Difference Between Authorized & Outstanding Shares

- Authorized Shares. The number of shares a corporation has the authorization to issue appears in the company’s articles of incorporation, also known as a certificate of incorporation.

- Issued Shares. A corporation issues shares to investors to raise cash and acquire assets. ...

- Outstanding Shares. ...

- Treasury Stock. ...

What is the difference between authorized and issued shares?

Difference between authorized share capital and issued & paid up share capital

- Definitions and meanings. ...

- Difference between authorized and issued & paid up share capital: Authorized share capital is the maximum extent of funding that can be raised through issue of shares.

- Authorized versus issued & paid up share capital – tabular comparison. ...

What is the difference between issued and outstanding?

The Differences Between Common Stock Outstanding & Issued

- Common Stock. Most companies have only one class of stock: common stock. ...

- Authorized Shares. When a company incorporates, it files a document with its state government called its articles of incorporation.

- Issued Shares. ...

- Outstanding Shares. ...

How to calculate outstanding shares?

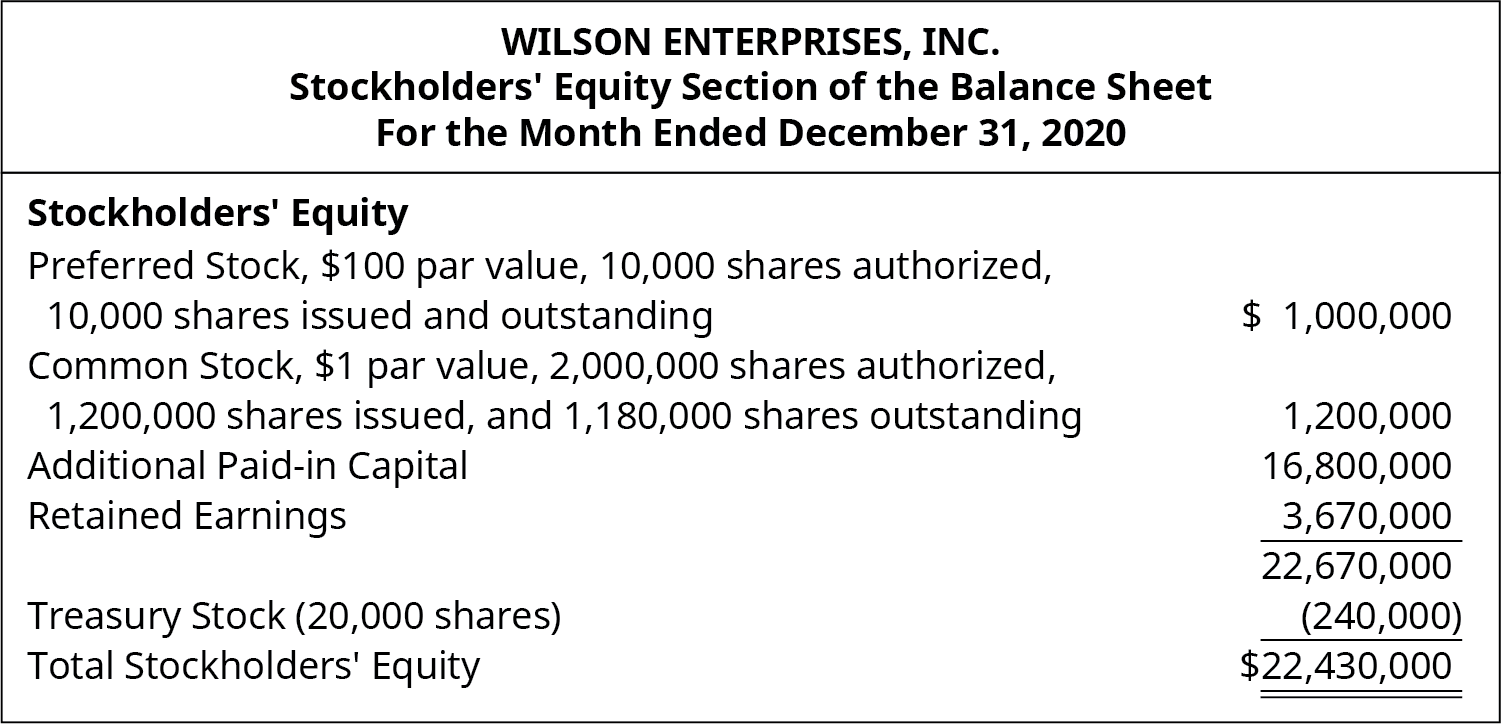

You can calculate outstanding shares by:

- Finding the company’s total number of preferred stock, common stock outstanding, and treasury stock.

