What does a payout ratio tell?

The payout ratio, also known as the dividend payout ratio, shows the percentage of a company’s earnings paid out as dividends to shareholders. A payout ratio over 100% indicates that the company is paying out more in dividends than its earnings can support, which some view as an unsustainable practice.

What is an ideal payout ratio?

What is an ideal payout ratio? The ideal dividend payout ratio lies between 35% to 55% . That means about a third to a little over a half of a company's annual net earnings are paid out to shareholders.

How do you calculate stock holding ratio?

- In the example used above, the average inventory is $6,000, the COGS is $26,000 and the number of days in the period is 365.

- Calculate the days in inventory with the formula ( $ 6, 000 / $ 26, 000) ∗ 365 = 84.2 {\displaystyle (\$6,000/\$26,000)*365=84.2}

- You still get the same answer. It takes this company 84.2 days to sell its average inventory.

How to calculate dividend payout ratio of stocks?

What is the Payout Ratio Formula?

- Explanation. Step 1: Firstly, figure out the company’s net income during the given period from its income statement.

- Relevance and Use of Payout Ratio Formula. The concept of payout ratio is very important for both companies and investors. ...

- Payout Ratio Formula Calculator

- Recommended Articles. This is a guide to the Payout Ratio Formula. ...

What is a good stock payout ratio?

For financially strong companies in these industries, a good dividend payout ratio is less than 75% of their earnings. However, companies in fast-growing sectors or those with more volatile cash flows and weaker balance sheets need a lower dividend payout ratio. Ideally, it should be below 50%.

Is a low payout ratio good?

So a stock with a low payout ratio may nonetheless be a good bet. If there is no dividend or only a small one, investors who need income can sell some shares from time to time. There is a difference between how startups or smaller companies treat their dividends and how larger, more established companies do.

What does 100% dividend payout mean?

If a company has a dividend payout ratio over 100% then that means that the company is paying out more to its shareholders than earnings coming in. This is typically not a good recipe for the company's financial health; it can be a sign that the dividend payment will be cut in the future.

How is payout ratio calculated?

The dividend payout ratio can be calculated by taking the yearly dividend per share and dividing it by the earnings per share or you can use the dividends divided by net income.

What is a good dividend?

What is a good dividend yield? In general, dividend yields of 2% to 4% are considered strong, and anything above 4% can be a great buy—but also a risky one. When comparing stocks, it's important to look at more than just the dividend yield.

Do Tesla pay dividends?

Plus, Tesla does not pay a dividend to shareholders, which is also an important factor for income investors to consider. As a result, we believe income investors looking for lower volatility should consider high-quality dividend growth stocks, such as the Dividend Aristocrats.

Are dividends profitable?

Dividend is usually a part of the profit that the company shares with its shareholders. Description: After paying its creditors, a company can use part or whole of the residual profits to reward its shareholders as dividends.

What if dividend payout ratio is negative?

What does a negative payout ratio mean? When a company generates negative earnings, or a net loss, and still pays a dividend, it has a negative payout ratio. A negative payout ratio of any size is typically a bad sign. It means the company had to use existing cash or raise additional money to pay the dividend.

What does a 0.2 dividend mean?

If there is a stock dividend declared of 0.2, the number of shares outstanding will increase by 20% to 240 million. With this new number of shares outstanding, the company's market cap remains the same, but the share price will decrease to $3.13 ($750/240). A cash dividend does not dilute share price.

What is considered a high dividend payout ratio?

between 55% to 75%High. Payout ratios that are between 55% to 75% are considered high because the company is expected to distribute more than half of its earnings as dividends, which implies less retained earnings.

How is dividend paid?

Most companies prefer to pay a dividend to their shareholders in the form of cash. Usually, such an income is electronically wired or is extended in the form of a cheque. Some companies may reward their shareholders in the form of physical assets, investment securities and real estates.

How much dividend should a company pay?

A good dividend yield is anywhere between 4% to 6%. It depends on market conditions and interest rates. However, the yield alone cannot be a good indicator to buy a company's share.

What Is a Payout Ratio?

Payout ratios, otherwise known as dividend payout ratios, are defined as the percentage of net income that a publicly-traded company shells out as part of their dividend payments to investors.

What Is the Payout Ratio Formula?

Here’s the formula financial specialists use to calculate payout ratios, which determines the dividend payouts companies make to their shareholders.

Regular and Reliable Payout Ratios

Managing the proper amount of dividend payments means establishing a target for company payout ratios, and then using those ratios as a reliable, long-term calculus for figuring out what companies can pay in dividends over the long haul.

What Is a Dividend Payout Ratio?

The dividend payout ratio is the ratio of the total amount of dividends paid out to shareholders relative to the net income of the company. It is the percentage of earnings paid to shareholders via dividends. The amount that is not paid to shareholders is retained by the company to pay off debt or to reinvest in core operations.

