What was your best annual return in the stock market?

What to expect the stock market to return

- Temper your enthusiasm during good times. Congratulations, you’re making money. ...

- Become more optimistic when things look bad. A down market should cause you to celebrate: You can buy stocks at attractive valuations and anticipate higher future returns.

- You get the average return only if you buy and hold. ...

What is the average stock market return over 30 years?

Average Market Return for the Last 30 Years. When we add another decade to the mix, the average return inches closer to the annual average of 10%. Looking at the S&P 500 for the years 1991 to 2020, the average stock market return for the last 30 years is 10.72% (8.29% when adjusted for inflation).

How do you calculate stock market returns?

Part 1 Part 1 of 3: Calculating Stock Returns Download Article

- Determine a period in which to measure returns. The period is the timeframe in which your stock price varies.

- Choose a number of periods. The number of periods, n, represents how many periods you will be measuring within your calculation.

- Locate closing price information. ...

- Calculate returns. ...

How much return can you expect from stock market?

What Is a Good Rate of Return?

- Gold. For the most part, gold hasn’t gained much in real value over the long term. ...

- Cash. Money, or fiat currencies, can depreciate in value over time. ...

- Bonds. From 1926 through 2018, the average annual return for bonds was 5.3.%. ...

- Stocks. Since 1926, the average annual return for stocks has been 10.1%. ...

- Real Estate. ...

What is the average stock market return over 30 years?

10.72%Looking at the S&P 500 for the years 1991 to 2020, the average stock market return for the last 30 years is 10.72% (8.29% when adjusted for inflation). Some of this success can be attributed to the dot-com boom in the late 1990s (before the bust), which resulted in high return rates for five consecutive years.

What is the average stock market return over 10 years?

The S&P 500's average annual returns over the past decade have come in at around 14.7%, beating the long-term historic average of 10.7% since the benchmark index was introduced 65 years ago.

What is the average stock market return for the last 5 years?

5, 10, 20, and 30-Year Return on the Stock MarketAverage Rate of ReturnInflation-Adjusted Return5-Year (2017-2021)18.55%15.19%10-Year (2012-2021)16.58%14.15%20-Year (2002-2021)9.51%7.04%30-Year (1992-2021)10.66%8.10%Apr 22, 2022

What is the 10 year average return on the Dow?

15.03%Looking at the annualized average returns of these benchmark indexes for the ten years ending June 30, 2019 shows: S&P 500:14.70% Dow Jones Industrial Average: 15.03% Russell 2000: 13.45%

How much would $8000 invested in the S&P 500 in 1980 be worth today?

To help put this inflation into perspective, if we had invested $8,000 in the S&P 500 index in 1980, our investment would be nominally worth approximately $876,699.23 in 2022.

What is the average return on a 401k?

5% to 8%Many retirement planners suggest the typical 401(k) portfolio generates an average annual return of 5% to 8% based on market conditions. But your 401(k) return depends on different factors like your contributions, investment selection and fees.

What should my portfolio look like at 55?

The point is that you should remain diversified in both stocks and bonds, but in an age-appropriate manner. A conservative portfolio, for example, might consist of 70% to 75% bonds, 15% to 20% stocks, and 5% to 15% in cash or cash equivalents, such as a money-market fund.

Where can I get a 5% return?

9 Safe Investments With the Highest ReturnsHigh-Yield Savings Accounts.Certificates of Deposit.Money Market Accounts.Treasury Bonds.Treasury Inflation-Protected Securities.Municipal Bonds.Corporate Bonds.S&P 500 Index Fund/ETF.More items...•

How much does the average person invest in stocks?

As of 2021, the top 10 percent of Americans owned an average of $969,000 in stocks. The next 40 percent owned $132,000 on average. For the bottom half of families, it was just under $54,000. In terms of what percent of Americans own stocks, the answer is about 56%, down from a high of 62% in 2007.

Does money double every 7 years?

According to Standard and Poor's, the average annualized return of the S&P index, which later became the S&P 500, from 1926 to 2020 was 10%. At 10%, you could double your initial investment every seven years (72 divided by 10).

What is the average return of stocks for the last 50 years?

The index has returned a historic annualized average return of around 10.5% since its 1957 inception through 2021.

What is the average stock market return over the last 40 years?

Buy-and-hold investing But we do know that, historically, the stock market has gone up more years than it has gone down. The S&P 500 gained value in 40 of the past 50 years, generating an average annualized return of 9.4%.

How long has VTSAX been available?

It has been available since 1992. Starting in November 2000, a 6.68% annual return rate minimum has been consistent for VTSAX. It continues to produce that rate today. Furthermore, since March 2009, for a 10-year period, fund investors have enjoyed a 16.05% annual return.

Why is the S&P 500 considered the market?

To investors, the S&P 500 Index is referred to as “the market.” This is because it consists of 500 large publicly traded companies in the United States. As such, investing in the S&P 500 is considered the trusted path for investors around the globe.

