Accounting, finance, etc.

| "Stock" | Possible units of stock | "Inflow (s)" | "Outflow (s)" | Possible units of flow |

| bank balance | yen | deposits interest | withdrawals | yen per month |

| inventory of lumber | board feet | incoming lumber | outgoing lumber | board feet per week |

| housing stock | dollars | housing investment | housing depreciation | dollars per year |

| equity shareholdings | shares (of ' stock ') | purchases of shares | sales of shares | shares per month |

Full Answer

What is the difference between flow and stock?

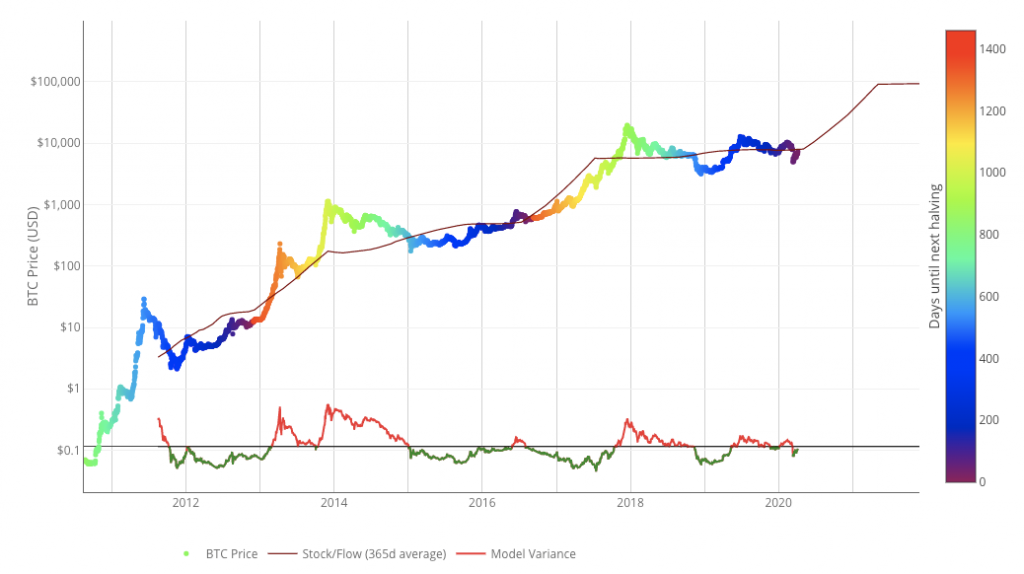

Stock to flow is a forecasting tool for Bitcoin price. It creates a line on the chart above that shows an estimated price level based on the number of bitcoins available in the market relative to the amount being produced (mined) each year. The score on the stock to flow line is the forecasted price for bitcoin at that particular time.

Is the GDP a stock or a flow?

Oct 18, 2021 · But the stock to flow formula itself is nothing new, though. It measures the abundance of a particular resource. In most cases, it is used for natural resources like gold, oil or other commodities that can be traded on the traditional stock markets. It is calculated by dividing the resources held by the amount that is annually produced.

Is capital a stock or flow?

Oct 16, 2020 · In simple words, the Stock-to-Flow model is a way to measure the sufficiency of a certain asset. The stock-to-growth ratio is the amount of resources held in …

What are flow and stock variables?

Apr 23, 2021 · The stock-to-flow pricing model was created by anonymous Twitter user PlanB, who claims to be a Dutch institutional investor with a legal and quantitative finance background that manages around $100 billion in assets.

What is a stock-to-flow ratio?

Stock is the amount of existing reserves of some substance. Flow is the (annual) rate at which that substance is produced. The ratio of stock to flow is stock-to-flow (S2F). The higher this value, the more scarce something is. Gold, for example, has (as of 2019) a S2F ratio of 62.Oct 31, 2021

What is the stock 2 flow model?

In fact, the stock-to-flow model assumes that there is a relationship between the amount of a precious metal that is mined each year (flow) and the amount already mined previously (stock). For example, the gold that is mined each year is just under 2% of the gold in circulation (held by central banks and individuals).Jan 2, 2022

Is stock-to-flow accurate Bitcoin?

