What is OHLC and why is it important?

As a trader, knowing the OHLC prices is a very important thing. It is important because it tells you the range of the assets within the day. This range can help you identify the amount of volatility in the market.

What are the advantages of OHLC trading strategy?

The first advantage of the OHLC strategy is that it’s easy to use. Both novice traders and experienced day traders can benefit from this trading strategy. Secondly, this trading method doesn’t require prolonged analysis. This means you don’t have to spend countless hours analyzing the market.

What is the OHLC on a daily chart?

A candlestick on a daily chart represents the OHLC during the day. On platform like MT4 and our proprietary Ppro8, it is easy to update the OHLC. You do this by simply going to the properties and selecting show Open-High-Low-Close. This will show you these numbers at the top part of the chart.

What is ohlcv (ohlcv)?

When discussing open, high, low, close, and volume (OHLCV) of a securities price, it’s essential to understand the period. Unless otherwise specified, the period is commonly daily; however, traders incorporate multiple periods when reviewing the price action of a security.

What is price OHLC?

An open-high-low-close chart (also OHLC) is a type of chart typically used to illustrate movements in the price of a financial instrument over time. Each vertical line on the chart shows the price range (the highest and lowest prices) over one unit of time, e.g., one day or one hour.

What is OHLC in Zerodha?

But, the OHLC (open, high, low, close) values are updated once again after the trading day ends, with data from the 'bhavcopy' provided by the exchange.

What is volume in OHLC?

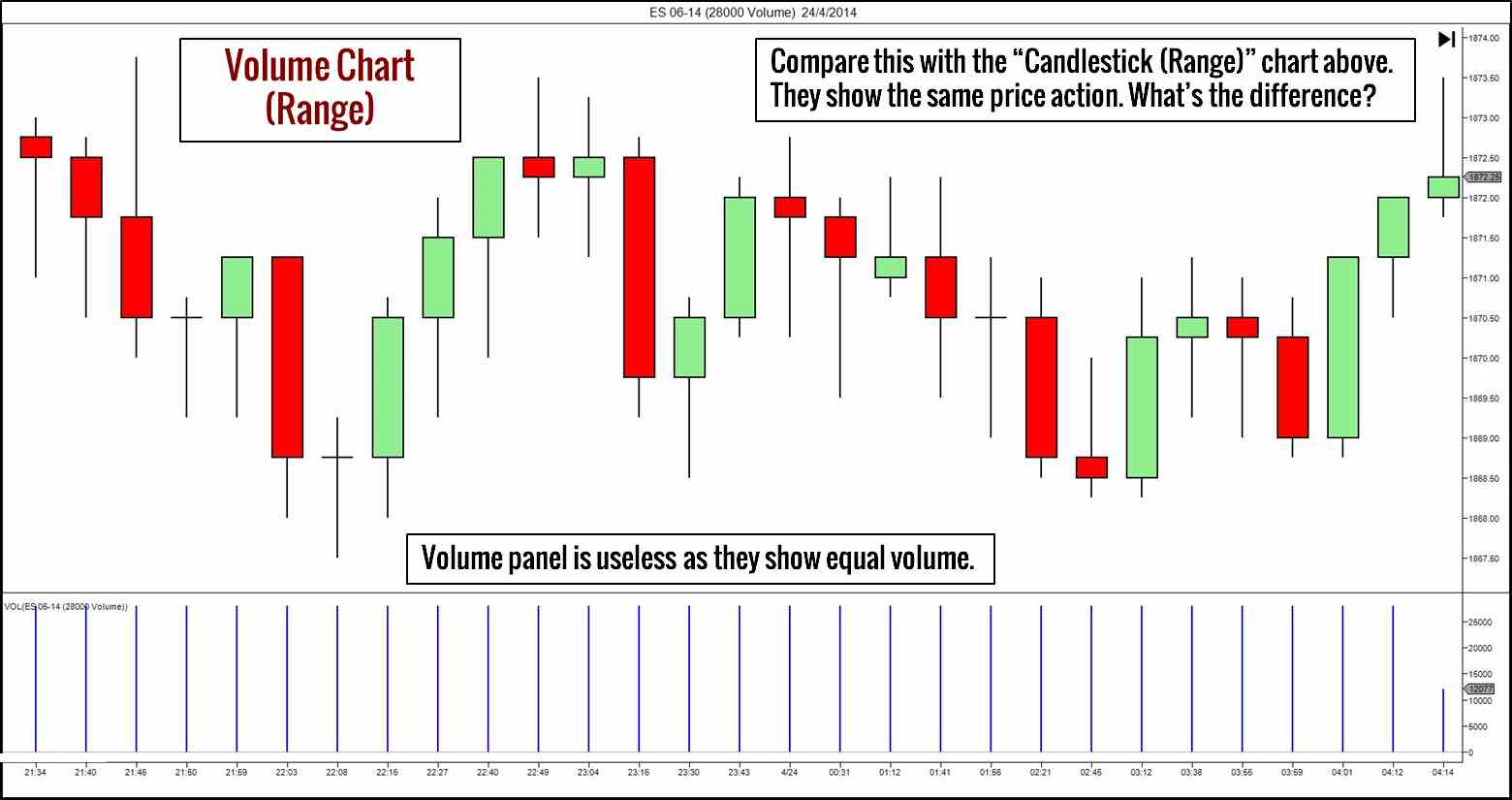

The OHLC-Volume plot is actually a stacked plot containing an upper Japanese Candlestick plot that displays the opening, highest, lowest, and closing prices of a security over a given time interval, and a lower column plot that shows the trade volume.

