How to trade order flow?

Sep 30, 2020 · Order flow trading is a type of analysis that involves watching the flow of trading orders and their subsequent impact on the price to anticipate future price movement. In other words, the order flow analysis allows you to see how …

What is trading order flow?

Dec 07, 2021 · Order flow is the mechanism that facilitates price movement in the stock market. If no orders were executed, the prices of assets would essentially stay the same. There’s an argument that massive firms that hold large inventories of stocks and options make it possible for the market to function given the volume of stock trades that take place.

How does PFoF work?

Order Flow VWAP Identify key price thresholds and measure momentum with volume-weighted average price (VWAP), a moving average that also incorporates volume data. Deviation bands indicate price levels where buying & selling pressure are anticipated Confirm trends and track price breakouts Order Flow Cumulative Delta

What is payment for order flow?

Jul 11, 2019 · Order flow trading is a method that attempts to anticipate price movement based on the current orders that are visible on both the buy and sell-side. How many bids are being placed versus asks? The unknown factor, of course, is the number of buyers and sellers that suddenly jump into the markets (or traders who might know if any large buyers or sellers are …

How is order flow used in trading?

5:341:04:44Trading Order Flow: Keeping It Simple, Practical & Effective - YouTubeYouTubeStart of suggested clipEnd of suggested clipNow. I will say that when you're looking at levels. The better time might not be the best priceMoreNow. I will say that when you're looking at levels. The better time might not be the best price sometimes the better time is when you've got more confirmation. And quite often you pay for confirmation

What is order flow chart?

The general purpose of order flow charts is to visualise the huge amounts of data generated by exchanges in trading. Order flow charts provide traders a visual opportunity to gain more insights and transparency into the trading process in real time.

What is order flow analysis in trading?

Order flow is a form of data analysis that allows traders to predict price shifts before they happen by studying the flow of the trading orders in the market and how it affects the prices.Dec 22, 2020

Is order flow useful?

Order Flow can't improve something that doesn't work. Order Flow can be used on it's own, without charts to enter and exit the market but you also have to be able to recognize different market states that need different/altered setups. There is nothing magical about this.

Why do firms pay for order flow?

Å portion of the better price is passed back to the customer in the form of what's called price improvement, after the market maker takes its profit on the spread between the buy and sell prices. And some of that profit goes to the broker as a rebate for steering the order its way. That's the payment for order flow.

What is toxic order flow?

Order flow is regarded as toxic when it adversely selects market makers who may be unaware that they are providing liquidity at a loss.

How do you monitor order flow?

0:086:50ATAS | Order Flow Trading - How to Monitor Orders, Positions, Account ...YouTubeStart of suggested clipEnd of suggested clipIf you do have multiple accounts that you're trading with you can just simply click on the accountMoreIf you do have multiple accounts that you're trading with you can just simply click on the account and it'll filter alphabetically of course.

How do you calculate order flow in stock?

14:2122:43Why PRICE ACTION TRADING & ORDER FLOW works in DAY ...YouTubeStart of suggested clipEnd of suggested clipThis point of control region. Now point of control in a candle is that point where maximum volumeMoreThis point of control region. Now point of control in a candle is that point where maximum volume has come in so how would you read this scan d. So this bullish candle that has formed maximum.

What is order flow trading?

The essence of order flow trading is to trade based on the actions of the markets, which are displayed by the bid and ask volume that has traded. The order flow trading tools not only show us the buy and sells imbalances, but equally, it shows us the timing of the execution.

What is footprint chart?

The footprint chart shows us how aggressive are the buyers and sellers. We can use this information to see where the big inventory of orders is sitting and compare it with what the market is doing.

What is PFOF in trading?

Payment for order flow (PFOF) is the compensation and benefit a brokerage firm receives for directing orders to different parties for trade execution. The brokerage firm receives a small payment, usually fractions of a penny per share, as compensation for directing the order to a particular market maker.

Who invented the payment for order flow?

