Average volume, or the ADTV (average daily trading volume), in stocks refers to the average number of shares that are traded in a day. Usually, it's calculated over 20-day or 30-day periods, according to Investopedia. Article continues below advertisement Calculating the average daily volume is straightforward.

How do you calculate average daily trading volume?

Average volume, or the ADTV (average daily trading volume), in stocks refers to the average number of shares that are traded in a day.

What does average volume mean in stocks?

Jul 20, 2006 · Average daily trading volume (ADTV) is the average number of shares traded within a day in a given stock.

What is average daily trading volume?

Dec 14, 2003 · Daily volume is the most common time frame used when discussing stock volume. Average daily trading volume is the daily volume of shares traded, averaged over a number of days; this smooths out ...

What is daily trading volume?

The Average Volume is the total volume for a specified period divided by the number of bars in that same period. How this indicator works Compare the Average Volume for the specified period to determine if volume is above or below average.

What is a good average volume in stocks?

Is higher than average volume good?

Is high volume good for a stock?

What does 10 day average volume mean in stocks?

Is it good to buy stocks with low volume?

How do you read stock volume?

What is considered low volume?

What is considered high volume?

There's no specific dividing line between the two. However, high volume stocks typically trade at a volume of 500,000 or more shares per day. Low volume stocks would be below that mark.Apr 12, 2022

Is low volume bullish or bearish?

Down volume indicates bearish trading, while up volume indicates bullish trading. If the price of a security falls, but only on low volume, there may be other factors at work aside from a true bear turn.

What volume is 90days?

What is the best volume indicator?

- VWAP.

- Volume-Weighted Moving Average (VWMA)

- Money Flow Index (MFI)

- Accumulation and distribution indicator.

- Klinger Oscillator.

- On Balance Volume (OBV)

- Other volume indicators.

What is average volume in Robinhood?

What does it mean when the average daily volume increases?

When average daily trading volume (ADTV) increases or decreases dramatically, it signals that there has been a substantial shift in how people value or view the asset. Usually, higher average daily trading volume means that the security is more competitive, has narrower spreads and is typically less volatile.

Why is volume important in trading?

Average daily trading volume is an important metric because high or low trading volume attracts different types of traders and investors. Many traders and investors prefer higher average daily trading volume compared to low trading volume, because with high volume it is easier to get into and out positions. Low volume assets have fewer buyers and ...

Why do traders prefer high volume vs low volume?

Many traders and investors prefer higher average daily trading volume compared to low trading volume, because with high volume it is easier to get into and out positions. Low volume assets have fewer buyers and sellers, and therefore it may be harder to enter or exit at a desired price.

What does lack of volume mean?

A lack of volume indicates the breakout may fail . Volume also helps confirm price moves either higher or lower. During strong price pushes up or down, volume should also rise. If it isn't, there may not be enough interest to keep pushing the price. If there isn't enough interest then the price may pullback .

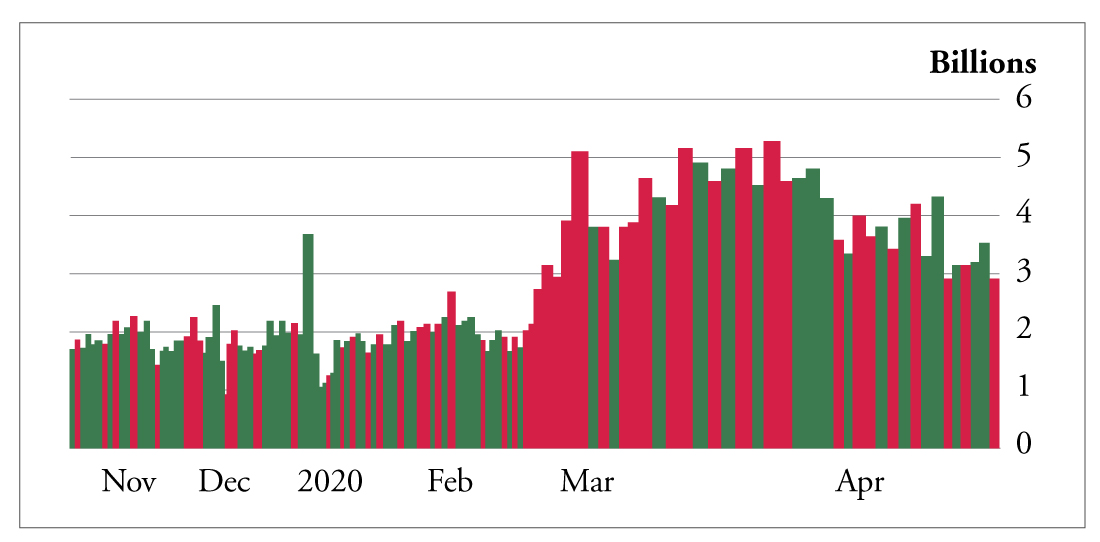

What does the red and green bar on a volume chart mean?

