Why did the stock market fall during the Great Depression?

The prosperous decade leading up to the stock market crash of 1929, with easy access to credit and a culture that encouraged speculation and risk-taking, put into place the conditions for the country’s fall. The stock market, which had been growing for years, began to decline in the summer and early fall of 1929, precipitating a panic that led to a massive stock sell-off in late October.

What's really causing the stock market to crash?

While the exact cause of each of these crashes can get a bit complicated, stock market crashes are generally caused by some combination of speculation, leverage, and several other key factors. Here's a rundown of six different stock market crash catalysts that could contribute to the next plunge in the market.

What are facts about the stock market crash?

- Tales of bankers leaping to their death when they saw the results of the markets are now regarded as a myth.

- The ticker tapes were so far behind that analysts had beds brought into their offices and worked around the clock in shifts to try and catch up.

- In today’s money the losses amount to more than $400 billion in just 4 days.

What actually happens during a stock market crash?

The stock market crash of 1987 was a steep decline in U.S. stock prices over a few days in October of 1987; in addition to impacting the U.S. stock market, its repercussions were also observed in other major world stock markets.

What was the stock market crash in simple terms?

The stock market crash of 1929 was a collapse of stock prices that began on October 24, 1929. By October 29, 1929, the Dow Jones Industrial Average had dropped by 30.57%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression.

Why did the stock market crash contribute to the Great Depression?

Panic Made the Situation Worse Public panic in the days after the stock market crash led to hordes of people rushing to banks to withdraw their funds in a number of “bank runs,” and investors were unable to withdraw their money because bank officials had invested the money in the market.

How did the stock market crash in 1929 definition?

The stock market crash of 1929 began on Thursday, Oct. 24, 1929, when panicked investors sent the Dow Jones Industrial Average (DJIA) plunging 11% in heavy trading. 3. The 1929 crash was preceded by a decade of record economic growth and speculation in a bull market that saw the DJIA skyrocket over five years.

Why did the stock market crash?

Caused by the collapse of the housing market, subprime mortgage lending and repackaged housing securities, the financial crisis of 2008 caused a downturn that took the economy more than a decade to fully recover from.

What happens when stock market crash?

During a stock market crash, equity prices collapse over the course of one or a few days. The market decline is rapid. Investors fear the worst and attempt to liquidate their positions, or convert them to cash; oftentimes, this means locking in previously unrealized losses.

What were the effects of the stock market crash?

Business houses closed their doors, factories shut down and banks failed. Farm income fell some 50 percent. By 1932 approximately one out of every four Americans was unemployed. According to historian Arthur M.

What were the 5 causes of the Great Depression?