Ironically, payment for order flow is a practice pioneered by Bernard Madoff — the same Madoff of Ponzi scheme notoriety.

What are the 605 and 606 reports?

If you dig around a broker’s website, you may find two reports, labeled Rule 605 and Rule 606, which display execution quality and payment for order flow statistics . These reports can be nearly impossible to find in spite of the fact that the SEC requires broker-dealers to make them available to investors. The SEC mandated these reports in 2005, though the format and reporting requirements have changed over the years with the most recent updates made in 2018. A group of brokers and market makers created a working group with the Financial Information Forum (FIF) that attempted to standardize reporting of order execution quality that has dwindled to just a single retail brokerage ( Fidelity) and a single market maker ( Two Sigma Securities ). FIF notes that the 605/606 reports “do not provide the level of information that allows a retail investor to gauge how well a broker-dealer typically fills a retail order when compared to the ‘national best bid or offer’ (NBBO) at the time the order was received by the executing broker-dealer.”

What is market maker?

The market maker or exchange benefits from the additional share volume it handles, so it compensates brokerage firms for directing traffic. Investors, particularly retail investors, who often lack bargaining power, can possibly benefit from the competition to fill their order requests.

Footprints

The Order Flow does not show standard candles, but it shows FOOTPRINTS.

High Volume Nodes

Possibly the most important place in any footprint is the High Volume Node. It represents the place where the heaviest volumes were traded.

Why do prices move?

Prices move because of an imbalance between the amount of buyers demand to sellers supply. This is how exchanges determine what will be the next quote tick. This works on every market, from stocks, futures, options, commodities, bonds, and forex currencies.

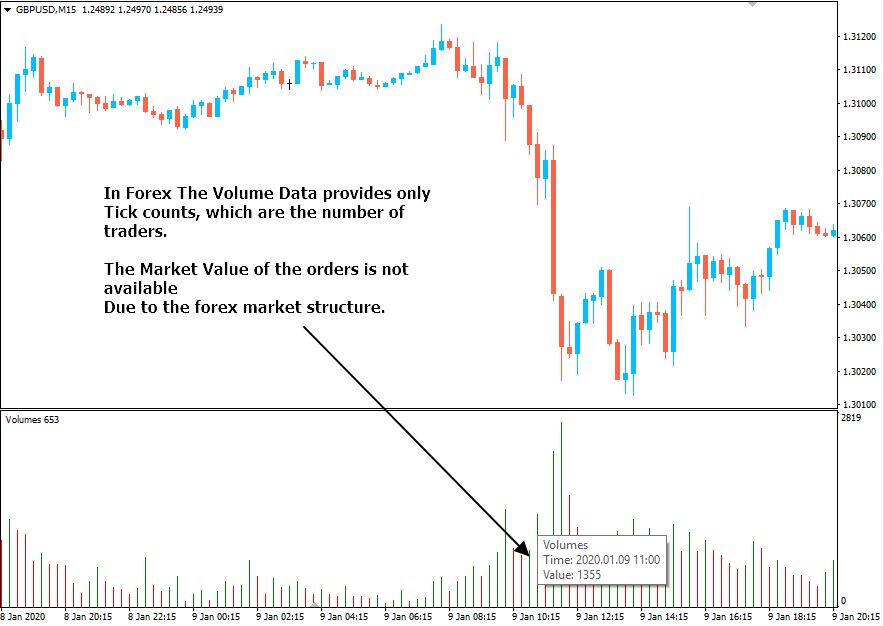

What is order flow in forex?

In most financial markets, order flow is the accumulation of orders awaiting at a specific price level. It is a combination of how many orders count and their size. The situation in Forex is different. There is no reliable volume data that traders can rely on.

How does leg up help in trading?

This leg up will practically provide you with the advantage of buying at a very cheap price and selling at the highest , most expensive. It will also allow you the comfort of knowing your trade ahead of time so you can set future orders to be filled at a future time whenever price hits the mark. This reduces screen time and will make your trading routine very easy and relaxed, leaving you enough time to be an analyst and well prepared for the trades.