What is missing from DJIA?

What’s missing from the DJIA are the dividends that should be included in the rate of the average stock market return. Because of this, the payouts are of less value. But we can look at the compounded annual growth rate per year for DJIA which is around 2%.

What is Warren Buffet's S&P 500 gain?

From 1965 through 2018, the S&P 500 Index compounded annual gain is 9.7% . For the 2018 year-end, it’s 10% for the 10-year average return. The rate includes dividends.

Can you earn interest in bear markets?

It’s also vital to know how to handle your stocks in times of market volatility and calmness. Yes, you can earn interest confidently in both bullish and bear markets, so go ahead and start investing – but know that to beat the average stock market return you’ll have to make smart investing decisions.

When to flip the rule around?

Flip that rule around when you see lower returns. Following the recent returns on the stock market is the best way to make realistic expectations. That’s a general rule, not an absolute because the stock market goes up and down year by year.

Is it hard to break old habits?

Old habits are hard but not impossible to break if investors practice wiser moves more consistently. The average stock return is the benchmark of your investment strategy. It makes the most difference in long-term retirement goal planning. Saving early is important if you want to earn the most.

Average stock market returns

In general, when people say "the stock market," they mean the S&P 500 index. The S&P 500 is a collection -- referred to as a stock market index -- of just over 500 of the largest publicly traded U.S. companies. (The list is updated every quarter with major changes annually.) While there are thousands more stocks trading on U.S.

10-year, 30-year, and 50-year average stock market returns

Let's take a look at the stock market's average annualized returns over the past 10, 30, and 50 years, using the S&P 500 as our proxy for the market.

Stock market returns vs. inflation

In addition to showing the average returns, the table above also shows useful information on stock returns adjusted for inflation. For example, $1 invested in 1972 would be worth $46.69 today.

How does down year affect the market?

The market's down years have an impact, but the degree to which they impact you often gets determined by whether you decide to stay invested or get out. An investor with a long-term view may have great returns over time, while one with a short-term view who gets in and then gets out after a bad year may have a loss.

How much money would you lose if you invested $1,000 in an index fund?

If you invested $1,000 at the beginning of the year in an index fund, you would have 37% less money invested at the end of the year or a loss of $370, but you only experience a real loss if you sell the investment at that time.

What is the average annualized return of the S&P 500?

Between 2000 and 2019, the average annualized return of the S&P 500 Index was about 8.87%. In any given year, the actual return you earn may be quite different than the average return, which averages out several years' worth of performance. You may hear the media talking a lot about market corrections and bear markets:

What is sequence risk in retirement?

The pattern of returns varies over different decades. In retirement, your investments may be exposed to a bad pattern where many negative years occur early on in retirement, which financial planners call sequence risk.

When does a bear market occur?

A bear market occurs when the market goes down over 20% from its previous high. Most bear markets last for about a year in length. 1 .

When to look at rolling returns?

You can alternatively view returns as rolling returns, which look at market returns of 12-month periods, such as February to the following January, March to the following February, or April to the following March. Check out these graphs of historical rolling returns, for a perspective that extends beyond a calendar year view.

Can you stay out of stocks during a bear market?

No one knows ahead of time when those negative stock market returns will occur. If you don't have the fortitude to stay invested through a bear market, then you may decide to either stay out of stocks or be prepared to lose money, because no one can consistently time the market to get in and out and avoid the down years.

How Inflation Affects S&P 500 Returns

One of the major problems for an investor hoping to regularly recreate that 10% average return is inflation. Adjusted for inflation, the historical average annual return is only around 7%.

How Market Timing Affects S&P 500 Returns

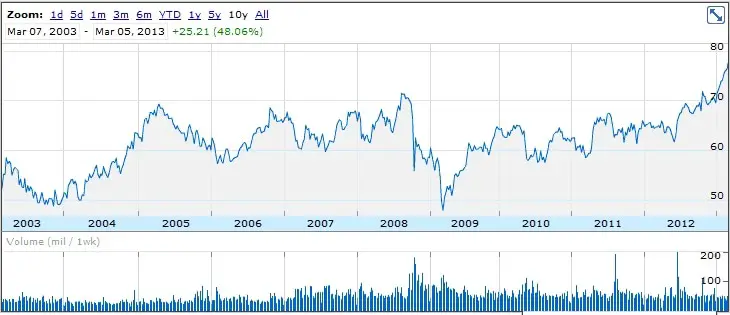

Another major factor in annual returns for an investor in the S&P 500 is when they choose to enter the market. For example, the SPDR® S&P 500® ETF, which corresponds to the index, performed very well for an investor who bought between 1996 and 2000, but investors saw a consistent downward trend from 2000 to 2002.

The History of the S&P 500 Index

The Standard & Poors 500 Index is a collection of stocks intended to reflect the overall return characteristics of the stock market as a whole. The stocks that make up the S&P 500 are selected by market capitalization, liquidity, and industry.

