Marketable securities are assets that can be liquidated to cash quickly. These short-term liquid securities can be bought or sold on a public stock exchange or a public bond exchange. These securities tend to mature in a year or less and can be either debt or equity.

What are marketable securities?

1 Marketable securities are assets that can be liquidated to cash quickly. 2 These short-term liquid securities can be bought or sold on a public stock exchange or a public bond exchange. 3 These securities tend to mature in a year or less and can be either debt or equity. More items...

What makes an investment marketable?

From a liquidity standpoint, investments are marketable when they can be bought and sold quickly. If an investor or a business needs some cash in a pinch, it is much easier to enter the market and liquidate marketable securities.

What is an example of a marketable stock?

A common example of this is when companies purchase shares of another company's stock as part of an acquisition bid. Shares of stock are highly liquid; you can sell them at any time. As a result, ordinarily a company would consider all of its stock holdings as marketable.

What are marketable securities examples?

Stocks, bonds, preferred shares, and ETFs are among the most common examples of marketable securities. Money market instruments, futures, options, and hedge fund investments can also be marketable securities.

What is marketable and non marketable?

Marketable and Non-marketable Marketable securities consist of bills, notes, bonds, and TIPS. Non-marketable securities consist of Domestic, Foreign, REA, SLGS, US Savings, GAS and Other. Marketable securities are negotiable and transferable and may be sold on the secondary market.

What is marketable securities on a balance sheet?

Marketable Securities are the liquid assets that are readily convertible into cash reported under the current head assets in the company's balance sheet, and the top example of which includes commercial paper, Treasury bills, commercial paper, and the other different money market instruments.

Why do companies buy marketable securities?

It is part of a figure that helps determine how liquid a company is, its ability to pay expenses, or pay down debt if it needs to liquidate assets into cash to do so. Investing in marketable securities is much preferred to holding cash in hand because investments provide returns and therefore generate profits.

What are marketable goods?

adjective. (Retail: Marketing) Marketable goods are able to be sold because people want to buy them. They must sell off the most marketable of the company's assets as quickly as possible. If the product is highly marketable, the manufacturer often can have their choice of several dealers in any one geographic area.

Is a 401k a marketable securities?

QUALIFIED PLANS (401(K), ROTH 401(K), ETC.): Marketable securities are non-cash financial investments that are easily sold for cash at market value. A retirement account where funds are deposited BEFORE taxes and then invested in marketable securities by the investor. Contributions are limited.

Is marketable securities a asset?

Key Takeaways Marketable securities are assets that can be liquidated to cash quickly. These short-term liquid securities can be bought or sold on a public stock exchange or a public bond exchange. These securities tend to mature in a year or less and can be either debt or equity.

Is marketable securities a current asset?

Marketable securities are highly liquid assets meaning they can be easily converted to cash at no loss of value. They are not typically part of a businesses' operations and are defined as a current asset, meaning they are expected to be converted into cash in less than 12 months.

Are mutual funds marketable securities?

Marketable securities include stocks, bonds, mutual funds and certificates of deposit (CD). Marketable securities represent either debt or equity. Stocks are an example of equity, while bonds represent debt.

Are marketable securities the same as cash?

Cash equivalents are highly liquid investments that are readily convertible into cash with original maturities of three months or less when purchased. Marketable securities consist of securities with original maturities greater than 90 days when purchased.

Are marketable securities the same as short term investments?

Short-term investments, also known as marketable securities or temporary investments, are financial investments that can easily be converted to cash, typically within 5 years. Short-term investments can also refer to the holdings a company owns but intends to sell within a year.

Is marketable securities an investing activity?

Investing activities can include: Proceeds from the sale of other businesses (divestitures) Purchases of marketable securities (i.e., stocks, bonds, etc.)

Types of Marketable Securities

There are numerous types of marketable securities, but stocks are the most common type of equity. Bonds and bills are the most common debt securities.

Stocks as Securities

Stock represents an equity investment because shareholders maintain partial ownership in the company in which they have invested. The company can use shareholder investment as equity capital to fund the company's operations and expansion.

Bonds as Securities

Bonds are the most common form of marketable debt security and are a useful source of capital to businesses that are looking to grow. A bond is a security issued by a company or government that allows it to borrow money from investors.

Preferred Shares

There is another type of marketable security that has some of the qualities of both equity and debt. Preferred shares have the benefit of fixed dividends that are paid before the dividends to common stockholders, which makes them more like bonds. However, bondholders remain senior to preferred shareholders.

