What is svxy ETF?

SVXY is the ProShares Short VIX Short-Term Futures ETF, which provides investors exposure to short VIX futures contracts. Put simply, investors who buy SVXY are short S&P 500 volatility futures.

Is svxy a good stock to buy now?

Because SVXY trades inverse to VXX, the long-term trend for SVXY has been to rise in price. If you think it’s “easy money” after buying SVXY however, think again! Before taking the plunge, you need to view the SVXY price history and know what to expect when markets are rattled by bad news. What Is SVXY Stock Price History?

What is uvxy and svxy?

This means it is ill-suited to a long-term buy and hold strategy and is instead suited to very short-term bets on price volatility. Traders can also take the opposite of UVXY, which is the SVXY. SVXY tracks the opposite of the VIX, such that if the VIX goes down, SVXY goes up.

What is the difference between the svxy and Vix?

The SVXY mirrors the performance of the VIX futures, which behave very differently. When volatility spikes, the Volatility Index, or VIX, may rise significantly. However, the VIX futures may build in an expectation that prices will return to lower levels.

Is SVXY a good investment?

Regardless, the point I want to stress here is this: yes, SVXY is a good buy, and yes, it is likely going to continue pushing higher, but firm risk management hedges must be in place to trade this instrument in my opinion.

What does the SVXY mean?

SVXY is the best (and only) inverse VIX ETF for Q2 2022 Inverse VIX exchange-traded funds (ETFs) offer investors a straightforward way to bet against the future direction of market volatility. The Cboe Volatility Index (VIX), also known as the market's “fear gauge,” is the most widely used benchmark of volatility.

What is SVXY based on?

About the Index The VIX measures expected volatility of the S&P 500 over the next 30 days and is calculated based on the price of a constantly changing portfolio of options on the S&P 500.

How does SVXY ETF work?

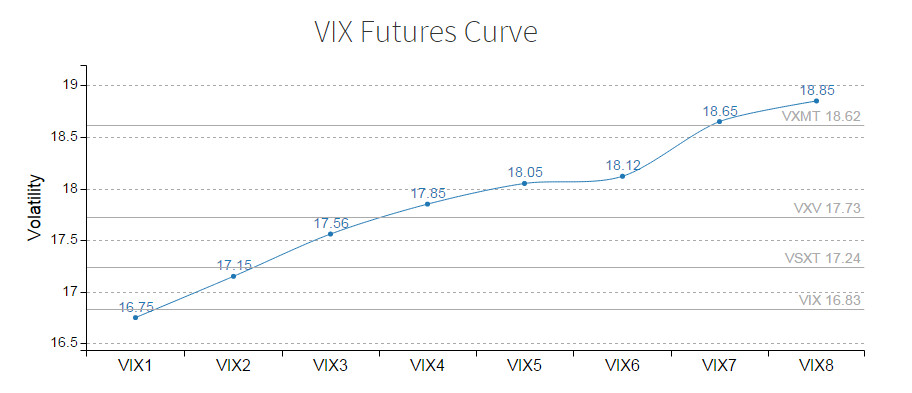

SVXY is an ETF that systematically shorts the front-end of the VIX futures curve, specifically the first two months. The product is managed by ProShares and is structured as an ETF, not an ETN.

What is the difference between SVXY and UVXY?

UVXY has a 0.95% expense ratio, which is lower than SVXY's 1.38% expense ratio. Scroll down to visually compare performance, riskiness, drawdowns, and other indicators and decide which one is better suits your portfolio: UVXY or SVXY....Key characteristics.UVXYSVXYMax Drawdown-100.00%-95.25%6 more rows•Jun 4, 2022

Can you hold SVXY long term?

The data shows a very clear trend - holding periods longer than 1 month see a continuous decrease in correlation with the VIX. In other words, the longer you hold UVXY, the less of a chance that your returns will actually line up with the underlying index.

What is inverse volatility ETF?

An inverse volatility exchange-traded fund (ETF) is a financial product that allows investors to gain exposure to volatility, and thus hedge against portfolio risk, without having to buy options.

What is ProShares Ultra VIX short-Term Futures?