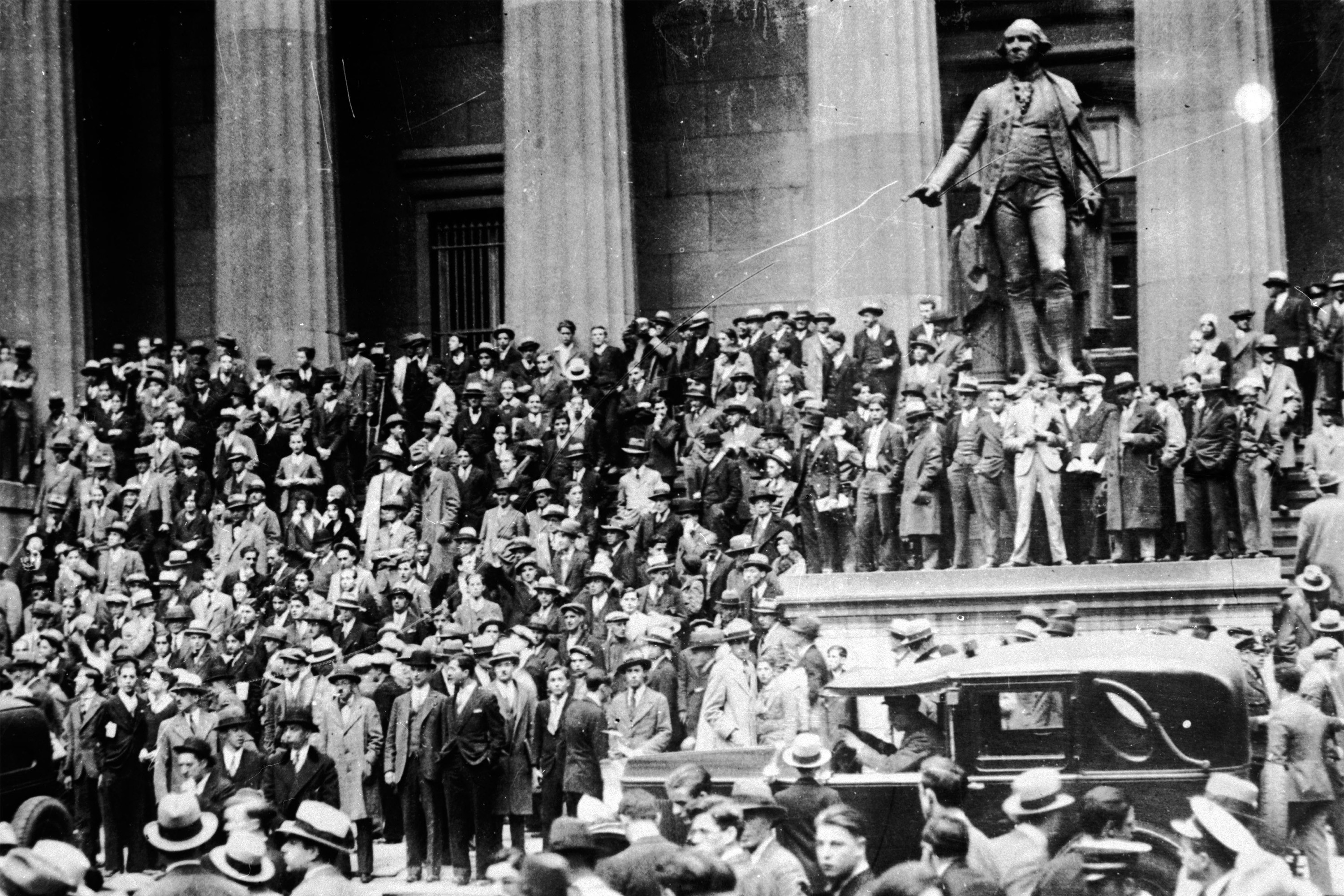

of 05. Stock Market Crash of 1929. Workers flood the streets in a panic following the Black Tuesday stock market crash on Wall Street, New York City, 1929. ... of 05. Bank Failures. ... of 05. Reduction in Purchasing Across the Board. ... of 05. American Economic Policy With Europe. ... of 05. Drought Conditions.

How long did the stock market crash last?

Wall Street Crash of 1929Crowd gathering on Wall Street after the 1929 crashDateSeptember 4 – November 13, 1929TypeStock market crashCauseFears of excessive speculation by the Federal Reserve

When was the stock market crash?

October 28, 1929On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system. The Roaring Twenties roared loudest and longest on the New York Stock Exchange. Share prices rose to unprecedented heights.

What was the stock market crash of 1929?

The stock market crash of 1929 was not the sole cause of the Great Depression, but it did act to accelerate the global economic collapse ...

What were the causes of the 1929 stock market crash?

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

What happened to stock market in 1929?

Stock prices began to decline in September and early October 1929, and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded. Investment companies and leading bankers attempted to stabilize the market by buying up great blocks of stock, producing a moderate rally on Friday. On Monday, however, the storm broke anew, and the market went into free fall. Black Monday was followed by Black Tuesday (October 29, 1929), in which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading.

What happened on October 29, 1929?

On October 29, 1929, Black Tuesday hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), ...

What happened after Black Tuesday?

In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time .

When did stock prices drop in 1929?

Stock prices began to decline in September and early October 1929 , and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded.