Exchange-Traded Funds (ETFs)

An exchange-traded fund (ETF) allows investors to buy and sell collections of other assets, including stocks, bonds, and commodities. ETFs are marketable securities by definition because they are traded on public exchanges. The assets held by exchange-traded funds may themselves be marketable securities, such as stocks in the Dow Jones.

Other Marketable Securities

Marketable securities can also come in the form of money market instruments, derivatives, and indirect investments. Each of these types contains several different specific securities.

Features of Marketable Securities

The overriding characteristic of marketable securities is their liquidity. Liquidity is the ability to convert assets into cash and use them as an intermediary in other economic activities. The security is further made liquid by its relative supply and demand in the market. The volume of transactions also plays a vital part in liquidity.

Characteristics of marketable securities

Some investors are more eager to grab this type of investment because of the short maturity periods, which tend to be less than a year. Converting or liquidating these investments into cash is much easier than is the case with longer-term securities.

Accounting for marketable securities

Short-term liquid securities are classified differently when it comes to their accounting, based on the purpose for which they are bought.

Additional resources

Thank you for reading CFI’s guide to understanding the nature of how companies report their short-term liquid investments. To keep learning and advancing your career as a financial analyst, these CFI resources will help you on your way:

Financial Analyst Training

Get world-class financial training with CFI’s online certified financial analyst training program Become a Certified Financial Modeling & Valuation Analyst (FMVA)®CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today!!

What Is a Security?

To understand marketable securities, we first need to understand the concept of a security.

What Is a Marketable Security?

A marketable security is a form of security that can be sold or otherwise converted to cash within less than one year. These products are considered relatively liquid compared to products that are locked into long-term positions.

Why Do Marketable Securities Matter?

Marketable securities are a measure of how much capital a business can access for any upcoming spending.

Non-Current Marketable Securities

Finally, whether a company marks a product as a marketable security or not may depend on its intentions.

Features of Marketable Securities

Well, there are many features of these securities, but the two most important ones that set them apart from the rest are highlighted below.

Classification

Marketable securities on the balance sheet can be classified into two categories:

Marketable Securities Types

There are different types of Marketable Securities. Some of the common securities available in the market are discussed here.

Why Corporates Purchase Low Yielding Marketable Securities?

Before we answer that question, let us look at another marketable securities example Marketable Securities Example Marketable Securities is an investment option for the organization to earn returns on existing cash while maintaining cash flow due to high liquidity.

Why Invest in Marketable Securities?

Now let us come back to the question asked above. Almost every company will invest a certain amount of funds in marketable securities. Broad reasons for investing in marketable security as follows -:

Conclusion

All the above features and advantages of marketable securities on the balance sheet have made them quite popular means of the financial instrument. Almost every company holds some amount of marketable securities.

What are Marketable Securities?

Marketable securities are investments that are easily bought and sold on public exchanges, like NASDAQ and the New York Stock Exchange. Because these investments trade on a regular basis, they have high liquidity, which means that they can easily convert into cash without affecting their value.

Types of Marketable Securities

Investors have their choice among a variety of marketable securities that trade regularly and are typically highly liquid.

The Bottom Line

Each of these types of marketable securities has its reasons why they belong in your portfolio. For most people, a combination of stocks, bonds and money market securities will make up the bulk of your investments. Depending on your goals, risk appetite and time horizon, the investment mix of these securities within your portfolio will vary.

Tips on Investing

Whether you want to invest in stocks, bonds or other assets, a financial advisor can help you design an asset allocation and then manage your investments for you. SmartAsset’s free tool can match you with up to three advisors in your area in just five minutes. If you’re ready to find a local advisor, get started now.

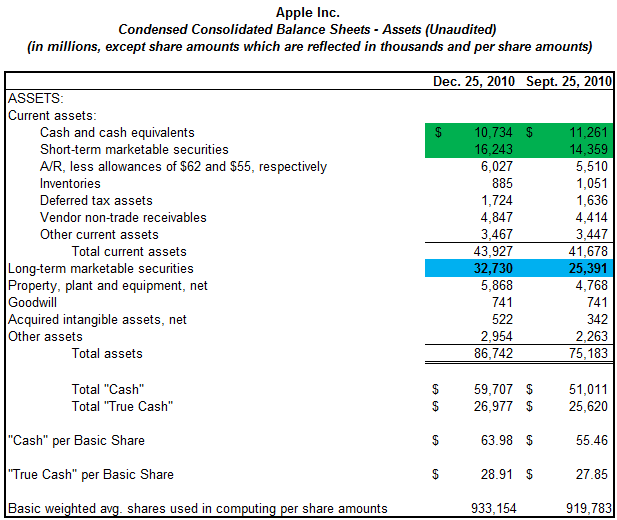

Marketable securities in Cupertino

Investors who dig through the annual reports of publicly traded companies will often find that large companies hold marketable securities on their balance sheets.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

What Are Marketable Securities?