Historical S&P 500 Returns

The annual total nominal returns (%, including dividends, but not accounting for inflation) of the S&P 500 for the past 50 years are depicted below.

Average annual return of the S&P 500

Over the long term, the average historical stock market return has been about 7% a year after inflation. Looking at long periods of time rather than any one year shows something else—remarkable consistency.

10-year, 30-year, and 50-year average stock market returns

Knowing that the market has boom years and inevitable slumps, it’s useful to look at the market’s average returns over the longer term.

Market timing

Statistically, investors who try to time the market or trade their way to fortune with short-term moves overwhelmingly earn returns that fail to match the S&P 500. Plus, this kind of strategy often takes up a disproportionate amount of the investor’s time and results in fees and taxes that eat into returns.

Why the market is geared toward long-term investments

History tells us that the stock market has increased more years than it has fallen. This is a basic truth that is helpful for those who are beginning to invest; it’s also what leads us to that long-term return of an annualized historical average return of 7%.

What is the best way to build wealth?

Investing experts, including Warren Buffett and investing author and economist Benjamin Graham, say the best way to build wealth is to keep investments for the long term, a strategy called buy-and-hold investing .

How to get the average return on your investment?

The best way to get the average return on your investments is long-term buy-and-hold investing. Investing experts, including Warren Buffett and investing author and economist Benjamin Graham, say the best way to build wealth is to keep investments for the long term, a strategy called buy-and-hold investing .

How much did Berkshire Hathaway gain in the S&P 500 in 2020?

Berkshire Hathaway has tracked S&P 500 data back to 1965. According to the company's data, the compounded annual gain in the S&P 500 between 1965 and 2020 was 10.2%. While that sounds like a good overall return, not every year has been the same.

How much did the S&P 500 increase in 2019?

While the S&P 500 fell more than 4% between the first and last day of 2018, values and dividends increased by 31.5% during 2019. However, when many years of returns are put together, the ups and downs start to even out.

Does the S&P 500 represent the whole market?

The average annual return from the S&P 500 doesn't necessarily represent the whole market or all investments. There are many stock market indexes, including the S&P 500. This index includes 500 of the largest US companies, and some investors use the performance of this index as a measure of how well the market is doing.

How does inflation affect the value of a dollar?

Inflation reduces the value of a dollar over time. To manage this risk, investors look for returns that are higher than the inflation rate. For example, a currency that appreciates 6% during 2% inflation may be considered a relatively good inflation hedge.

How much is the fossil fuel tax cut worth?

Fossil fuel subsidies in the U.S. are facilitated through tax cuts, and are estimated to be worth around $20 billion per year. This may change very soon, as the Biden administration has signaled its intention to eliminate these subsidies as part of its 2021 tax plan.

Why is the yuan pegged against the dollar?

This is perhaps not surprising, given that the yuan was pegged against the U.S. dollar in 1994 to keep the yuan low and make China’s exports competitive. In 2005, China moved to a “managed float” system where the price of the yuan is allowed to fluctuate in a narrow band relative to a basket of foreign currencies.

How many electric vehicles will be on the road by 2050?

For starters, the IRENA estimates that 1.1 billion electric vehicles will be on the road by 2050, up from 8 million in 2019. The resulting need for charging infrastructure is reflected by Scenario 2’s higher share of electrification (49% vs 30%).

Why is the Japanese yen the best currency?

The Japanese yen acted as the best inflation hedge, with its annual appreciation beating U.S. inflation 48% of the time. Demand for the safe haven currency has historically been strong for three main reasons: After the Japanese banking crisis of the late 1990s, the government introduced a number of policy measures.

Where did the numbers come from in 1825?

From 1825-1925, numbers come from researchers at Yale University and Pennsylvania State University.

When were the S&P 90 returns based on the S&P 500?

From 1926-1956, returns are from the S&P 90, the S&P 500’s predecessor. Finally, from 1957 to date, returns are based on the S&P 500. Here are historical stock market returns by year: Source: Journal of Financial Markets, Slickcharts.

How Often Does The Stock Market Lose Money?

Time in The Market vs. Timing The Market

- The market's down yearshave an impact, but the degree to which they impact you often gets determined by whether you decide to stay invested or get out. An investor with a long-term view may have great returns over time, while one with a short-term view who gets in and then gets out after a bad year may have a loss. For example, in 2008, the S&P 500 lost about 37% of its value.8If you had invested $1,000 at the beginning of the yea…

Calendar Returns vs. Rolling Returns

- Most investors don't invest on Jan. 1 and withdraw on Dec. 31, yet market returns tend to be reported on a calendar-year basis. You can alternatively view returns as rolling returns, which look at market returns of 12-month periods, such as February to the following January, March to the following February, or April to the following March. The table below shows calendar-year stock market returns from 1980 to 2021.6

Frequently Asked Questions

- The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.