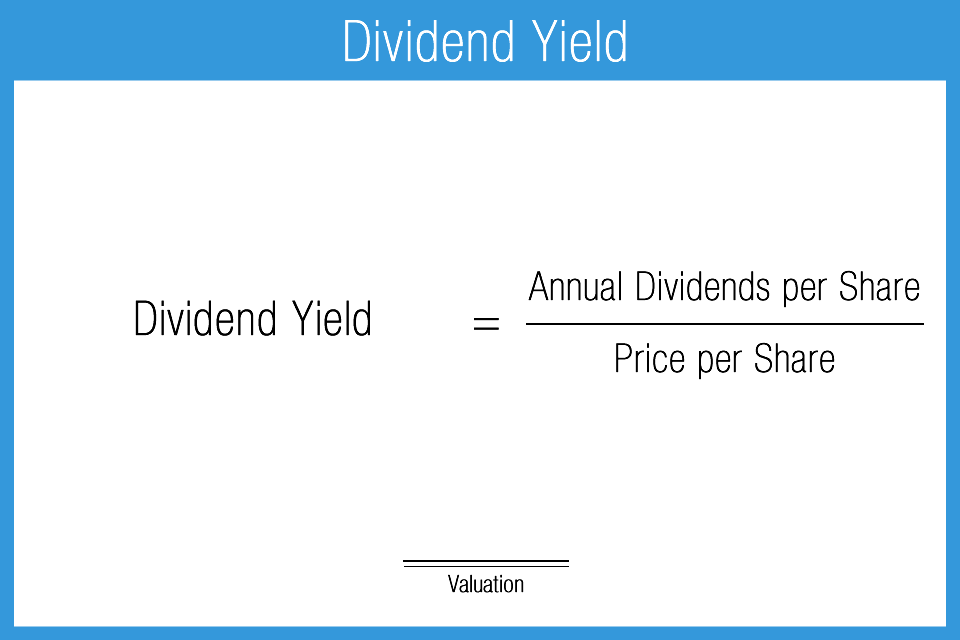

Formula and Calculation of Dividend Payout Ratio

The dividend payout ratio can be calculated as the yearly dividend per share divided by the earnings per share (EPS), or equivalently, the dividends divided by net income (as shown below).

What the Dividend Payout Ratio Tells You

Several considerations go into interpreting the dividend payout ratio, most importantly the company's level of maturity. A new, growth-oriented company that aims to expand, develop new products, and move into new markets would be expected to reinvest most or all of its earnings and could be forgiven for having a low or even zero payout ratio.

How to Calculate the Payout Ratio in Excel

First, if you are given the sum of the dividends over a certain period and the outstanding shares, you can calculate the dividends per share (DPS). Suppose you are invested in a company that paid a total of $5 million last year and it has 5 million shares outstanding. On Microsoft Excel, enter "Dividends per Share" into cell A1.

Example of How to Use the Payout Ratio

Companies that make a profit at the end of a fiscal period can do several things with the profit they earned. They can pay it to shareholders as dividends, they can retain it to reinvest in the growth of its business, or they can do both.

The Difference Between Dividend Payout and Dividend Yield

When comparing these two measures, it's important to know that the dividend yield tells you what the simple rate of return is in the form of cash dividends to shareholders, but the dividend payout ratio represents how much of a company's net earnings are paid out as dividends.

What does the payout ratio tell you?

The payout ratio is a key financial metric used to determine the sustainability of a company’s dividend payment program. It is the amount of dividends paid to shareholders relative to the total net income of a company.

Formula

Where: Annualized Dividend per share = Most recently observed dividend * previously observed frequency of dividend payments Current calendar year EPS = Mean Analyst Basic EPS estimates for the current calendar year

Loss Making

A payout ratio less than 0% is only possible if the analyst’s estimates for EPS for the next year end are negative. A dividend to common shareholders is paid out of the bottom line.

Good

A range of 0% to 35% is considered a good payout. A payout in that range is usually observed when a company just initiates a dividend. Typical characteristics of companies in this range are “value” stocks. If the company recently started paying a dividend, the market doesn’t value it as much as a company that has been paying a dividend for years.

Healthy

A range of 35% to 55% is considered healthy and appropriate from a dividend investor’s point of view. A company that is likely to distribute roughly half of its earnings as dividends means that the company is well established and a leader in its industry. It’s also reinvesting half of its earnings for growth, which is welcome.

High

Payout ratios that are between 55% to 75% are considered high because the company is expected to distribute more than half of its earnings as dividends, which implies less retained earnings. A higher payout ratio viewed in isolation from the dividend investor’s perspective is very good.

Very High

A payout ratio that is between 75% to 95% is considered very high. It implies that the company is bordering towards declaring almost all the money it makes as dividends. This increases the risk of the company cutting its dividends because our formula is forward looking.

