Individual investors move the market with leveraged instruments The stimulus money plowed into stocks is one thing. Another is the gears that this money will start turning inside the market.

Full Answer

How will stimulus checks affect the stock market?

The “stimmies,” he said — using a popular online term for stimulus checks — will go into people’s trading accounts, and “they will trade.” For a decade before the pandemic, small investors accounted for roughly a tenth of trading activity in the stock market.

Will there be another wave of stimulus check trading?

“The answer is liquidity which appears to be reverberating once again in an intense manner via retail investors, in a repeat to Q2 of last year,” they said in a recent note. Now that Biden is dangling $1,400 checks for ~150 million Americans, investors are bracing for another wave of “stimulus check” trading.

Are people really investing all their Stimulus money in stocks?

People are indeed plowing a big chunk of their stimulus money into stocks. And from record new brokerage accounts, it seems a lot of them are just now dipping their toes in investing.

What is a stimulus package?

A stimulus package is a collection of measures introduced by a government or central bank to intervene in a struggling economy and promote growth, or counteract economic contraction. As the name suggests, its purpose is to breathe life into an economy which is suffering or in recession.

How many people got a stimulus check?

91% got a stimulus check; 46% invested at least some of their stimulus check; and. Of those who invested their stimulus check, 70% invested at least half or less of their stimulus check. That means nearly half of respondents invested their stimulus check — which was intended to be essential money to help recipients weather the financial storm ...

Did stimulus recipients invest in the stock market?

This data suggests that not only did many recipients of stimulus checks invest in the stock market, but also many didn’t understand in what they were investing.

How Much Stimulus Money Could Be Going To The Stock Markets?

The speculations are that we could see approximately 9% to 10% of the total stimulus money going towards stocks. To put this into perspective, we could see anywhere between $150 billion to $190 billion cash pumped into the U.S. stock market.

Will retail investors flock to meme stocks?

Retail investors are likely to flock towards meme stocks with their stimulus money, as they are more likely to take on risk for a potentially big reward.

Will retail traders invest in the stock market?

Retail traders are likely to invest into the U.S. stock market with their fresh capital, and this could fade all the qualms around inflation and bond yields. Thus, stock indices may reach their new all-time highs in the coming weeks.

What Is a Stimulus Package?

A stimulus package is a collection of measures introduced by a government or central bank to intervene in a struggling economy and promote growth, or counteract economic contraction. As the name suggests, its purpose is to breathe life into an economy which is suffering or in recession.

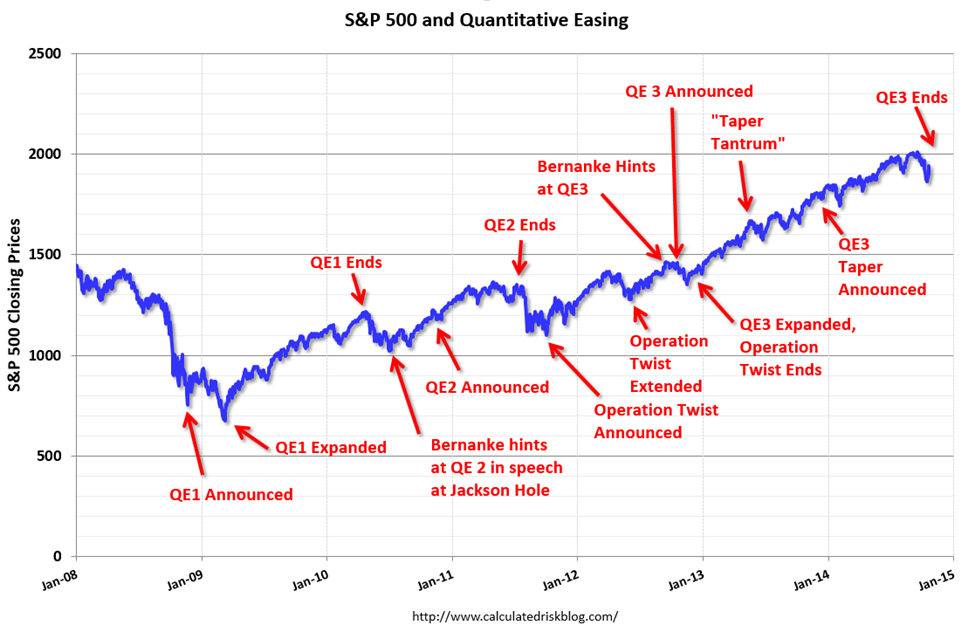

How Do Monetary and Fiscal Stimulus Affect the Financial Markets?

So now we know what measures are available for governments and central banks to employ as part of their stimulus plan, what effect do they have on the financial markets?

How does quantitative easing affect the economy?

As well as pumping more money into the economy, quantitative easing increases competition in the purchase of government bonds, reducing returns. This, in turn, encourages professional investors to invest in riskier assets - such as equities. Both of these effects can have a stimulative impact on the economy.

What is the relationship between interest rates and the forex market?

