What does the price of a stock represent?

So, the price represents how much the stock trades at—or the price agreed upon by a buyer and a seller. If there are more buyers than sellers, the stock's price will climb. If there are more sellers than buyers, the price will drop.

What is the relationship between stock price&earnings per share?

By dividing a company's share price by its earnings per share, an investor can see the value of a stock in terms of how much the market is willing to pay for each dollar of earnings. EPS is one of the many indicators you could use to pick stocks.

What is the par value of a stock?

Some states require that companies set a par value below which shares cannot be sold. To comply with state regulations, most companies set a par value for their stocks to a minimal amount. For example, the par value for shares of Apple (AAPL) is $0.00001 Are Bonds Issued at Par Value?

What is the per of a listed company’s share price?

The PER of a listed company’s share is the result of the collective perception of the market as to how risky the company is and what its earnings growth prospects are in relation to that of other companies.

See more

What is preferred stock?

What is the highest ranking of preferred stock?

A preferred stock is a class of stock that is granted certain rights that differ from common stock. Namely, preferred stock often possess higher dividend payments, and a higher claim to assets in the event of liquidation. In addition, preferred stock have a callable feature, which means that the issuer has the right to redeem ...

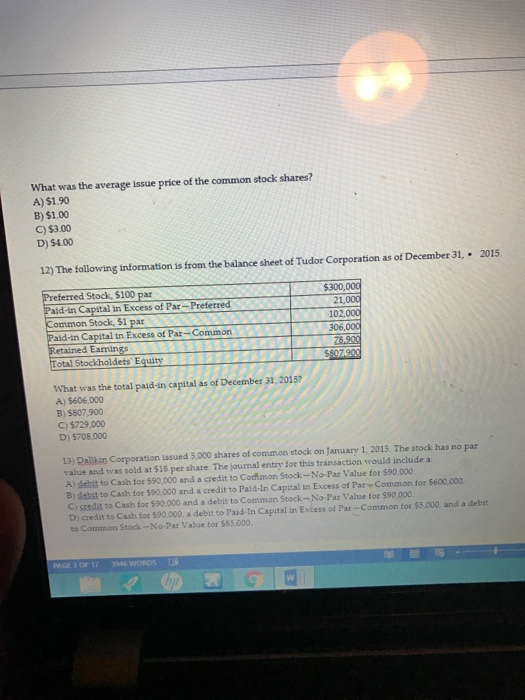

What is preferred shareholder?

The highest ranking is called prior, followed by first preference, second preference, etc. Preferred shareholders have a prior claim on a company's assets if it is liquidated, though they remain subordinate to bondholders.

What does it mean when a preferred stock is convertible?

Preferred shareholders have a prior claim on a company's assets if it is liquidated, though they remain subordinate to bondholders. Preferred shares are equity, but in many ways, they are hybrid assets that lie between stock and bonds.

Do preferred shares have voting rights?

Some preferred stock is convertible, meaning it can be exchanged for a given number of common shares under certain circumstances. 2 The board of directors might vote to convert the stock, the investor might have the option to convert, or the stock might have a specified date at which it automatically converts.

Who decides whether to pay dividends?

Preferred shares usually do not carry voting rights, although under some agreements these rights may revert to shareholders that have not received their dividend. 1 Preferred shares have less potential to appreciate in price than common stock, and they usually trade within a few dollars of their issue price, most commonly $25. Whether they trade at a discount or premium to the issue price depends on the company's credit-worthiness and the specifics of the issue: for example, whether the shares are cumulative, their priority relative to other issues, and whether they are callable. 2

Can a company issue preferred stock?

The decision to pay the dividend is at the discretion of a company's board of directors. Unlike common stockholders, preferred stockholders have limited rights which usually does not include voting. 1 Preferred stock combines features of debt, in that it pays fixed dividends, and equity, in that it has the potential to appreciate in price.

Why is it better to buy shares with a lower P/E?