When did the stock market peak?

During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929 after a period of wild speculation during the roaring twenties. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value.

What was the Dow down in 1932?

By July 8, 1932, the Dow was down to 41.22. That was an 89.2% loss from its record-high close of 381.17 on September 3, 1929. It was the worst bear market in terms of percentage loss in modern U.S. history. The largest one-day percentage gain also occurred during that time.

What happened in 1929?

Updated September 02, 2020. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929. By Oct. 29, 1929, the Dow Jones Industrial Average had dropped 24.8%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression .

How much did the Dow rise in 1933?

On March 15, 1933, the Dow rose 15.34%, a gain of 8.26 points, to close at 62.1. 8. The timeline of the Great Depression tracks critical events leading up to the greatest economic crisis the United States ever had. The Depression devastated the U.S. economy.

What happened on September 26th 1929?

September 26: The Bank of England also raised its rate to protect the gold standard. September 29, 1929: The Hatry Case threw British markets into panic. 6. October 3: Great Britain's Chancellor of the Exchequer Phillip Snowden called the U.S. stock market a "speculative orgy.".

What was the 1929 stock market crash?

The Wall Street crash of 1929, also called the Great Crash, was a sudden and steep decline in stock prices in the United States in late October of that year.

What caused the stock market to go down in 1929?

Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier that summer, both of which contributed to gradual declines in stock prices in September and October, eventually leading investors to panic. During the mid- to late 1920s, the stock market in the United States underwent rapid ...

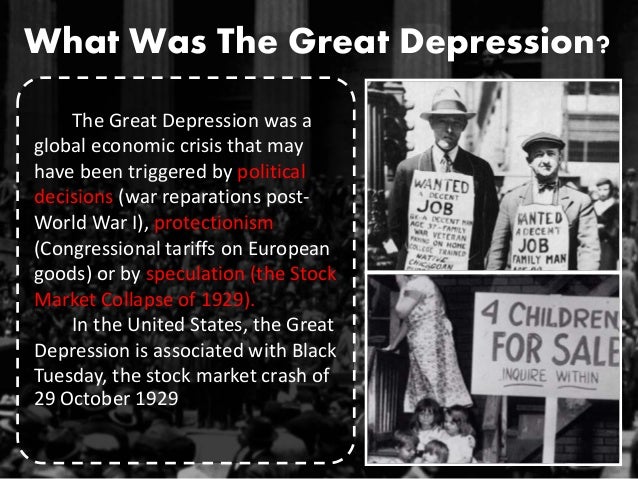

What was the Great Depression?

Stock market crash of 1929, also called the Great Crash, a sharp decline in U.S. stock market values in 1929 that contributed to the Great Depression of the 1930s. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. Crowds gathering outside the New York ...

How many points did the Dow close down?

Still, the Dow closed down only six points after a number of major banks and investment companies bought up great blocks of stock in a successful effort to stem the panic that day. Their attempts, however, ultimately failed to shore up the market. The panic began again on Black Monday (October 28), with the market closing down 12.8 percent.

What was the cause of the 1929 Wall Street crash?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it , during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels. Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier ...

Why did people sell their Liberty bonds?

People sold their Liberty Bonds and mortgaged their homes to pour their cash into the stock market. In the midsummer of 1929 some 300 million shares of stock were being carried on margin, pushing the Dow Jones Industrial Average to a peak of 381 points in September.

What was the stock market crash of 1929?

The stock market crash of 1929 followed a bull market that had seen the Dow Jones rise 400% in five years. But with industrial companies trading at price-to-earnings ratios (P/E ratios) of 15, valuations did not appear unreasonable after a decade of record productivity growth in manufacturing—that is, until you take into account the public utility holding companies.

What were the causes of the 1929 stock market crash?

The 1929 crash was preceded by a decade of record economic growth and speculation in a bull market that saw the DJIA skyrocket 400% over five years. Other factors leading up to the stock market crash include unscrupulous actions by public utility holding companies, overproduction of durable goods, and an ongoing agricultural slump.