The other important factor which explains the relationship between interest rates and the Forex market is inflation.

Why do investors use discounted cash flow?

Therefore, interest rates play a large role in influencing the equity markets.

What is the purpose of fiscal stimulus?

The government’s aim when undertaking fiscal stimulus is to increase the money in circulation in the economy. It has two different ways of doing this. The first is by reducing taxes, which increases peoples’ disposable income, giving them more money to spend which will hopefully lead to an increase in consumption.

Which company will benefit from the stimulus package?

Technology giant Apple, which is one of the biggest exporting companies in the US with around 60% of their revenue accounted for by foreign sales, could be one company which will benefit from the stimulus package and a weaker US dollar. Depicted: Admiral Markets MetaTrader 5 - Apple Inc. Weekly Chart.

Why are stimulus checks working?

The result is that stimulus checks are working backward. In theory, the checks are meant to encourage people to spend money on stuff. That should boost companies’ earnings and eventually their stock prices. But it’s the other way around.

How do individual investors move the market?

Individual investors move the market with leveraged instruments. The stimulus money plowed into stocks is one thing. Another is the gears that this money will start turning inside the market. You see, a lot of individual investors don’t just buy stocks. They often up the ante with leveraged derivatives called options.

What is the boredom market hypothesis?

There’s this theory. Bloomberg columnist Matt Levine calls it “the boredom markets hypothesis.” In short, it suggests people don’t always invest specifically to make money. Some simply view the stock market as a “fun casino” and trade for pure entertainment.

Who sells options?

You see, options are sold by dealers called market makers . They are big financial institutions whose job it is to buy and sell securities like bonds, stocks, and options at all times. (In financial lingo: provide liquidity.)

Does money go straight back into stocks?

But it’s the other way around. A lot of that money goes straight back into stocks—which artificially props up their prices without shoring up the underlying business. And the hotter the stock, the more its price becomes divorced from its intrinsic value.

How much stimulus money was sent to the US in January?

In January, almost $2 trillion in government transfer payments were sent to Americans after the December passage of a further $600 in stimulus checks. That month, retail trading activity exploded. The passage of the Biden administration’s American Rescue Plan, with the latest stimulus, could prompt another retail surge.

Who knew how to spend his stimulus check?

Abraham Sanchez knew exactly how he wanted to spend his stimulus check.

What happens to stocks during economic downturns?

Typically, during economic downturns, people cling to cash, cut spending on nonessentials and hunker down until there are signs of a recovery. Stock prices usually suffer. During the 2008 financial crisis, for example, the S&P 500 collapsed nearly 57 percent from its peak to its March 2009 nadir. It took four years for the index to return to its previous peak.

Does the stock market have correlation with the stimulus checks?

In a recent note to clients, market analysts with JPMorgan found that the intensity of retail trading in the stock and options markets “has exhibited correlation with previous rounds of U.S. stimulus checks.”

Passive Income Opportunities

A perennial favorite investment strategy around here is to hone in on stocks with healthy dividends. And the next three stocks are all excellent candidates. For starters, Walmart has raised its dividend for a whopping 48 years in a row. The company is operating in rarified air while delivering steady income to its investors.

The Bottom Line on Stimulus Stocks

More and more investors are beginning to dabble in the markets. The results can go several different ways though. Someone that loses their shirt shortly after entering the markets is going to be once bitten, twice shy. Losing money leaves a bad taste in folk’s mouth… one they don’t soon forget.

How are stimulus checks spent?

How stimulus checks are spent depends on several factors. If someone fears they are out of work for some time, then they tend to spend less of their check. However, if they view their unemployment as temporary, then more of the check will be spent sooner. If they are working and in a higher income group, more of the check will typically be saved. ...

Will the stimulus be more immediate?

It seems likely that this round of stimulus could have a more immediate impact on the U.S. consumer. This is because more targeted as lower income groups. However, the economic environment is different too. Now, more businesses are open and accessible, making them better able to benefit from higher spending. Furthermore, overall economic uncertainty, may now be slightly lower too, making recipients feel more comfortable spending than saving as a precaution.

Is unemployment short term?

It is believed this is, in part, due to the fact that the unemployment benefits were short-term and too small to make it worthwhile for an unemployment recipient to refuse a job offer. This time around may be similar as the latest stimulus proposal increases unemployment benefits until September.

Is the stimulus check law?

While the latest round of stimulus from the American Rescue Plan is not yet law, slightly tighter income targeting and more generous treatment of children may lead to a greater proportion of this round of checks being spent, and hence boosting the economy in the short-term. In addition to stimulus checks there is also other spending that will help lower income groups such as through Low Income Home Energy Assistance Program.

Will the stimulus be good for 2021?

However, as before, the stimulus measure does look set to boost the U.S. economy for much of 2021 and help various consumer-facing businesses. This time against a potentially slightly more favorable backdrop. However, now time for the markets there are also concerns about inflation.

Did the stimulus checks come during lockdown?

There was simply less things for stimulus checks to go on, with a lot of businesses closed and movement restricted.