- Add the number of preferred stock and common stock outstanding, then subtract the number of treasury shares from that total.

- Alternatively, you can calculate the weighted average of outstanding shares.

How to find authorized shares?

streamline operational support functions, improve overhead efficiency and better leverage economies of scale..." SHARE THIS POST Granite Construction NewsMORE Related Stocks Find News News

What is the difference between authorized stock and issued stock?

Authorized shares are those a company's founders or board of directors (B of D) have approved in their corporate filing paperwork. Issued shares are those that the owners have decided to sell in exchange for cash, which may be less than the number of shares actually authorized.

What does it mean when stock is issued and outstanding?

Issued and outstanding refers to the number of shares actually issued by a company to shareholders, and does not include shares that others may have an option to purchase.

What is Authorised stock?

Key Takeaways. Authorized stock refers to the maximum number of shares a publicly-traded company can issue, as specified in its articles of incorporation or charter. Those shares which have already been issued to the public, known as outstanding shares, make up some portion of a company's authorized stock.

Are authorized shares outstanding?

Key Takeaways Authorized shares are the maximum number of shares a company is allowed to issue to investors, as laid out in its articles of incorporation. Outstanding shares are the actual shares issued or sold to investors from the available number of authorized shares.

What is issued outstanding?

“Issued and outstanding” means the number of shares actually issued by the company to shareholders. For example, your company may have “authorized” 10 million shares to be issued, but may have only “issued” 6 million of them, meaning there are another 4 million shares that are authorized to be issued at a later time.

What is outstanding stock in accounting?

Outstanding stock is the authorized stock that the company has sold (issued) to and that shareholders currently hold. Commonly, the owners of outstanding stock receive dividend payments and have voting rights in shareholders' meetings. The company issues stock certificates to the owners of outstanding stock.

How do you find outstanding shares?

The number of shares outstanding is listed on a company's balance sheet as "Capital Stock" and is reported on the company's quarterly filings with the US Securities and Exchange Commission. The number of shares outstanding can also be found in the capital section of a company's annual report.

What is outstanding share capital?

Financial Terms By: o. Outstanding share capital. Issued share capital less the par value of shares that are held as the company's treasury stock. Most Popular Terms: Earnings per share (EPS)

Why are authorized shares higher than issued and outstanding stock?

Authorized stock is higher than issued and outstanding stock because companies need the flexibility of issuing additional shares without having to return to the regulatory authorities for approval. For example, a company may specify 10 million shares as the authorized number of shares in its incorporation documents. However, it may issue only 10 percent of the authorized amount when it lists on a stock market because the proceeds would be sufficient to fund operations. The accounting records would note the number of authorized shares but use the outstanding share count for calculating shareholders' equity.

What is authorized stock?

Authorized stock is the maximum number of shares a company can issue. Outstanding stock is the difference between issued stock and repurchased stock held for resale. Issued stock is what the company has issued, which is less than the authorized stock.

Why does a stock issue only 10 percent of the authorized amount when it lists on the stock market?

However, it may issue only 10 percent of the authorized amount when it lists on a stock market because the proceeds would be sufficient to fund operations. The accounting records would note the number of authorized shares but use the outstanding share count for calculating shareholders' equity.

Why do companies repurchase stock?

Companies sometimes repurchase stock as a way of returning cash to shareholders. The repurchased shares either are retired or are recorded in a separate treasury stock account if the company intends to reissue them later. The number of outstanding shares is equal to the number of issued shares minus treasury shares.

