How much is Spak stock worth?

Apr 21, 2022 · Defiance NextGen SPAC Derived ETF trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "SPAK."

What is a SPAC stock?

Apr 20, 2022 · Get Defiance Next Gen SPAC Derived ETF (SPAK:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC.

What are SPACs and should you invest in them?

SPAK | A complete Defiance Next Gen SPAC Derived ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing.

What is a special purpose acquisition company (SPAC)?

A SPAC stock is simply stock in a Special Purpose Acquisition Company, which is an entity formed for the sole purpose of eventually acquiring an existing company, but maintains no business operations of any other kind. The funds raised in the SPAC IPO are used to purchase a private company and bring it to the public market to trade on a stock exchange.

What is a Spak investment?

SPAC is the acronym for “special purpose acquisition company” and is often referred to as a “blank check” entity. A SPAC might be best described as money looking for a promising private company to invest in. A SPAC is a public company having already gone through the IPO process.Nov 3, 2021

Is Spak a buy?

During the day the stock fluctuated 1.32% from a day low at $16.69 to a day high of $16.91. The price has fallen in 8 of the last 10 days and is down by -5.81% for this period....Fair opening price April 18, 2022Current price$16.76$16.69 (Undervalued)

What is the Spak ETF?

SPAK Factset Analytics Insight SPAK is the first ETF to offer exposure to Special Purpose Acquisitions Corporations (SPACs), also known as “blank check” companies, and the stocks in which they invest. SPACs are companies with no commercial operations other than to raise capital for the purpose of acquiring others.Sep 30, 2020

What is a SPAC stock?

A special purpose acquisition company (SPAC) is a company that has no commercial operations and is formed strictly to raise capital through an initial public offering (IPO) or the purpose of acquiring or merging with an existing company.

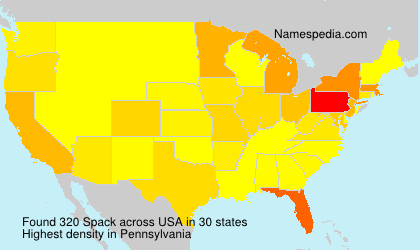

Is there a SPAC index?

The S&P U.S. SPAC Index is designed to measure the performance of a minimum of 30 common stocks of special purpose acquisition companies (SPACs) listed on U.S. exchanges.

How do you buy stock in SPAC?

If you're interested in adding SPACs to your portfolio, it's possible to buy them through an online brokerage account. Fidelity and Robinhood are two examples of online platforms that offer SPACs to investors. You can also look to an online brokerage account for SPAC ETFs as well.Oct 22, 2021

What are the best SPAC to buy?

Here are seven promising names to either buy now or keep on your radar in case they fall to a more favorable entry point:26 Capital Acquisition Corp. ... Digital World Acquisition Corp. ... Fintech Acquisition V (NASDAQ:FTCV)Gores Guggenheim (NASDAQ:GGPI)USHG Acquisition Corp.More items...•Dec 23, 2021

How much is SPAC shares worth?

Key DataLabelValueToday's High/Low$27.76/$27.66Share Volume9,24950 Day Avg. Daily VolumeN/APrevious Close$27.7314 more rows

Can I buy truth stocks?

So, can I buy Truth Social stock? As of March 2022, it isn't possible to buy Truth Social stock because the company isn't publicly listed – and is therefore not trading on the stock exchange. Likewise, Donald Trump has thus far decided to not publicly list Trump Media – meaning investors cannot buy TMTG stock either.Mar 15, 2022

What is a SPAC vs IPO?

SPACs versus IPOs In an IPO, a private company issues new shares and, with the help of an underwriter, sells them on a public exchange. In a SPAC transaction, the private company becomes publicly traded by merging with a listed shell company—the special-purpose acquisition company (SPAC).

What happens when you buy a SPAC stock?

A SPAC raises capital through an initial public offering (IPO) for the purpose of acquiring an existing operating company. Subsequently, an operating company can merge with (or be acquired by) the publicly traded SPAC and become a listed company in lieu of executing its own IPO.

