house with a mortgage might have equity in the house but not own it outright. The home owner's equity would be the difference between the market price of the house and the current mortgage balance.

Is JB Maverick the same as shareholders' equity?

J.B. Maverick is a novelist, scriptwriter, and published author with 17+ years of experience in the financial industry. Equity and shareholders' equity are not the same thing. While equity typically refers to the ownership of a public company, shareholders' equity is the net amount of a company's total assets and total liabilities, ...

Is owner's equity the same as stockholders equity?

In the case of a corporation, stockholders' equity and owners' equity mean the same thing. However, in the case of a sole proprietorship, the proper term is the owner's equity, as there are no stockholders. The equity of a corporation owned by one individual should also be listed as stockholder's equity because one person owns 100 percent ...

What is the difference between equity and capital?

Here are some key differences between equity and capital: Equity represents the total amount of money a business owner or shareholder would receive if they liquidated all their assets and paid off the company's debt. Capital refers only to a company's financial assets that are available to spend.

What is equity in business?

Equity is an owner's share of the assets of a business. Also referred to as owner's equity or shareholder's equity, it represents the amount of money a business owner or shareholder would receive if they liquidated all their assets and paid off the company's debt. Equity can also help you assess the overall value of a business.

What is shareholder equity?

Shareholder's equity, also called stockholder's equity, refers to the number of assets shareholders have in a company after deducting all liabilities. Businesses structured as corporations often use this type of equity. Shareholder's equity can show you how much money is available for shareholder distribution.

What are the things that affect equity?

Changes in a company's assets or liabilities, including gains and losses from operations or investments, accounting changes, the payout of cash dividends and other transactions, can affect equity. A few common items that impact a company's equity are: Retained earnings: This refers to any earnings a company accumulates after it pays shareholder ...

What is equity and capital?

Equity and capital are terms used to describe the monetary interest owners or shareholders have in a business through funds, assets or shares. While equity and capital have some similarities, there are key differences between these two terms that are important for successful business owners to know to ensure financial success for their companies.

Why do analysts include equity in their balance sheet?

Analysts often include equity on a company's balance sheet to determine the overall financial health of a business. To calculate equity, use the following formula:

What does it mean when a company has positive equity?

If a company has positive equity, it has enough assets to cover its liabilities. However, if a company has negative equity, it does not have enough assets to cover its liabilities. Equity can also determine how much each individual share of a company is worth.