A company can issue preferred shares under almost any set of terms, assuming they don't fall foul of laws or regulations. Most preferred issues have no maturity dates or very distant ones. 2. Institutions are usually the most common purchasers of preferred stock.

What is an individual company's P/E ratio?

Many investors will say that it is better to buy shares in companies with a lower P/E, because this means you are paying less for every dollar of earnings that you receive. In that sense, a lower P/E is like a lower price tag, making it attractive to investors looking for a bargain.

What is the inverse of the P/E ratio?

An individual company’s P/E ratio is much more meaningful when taken alongside P/E ratios of other companies within the same sector. For example, an energy company may have a high P/E ratio, but this may reflect a trend within the sector rather than one merely within the individual company. An individual company’s high P/E ratio, for example, would be less cause for concern when the entire sector has high P/E ratios.

What does a high P/E mean?

The inverse of the P/E ratio is the earnings yield (which can be thought of like the E/P ratio). The earnings yield is thus defined as EPS divided by the stock price, expressed as a percentage.

What is the P/E ratio?

A high P/E could mean that a stock's price is high relative to earnings and possibly overvalued.

What are the two types of P/E ratios?

The price-to-earnings ratio or P/E is one of the most widely-used stock analysis tools used by investors and analysts for determining stock valuation. In addition to showing whether a company's stock price is overvalued or undervalued, the P/E can reveal how a stock's valuation compares to its industry group or a benchmark like the S&P 500 Index.

What does N/A mean in P/E?

These two types of EPS metrics factor into the most common types of P/E ratios: the forward P/E and the trailing P/E. A third and less common variation uses the sum of the last two actual quarters and the estimates of the next two quarters.

What does the price of a stock tell you?

A company can have a P/E ratio of N/A if it's newly listed on the stock exchange and has not yet reported earnings, such as in the case of an initial public offering (IPO), but it also means a company has zero or negative earnings, Investors can thus interpret seeing "N/A" as a company reporting a net loss.

Why is stock so expensive?

The stock's price only tells you a company's current value or its market value . So, the price represents how much the stock trades at—or the price agreed upon by a buyer and a seller. If there are more buyers than sellers, the stock's price will climb. If there are more sellers than buyers, the price will drop.

How does financial health affect stock price?

A stock is cheap or expensive only in relation to its potential for growth (or lack of it). If a company’s share price plummets, its cost of equity rises, also causing its WACC to rise. A dramatic spike in the cost of capital can cause a business to shut its doors, especially capital-dependent businesses such as banks.

What is the goal of a stock investor?

Financial Health. A company's stock price is affected by its financial health. Stocks that perform well typically have very solid earnings and strong financial statements. Investors use this financial data along with the company's stock price to see whether a company is financially healthy.

What is reverse split?

The goal of the stock investor is to identify stocks that are currently undervalued by the market. Some of these factors are common sense, at least superficially. A company has created a game-changing technology, product, or service. Another company is laying off staff and closing divisions to reduce costs.

How does good news affect stock price?

A reverse split is just the opposite of a stock split, and it comes with its own psychology. Some investors view stocks that cost less than $10 as riskier than stocks with double-digit share prices. If a company’s share price drops to $6, it might counter this perception by doing a one-for-two reverse stock split.

What is intrinsic value?

It may be a positive earnings report, an announcement of a new product, or a plan to expand into a new area. Similarly, related economic data, such as a monthly jobs report with a positive spin may also help increase company share prices.

What is EPS in stock?

If there are more sellers than buyers, the price will drop. On the other hand, the intrinsic value is a company's actual worth in dollars. This includes both tangible and intangible factors, including the insights of fundamental analysis . An investor can investigate a company to determine its value.

How to determine if a stock is undervalued?

EPS equals the company's net profit minus preferred shares dividends divided by outstanding shares of common stock. Preferred shares are excluded from this calculation since these shareholders get priority in dividend payments and payouts if there is a liquidation event, which common stock shareholders would be excluded from.