What is OHLC in Angel Broking?

On hovering the mouse over the ticker symbol, you will see critical data about the stock's trading activity in the day, called the OHLC data. Day's Open: is the stock price when trading begins. Day's Close: is the stock price at the end of a trading day. Day's High: is the highest price of the stock during the day.

How do you trade OHLC?

7:569:59OHLC Charts Explained - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe close is near the bottom it's near the bottom of the knot the candle of the bar of the ohlc bar.MoreThe close is near the bottom it's near the bottom of the knot the candle of the bar of the ohlc bar. Okay. So when it closes really close to the bottom. All.

What is OHLC Crypto?

Key Takeaways. An OHLC chart shows the open, high, low, and close price for a given period. It can be applied to any timeframe. The vertical line represents the high and low for the period, while the line to the left marks the open price and the line to the right marks the closing price.

How do you read a tick volume?

0:163:32Tick Volume: Is it useful? - YouTubeYouTubeStart of suggested clipEnd of suggested clipVolume is that if prices change 100 times for example in five minutes that there's a higher activityMoreVolume is that if prices change 100 times for example in five minutes that there's a higher activity. Than if prices. Changes only 50 times. And this should reflect the corresponding.

What is O trading chart?

Open – Represented as O on the top of the chart, this indicates the price when the market opened that particular day. High – Represented as Hi on the top of the chart, this indicates the highest price the stock has traded at for the day.

What is opening interest?

Open interest is a measure of the flow of money into a futures or options market. Increasing open interest represents new or additional money coming into the market while decreasing open interest indicates money flowing out of the market.

What is UCL and LCL in share market?

UCL = Upper Control Limit. LCL = Lower Control Limit.

How do you read daily charts?

How to read stock market charts patternsIdentify the chart: Identify the charts and look at the top where you will find a ticker designation or symbol which is a short alphabetic identifier of a company. ... Choose a time window: ... Note the summary key: ... Track the prices: ... Note the volume traded: ... Look at the moving averages:

What open high strategy?

Open high low (OHL) strategy refers to an intraday trading strategy wherein a buy signal is generated when any stock or index has the exact value for open as well as low. This serves as an indication a trader must buy a stock.

What is OHLCV in stock trading?

When discussing open, high, low, close, and volume (OHLCV) of a securities price, it’s essential to understand the period. Unless otherwise specified, the period is commonly daily; however, traders incorporate multiple periods when reviewing the price action of a security. This is called multiple timeframe analysis. For example, a stock could be in a daily uptrend with a series of higher highs and higher lows, but be in a weekly downtrend with a string of lower highs and lower lows. With this out of the way, let’s dig deeper into these definitions through the lens of the most common trading period: the daily time period.

What is the high low close in stock?

What is Open High Low Close in Stocks? In stock trading, the high and low refer to the maximum and minimum prices in a given time period. Open and close are the prices at which a stock began and ended trading in the same period. Volume is the total amount of trading activity. Adjusted values factor in corporate actions such as dividends, ...

What does "open" mean in stock market?

Open means the price at which a stock started trading when the opening bell rang. It can be the same as where the stock closed the night before, but not always. Sometimes events such as company earnings reports that happen in after-hours trading can alter a stock’s price overnight. Then there is “close”.

What does volume mean in stock trading?

Volume refers to the number of shares that exchange hands for a stock with a specific period. Closing on a ‘high’ note, all of these terms help give us a better picture of a stock’s price action at a given point in time, helping us to make better trading decisions.

Why do companies issue additional shares of stock?

A company may also decide to issue additional shares of stock to raise capital for growth projects, debt repayment, or acquisitions. This has a similar effect to stock splits as there are more shares out there. However, issuing new equity changes the company’s cost of capital.

Why do companies split their shares?

A company may also split its shares to reduce the stock price or perform a reverse split to increase it. With more shares out there, each share has a lower claim on the company than it did before. The opposite is also true. With fewer shares available in the case of a reverse stock split, the stock’s price will increase.

What is OHLC short form?

OHLC is a short-form of Open, High, Low, Close. These terms are self-explanatory and you have likely used them before. The open is the price which the asset started the day at. For example, if you are trading Apple, the open price will be where the price starts the day. This price is determined by the demand and supply of the asset at the start ...

Why is knowing the OHLC important?

As a trader, knowing the OHLC prices is a very important thing. It is important because it tells you the range of the assets within the day. This range can help you identify the amount of volatility in the market. » Market Volatility. How to Cash In «.