The popular stock-to-flow model, created by the pseudonymous “PlanB,” has been pretty accurate in predicting Bitcoin prices so far. The brainchild behind the model has stated that the mid-cycle average should be around $100K per BTC.Nov 12, 2021

What is a stock-to-flow chart?

What Is the Stock-to-Flow Model? Stock-to-flow is an investment model that measures an asset's current stock against the rate of production or the total amount mined over the course of a year. Stock-to-flow is used to compare the relative abundance or scarcity of a particular resource.Oct 19, 2021

Why is stock flow important?

The stock-to-flow ratio as the most significant reason for gold's monetary importance. Supply and demand thus determine not only the prices of goods and services, but also the price of money, resp. its purchasing power.

What is stock flow model?

The stock-to-flow model predicts value changes in a more straightforward manner. It compares an asset's current stock to the rate of new production, or how much is produced in a year. A higher ratio suggests greater scarcity, which generally leads to a higher price.

WHO has predicted Bitcoin correctly?

The price of bitcoin is less than a few hundred dollars away from a prediction model made more than three months ago. The forecast was made by the pseudonymous Dutch analyst PlanB, who predicted in June that the cryptocurrency would be $43,000 at the end of September.Oct 1, 2021

What will be the price of Bitcoin in 2022?

Predictions For 2022 Bitcoin started 2022 at $46,657.53. Given that important trading factors remain steady, the price prediction indicates that many expect Bitcoin to reach $50,000 by the end of the year.Mar 14, 2022

Is there a future for Bitcoin cash?

Bitcoin Cash then forked and was born in August of 2017 and started off well but has a tumultuous time since then....What is the Future of Bitcoin Cash?YearPrice2021$500 – $7,0002022$7,000 – $2,0002023$4,500 – $3,5002025$5,000 – $12,000

How do you calculate stock-to-flow?

The Stock to Flow ratio is the amount of a resource held in reserves divided by the amount it is produced annually.Apr 12, 2020

What is Bitcoin stock flow?

Stock is the existing supply of Bitcoin in circulation. Flow refers to the number of tokens mined in a year.Aug 10, 2021

Can BTC hit 100k?

The most extreme crypto skeptics say Bitcoin will tank to as low as $10,000 in 2022, but a middle ground might be to say the cryptocurrency can still climb to $100,000 like many experts predicted late last year — just on a slower timeline.

Why is Bitcoin considered a store of value?

These are known as 'store of value' commodities because they retain value over long time frames due to their relative scarcity. It is difficult to significantly increase their supply i.e. the process of searching for gold and then mining it is expensive and takes time. Bitcoin is similar because it is also scarce.

What does a high ratio mean?

For store of value (SoV) commodities like gold, platinum, or silver, a high ratio indicates that they are mostly not consumed in industrial applications. Instead, the majority is stored as a monetary hedge, thus driving up the stock-to-flow ratio. A higher ratio indicates that the commodity is increasingly scarce - and therefore more valuable as ...

What is the S2F model?

The stock to flow model for Bitcoin was invented by PlanB, a Dutch Bitcoiner who is also very active on Twitter. But the stock to flow formula itself is nothing new, though. It measures the abundance of a particular resource.

Stock to flow and Bitcoin

Unlike gold, Bitcoin has a finite supply. There is no such thing as a new Bitcoin mine or additional resources that can be discovered in an exotic place. There will be only 21 million Bitcoin ever coming into existence. This can easily be verified by each node in the network and is guaranteed by Bitcoin’s protocol.

Will Bitcoin reach 100.000 US-Dollars?

That is the one question nobody can answer for sure. Instead of focusing on a single model, it is worth paying attention to more fundamental questions and draw conclusions from the events throughout 2021.

Why is stock to flow ratio lower?

The main reason for this is because the value derives from being destruction or consumption, hen ce there is always leftover inventory to cover the demands.

Does Bitcoin have a stock to flow ratio?

Of course, if you know how Bitcoin works, you will know that Bitcoin also has a Stock to Flow (S2F) ratio. The Stock to Flow model essentially treats Bitcoin as a commodity just like gold or silver. Similar to gold and silver, Bitcoin works quite the same way given its scarcity and low flow. Photo taken from Binance.

What is stock to flow?

