Where can I buy Nobl shares?

Shares of NOBL can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

Why invest in Nobl?

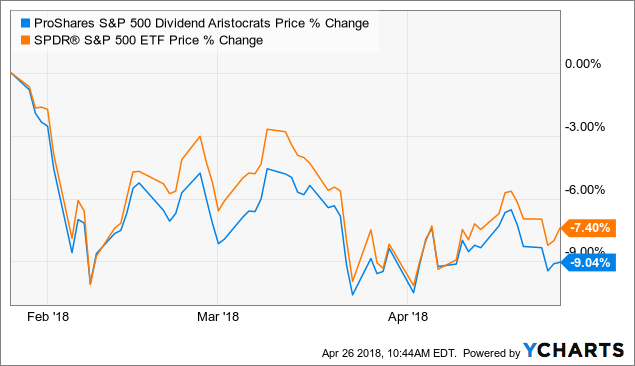

Often household names, NOBL's holdings generally have had stable earnings, solid fundamentals, and strong histories of profit and growth. NOBL strategy has a demonstrated history of weathering market turbulence over time by capturing most of the gains of rising markets and fewer of the losses in falling markets. More.. Why Invest in NOBL?

What is the Nobl index?

NOBL tracks an equal-weighted index of S&P 500 constituents that have increased dividend payments annually for at least 25 years. NOBL only selects companies from the S&P 500 that have increased their dividends for at least 25 consecutive years. Holdings are equal-weighted, with sector weights capped at 30%.

How does Nobl track dividend growth?

*Unless otherwise stated, data provided by FactSet. NOBL tracks an equal-weighted index of S&P 500 constituents that have increased dividend payments annually for at least 25 years. NOBL only selects companies from the S&P 500 that have increased their dividends for at least 25 consecutive years.

What are NOBL holdings?

Top 25 HoldingsCompanySymbolTotal Net AssetsExxon Mobil Corp.XOM1.72%Brown & Brown Inc.BRO1.70%Cardinal Health Inc.CAH1.70%Cintas Corp.CTAS1.67%21 more rows

What stocks make up NOBL?

NOBL Top 10 Holdings[View All]Exxon Mobil Corporation 1.99%Albemarle Corporation 1.99%Amcor PLC 1.86%Chevron Corporation 1.84%NextEra Energy, Inc. 1.73%Brown-Forman Corporation Class B 1.73%Air Products and Chemicals, Inc. 1.73%Genuine Parts Company 1.72%More items...

Is NOBL ETF a good buy?

NOBL has traded between $84.26 and $98.70 during this last 52-week period. NOBL has a beta of 0.92 and standard deviation of 22.24% for the trailing three-year period, which makes the fund a medium risk choice in the space. With about 66 holdings, it effectively diversifies company-specific risk.

What is ETF NOBL?

The ProShares S&P500 Dividend Aristocrats ETF (NOBL) is one of many funds trying to deliver exposure to large-cap U.S. stocks that pay out the best dividends. NOBL tracks an index that selects S&P 500 stocks that have increased their dividend for at least 25 consecutive years.

Does nobl pay monthly dividends?

ProShares S&P 500 Dividend Aristocrats ETF (NOBL) The dividend is paid every three months and the last ex-dividend date was Mar 23, 2022.

Is nobl a mutual fund?

NOBL: ProShares S&P 500 Dividend Aristocrats ETF - MutualFunds.com.

Is NOBL a buy or sell?

Today NOBL ranks #14075 as sell candidate.

How can I invest in NOBL?

How To Buy NOBLFind a reliable broker. Don't worry, it's easy and free to open a brokerage account. ... Fund your new account. You'll need to transfer money into your new brokerage account before you can buy the stock. ... Search for NOBL on the brokerage app or site. ... Buy the stock.

Is NOBL actively managed?

NOBL is a passively managed ETF that invests in the S&P 500 companies that have increased dividends each year for at least 25 consecutive years.

Which ETF has the highest dividend?

25 high-dividend ETFs of June 2022ETF nameTotal assets (millions)Annual dividend yieldVanguard Dividend Appreciation ETF$60,798.701.53%Health Care Select Sector SPDR Fund$37,741.001.36%iShares Core S&P 500 ETF$290,178.001.25%Vanguard S&P 500 ETF$251,513.001.24%21 more rows

Do ETFs pay dividends?

ETFs are required to pay their investors any dividends they receive for shares that are held in the fund. They may pay in cash or in additional shares of the ETF. So, ETFs pay dividends, if any of the stocks held in the fund pay dividends.

How do I buy S&P 500 Dividend Aristocrats?

To be added to the Dividend Aristocrat index, a company has to meet the following criteria:The company must currently be part of the S&P 500 index.Must have grown its dividend payouts each year for at least 25 years.Its market cap must be a minimum of $3 billion.Liquidity, at least $5 million.More items...

How has ProShares S&P 500 Aristocrats ETF's stock performed in 2022?

ProShares S&P 500 Aristocrats ETF's stock was trading at $98.18 at the beginning of 2022. Since then, NOBL stock has decreased by 10.6% and is now...