What caused the 1929 financial crash?

Another factor experts cite as leading to the 1929 crash is the overproduction in many industries that caused an oversupply of steel, iron, and durable goods. When it became clear that demand was low and there were not enough buyers for their goods, manufacturers dumped their products at a loss and share prices began to plummet. Some experts also cite an ongoing agricultural recession as another factor impacting the financial markets.

What was the cause of the 1929 crash?

The lack of government oversight was one of the major causes of the 1929 crash—thanks to laissez-faire economic theories. In response, Congress passed an array of important federal regulations aimed at stabilizing the markets.

What was the effect of the Great Depression on the working population?

In the end, a quarter of America’s working population would lose their jobs as the Great Depression ushered in an era of isolationism, protectionism, and nationalism. The infamous Smoot-Hawley Tariff Act in 1930 started a spiral of beggar-thy-neighbor economic policies.

What broke the camel's back?

However, the straw that broke the camel’s back was probably the news in Oct. 1929 that the public utility holding companies would be regulated. The resulting sell-off cascaded through the system as investors who had bought stocks on margin became forced sellers.

When did the Dow Jones Industrial Average bottom out?

In fact, the Dow Jones Industrial Average (DJIA) did not bottom out until July 8, 1932, by which time it had fallen 89% from its Sept. 1929 peak, making it the biggest bear market in Wall Street’s history. The Dow Jones did not return to its 1929 high until Nov. 1954.

What was the first major market crash?

The Great Depression Crash of October 1929. This was the first major U.S. market crash, where speculations caused share prices to skyrocket. There was a growing interest in commodities such as autos and homes. Unsophisticated investors flooded the market, driving up prices in a panic buying mode.

How does a stock market crash affect the economy?

Stock market crashes have severe effects on the economy and investors’ behavior. Essentially, the overall economy of a country depends on its stock market. A country’s stock market trend becomes the main focus when investors intend to invest. The most common ways investors are bound to lose their money in the event of a stock market collapse is ...

What caused the 2007/08 stock market crash?

The 2007/08 stock market crash was triggered by the collapse of mortgage-backed securities in the housing sector. High frequency of speculative trading caused the securities rise and decline in value as housing prices receded. With most homeowners unable to meet their debt obligations, financial institutions slid into bankruptcy, causing the Great Recession.

What caused the market to collapse in March 2020?

The market collapse in March 2020 was caused by the government’s reaction to the Novel COVID-19 outbreak, a rapidly spreading coronavirus around the world. The pandemic impacted many sectors worldwide, including healthcare, natural gas, food, and software.

What are some examples of stock market crashes?

Historical examples of stock market crashes include the 1929 stock market crash, 1987 October stock market crash, and the 2020 COVID-19 stock market crash.

What was the 2010 flash crash?

2010 Flash Crash The 2010 Flash Crash is the market crash that occurred on May 6, 2010. During the 2010 crash, leading US stock indices, including the Dow. The Economic Crash of 2020 The economic crash of 2020 was precipitated by the COVID-19 pandemic.

How can turbulence dampen markets?

Turbulent markets can also be dampened by the purchase of massive quantities of stocks by large entities when prices drop. By so doing, established entities hold prices up to prevent individual traders from panic trading. This method is limited in its effectiveness.

What was the stock market crash of 1929?

The stock market crash of 1929 followed an epic period of economic growth during what's now known as the Roaring Twenties. The Dow Jones Industrial Average ( DJINDICES:^DJI) was at 63 points in August 1921 and increased six-fold over the next eight years, closing at a high of 381.17 points on Sept. 3, 1929. That September day marked the peak of the ...

What happened to the stock market in 1929?

When the stock market crashed in September 1929, all of the entwined investment trusts similarly collapsed. In the wake of the crash, the banks and other lenders that financed the stock-buying spree had little means to collect what they were owed. Their only collateral was stocks for which the amount of debt outstanding exceeded the stocks' worth.

What was the total non-corporate debt in 1929?

