How risky is Apple stock?

The iPhone maker has warned of supply shortages as the U.S.-China trade tensions and the coronavirus pandemic have intensified pressure on global supply chains.

When will Apple Pay its next dividend?

Apple's last dividend payment date was on 2022-02-10, when Apple shareholders who owned AAPL shares before 2022-02-04 received a dividend payment of $0.2200 per share. Apple's next dividend payment date has not been announced yet. Add AAPL to your watchlist to be reminded of . AAPL 's next dividend payment.

Does Apple stock pay a dividend?

You may be surprised, but yes Apple (ticker symbol – AAPL) does indeed pay a dividend. In fact, the company has been raising their dividend for 9 consecutive years (as of 2021) … which is impressive.

What stocks have the highest dividend yield?

Dividend yield: 8.1%. Prospect Capital Corp. ( PSEC) Recently making an appearance in U.S. News as one of the best monthly dividend stocks, Prospect Capital is a triple threat with a big-time ...

See more

What is the dividend for 1 stock of Apple?

This statistic presents the dividend per share of Apple Inc from 2013 to 2021. In 2021, the dividend paid by Apple to its shareholders amounted to 0.87 U.S. dollars per share, a significant decrease compared to the previous year.

Is Apple currently paying dividends?

Tech giant Apple (ticker:AAPL) declared a quarterly dividend of 23 cents a share, up by a penny, or 4.5%.

How much dividend does Apple pay monthly?

Apple's Hidden 10.1% Dividend (paid monthly)

What is a good dividend yield?

2% to 4%What is a good dividend yield? In general, dividend yields of 2% to 4% are considered strong, and anything above 4% can be a great buy—but also a risky one.

Which stock pays the highest dividend?

9 highest dividend-paying stocks in the S&P 500:AT&T Inc. (T)Williams Cos. Inc. (WMB)Devon Energy Corp. (DVN)Oneok Inc. (OKE)Simon Property Group Inc. (SPG)Kinder Morgan Inc. (KMI)Vornado Realty Trust (VNO)Altria Group Inc. (MO)More items...•

Why is Apple's dividend so low?

However, because of the rapid rise in Apple's stock price, its dividend yield is low. Thus, not providing much income per dollar invested. 3. On the other hand, the combination of regular, rising dividends and large increases in the stock price has made Apple an excellent investment for long-term total returns.

What is Amazon's dividend yield?

0.00%The current dividend yield for Amazon as of July 15, 2022 is 0.00%.

What is Apple's dividend in 2022?

Dividend HistoryDeclaredRecordAmountApril 27, 2022May 9, 2022$0.23January 27, 2022February 7, 2022$0.22October 28, 2021November 8, 2021$0.22July 27, 2021August 9, 2021$0.2276 more rows

What is Apple's dividend yield?

The current dividend yield for Apple (NASDAQ:AAPL) is 0.67%. Learn more on AAPL's dividend yield history.

How much is Apple's annual dividend?

The annual dividend for Apple (NASDAQ:AAPL) is $0.92. Learn more on AAPL's annual dividend history.

How often does Apple pay dividends?

Apple (NASDAQ:AAPL) pays quarterly dividends to shareholders.

When was Apple's most recent dividend payment?

Apple's most recent quarterly dividend payment of $0.23 per share was made to shareholders on Thursday, May 12, 2022.

Is Apple's dividend growing?

Over the past three years, Apple's dividend has grown by an average of 7.06% per year.

What track record does Apple have of raising its dividend?

Apple (NASDAQ:AAPL) has increased its dividend for the past 11 consecutive years.

When did Apple last increase or decrease its dividend?

The most recent change in Apple's dividend was an increase of $0.01 on Thursday, April 28, 2022.

What is Apple's dividend payout ratio?

The dividend payout ratio for AAPL is: 14.94% based on the trailing year of earnings 15.06% based on this year's estimates 13.86% based on next...

Is Apple stock a Buy, Sell or Hold?

Apple stock has received a consensus rating of buy. The average rating score is Aaa and is based on 80 buy ratings, 18 hold ratings, and 1 sell rat...

What was the 52-week low for Apple stock?

The low in the last 52 weeks of Apple stock was 125.94. According to the current price, Apple is 108.89% away from the 52-week low.

What was the 52-week high for Apple stock?

The high in the last 52 weeks of Apple stock was 182.90. According to the current price, Apple is 74.98% away from the 52-week high.

What are analysts forecasts for Apple stock?

The 99 analysts offering price forecasts for Apple have a median target of 195.24, with a high estimate of 600.00 and a low estimate of 90.00. The...

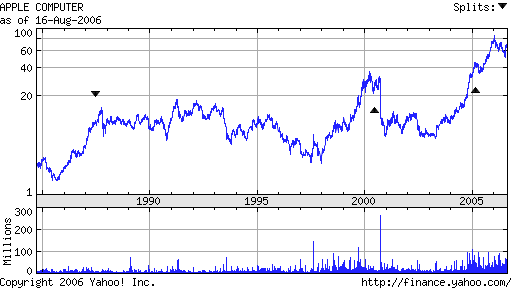

When did Apple stock split?