What other stocks do shareholders of ProShares S&P 500 Aristocrats ETF own?

Based on aggregate information from My MarketBeat watchlists, some companies that other ProShares S&P 500 Aristocrats ETF investors own include AT...

What is ProShares S&P 500 Aristocrats ETF's stock symbol?

ProShares S&P 500 Aristocrats ETF trades on the BATS under the ticker symbol "NOBL."

Who are ProShares S&P 500 Aristocrats ETF's major shareholders?

ProShares S&P 500 Aristocrats ETF's stock is owned by a number of institutional and retail investors. Top institutional investors include CFS Inves...

Which institutional investors are selling ProShares S&P 500 Aristocrats ETF stock?

NOBL stock was sold by a variety of institutional investors in the last quarter, including Stuart Chaussee & Associates Inc., ForthRight Wealth Man...

Which institutional investors are buying ProShares S&P 500 Aristocrats ETF stock?

NOBL stock was bought by a variety of institutional investors in the last quarter, including CFS Investment Advisory Services LLC, Bank of America...

How do I buy shares of ProShares S&P 500 Aristocrats ETF?

Shares of NOBL can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBul...

What is ProShares S&P 500 Aristocrats ETF's stock price today?

One share of NOBL stock can currently be purchased for approximately $87.81.

Performance

Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded.

About the Fund

Price to book ratio measures market value of a fund or index relative to the collective book values of its component stocks.

Index

The S&P 500 ® Dividend Aristocrats ® Index, constructed and maintained by S&P Dow Jones Indices LLC, targets companies that are currently members of the S&P 500 ®, have increased dividend payments each year for at least 25 years, and meet certain market capitalization and liquidity requirements.

Signals & Forecast

Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD). Some negative signals were issued as well, and these may have some influence on the near short-term development.

Support, Risk & Stop-loss

ProShares S&P 500 Dividend Aristocrats finds support from accumulated volume at $91.59 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Is ProShares S&P 500 Dividend Aristocrats ETF ETF A Buy?

ProShares S&P 500 Dividend Aristocrats holds several negative signals and is within a falling trend, so we believe it will still perform weakly in the next couple of days or weeks. We therefore hold a negative evaluation of this ETF.

Golden Star Signal

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

Top Fintech Company

featured in The Global Fintech Index 2020 as the top Fintech company of the country.

How has ProShares S&P 500 Aristocrats ETF's stock been impacted by Coronavirus?

ProShares S&P 500 Aristocrats ETF's stock was trading at $63.55 on March 11th, 2020 when Coronavirus reached pandemic status according to the World Health Organization (WHO). Since then, NOBL stock has increased by 44.2% and is now trading at $91.65. View which stocks have been most impacted by COVID-19.

What other stocks do shareholders of ProShares S&P 500 Aristocrats ETF own?

Based on aggregate information from My MarketBeat watchlists, some companies that other ProShares S&P 500 Aristocrats ETF investors own include AT&T (T), Johnson & Johnson (JNJ), Intel (INTC), Chevron (CVX), 3M (MMM), Exxon Mobil (XOM), AbbVie (ABBV), Walt Disney (DIS), Home Depot (HD) and Coca-Cola (KO).

What is ProShares S&P 500 Aristocrats ETF's stock symbol?

ProShares S&P 500 Aristocrats ETF trades on the BATS under the ticker symbol "NOBL."

Who are ProShares S&P 500 Aristocrats ETF's major shareholders?

ProShares S&P 500 Aristocrats ETF's stock is owned by a variety of retail and institutional investors. Top institutional investors include Bank of America Corp DE (0.00%), LPL Financial LLC (0.00%), Wells Fargo & Company MN (0.00%), IAM Advisory LLC (0.00%), Raymond James Financial Services Advisors Inc.

Which institutional investors are selling ProShares S&P 500 Aristocrats ETF stock?

NOBL stock was sold by a variety of institutional investors in the last quarter, including CIBC World Markets Inc., Koshinski Asset Management Inc., RFG Advisory LLC, Financial Advisory Service Inc., JPMorgan Chase & Co., Harbour Investments Inc., Sound View Wealth Advisors Group LLC, and Nomura Asset Management Co. Ltd..

Which institutional investors are buying ProShares S&P 500 Aristocrats ETF stock?

NOBL stock was purchased by a variety of institutional investors in the last quarter, including Stuart Chaussee & Associates Inc., National Bank of Canada FI, LPL Financial LLC, HighTower Advisors LLC, Janney Montgomery Scott LLC, Bank of America Corp DE, J.W. Cole Advisors Inc., and Raymond James Financial Services Advisors Inc..

How do I buy shares of ProShares S&P 500 Aristocrats ETF?

Shares of NOBL can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

Benchmark for NOBL

The S&P 500 Dividend Aristocrats Index targets companies that are currently members of the S&P 500, have increased dividend payments each year for at least 25 years & meet certain market capitalization & liquidity requirements.

Fund Summary for NOBL

The ProShares S&P 500 Dividend Aristocrats ETF seeks investment results, before fees and expenses that track the performance of the S&P 500 Dividend Aristocrats Index.