By September 1929, total noncorporate debt in the U.S. amounted to 40% of the nation's Gross Domestic Product (GDP). At the same time that readily available credit was fueling consumer spending, the buoyant stock market gave rise to many new brokerage houses and investment trusts, which enabled the average person to buy stocks.

What happened after 1929?

The bursting of the stock market's bubble unleashed a cascade of market forces that plagued the U.S. economy for years after 1929 . The economy likely could have recovered more quickly in those ensuing years had the combined effects of excessive borrowing, business closures, and mass layoffs not exacerbated and prolonged the crisis.

When did the Dow drop?

By mid-November 1929, the Dow had declined by almost half. It didn't reach its lowest point until midway through 1932, when it closed at 41.22 points -- 89% below its peak. The Dow didn't return to its September 1929 high until November 1954.

What percentage of all consumer purchases were made on installment plans in 1927?

By 1927, 15% of all major consumer purchases were being made on installment plans. People in the 1920s acquired six of every 10 automobiles and eight of every 10 radios on credit.

How did the stock market crash affect people?

Although only a small percentage of Americans had invested in the stock market, the crash affected everyone. Banks lost millions and, in response, foreclosed on business and personal loans, which in turn pressured customers to pay back their loans, whether or not they had the cash.

How to explain the stock market crash?

By the end of this section, you will be able to: 1 Identify the causes of the stock market crash of 1929 2 Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly 3 Explain how a stock market crash might contribute to a nationwide economic disaster

What happened to the stock market on September 20th?

Even the collapse of the London Stock Exchange on September 20 failed to fully curtail the optimism of American investors. However, when the New York Stock Exchange lost 11 percent of its value on October 24—often referred to as “Black Thursday”—key American investors sat up and took notice.

What happened on October 29, 1929?

October 29, 1929, or Black Tuesday, witnessed thousands of people racing to Wall Street discount brokerages and markets to sell their stocks. Prices plummeted throughout the day, eventually leading to a complete stock market crash. The financial outcome of the crash was devastating.

How much did the stock market lose in 1929?

Between September 1 and November 30, 1929, the stock market lost over one-half its value, dropping from $64 billion to approximately $30 billion. Any effort to stem the tide was, as one historian noted, tantamount to bailing Niagara Falls with a bucket.

What were the advertisements selling in the 1920s?

In the 1920s, advertisers were selling opportunity and euphoria, further feeding the notions of many Americans that prosperity would never end. In the decade before the Great Depression, the optimism of the American public was seemingly boundless.

How many shares were traded on Black Tuesday?

On Black Tuesday, October 29, stock holders traded over sixteen million shares and lost over $14 billion in wealth in a single day. To put this in context, a trading day of three million shares was considered a busy day on the stock market. People unloaded their stock as quickly as they could, never minding the loss.

What was the cause of the 1929 stock market crash?

Most economists agree that several, compounding factors led to the stock market crash of 1929. A soaring, overheated economy that was destined to one day fall likely played a large role.

Why did the stock market crash make the situation worse?

Public panic in the days after the stock market crash led to hordes of people rushing to banks to withdraw their funds in a number of “bank runs,” and investors were unable to withdraw their money because bank officials had invested the money in the market.

What was the worst economic event in history?

The stock market crash of 1929 was the worst economic event in world history. What exactly caused the stock market crash, and could it have been prevented?

Why did people buy stocks in the 1920s?

During the 1920s, there was a rapid growth in bank credit and easily acquired loans. People encouraged by the market’s stability were unafraid of debt.

When did the Dow go up?

The market officially peaked on September 3, 1929, when the Dow shot up to 381.

When did the Federal Reserve raise the interest rate?

The Government Raised Interest Rates. In August 1929 – just weeks before the stock market crashed – the Federal Reserve Bank of New York raised the interest rate from 5 percent to 6 percent. Some experts say this steep, sudden hike cooled investor enthusiasm, which affected market stability and sharply reduced economic growth.

Who was the bankrupt investor who tried to sell his roadster?