How do SPACs go public?

SPACs typically use the funds they've raised to acquire an existing, but privately held, company. They then merge with that target, which allows the target to go public while avoiding the much longer IPO process.Jul 6, 2021

Is Defiance NextGen SPAC Derived ETF a good dividend stock?

Defiance NextGen SPAC Derived ETF pays an annual dividend of $0.31 per share and currently has a dividend yield of 1.75%.

What other stocks do shareholders of Defiance NextGen SPAC Derived ETF own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Defiance NextGen SPAC Derived ETF investors own include Al...

What is Defiance NextGen SPAC Derived ETF's stock symbol?

Defiance NextGen SPAC Derived ETF trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "SPAK."

Who are Defiance NextGen SPAC Derived ETF's major shareholders?

Defiance NextGen SPAC Derived ETF's stock is owned by a number of retail and institutional investors. Top institutional shareholders include Susque...

Which institutional investors are buying Defiance NextGen SPAC Derived ETF stock?

SPAK stock was purchased by a variety of institutional investors in the last quarter, including Susquehanna International Group LLP.

How do I buy shares of Defiance NextGen SPAC Derived ETF?

Shares of SPAK can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBul...

What is Defiance NextGen SPAC Derived ETF's stock price today?

One share of SPAK stock can currently be purchased for approximately $16.85.

How much money does Defiance NextGen SPAC Derived ETF make?

Defiance NextGen SPAC Derived ETF has a market capitalization of $20.73 million.

Is Defiance NextGen SPAC Derived ETF a good dividend stock?

Defiance NextGen SPAC Derived ETF pays an annual dividend of $0.31 per share and currently has a dividend yield of 1.75%.

What other stocks do shareholders of Defiance NextGen SPAC Derived ETF own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Defiance NextGen SPAC Derived ETF investors own include Alibaba Group (BABA), NVIDIA (NVDA), Pfizer (PFE), AT&T (T), Crown Castle International (CCI), Beyond Meat (BYND), B2Gold (BTG), Berkshire Hathaway (BRK.B), Baidu (BIDU) and B&G Foods (BGS).

What is Defiance NextGen SPAC Derived ETF's stock symbol?

Defiance NextGen SPAC Derived ETF trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "SPAK."

Who are Defiance NextGen SPAC Derived ETF's major shareholders?

Defiance NextGen SPAC Derived ETF's stock is owned by many different institutional and retail investors. Top institutional shareholders include Susquehanna International Group LLP (0.00%).

Which major investors are buying Defiance NextGen SPAC Derived ETF stock?

SPAK stock was bought by a variety of institutional investors in the last quarter, including Susquehanna International Group LLP.

How do I buy shares of Defiance NextGen SPAC Derived ETF?

Shares of SPAK can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

What is Defiance NextGen SPAC Derived ETF's stock price today?

One share of SPAK stock can currently be purchased for approximately $17.55.

SPAC Overview

When compared to a traditional IPO, the SPAC IPO process is generally quicker and simpler.

Investing in a SPAC Stock

SPAC stocks are typically priced at $10 per share. Investors purchase shares with a partial or full warrant and then wait for the SPAC to make an acquisition.

Advantages of SPAC Stocks

Pricing: The majority of SPAC stocks have an initial IPO listing of $10 per share, an amount that’s favorable for most retail investors. It’s common for the price point to remain close to the initial price for a few days following the IPO’s listing.

Possible Drawbacks of a SPAC Stock

The main disadvantages with SPAC stocks center around the uncertainty of the investment as a whole. Investors are in the dark as to what the acquisition will be until it is announced. They are also unaware of how long the process will take within the two-year time limit.

How Woodruff Sawyer Can Help

Woodruff Sawyer is the market leader for placing Directors and Officers (D&O) insurance for IPO companies. Woodruff Sawyer is also a nationally recognized leader when it comes to Representations and Warranties Insurance (RWI), a critical element of the SPAC M&A process.