ProShares Ultra VIX Short-Term Futures ETF provides leveraged exposure to the S&P 500 VIX Short-Term Futures Index, which measures the returns of a portfolio of monthly VIX futures contracts with a weighted average of one month to expiration.

How do you trade in VIX?

The primary way to trade on VIX is to buy exchange-traded funds (ETFs), and exchange-traded notes (ETNs) tied to VIX itself. ETFs and ETNs related to the VIX include the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) and the ProShares Short VIX Short-Term Futures ETF (SVXY).

Can I buy VIX stock?

Investors cannot buy VIX, and even if they could, it would be an investment with a great deal of risk. The Chicago Board Options Exchange Volatility Index® (VIX®) reflects a market estimate of future volatility. VIX is constructed using the implied volatilities of a wide range of S&P 500 index options.

When the VIX is high it time to buy?

"If the VIX is high, it's time to buy" tells us that market participants are too bearish and implied volatility has reached capacity. This means the market will likely turn bullish and implied volatility will likely move back toward the mean.

Which VIX is best?

The VIX exchange-traded funds (ETFs) with the best one-year trailing total returns are VIXM, VXZ, and VIXY. All three of these ETFs hold futures contracts to track market volatility.

Innova Wealth Partners Buys iShares 7-10 Year Treasury Bond ETF, ProShares Short VIX Short-Term ..

Investment company Innova Wealth Partners (Current Portfolio) buys iShares 7-10 Year Treasury Bond ETF, ProShares Short VIX Short-Term Futures ETF, iShares Core U.S.

Best (and Only) Inverse VIX ETF for Q1 2022

Inverse VIX exchange-traded funds (ETFs) offer investors a straightforward way to bet against the future direction of market volatility. The Cboe Volatility Index (VIX), also known as the market’s “fear gauge,” is the most widely used benchmark of volatility.

Performance

Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded.

Index

The S&P 500 VIX Short-Term Futures Index measures the returns of a portfolio of monthly VIX futures contracts that rolls positions from first-month contracts into second-month contracts on a daily basis. The index maintains a weighted average of one month to expiration.

Portfolio Hedging Series Research & Insights

Investing involves risk. Market downturns will happen. Having a sound investment strategy can help smooth out the turbulence in your portfolio and save you from getting caught up in a herd mentality of selling low into a down market.

Signals & Forecast

The ProShares Short VIX Short-Term Futures ETF holds buy signals from both short and long-term moving averages giving a positive forecast for the stock, but the ETF has a general sell signal from the relation between the two signals where the long-term average is above the short-term average.

Support, Risk & Stop-loss

On the downside, the ETF finds support just below today's level from accumulated volume at $53.49 and $52.90. There is natural risk involved when a ETF is testing a support level, since if this is broken, the ETF then may fall to the next support level.

Is ProShares Short VIX Short-Term Futures ETF ETF A Buy?

ProShares Short VIX Short-Term Futures holds several positive signals, but we still don't find these to be enough for a buy candidate. At the current level, it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development.

About ProShares Short VIX Short-Term Futures ETF

The index seeks to offer exposure to market volatility through publicly traded futures markets and is designed to measure the implied volatility of the S&P 500 over 30 days in the future.... Read more

Golden Star Signal

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

Top Fintech Company

featured in The Global Fintech Index 2020 as the top Fintech company of the country.

What Does UVXY Track?

According to the UVXY prospectus, it attempts to measure 1.5 times the daily returns of the S&P VIX Short-Term Futures.

How Long Can You Hold UVXY?

If you were to compare the annual returns of UVXY in any given year, you would find that it almost always ends lower than when it began.

Conclusion

UVXY is an ETF that allows investors to be exposed to short-term volatility.

SVXY is the best (and only) inverse VIX ETF for Q1 2022

Matthew Johnston has more than 5 years writing content for Investopedia. He is an expert on company news, market news, political news, trading news, investing, and the economy. He received his bachelor's degree in interdisciplinary studies from St. Stephen's University and his master's degree in economics at The New School for Social Research.

ProShares Short VIX Short-Term Futures ETF (SVXY)

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.