What is Series 1a preferred stock?

Series A-1 Preferred Stock means the shares of the Company's preferred stock, par value $0.001 per share, designated as Series A-1 Preferred Stock in the Company Certificate of Incorporation.

Can you sell Series A preferred stock?

However, more like stocks and unlike bonds, companies may suspend these payments at any time. Preferred stocks oftentimes share another trait with many bonds — the call feature. The company that sold you the preferred stock can usually, but not always, force you to sell the shares back at a predetermined price.

What is the difference between common stock and Series A preferred stock?

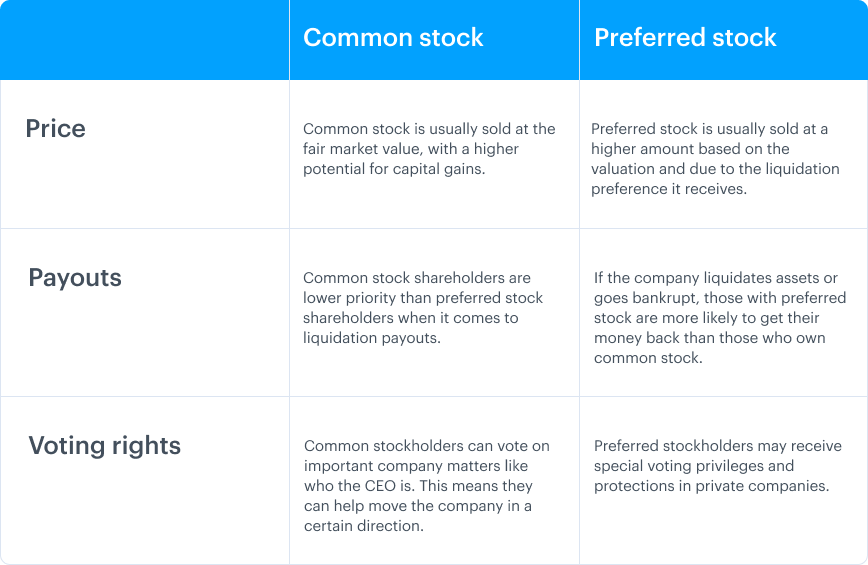

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

What is Series A in stock?

Series A financing refers to an investment in a privately-held start-up company after it has shown progress in building its business model and demonstrates the potential to grow and generate revenue.

What is the downside of preferred stock?

Disadvantages of preferred shares include limited upside potential, interest rate sensitivity, lack of dividend growth, dividend income risk, principal risk and lack of voting rights for shareholders.

Who buys preferred stock?

Most shareholders are attracted to preferred stocks because they offer more consistent dividends than common shares and higher payments than bonds. However, these dividend payments can be deferred by the company if it falls into a period of tight cash flow or other financial hardship.

Should I buy preferred or common stock?

Preferred stock may be a better investment for short-term investors who can't hold common stock long enough to overcome dips in the share price. This is because preferred stock tends to fluctuate a lot less, though it also has less potential for long-term growth than common stock.Mar 1, 2022

When should you buy preferred stock?

Preferred stocks can make an attractive investment for those seeking steady income with a higher payout than they'd receive from common stock dividends or bonds. But they forgo the uncapped upside potential of common stocks and the safety of bonds.Aug 18, 2021

Is preferred stock worth more than common stock?

Preferred stock is generally considered less volatile than common stock but typically has less potential for profit. Preferred stockholders generally do not have voting rights, as common stockholders do, but they have a greater claim to the company's assets.

How much is a series A round?

According to data from Fundz, the average funding amount for a Series A round in 2020 was $15.7 million. Crunchbase puts it at around $14 million. While the funding amount can vary, one thing that has been consistent over the past decade is that the average Series A round amount is increasing.Nov 1, 2021

What do Series A investors look for?

Most Series A investors are looking for significant returns on their money, with 200% to 300% not uncommon. Startups provide Series A investors with detailed information on their business model and projections for future growth. The prospective Series A investors will then perform their due diligence.Apr 4, 2021

What are the 4 types of stocks?

