What is better stock dividend or stock split?

A stock dividend is issued to keep earnings in the company and make the company more valuable in the future. When a company is considered more valuable, stock prices rise. A stock split is performed because a company's stock is outperforming the company's goals.

Does the dividend stay the same after a stock split?

In general, dividends declared after a stock split will be reduced proportionately per share to account for the increase in shares outstanding, leaving total dividend payments unaffected. The dividend payout ratio of a company shows the percentage of net income, or earnings, paid out to shareholders in dividends.

What are stock dividends and stock splits Why might a company want to issue them instead of a cash dividend?

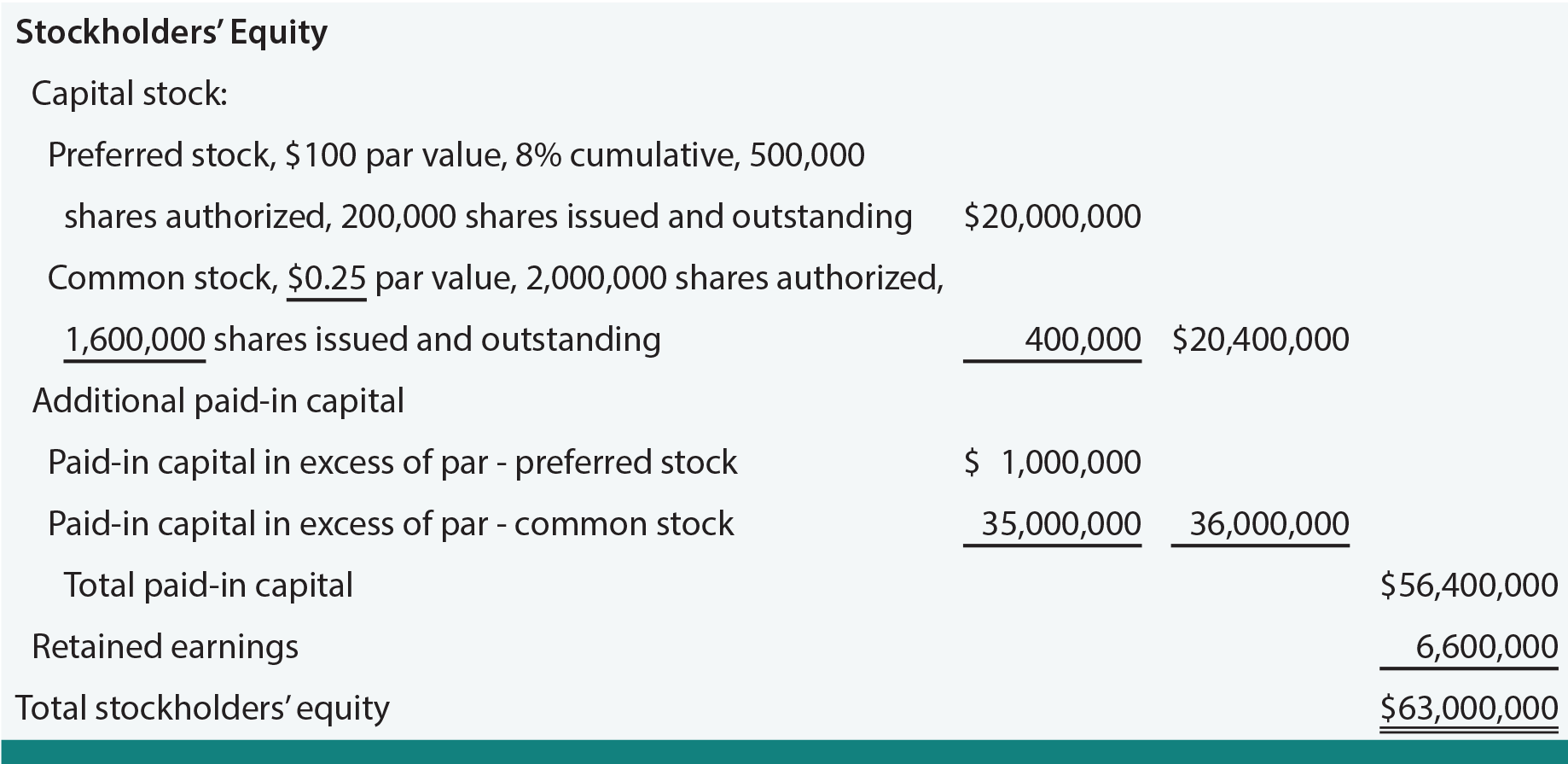

A corporation might issue a stock dividend instead of paying a cash dividend for the following reasons: To increase the number of shares of stock outstanding. To reduce the market price per share of stock. To transfer some of the corporation's retained earnings to paid-in capital.

How do dividends work after a stock split?

The shareholders still receive the same dividend payout they would have before the stock split; it's just split because the shares were doubled. Typically, to avoid complication, a company will not issue dividends and split its stock around the same time.

Is a stock split good for investors?

In most cases, stock splits have no impact on the broader stock market. The S&P 500, the index most closely followed by many investors and portfolio managers, is weighted by firms' market value, so a split has no impact.

What is the point of a stock dividend?

A dividend is a distribution of a portion of a company's earnings, decided by the board of directors. The purpose of dividends is to return wealth back to the shareholders of a company. There are two main types of dividends: cash and stock.

How many shares do you need to get dividends?

Most dividend stocks pay out four times per year, or quarterly. To build a monthly dividend portfolio, you'll need to buy at least 3 different stocks so each month is covered.

How do you make money off dividends?

7 top ways to make money with dividends include:Invest in stocks that pay dividends.Reinvest all dividends received.Invest for higher dividend yields.Invest for dividend growth.Swap portfolio holdings.Sell portfolio holdings for homemade dividends.Minimize income taxes.