Is the forex market centralized?

The forex market is a decentralized market that has no exchange responsible to govern this market. Other markets like the stock exchanges, futures market, and commodities market, have a centralized exchange that governs the respective market. These other markets can, therefore, provide the tape of the volume of the order flow.

Why is stop loss important?

At highly liquidated market conditions such as in economic events releases or major surprising events, order flow levels might be washed off and not give the expected reaction. This is why using stop loss for your risk management is crucial.

What is volume in forex?

In most Forex platforms, the volume is the accumulated tick count and it does not provide orders on the axis of price above and below market as you could find in level 2 for stocks. Therefore, in forex, you would have to analyze and figure out where the awaiting order flow is by analyzing the chart patterns.

Why is order flow important in trading?

However, trading Order Flow gives you an important edge for your trades execution. Order flow provides you more advantages: A simple concept to learn and to understand the market’s behavior. High risk to reward ratio.

Order Flow Volume Profile Indicator & Drawing Tool

Analyze the distribution of trading volume over price for a specified time range to identify significant levels of support and resistance with this comprehensive visual display.

Volumetric Bars

Volumetric bars track buyers and sellers tick by tick giving you a comprehensive view of the activity for order flow trading.

Order Flow VWAP

Identify key price thresholds and measure momentum with volume-weighted average price (VWAP), a moving average that also incorporates volume data.

Order Flow Cumulative Delta

Track aggressing buying & selling with Cumulative Delta, a visual display of the net difference between buyers & sellers at each price level traded.

Order Flow Trade Detector

Analyze the tape and visualize significant trade events on your chart. A powerful combination when used in conjunction with the Order Flow Depth Map.

Order Flow Market Depth Map

Historic and real-time visualization of the limit order book giving you clear insight of market depth and order flow.

How to Identify Imbalance in the Markets with Order Flow Trading

Recently, “order flow” has become something of a buzzword, as if a newfound popularity has grown around one of the oldest of market functionalities, a common-sense mechanism that has suddenly become imbued with a secret that retail traders wish to unlock, thinking that perhaps this, among other things, will be the tactic to give them an edge over other traders who may not have the know-how to use it..

What is Order Flow Trading?

Order flow trading is a method that attempts to anticipate price movement based on the current orders that are visible on both the buy and sell-side.

What is the difference between a stock and a flow?

Thus, a stock refers to the value of an asset at a balance date (or point in time), while a flow refers to the total value of transactions (sales or purchases, incomes or expenditures) during an accounting period.

What are stock and flow?

Stocks and flows also have natural meanings in many contexts outside of economics, business and related fields. The concepts apply to many conserved quantities such as energy, and to materials such as in stoichiometry, water reservoir management, and greenhouse gases and other durable pollutants that accumulate in the environment or in organisms. Climate change mitigation, for example, is a fairly straightforward stock and flow problem with the primary goal of reducing the stock (the concentration of durable greenhouse gases in the atmosphere) by manipulating the flows (reducing inflows such as greenhouse gas emissions into the atmosphere, and increasing outflows such as carbon dioxide removal ). In living systems, such as the human body, energy homeostasis describes the linear relationship between flows (the food we eat and the energy we expend along with the wastes we excrete) and the stock (manifesting as our gain or loss of body weight over time). In Earth system science, many stock and flow problems arise, such as in the carbon cycle, the nitrogen cycle, the water cycle, and Earth's energy budget. Thus stocks and flows are the basic building blocks of system dynamics models. Jay Forrester originally referred to them as "levels" rather than stocks, together with "rates" or "rates of flow".

Can you compare stocks and flows?

Comparing stocks and flows. Further information: Dimensional analysis § Commensurability. Stocks and flows have different units and are thus not commensurable – they cannot be meaningfully compared, equated, added, or subtracted. However, one may meaningfully take ratios of stocks and flows, or multiply or divide them.