How does a bond differ from a stock?

Oct 30, 2021 · Stocks are favored by those with a long-term investment horizon and a tolerance for short-term risk. Bonds lack the powerful long-term return potential of stocks, but they are preferred by investors who want to increase their income. They also are less risky than stocks.

Are bonds safer than stocks?

Differences Between Stocks and Bonds. A stock represents a collection of shares in a company which is entitled to receive a fixed amount of dividend at the end of relevant financial year which are mostly called as Equity of the company, whereas bonds term is associated with debt raised by the company from outsiders which carry a fixed ratio of return each year and can be …

Which is better stocks or bonds?

Jul 28, 2021 · The Difference Between Stocks and Bonds. First, Stocks represent a unit of Ownership in a Business, whereas Bonds are a unit of a larger amount of money lent to a Business. When you buy a Stock, you become an owner of the underlying Business and are entitled to receive your share of any distributions (or ‘Dividends‘) paid to owners.

How are bonds different from stocks?

Jun 17, 2020 · What’s the difference between stocks and bonds? Stocks give you partial ownership in a corporation, while bonds are a loan from you to a company or government. The biggest difference between them...

What is the difference between a stock and a bond?

Key Differences. A stock is a financial instrument issued by a company depicting the right of ownership in return for funds provided as equity. A bond is a financial instrument issued for raising an additional amount of capital.

What is bond loan?

Bonds are actually loans that are secured by a specific physical asset. It highlights the amount of debt taken with a promise to pay the principal amount in the future and periodically offering them the yields at a pre-decided percentage. In this article, we shall understand the importance of Stocks vs Bonds and the differences between them.

What is the difference between bonds and stocks?

The difference between stocks and bonds. The difference between stocks and bonds is that stocks are shares in the ownership of a business, while bonds are a form of debt that the issuing entity promises to repay at some point in the future.

What is delayed payment?

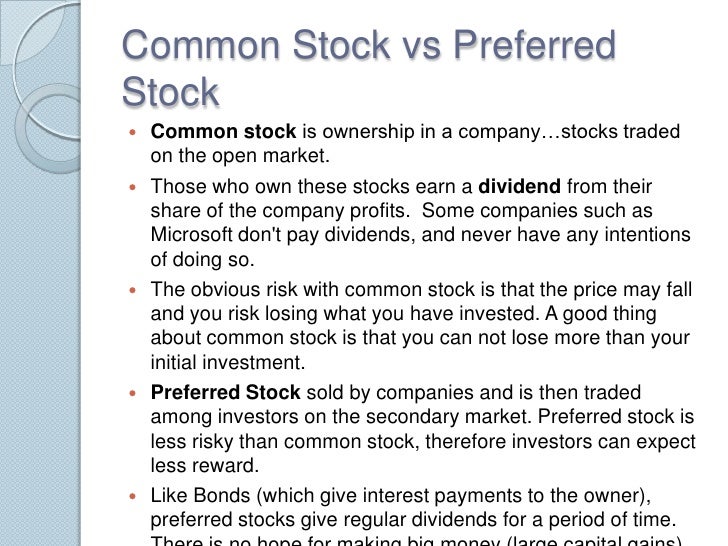

A delayed payment or cancellation feature reduces the amount that investors will be willing to pay for a bond. Voting rights. The holders of stock can vote on certain company issues, such as the election of directors. Bond holders have no voting rights.

Is it riskier to invest in stocks or bonds?

This means that stocks are a riskier investment than bonds. Periodic payments. A company has the option to reward its shareholders with dividends, whereas it is usually obligated to make periodic interest payments to its bond holders for very specific amounts.

Intro to the Difference Between Stocks and Bonds

When people first learn about Finance, they typically hear about Stocks and Bonds soon after.

The Difference Between Stocks and Bonds: Big Picture

Before we dive into the deep end, let’s begin here with a big picture view of Stocks versus Bonds.

Difference Between Stocks and Bonds: Bonds

A Business’ Debt usually consists of Loans or Bonds. Since most people are familiar with Bonds that they can buy and sell, we’ll focus on Bonds here.

Difference Between Stocks and Bonds: Stocks

To initially fund a private Business, the investors (or ‘ Shareholders ‘) invest through an Equity Contribution and gain ownership (or ‘ Equity ‘) proportional to their investment.

Typical Stock and Bond Investors

Once a Business publicly lists its Stocks and Bonds, Investors can buy and sell every day.

Wrap-Up: The Difference Between Stocks and Bonds

In summary, Stocks and Bonds differ in that one reflects ownership (or ‘ Equity ‘) and the other reflects Borrowing (or ‘ Debt ‘).

Stocks vs Bonds: Full Animated Explainer Video

If you enjoyed this article, definitely check out our full Animated Explainer Video below on the differences between Hedge Funds and Mutual Funds.

What is the difference between a stock and a bond?

Stocks give you partial ownership in a corporation, while bonds are a loan from you to a company or government. The biggest difference between them is how they generate profit: stocks must appreciate in value and be sold later on the stock market, while most bonds pay fixed interest over time.

How do bonds and stocks make money?

To make money from stocks, you’ll need to sell the company’s shares at a higher price than you paid for them to generate a profit or capital gain.