Bankrupt investor Walter Thornton trying to sell his luxury roadster for $100 cash on the streets of New York City following the 1929 stock market crash. (Credit: Bettmann Archive/Getty Images) Bettmann Archive/Getty Images.

Black Thursday

Before The Crash: A Period of Phenomenal Growth

- In the first half of the 1920s, companies experienced a great deal of success in exporting to Europe, which was rebuilding from World War I. Unemployment was low, and automobiles spread across the country, creating jobs and efficiencies for the economy. Until the peak in 1929, stock prices went up by nearly 10 times. In the 1920s, investing in the stock market became somewha…

Overproduction and Oversupply in Markets

- People were not buying stocks on fundamentals; they were buying in anticipation of rising share prices. Rising share prices brought more people into the markets, convinced that it was easy money. In mid-1929, the economy stumbled due to excess production in many industries, creating an oversupply. Essentially, companies could acquire money cheaply due to high share prices an…

Global Trade and Tariffs

- With Europe recovering from the Great War and production increasing, the oversupply of agricultural goods meant American farmers lost a key market to sell their goods. The result was a series of legislative measures by the U.S. Congress to increase tariffs on imports from Europe. However, the tariffs expanded beyond agricultural goods, and many nations also added tariffs t…

Excess Debt

- Margin trading can lead to significant gains in bull markets (or rising markets) since the borrowed funds allow investors to buy more stock than they could otherwise afford by using only cash. As a result, when stock prices rise, the gains are magnified by the leverageor borrowed funds. However, when markets are falling, the losses in the stock positions are also magnified. If a port…

A Timeline of What Happened

Financial Climate Leading Up to The Crash

- Earlier in the week of the stock market crash, the New York Times and other media outlets may have fanned the panic with articles about violent trading periods, short-selling, and the exit of foreign investors; however many reports downplayed the severity of these changes, comparing the market instead to a similar "spring crash" earlier that year, after which the market bounced b…

Effects of The Crash

- The crash wiped many people out. They were forced to sell businesses and cash in their life savings. Brokers called in their loans when the stock market started falling. People scrambled to find enough money to pay for their margins. They lost faith in Wall Street. By July 8, 1932, the Dow was down to 41.22. That was an 89.2% loss from its record-h...

Key Events

- March 1929:The Dow dropped, but bankers reassured investors.

- August 8: The Federal Reserve Bank of New York raised the discount rate to 6%.16

- September 3: The Dow peaked at 381.17. That was a 27% increase over the prior year's peak.1

- September 26: The Bank of England also raised its rate to protect the gold standard.17

What Was The Stock Market Crash of 1929?

Understanding The Stock Market Crash of 1929

- The stock market crash of 1929 followed a bull market that had seen the Dow Jones rise significantly in five years. But with industrial companies trading at price-to-earnings ratios (P/E ratios) of over 15, valuations did not appear unreasonable after a decade of record productivity growth in manufacturing; that is, until you take into account the public utility holding companies.…

Other Factors Leading to The 1929 Stock Market Crash

- Another factor experts cite as leading to the 1929 crashis the overproduction in many industries that caused an oversupply of steel, iron, and durable goods. When it became clear that demand was low and there were not enough buyers for their goods, manufacturers dumped their products at a loss and share prices began to plummet. Some experts also cite an ongoing agricultural rec…

The Aftermath of The 1929 Stock Market Crash

- Instead of trying to stabilize the financial system, the Fed, thinking the crash was necessary or even desirable, did nothing to prevent the wave of bank failures that paralyzed the financial system—and so made the slump worse than it might have been. As Treasury Secretary Andrew Mellon told President Herbert Hoover: "Liquidate labor, liquidate stocks, liquidate the farmers, liq…

Special Considerations

- The lack of government oversight was one of the major causes of the 1929 crash, thanks to laissez-faire economic theories. In response, Congress passed an array of important federal regulations aimed at stabilizing the markets. These include the Glass Steagall Act of 1933, the Securities and Exchange Act of 1934, and the Public Utility Holding Companies Act of 1935.