Marketable securities are a form of security or debt that can be converted or sold for cash in a year or less. Their liquidity comes from both the time they can be redeemed and their redemption rate. Their price has little to do with the rate at which they are bought or sold.

The Use of Marketable Securities

Businesses can liquidate marketable securities within a year at face value or close to face value. As such, they have quick access to this cash to invest or use when needed. Marketable securities are usually classified as current assets on a company’s balance sheet because of their short-term liquidity potential.

How Other Parties Consider Marketable Securities

Lenders will look at them for deciding whether to grant a loan and also the interest rate for loans.

Why Companies Obtain Marketable Securities

Marketable securities are a means for a company to have ready access to cash when needed. They also offer a chance to obtain a rate of return that would otherwise not be available.

Marketable Equity Securities vs. Marketable Debt Securities

Businesses can buy marketable equity securities to obtain equity or stock in another company. The acquiring business lists them as a current asset on their balance sheet. However, if the business acquires them as part of a buyout, the company will list them as a long-term asset on their balance sheet.

Liquidity Ratios and Marketable Securities

Liquidity ratios are indicators of how well a company may meet short-term financial obligations. There are three types of liquidity ratios that marketable securities are used to calculate:

Other Types of Marketable Securities

Preferred stocks or shares bought from another company are similar to bonds. Both have a fixed rate of return. However, bonds provide a fixed interest rate to the investors, whereas preferred shares afford fixed dividends that are paid out to the investors before common shareholders.

What Are Marketable Securities

Understanding Marketable Securities

- Businesses typically hold cash in their reserves to prepare them for situations in which they may need to act swiftly, such as taking advantage of an acquisition opportunity that comes up or making contingent payments. However, instead of holding on to all the cash in its coffers which presents no opportunity to earn interest, a business will invest a portion of the cash in short-ter…

Special Considerations

- Marketable securities are evaluated by analysts when conducting liquidity ratio analysis on a company or sector. Liquidity ratios measure a company's ability to meet its short-term financial obligations as they come due.4In other words, this ratio assesses whether a company can pay its short-term debts using its most liquid assets. Liquidity ratios include:

Characteristics of Marketable Securities

Accounting For Marketable Securities

- Short-term liquid securities are classified differently when it comes to their accounting, based on the purpose for which they are bought. There are three different classifications of marketable securities: 1. Available for sale 2. Held for trading 3. Held to maturity These classifications are dependent on certain criteria, but also on the history of transactions any given investor or firm h…

Example from Amazon’s Balance Sheet

- When performing financial analysis, it’s important to know how to incorporate these types of short-term liquid investments. These investments will be listed under Current Assets on the balance sheet because they are due within a year, but will not be considered as part of Cash and Equivalentsbecause they consist of equity securities and/or fixed-income securities that mature …

Additional Resources

- Thank you for reading CFI’s guide on Marketable Securities. To keep learning and advancing your career as a financial analyst, these CFI resources will help you on your way: 1. Analysis of financial statements 2. Comparable company analysis 3. What is financial modeling? 4. DCF modeling guide

What Is A Security?

What Is A Marketable Security?

- A marketable security is a form of security that can be sold or otherwise converted to cash within less than one year. These products are considered relatively liquid compared to products that are locked into long-term positions. To be considered marketable, a security must have a face value or near-face value transaction within the one-year period. There must also be no restriction on li…

Why Do Marketable Securities Matter?

- Marketable securities are a measure of how much capital a business can access for any upcoming spending. When a business calculates its assets and total net worth it has two sections of the balance sheet: Current Assets and Non-current Assets. Anyone who has spent much time overseas might recognize this terminology, as outside of the U.S. most bank...

Non-Current Marketable Securities

- Finally, whether a company marks a product as a marketable security or not may depend on its intentions. A company might buy a security that could typically be highly liquid but it will intend to keep that product for a longer term. In this case, because the company doesn't intend to sell the asset within the next year, it will list the asset as non-current and will not consider it a marketabl…