How to use OHLC bar?

The simplest way to use the OHLC bar is to use the Japanese candlesticks. These are the most common types of charts. This is easy because a candlestick is essentially an OHLC chart. A candlestick has four main parts as shown below. The parts not shown below are the upper and lower shadows and the body.

Why isn't a line chart an OHLC?

A line chart is not an OHLC because it only shows the closing price of an asset. Similarly, point and figures, kagi, and renko are not OHLC charts because they usually remove the noise of time.

What does it mean when Apple stock is $100?

For example, if the open price of Apple is $100, its high is $101, the low is $99.5, and the close is $100, it means that there is no volatility in the stock. However, if the open is $100, high is at $110, low is at $95, and the close is at $115, it means that there is a lot of volatility on the company’s stock.

Why is it so hard to know when the market is open and close?

The problem is that it is very difficult for you to know the open and close prices because of the extended hours trading. Extended hours is also known as pre-market and after-market trading. This is the trading that happens after the market closes and before it opens.

Does OHLC provide pointers?

Unlike other indicators like the RSI and moving averages, OHLC does not provide pointers as to where the price of an asset will move. Instead, it helps provide an indication as to how the assets are trading and the ranges to watch.

External links

Video describing the parts of the OHLC chart, determining uptrends/downtrends and reversals. Sources cited

Other Languages

Visit the main overall explanation for Technical analysis that is translated into many languages.

What is share market jargon?

Share Market Jargons are some specific terms used in share market and related activities. They are best means of understanding among the investors or the shareholders in the stock market.

What does volume mean in stock market?

The Volume of any particular stock indicates the total number of traded company shares. This includes both the shares that all the traders aggregately buy and sell in a given day.

What is the face value of a stock?

When you buy a stock, it has a default value which, in the stock market terminology is called the Face Value. So, it is the fixed denomination which the company set for a particular stock.

What is the sell signal in stock market?

Sell signal – when the stock has the same value for open and high. In other words, the open high low formula is: Open=Low (buy). Open=High (sell). During the first minutes that the stock market is open (at 9:30 AM EST), you can determine if there are OHL trading opportunities for that day or not.

Is OHL trading good?

In summary, the OHL strategy for day trading can help you maximize your profits with the least amount of risk. One good trade per day with the OHL trading strategy is more than enough to achieve your profit goals.

Understanding OHLC Charts

- OHLC charts consist of a vertical line and two short horizontal lines extending to the left and right of the horizontal line. The horizontal line extending to the left represents the opening price for the period, while the horizontal line extending to the right represents the closing price for the period…

Interpreting OHLC Charts

- There are several different techniques that technical analysts use to interpret OHLC charts. Here are several guidelines. Vertical Height: The vertical height of an OHLC bar is indicative of the volatilityduring the period. If the line height is great, then traders know that there's a lot of volatility and indecision in the market. Horizontal Line Position: The position of the left and right horizont…

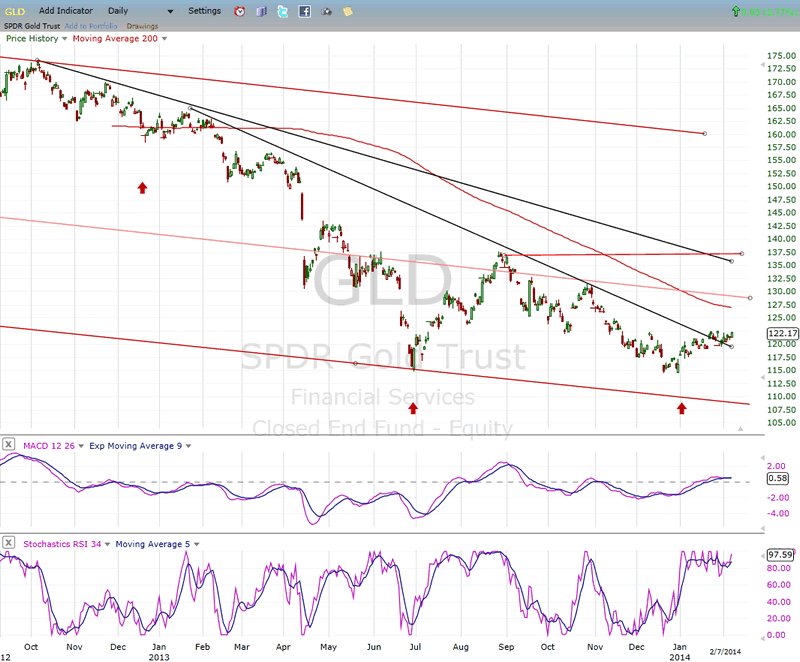

Example of An OHLC Chart

- The following is an OHLC chart for the S&P 500 SPDR ETF (SPY). Overall rises are typically marked by a greater number of black bars, like the period at the start of October. Trough mid-November the price moves slightly higher but mostly sideways, marked by more alternating bar colors. In mid-November, the price starts to rise, marked by a couple wider ranging black bars. A…