What is a bond?

Bonds are a loan from you to a company or government. There’s no equity involved, nor any shares to buy. Put simply, a company or government is in debt to you when you buy a bond, and it will pay you interest on the loan for a set period, after which it will pay back the full amount you bought the bond for.

Is corporate bond risky?

Corporate bonds, on the other hand, have widely varying levels of risk and returns. If a company has a higher likelihood of going bankrupt and is therefore unable to continue paying interest, its bonds will be considered much riskier than those from a company with a very low chance of going bankrupt.

What is the average annual return of the S&P 500?

However, with that higher risk can come higher returns. As of June 11, 2020, the S&P 500 has a 10-year average annual return of 10.65%, while the U.S. bond market, measured by the Bloomberg Barclays U.S. Aggregate Bond Index, has a 10-year total return of 3.92%.

What is corporate bond?

A company’s ability to pay back debt is reflected in its credit rating, which is assigned by credit rating agencies like Moody’s and Standard & Poor’s. Corporate bonds can be grouped into two categories: investment-grade bonds and high-yield bonds. Investment grade. Higher credit rating, lower risk, lower returns.

Why are dividend stocks important?

Because these companies typically aren’t targeting aggressive growth, their stock price may not rise as high or as quickly as smaller companies, but the consistent dividend payouts can be valuable to investors looking to diversify their fixed-income assets.

What is the difference between bond and stock market?

One major difference between the bond and stock markets is that the stock market has central places or exchanges where stocks are bought and sold. The other key difference between the stock and bond market is the risk involved in investing in each. When it comes to stocks, investors may be exposed to risks such as country or geopolitical risk ...

What is bond market?

The bond market is where investors go to trade (buy and sell) debt securities, prominently bonds, which may be issued by corporations or governments. The bond market is also known as the debt or the credit market. Securities sold on the bond market are all various forms of debt. By buying a bond, credit, or debt security, ...

What are the major stock exchanges?

In the United States, the prominent stock exchanges include: 1 Nasdaq, a global, electronic exchange that lists the securities of smaller capitalization companies from different parts of the world. Although technology and financial stock make up the bulk of the index, it also includes consumer goods and services, healthcare, and utilities. This exchange also forms the basis of the U.S. technology sector benchmark index. 6 2 New York Stock Exchange (NYSE) is the largest exchange in the world based on the total market cap of its listed securities. Most of the oldest and largest publicly-traded companies are listed on the NYSE. The NYSE has gone through a series of mergers and was most recently purchased by the Intercontinental Exchange (ICE) in 2013. 7 Thirty of the largest companies on the NYSE make up the Dow Jones Industrial Average (DJIA), which is one of the oldest and most-watched indexes in the world. 8 3 American Stock Exchange (AMEX), which was acquired by the NYSE Euronext and became the NYSE American in 2017. 9 10 It was first known for trading and introducing new products and asset classes. The exchange was also the first to introduce an ETF. Operating electronically, the exchange is home to mostly small-cap stocks.

Why do bonds fall?

Bonds, on the other hand, are more susceptible to risks such as inflation and interest rates. When interest rates rise, bond prices tend to fall. If interest rates are high and you need to sell your bond before it matures, you may end up getting less than the purchase price.

What is mortgage bond?

A mortgage bond is a type of security backed by pooled mortgages, paying interest to the holder monthly, quarterly, or semi-annually.

What is underwriting in bond market?

In the bond market, an underwriter buys securities from the issuers and resells them for a profit. Participants: These entities buy and sell bonds and other related securities. By buying bonds, the participant issues a loan for the length of the security and receives interest in return.

What is the function of the stock market?

The primary function of the stock market is to bring buyers and sellers together into a fair, regulated, and controlled environment where they can execute their trades. This gives those involved the confidence that trading is done with transparency, and that pricing is fair and honest.

What is the difference between bonds and stocks?

The difference between stocks and bonds is that stocks are shares in the ownership of a business, while bonds are a form of debt that the issuing entity promises to repay at some point in the future. In general, though, bonds offer a guaranteed payback, and stocks do not.

What is a bond?

A bond is a debt instrument. The company or government issuing it borrows your money and pays you a fixed amount of money for the use of the loan you have made available to the company or government. The selling price is usually what the face value of the bond is, but this can vary according to interest rates determined by the Federal Reserve.

/united-states-savings-bonds-of-varying-amounts-182885962-5b85b7ff46e0fb0025bf2ba7.jpg)

What Are Stocks?

- Stocks are securities that represents a fraction of the ownership of the issuing corporation. They are issued to investors in the form of stock certificates.

What Are Bonds?

- Bonds are a fixed obligation to pay that are issued by a corporation or government entity to investors. They usually include a periodic coupon payment, and are paid off as of a specific maturity date.

Comparing Stocks and Bonds

- The difference between stocks and bonds is that stocks are shares in the ownership of a business, while bonds are a form of debt that the issuing entity promises to repay at some point in the future. A balance between the two types of funding must be achieved to ensure a proper capital structurefor a business. More specifically, here are the key differences between stocks a…

Shared Features of Stocks and Bonds

- There are also variations on the stock and bond concept that share features of both. The use of conversion features and the manner in which stocks and bonds are traded are noted below.