What is a stock split?

Stock splits increase the share count and reduce the share price. For example, a 2-to-1 stock split would double the outstanding stock and reduce the share price by about 50 percent. The company may have to increase the authorized stock. Reverse stock splits reduce the outstanding stock but increase share prices.

Can you access authorized shares?

You cannot access authorized shares until they start trading. A company may apply for an increase to its authorized stock if it needs to raise additional capital either for operations or for strategic acquisitions. The outstanding share count changes when a company issues new shares or repurchases existing shares.

Does a reverse stock split increase the value of a stock?

Reverse stock splits reduce the outstanding stock but increase share prices. Stock splits and reverse splits have no immediate effect on the total value of the shares in your portfolio.

Why is it good to have an extra cushion of authorized but unissued shares?

Its always good to have the ‘extra cushion’ of authorized but unissued shares for the following reasons: Issuance to new investors.

Can warrants be converted to common stock?

Company has warrants and other convertible securities which can be converted to common stock. If the company does not have sufficient 'authorized unissued shares’ it will have to amend its charter which can be quite a tedious process.

Can authorized shares be changed?

The authorized shares can be changed by a formal board and shareholder approval only . The authorized shares are usually much greater than the issued and outstanding shares ( covered below ) as it allows companies to issue more shares as and when needed.

Authorized Stock

When a company first legally incorporates, a decision is taken as to the maximum number of shares it may issue.

Outstanding Stock

You might have guessed it already, but this is the number of shares a company actually issues or sells to investors.

Authorized Stock vs Outstanding Stock Example

So, the authorized stock is the total number of shares a company is legally allowed to sell, and the outstanding stock is the number of shares still in the hands of investors.

Frequently Asked Questions

Yes, everything from a corporation to a one man show has, as long as it is a legally incorporated business. When the company registers, this is part of the paperwork.

Conclusion

We hope this has been an insightful glimpse into the difference between authorized stock and outstanding stock.

By Andrew

My name is Andrew and I run Slick Bucks to help folks learn to manage money cleverly, and how that clever management can make you wealthier.

What is the difference between issued and outstanding shares?

The key difference between issued vs outstanding shares is that Issue shares is the total shares that are issued by the company to raise the funds. Whereas, outstanding shares are the shares available with the shareholders at the given point of time after excluding the shares which are bought back.

What is outstanding stock?

Outstanding Shares. Definition. Investors and shareholders of the Company hold these shares. They also include the shares held by the Company in the treasury after it buys back its shares. It is a share issued minus the shares held in the treasury. These are the actual number of shares that the investors hold.

Why are outstanding shares important?

The Outstanding Shares are useful to know the financial performance of the Company per share. E.g., to calculate earnings per share EPS, the earning are divided by outstanding shares and not the issued shares. Outstanding shares are less than or equal to issued shares.

What happens when a company buys back its shares and does not retire them?

When a company buys back its shares and does not retire them, they are said to place in the treasury. Thus, after subtracting such shares in the treasury, the remaining are said to be outstanding shares. We use the number of outstanding shares for calculating various financial ratios, like the Earnings per share (EPS).

What is an issued share?

Issued shares are the shares that a company issues. Its shareholders and investors hold these shares. The company issues these to the people in the Company or the general public and some large investment institutions.

Do outstanding shares include treasury stock?

In contrast, outstanding shares do not include treasury stock. The financial statements don’t report Issued shares. In comparison, Financial statements don’t report outstanding shares. Outstanding shares help in determining the voting power in the Company for each shareholder and also the total number of voting shares.

What is authorized share?

Authorized shares are the number of shares that a corporation is legally allowed to issue. The number of authorized shares is initially set in a company's articles of incorporation. The shareholders can increase the number of authorized shares at any time at a shareholders meeting, as long as a majority of shareholders vote in favor of the change.

Is the number of shares equal to the number of authorized shares?

The number of outstanding shares is always equal to or less than the number of authorized shares. The number of authorized shares may be kept substantially higher than the number of outstanding shares, so that an organization has the flexibility to sell more shares at any time, depending on its financing needs.