What is the PEG ratio?

P/E is often used to determine whether a stock is undervalued or overvalued and is calculated by dividing the stock price by the EPS.

Why is EPS important?

The PEG ratio is P/E divided by the earnings growth rate. The PEG is a better measure than just the P/E ratio to determine whether a stock is undervalued, fairly valued or overvalued, Kass says.

How long does it take to see how a company's EPS has changed?

EPS is a widely used metric because it's easy to use and understand, which is why investors value the metric so much. For these reasons, experts recommend looking out for earnings manipulation because earnings are so important to the market's view of a company. Reese identifies earning manipulations by monitoring a firm's revenue ...

Do companies with negative earnings per share have positive stock prices?

Experts recommend gathering as much of the company's history as available, at a minimum of four to five years, to see how the EPS has changed. The higher the EPS or if the trend is increasing, the more profitable a company is.

Is EPS a factor of valuation?

Companies with negative earnings per share still have positive stock prices, Trainer says. "That tells us the market is forward-looking – it's not looking at the current earnings but also future earnings.". The stock's valuation can be improved by convincing investors profits will be better in the future.

How to calculate EPS?

In other sectors like real estate or utilities, EPS might not be the main factor that drives valuation. EPS is said to be stable when a company produces positive earnings. "We measure a firm's earnings stability by how well companies do during an economic downturn.

What is EPS adjusted for?

To calculate a company's EPS, the balance sheet and income statement are used to find the period-end number of common shares, dividends paid on preferred stock (if any), and the net income or earnings.

Why is EPS higher?

It is common for a company to report EPS that is adjusted for extraordinary items and potential share dilution. The higher a company's EPS, the more profitable it is considered to be.

How can a company game its EPS?

A higher EPS indicates greater value because investors will pay more for a company's shares if they think the company has higher profits relative to its share price. EPS can be arrived at in several forms, such as excluding extraordinary items or discontinued operations, or on a diluted basis. 1:10.

Why is it more accurate to use a weighted average number of common shares over the reporting term?

For instance, a company can game its EPS by buying back stock, reducing the number of shares outstanding, and inflating the EPS number given the same level of earnings. Changes to accounting policy for reporting earnings can also change EPS.

What is diluted EPS?

It is more accurate to use a weighted average number of common shares over the reporting term because the number of shares can change over time. Any stock dividends or splits that occur must be reflected in the calculation of the weighted average number of shares outstanding.

What is the importance of EPS?

Analysts will sometimes distinguish between “basic” and “diluted” EPS. Basic EPS consists of the company’s net income divided by its outstanding shares. It is the figure most commonly reported in the financial media, and it is also the simplest definition of EPS.

What is par value in stock?

An important aspect of EPS that is often ignored is the capital that is required to generate the earnings (net income) in the calculation. Two companies could generate the same EPS, but one could do so with fewer net assets; that company would be more efficient at using its capital to generate income and, all other things being equal, would be a "better" company in terms of efficiency. A metric that can be used to identify more efficient companies is the return on equity (ROE).

Where to find no par stock certificates?

Par value for a share refers to the stock value stated in the corporate charter. Shares usually have no par value or very low par value, such as one cent per share. In the case of equity, the par value has very little relation to the shares' market price. 1:46.

What happens to a 4% coupon bond?

The par value of a company's stock can be found in the Shareholders' Equity section of the balance sheet .

Why is par value important?

If a 4% coupon bond is issued when interest rates are 4%, the bond will trade at its par value since both interest and coupon rates are the same. However, if interest rates rise to 5%, the value of the bond will drop, causing it to trade below its par value.

Is a bond a premium or discount?

Par value is important for a bond or fixed- income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par, depending on factors such as the level of interest rates and the bond’s credit status. Par value for a bond is typically $1,000 or $100 ...