Signals & Forecast

A buy signal was issued from a pivot bottom point on Monday, January 10, 2022, and so far it has risen 2.13%. Further rise is indicated until a new top pivot has been found. Some negative signals were issued as well, and these may have some influence on the near short-term development.

Support, Risk & Stop-loss

ETF Series Solutions - Defiance NextGen finds support from accumulated volume at $20.25 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Is ETF Series Solutions - Defiance NextGen SPAC IPO ETF stock A Buy?

ETF Series Solutions - Defiance NextGen holds several negative signals and is within a wide and falling trend, so we believe it will still perform weakly in the next couple of days or weeks. We therefore hold a negative evaluation of this stock.

Golden Star Signal

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

Top Fintech Company

featured in The Global Fintech Index 2020 as the top Fintech company of the country.

Democratizing and Disrupting the IPO market

SPACs let the next generation investor in on the deals to bring the most ambitious and innovative companies public. Read more

Why Invest in a SPAC ETF?

SPACs give emerging companies both flexibility and control, while investors finally have access to some of the biggest investment deals in the market.

Reasons to invest in SPAK

SPACs’ flexibility, transparency 3 and wide access means that more money is being channeled for SPAC deals in 2021 than via the traditional IPO method. 4

What Is a Special Purpose Acquisition Company (SPAC)?

A special purpose acquisition company (SPAC) is a company that has no commercial operations and is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring or merging with an existing company.

How a SPAC Works

SPACs are generally formed by investors or sponsors with expertise in a particular industry or business sector, to pursue deals in that area. In creating a SPAC, the founders sometimes have at least one acquisition target in mind, but they don't identify that target to avoid extensive disclosures during the IPO process.

Advantages of SPACs

SPACs offer some significant advantages for companies that have been planning to become publicly listed. Firstly, a company can go public through the SPAC route in a matter of months, while the conventional IPO process is an arduous process that can take anywhere from six months to more than a year.

Risks of SPACs

An investor in a SPAC IPO is making a leap of faith that its promoters will be successful in acquiring or merging with a suitable target company in the future.

SPACs Make a Comeback

SPACs have become very popular in recent years, although new accounting regulations issued by the Securities and Exchange Commission in April 2021 caused new SPAC filings to plummet in the second quarter from the record levels of 2021's first quarter.

Examples of High-Profile SPAC Deals

One of the most high-profile recent deals involving special purpose acquisition companies involved Richard Branson's Virgin Galactic. Venture capitalist Chamath Palihapitiya's SPAC Social Capital Hedosophia Holdings bought a 49% stake in Virgin Galactic for $800 million before listing the company in 2019. 5

Why Would a Company Go Public Through a SPAC and Not an IPO?

To save time and money. Going public through an IPO is a lengthy process that involves complex regulatory filings and months of negotiations with underwriters and regulators.

What is a SPAC?

SPAC is an acronym for a Special Purpose Acquisition Company, basically a publicly traded firm that has no operations, no assets — other than a war chest of cash — and just one stated business plan: to eventually buy another company.

How SPACs work

If the SPAC set-up sounds like a situation ripe for abuse — it once was. Back in the 1980s, a lot of fraud surrounded these blank check companies, as they were then known.

Why SPACS are becoming popular

SPACs embarked on their newly respectable road in the mid-2010s. Big-name entrepreneurs, hedge-fund managers, and celebrities like Richard Branson, Bill Ackerman, and Michael Jordan became involved in them, as did mutual fund companies like Fidelity and T. Rowe Price, and investment banks like Morgan Stanley, Credit Suisse, and Goldman Sachs.

How to invest in SPACS

Getting into a SPAC is not as simple as buying regular equities: Hedge funds, mutual funds, and other deep-pocketed institutional investors typically find out about a new SPAC first. "It helps if a would-be investor has an existing relationship with a SPAC sponsor," says Gellasch.

The financial takeaway

A SPAC is definitely not "a 'widows and orphans' investment," according to Gellasch. "For one thing, you may be tying up your money for a year or more without knowing what the ultimate investment will be.