Along the bottom of the chart is a volume window. The red and green bars reflect daily volume, while the black line is the 20-day average volume. The average is less affected by single day events, and is a better gauge of whether overall volume is rising or falling.

What is ADTV in stock?

Average daily trading volume (ADTV) is the average number of shares traded within a day in a given stock. Daily volume is how many shares are traded each day, but this can be averaged over a number of days to find the average daily volume. Average daily trading volume is an important metric because high or low trading volume attracts different ...

Can an asset deviate from the average?

On any given day an asset can deviate from the average, producing much higher or lower volume. The average can also shift over time, rising, falling, or oscillating. Therefore, monitor volume and average volume regularly to make sure that the asset still falls within the volume parameters you desire for your trading.

What does volume mean in stock market?

Volume measures the number of shares traded in a stock or contracts traded in futures or options. Volume can be an indicator of market strength, as rising markets on increasing volume are typically viewed as strong and healthy. When prices fall on increasing volume, the trend is gathering strength to the downside.

What is trading volume?

Trading volume is a measure of how much of a given financial asset has traded in a period of time. For stocks, volume is measured in the number of shares traded and, for futures and options, it is based on how many contracts have changed hands.

Is volume an indicator of options?

The same is true for options traders, as trading volume is an indicator of an option's current interest. In fact, volume plays an important role in technical analysis and features prominently among some key technical indicators.

What is volume indicator?

Volume indicators are mathematical formulas that are visually represented in most commonly used charting platforms. Each indicator uses a slightly different formula, and traders should find the indicator that works best for their particular market approach .

What is volume used for?

Volume is a handy tool to study trends, and as you can see, there are many ways to use it. Basic guidelines can be used to assess market strength or weakness, as well as to check if volume is confirming a price move or signaling that a reversal might be at hand.

What is the purpose of indicators based on volume?

Indicators based on volume are sometimes used to help in the decision process. In short, while volume is not a precise tool, entry and exit signals can sometimes be identified by looking at price action, volume, and a volume indicator.

Why do buyers demand increasing numbers and increasing enthusiasm?

Buyers require increasing numbers and increasing enthusiasm in order to keep pushing prices higher. Increasing price and decreasing volume might suggest a lack of interest, and this is a warning of a potential reversal.

Description

The Average Volume is the total volume for a specified period divided by the number of bars in that same period.

How this indicator works

Compare the Average Volume for the specified period to determine if volume is above or below average.

What is relative volume?

Relative volume, or RVoL, is a comparison between current trading volume and average trading volume, which is often called “normal” or “past” volume. For example, if Tesla’s 10-day average volume is 33.875 million but has a current volume of 72.846 million, the relative volume would be 2.1. This means the stock has been traded 2.1 times more than the 10-day average.

What does it mean when a stock is inactive?

Increased trading activity often represents a significant rise or fall in a stock’s price—which is when day traders typically make their move. If a stock has a relative volume of less than one, it is considered inactive. A relative volume of two and above, however, indicates the stock is in play. If you’re ready to take on the risk of day trading, be sure to alleviate your risk by finding the best day trading broker .

What is a reversal in stock market?

A reversal marks an end of a trend. While it is difficult to know if the market is in an actual reversal or a continuation pattern, investors look to volume and candlestick charts, which is a viewing option on nearly all stock charts.

What does volume mean in stock?

Volume is the lifeblood of any stock. It represents the interest in the trading activity of said shares. Heavier volume indicates heavier interest and vice versa or lighter volume. A rise in volume tends to kick off significant price moves in many cases, however it is not a requirement. Despite conventional thinking, ...

What is volume in stock trading?

Volume is counted as the total number of shares that are actually traded (bought and sold) during the trading day or specified set period of time. It is a measure of the total turnover of shares. Each ticket represents a trade and counted towards the total trading volume.

How to tell if a stock is trading heavier or lighter than normal?

To determine if the volume is trading heavier or lighter than normal, traders can refer to the relative volume figure. Higher Relative Volume can bring volatility to a stock and make it easier to move.

Why do money managers use dollar volume?

Money managers use dollar volume metrics to determine whether a stock has enough liquidity to support a position. Dollar volume can also be used to get an idea of money flow when scanning for stocks breaking out or breaking down that are generating the highest dollar volume during the day.

What color is a volume bar?

Volume bars are usually colored green or red. Green represents net buying volume while red represents net selling volume. Some traders prefer to measure the volume with a moving average to spot when volume is relatively heavy or thin.

Average Daily Trading Volume Explained in Less Than 4 Minutes

Mike Price is a personal finance writer with more than six years of prior experience working in the banking industry. He specializes in writing about investing, real estate and accounting for The Balance. His work has also been featured in other notable financial websites such as The Motley Fool.