Unsustainable

Companies that have forward-looking payouts of 95% to 150% are distributing more money than they earn. A poor earnings estimate is likely to result in an unsustainable payout ratio in the triple digits. Only two things can happen from here: the dividend would be cut or eliminated altogether.

What Is a Dividend Payout Ratio?

A dividend is a payment from a company's stock to its shareholders that's usually paid out every quarter. It represents part of the company's profits that shareholders are entitled to for holding the company's stock.

How to Calculate a Dividend Payout Ratio

On the surface, the dividend payout ratio is simple. If a firm earns $1 a share and pays out 50 cents over a year, the ratio is 50%. A lower ratio suggests the firm earns enough to keep up those payments or to raise dividends over time even if earnings are uneven.

How to Analyze a Payout Ratio

The payout ratio can serve as a warning of the need to look deeper rather than a simple red light, green light signal to investors to "buy" or "sell."

Takeaway

The key is to attract and maintain a company's shareholders, and dividend increases are more of a reason for investors to hold on to a company's shares for the long term. Monitoring the dividend payout ratio can help you understand the nature of dividend changes and what this may mean for the dynamics of the business.

10 Large-Cap Growth Stocks to Buy

Paulina Likos is an investing reporter at U.S. News & World Report, specializing in diversification and risk management. She covers investing themes including asset management, global equities, the private markets, cryptocurrency and millennial investing trends. She previously worked as a risk manager at Fannie Mae. Read more

What is the Target Payout Ratio?

A target payout ratio is a measure of the percentage of a company's earnings it would like to pay out to shareholders as dividends over the long-term.

Understanding the Target Payout Ratio

Since dividend cuts are perceived negatively by markets, management teams are usually reluctant to increase dividends unless they are fairly confident they will not have to reverse their decision due to cash flow pressure in the near future.

Dividends and Stock Prices

Investors closely follow information related to dividend payout, and stock prices often react poorly to unexpected changes in a company’s target payout ratio. Because of the message that dividend policy can send about a company’s prospects, company managements share payout guidance as well as planned changes to target payout ratios.

Example of Target Dividend Policy

As of 2019, the big box retailer Target Corporation ( TGT) has maintained an increasing dividend policy every year for more than 50 years. In 1967 the company paid $0.0021 per share. In 2018, Target paid $2.52 per share, and increased the dividend for 2019.

What Is a Payout?

Payouts refer to the expected financial returns or monetary disbursements from investments or annuities. A payout may be expressed on an overall or periodic basis and as either a percentage of the investment's cost or in a real dollar amount.

Understanding Payout

In terms of financial securities, such as annuities and dividends, payouts refer to the amounts received at given points in time. For example, in the case of an annuity, payouts are made to the annuitant at regular intervals, such as monthly or quarterly.

Payout Ratio as a Measure of Distribution

There are two main ways that companies can distribute earnings to investors: dividends and share buybacks. With dividends, payouts are made by corporations to their investors and can be in the form of cash dividends or stock dividends. The payout ratio is the percentage rate of income the company pays out to investors in the form of distributions.

Payout and Payout Period as a Capital Budgeting Tool

The term "payout" may also refer to the capital budgeting tool used to determine the number of years it takes for a project to pay for itself. Projects that take longer are considered less desirable than projects with a shorter period.

What is a good payout ratio then?

Based on my experience, I like companies that have a payout ratio between 25% and 80%. However, I would not filter stocks by payout ratio and automatically eliminate companies outside this range.

I never use a maximum payout ratio in my research

Using my DSR stock screener, it would be tempting to use a minimum and maximum payout ratio metric. Simply by selecting stocks showing a payout ratio between 30% and 80%, you drop the stock screener list of stocks from 1,013 to 388. With a single filter, you could slash 625 companies, that’s 62% of all stocks covered by DSR!

Dividend Ratio: Understanding the Basics

The dividend payout ratio refers to the amount of dividend shareholders earn relative to the total net income of a company. The amount that is not distributed to shareholders is retained by the company for growth and other purposes.

The Bottom Line

Dividend investing is income investing. Our code takes into account cases of special dividends, non-dividend paying companies, missed/delayed payouts and dividend suspensions where the payout ratio can be either 0% or NM.

Introduction

The first concept to discuss is the payout ratio in its simplest form. The equation to calculate the traditional payout ratio is to divide a company’s annual dividend per share by the company’s earnings per share. For example, if a stock pays a $1 dividend each year and earns $3 per year in profits, the payout ratio is 33%.

Interpretation of Negative Payout Ratios

If a company is projected to lose money in a forecasted period, mathematically that would make the payout ratio negative. For example, if a company pays a $1 annual dividend but is expected to lose $4 per share next year, its forward-looking payout ratio will be -25%.

The Bottom Line

Many companies strive to reward shareholders with quarterly dividend payments, but those dividends must be supported by underlying profits. If and when a company incurs losses, its payout ratio will go negative, which is a major red flag that the dividend is in danger of being cut.