What is Stock-to-Flow model? In simple words, the Stock-to-Flow model is a way to measure the sufficiency of a certain asset. The stock-to-growth ratio is the amount of resources held in reserves divided by its annual production. Usually, Stock-to-Flow is applied to natural resources. Take, for example, gold.

Is stock to flow a model?

Although the Stock-to-Flow model is of interest for deficit measurement, it does not take into account all parts of the picture. The models are as true as their underlying assumptions. Above all, Stock-to-Flow is based on the assumption that the deficit measured by the model is capable of managing value. According to Stock-to-Flow critics, the model would be untenable if Bitcoin had no other useful properties than supply shortage.

How much stock to flow in 2024?

The stock to flow will climb to 52, which is much closer to gold. The following halving, in 2024, will raise that number to 113 and remember - gold has stock to flow of "only" 62 and it does not have halving events.

What do the colored dots on the stock chart mean?

Colored dots are representing end of day actual price (Y axis right side) in selected currency. Different colors are there to indicate how many days are left until next halving event. You can see color scale presented vertically on the right side of the chart. Stock to flow 10 days.

What is stock flow?

The Stock-to-Flow model analyzes the relationship between the currently available stock of resources and its production rate. This model is mainly applied to precious metals and other commodities. But, it can also be applied to Bitcoin as well. According to this model, Bitcoin is an asset that retains its value for the long-term.

Why does the stock to flow model fail?

The stock-to-flow model fails if Bitcoin doesn’t have any other useful qualities other than the supply scarcity. In the case of gold, it’s scarcity, predictable flow, and global liquidity have made it a relatively stable store of value compared to fiat currencies, which are prone to devaluation. Bitcoin is volatile in nature. If this volatility was predictable to some extent, then the valuation model may be more reliable.

Why do commodities have a low stock to flow ratio?

Consumable goods and industrial commodities have a low stock-to-flow ratio. It is because their value comes down due to being destroyed or consumed. The stock is there to cover the demand. As they do not have high value, they tend to work poorly as investment assets.

What are stock and flow?

Stocks and flows also have natural meanings in many contexts outside of economics, business and related fields. The concepts apply to many conserved quantities such as energy, and to materials such as in stoichiometry, water reservoir management, and greenhouse gases and other durable pollutants that accumulate in the environment or in organisms. Climate change mitigation, for example, is a fairly straightforward stock and flow problem with the primary goal of reducing the stock (the concentration of durable greenhouse gases in the atmosphere) by manipulating the flows (reducing inflows such as greenhouse gas emissions into the atmosphere, and increasing outflows such as carbon dioxide removal ). In living systems, such as the human body, energy homeostasis describes the linear relationship between flows (the food we eat and the energy we expend along with the wastes we excrete) and the stock (manifesting as our gain or loss of body weight over time). In Earth system science, many stock and flow problems arise, such as in the carbon cycle, the nitrogen cycle, the water cycle, and Earth's energy budget. Thus stocks and flows are the basic building blocks of system dynamics models. Jay Forrester originally referred to them as "levels" rather than stocks, together with "rates" or "rates of flow".

What is the difference between a stock and a flow?

Thus, a stock refers to the value of an asset at a balance date (or point in time), while a flow refers to the total value of transactions (sales or purchases, incomes or expenditures) during an accounting period.

What is a stock level variable?

A stock (or "level variable") in this broader sense is some entity that is accumulated over time by inflows and/or depleted by outflows. Stocks can only be changed via flows. Mathematically a stock can be seen as an accumulation or integration of flows over time – with outflows subtracting from the stock.

How many machines did the stock of physical capital have in 2010?

For example, if a country's stock of physical capital on January 1, 2010 is 20 machines and on January 1, 2011 is 23 machines, then the flow of net investment during 2010 was 3 machines per year. If it then has 27 machines on January 1, 2012, the flow of net investment during 2010 and 2011 averaged. machines per year.

Is nominal gross domestic product a flow variable?

For example, U.S. nominal gross domestic product refers to a total number of dollars spent over a time period, such as a year. Therefore, it is a flow variable, and has units of dollars/year.

Can you compare stocks and flows?

Comparing stocks and flows. Further information: Dimensional analysis § Commensurability. Stocks and flows have different units and are thus not commensurable – they cannot be meaningfully compared, equated, added, or subtracted. However, one may meaningfully take ratios of stocks and flows, or multiply or divide them.