What Are The Different Types Of Stock?Common Stock. When investment professionals talk about stock, they almost always mean common stock. ... Preferred Stock. ... Class A Stock and Class B Stock. ... Large-Cap Stocks. ... Mid-Cap Stocks. ... Small-Cap Stocks. ... Growth Stocks. ... Value Stocks.More items...•Feb 10, 2022

What Is Series A Financing?

Series A financing refers to an investment in a privately-held, start-up company after it has shown progress in building its business model and demonstrates the potential to grow and generate revenue.

Understanding Series A Financing

Initially, start-up companies rely on small investors for seed capital to begin operations. Seed capital can come from the entrepreneurs and founders of the company (a.k.a., friends and family), angel investors, and other small investors seeking to get in on the ground floor of a potentially exciting new opportunity.

How Series A Financing Works

After a start-up, let’s call it XYZ, has established itself with a viable product or business model, it may still lack sufficient revenue, if any, to expand. It will then reach out to or be approached by VC or PE firms for additional funding.

An Example of Series A Financing

XYZ has developed novel software that allows investors to link their accounts, make payments, investments, and move their assets between financial institutions, all on their mobile devices.

What is preferred stock?

Preferred Shares Preferred shares (preferred stock, preference shares) are the class of stock ownership in a corporation that has a priority claim on the company’s assets over common stock shares. The shares are more senior than common stock but are more junior relative to debt, such as bonds. .

What is seed financing?

Seed financing is a type of equity-based financing. In other words, investors commit their capital in exchange for an equity interest in a company. , series A financing is a type of equity-based financing. This means that a company secures the required capital from investors by selling the company’s shares.

Does series A financing have voting rights?

However, in most cases, series A financing comes with anti-dilution provisions. Startups usually issue preferred shares that do not provide their owners with voting rights. At the same time, it is quite common that the companies issue convertible preferred shares.

What is preferred stock?

Preferred stock is a special class of equity that adds debt features. As with common stock, shareholders receive a share of ownership in the company. Preferred stock also receives special rights, including guaranteed dividends that must be paid out before dividends to common shareholders, priority in the event of a liquidation, ...

What happens to preferred stock when the company goes out of business?

If the company goes out of business and is liquidated, debt holders will be repaid first. Next, preferred shareholders will receive any outstanding dividends.

What is a participating feature?

Participating: A participating feature gives preferred shareholders the right to receive a share of dividends paid to common shareholders. This is in addition to preferred dividends. Convertible: Convertible preferred shares may be exchanged for common shares.

Why do preferred shares count as equity?

To avoid increasing your debt ratios; preferred shares count as equity on your balance sheet. To pay dividends at your discretion. Because dividend payments are typically smaller than principal plus interest debt payments. Because a call feature can protect against rising interest rates.

What is callable option?

Callable: A call option gives you the right to repurchase preferred shares at a fixed price or par value after a set date. You have sole discretion whether to exercise the option. Cumulative: You may retain the right to suspend payment of dividends.

What is preferred shareholder?

Preferred shareholders also have priority over common shareholders in any remaining equity. The preferred shareholder agreement sets out how remaining equity is divided. Preferred shareholders may receive a fixed amount or a certain ratio versus common shareholders.

Do preferred stock companies pay dividends?

While preferred stock is outstanding, the company must pay dividends. The dividend may be a fixed dollar amount or based on a metric such as profits. Common shareholders may not receive dividends unless preferred dividends have been fully paid. This includes any accumulated dividends.

A Sample Fact Pattern

Meet our early-stage investor, let’s call her Marianne. She invests in a SAFE or a Note in an early financing round of a company. Marianne negotiates a deal with the company that gives her a valuation cap of $5 million.

Shadow Preferred Stock

Enter “shadow preferred stock” to solve the problem of the liquidation preference overhang. The solution is that Marianne (and other Note or SAFE holders) is issued a sub-series of preferred stock called Series A-1.

Examples of Series M Preferred Stock in a sentence

Each share of Series M Preferred Stock shall be identical in all respects to every other share of Series M Preferred Stock.

More Definitions of Series M Preferred Stock

Series M Preferred Stock means the shares of Series M Preferred Stock authorized pursuant to the Certificate of Incorporation.