Definition and Examples of Average Daily Trading Volume

Average daily trading volume is the average amount of shares traded in a stock over a given period. The most common periods are one month, one quarter, or one year. Average daily trading volume is generally compared to either the daily volume or another average calculated over a different time frame, to find how much volume is changing.

How Average Daily Trading Volume Works

To understand how daily trading volume works, it’s best to go look at a stock’s volume numbers through a website like Morning star. Take Best Buy’s (BBY) volume numbers on the Morningstar website, for example:

What does volume mean in trading?

The first is that trading volume is an indicator of the overall level of interest in a stock shown by all potential stock traders. are committed to an investment in the stock. It usually indicates that the consensus opinion of market analysts is that the stock shows little probability for significant price appreciation.

What does high volume mean in stock market?

Conversely, a high average trading volume shows greater interest in the stock and is generally interpreted as meaning that many investors believe the stock will rise in price over time. 2. Indicates the trading liquidity in a stock. Average daily trading volume is also an indication of how liquid the trading in a stock is.

Why is volume important in stock market?

Why Volume of Trading is Important to Investors. 1. Indicates the overall level of interest in a stock. Stock market investors track the average daily trading volume for several important reasons. The first is that trading volume is an indicator of the overall level of interest in a stock shown by all potential stock traders.

Why do investors track the average daily trading volume?

The first is that trading volume is an indicator of the overall level of interest in a stock shown by all potential stock traders.

What does it mean when a stock has a low volume?

An extremely low average trading volume for a stock indicates that not many investors are following or interested in the stock and that few, if any, large institutional investors.

What is ADTV in stock market?

What is the Average Daily Trading Volume (ADTV)? Average Daily Trading Volume (ADTV) is a technical indicator used by investors that refers to the number of shares of a particular stock that, on average, change hands during a single trading day.

What is stock volume?

Stock volume is the count of the number of shares traded in a given time period, usually daily for a typical chart. For any given transaction, there is a buyer and a seller; the stock volume is a count of the number of shares exchanged between a buyer and a seller.

What is volume in stocks?

Volume in stocks refers to the total number of shares traded for a particular period. If 2 million shares are traded in a day, the day’s trading volume is 2 million. Importantly this means that 2 million stocks change hands from buyer to seller.

What does volume change mean?

The changes in volume from day to day indicate that a stock is more in demand if the volume bar rises and the stock price increases or less in demand if volume drops on price decreases.

Is volume important in technical analysis?

Yes, volume indicators in technical analysis are considered important, second only to the stock price trend . Combining the stock price movement with the increases or decreases in volume provides an insight into the supply and demand and sentiment of the market participants. Important volume indicators are “Volume Bars,” “Equivolume,” ...

What does a green volume bar mean on a stock chart?

A red volume bar indicates the close price for the time period was lower than the open price. A green volume bar indicates that the close price was higher than the open price.

What is the best volume indicator?

The Best Volume Indicator. While there are no “best” volume indicators, there are three essential volume indicators. The Volume Bar indicator is the most used and indicates supply and demand for a time period. The Volume at Price indicator shows the supply and demand at a specific price level.

What is volume bar chart?

The Volume Bar Chart enables you to visualize supply and demand for a given stock at a specific minute, hour, day, week, or month. This is the most commonly used volume indicator in the technical analysis of stocks and commodities.

Appearance

Purpose

- The trading volume is a measure of the total shares that have changed hands for a specific time period. The dollar volume is the total value of the shares traded. Dollar volume is calculated by trading volume multiplied by price. For example, if XYZ has a total trading volume of 100,000 shares at $5, then the dollar volume is $500,000. Money manage...

Significance

- Volume is the lifeblood of any stock. It represents the interest in the trading activity of said shares. Heavier volume indicates heavier interest and vice versa or lighter volume.

Effects

- A rise in volume tends to kick off significant price moves in many cases, however it is not a requirement. Despite conventional thinking, breakouts or breakdowns dont always require heavy volume especially in this age of algorithms that know precisely what price levels will efficiently trigger significant movement. Many traders have gone bust shorting light volume breakouts tha…

Use

- The cliché Never short a dull market. plays right into this. Often times, the heaviest volume bar forms at the peak of the move. It indicates the last of the chasers. This is why heavy volume hammer and shooting star candlesticks can form highly effective reversal signals. Volume analysis should be used in the context of the trading market environment with other supporting t…

Definition

- Liquidity refers to how much the market can absorb either buying or selling without making a market impact. How many shares can you buy or sell without moving the price of the stock? Liquidity overrides price. This is especially true for large stock traders and fund managers. High frequency trading programs and smart algorithms detects large orders and can possibly front ru…

Example

- For example, If you own 100,000 shares of a stock currently trading at $8 with an average daily volume 1 million shares, you may cause the stock to fall to $7 when selling the shares in a single session, resulting in an average selling price of $7.50. So while the value of the position is worth $8 million, the actual value of the position is $7.5 million. There was a $500,000 market impact o…