When did Apple release its 3rd generation?

After Apple’s first two-for-one stock split in June 1987, shareholders received two shares at a stock price of $41.50 each for their stock which had closed the previous day at stock price of $78.50. Throughout the 1990’s, Apple stock price would swing violently. Often times falling below as stock price of $10.

When did the Apple II come out?

In May 1980, just five months before its IPO, Apple released the third generation of its computer. Apple III, like Mac computers of today, forwent the cooling fan. Rather, the computer dissipated CPU heat through the machine’s chassis. On December 12, 1980, Apple stock began trading on the Nasdaq at $22 per share.

What is Moody's daily credit risk score?

Wozniak wasted no time in moving on to the Apple II. Released in 1977, the updated model kept many of the innovative features from the duo’s first machines, like the 60 character-per-second display screen and cassette interface, while adding more memory and colors to the display.

What is the stock price of Apple in 2020?

Moody’s Daily Credit Risk Score is a 1-10 score of a company’s credit risk, based on an analysis of the firm’s balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company’s liability structure.

When did Apple split?

Apple's stock was trading at $68.8575 on March 11th, 2020 when COVID-19 (Coronavirus) reached pandemic status according to the World Health Organization (WHO). Since then, AAPL stock has increased by 115.7% and is now trading at $148.56. View which stocks have been most impacted by COVID-19.

Is Apple benefiting from the services segment?

Shares of Apple split on Monday, August 31st 2020. The 4-1 split was announced on Thursday, July 30th 2020. The newly minted shares were distributed to shareholders after the market closes on Friday, August 28th 2020. An investor that had 100 shares of Apple stock prior to the split would have 400 shares after the split.

Apple (AAPL)

According to Zacks Investment Research, "Apple is benefiting from continued momentum in the Services segment, driven by a robust performance of App Store, Apple Music, video and cloud services. Moreover, demand remains healthy for other Apple devices including iPad, Mac and Wearables.

About Dividend Yield (TTM)

This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. How good is it? See rankings and related performance below.

What is the dividend yield for Apple in 2021?

For Apple Inc., the company has a dividend yield of 0.51% compared to the Computer - Mini computers industry's yield of 1.09%.

What is the dividend payout ratio for Apple?

As of July 18, 2021, Apple's dividend yield was 0.6%. During the second quarter of 2021, Apple paid a $0.22 per share dividend—this was a 7% increase from the $0.205 per share dividend paid in the first quarter. Its dividend payout ratio for the fiscal year 2020 was 25%, which is in line with what it was for 2018 and 2019.

How much does Apple pay in dividends?

Its dividend payout ratio for the fiscal year 2020 was 25%, which is in line with what it was for 2018 and 2019. Apple's quarterly dividend grew by an annualized rate of 9.1% from the second quarter of 2016 to the second quarter of 2021.

Is Apple paying dividends in 2021?

For the past three years, Apple's dividend payout ratio has stayed relatively steady. In both 2020 and 2019, the company paid out $14.1 billion in dividends, and in 2018 it paid $13.7 billion. In the meantime, its cash hoard of cash and cash equivalents remains relatively high at $38 billion. 6 7 2.

Apple's relatively small dividend yield does not tell the whole story of why this stock has potential for growth and dividend investors

For most companies, a dividend cut is an exception, rather than the norm. Ideally, companies increase their dividends over time, assuming their revenue and earnings growth can support it. Apple's quarterly dividend paid during the second quarter of 2021 was $0.22, a 7% increase from the $0.205 paid during the first quarter of the year.

Augmented and virtual reality on deck

Harnessing and monetizing new technology is the name of the game in tech. The metaverse, augmented reality (AR), and virtual reality (VR) are all developing into the next big wave of technological change.

Apple revenue and margins are on fire

The potential for AR/VR products is incredible. These technologies can help with project visualization, communication, design functions, and more in the business world. Outside of business uses, consumers will be able to access products to interact socially, visualize products in rooms, virtually relive events, and play games.

Total yield is higher than you may think

Led by an increase in iPhone sales, fiscal 2021 (ended Sept. 30) saw Apple return to the growth investors have sought for several years. Top-line revenue exceeded $365 billion, a full 33% over fiscal 2020. EBITDA came in at over $120 billion, a 55% increase over fiscal 2020.

Is Apple still a buy?

Apple pays investors a relatively small dividend which currently stands at $0.22 per share per quarter. The dividend has been raised for each of the past nine years. While the yield is just 0.5%, much of the reason for that is the big runup in the stock price depressing any yield. That's actually a good thing.

Premium Investing Services

Apple stock has made impressive gains in 2021, and investors anticipate big things in 2022. Revenue rose considerably over 2020, as did margins and cash flow. The company continues to pay a small dividend and execute substantial share buybacks.