How to interpret the MACD on a trading chart?

- The first is the number of periods that are used to calculate the faster-moving average.

- The second is the number of periods that are used in the slower moving average.

- And the third is the number of bars that are used to calculate the moving average of the difference between the faster and slower moving averages.

When to use and how to read the MACD indicator?

- Alternatively, a trader could use a break below the previous swing low or above the prior swing high to exit the trade.

- The moving average is one of the most common indicators in the world.

- Third, notice that the MACD formed a higher low as Google formed a lower low in November.

How to use the MACD indicator in your trading?

The MACD is a popular momentum and trend-following indicator that is based on the information of moving averages and, thus, ideal to act as an additional momentum tool and momentum filter for your trading. In this article, we will explain what the MACD indicator does, how it helps you analyze price and how to use it in your own trading.

What does MACD mean in stocks?

One extremely popular momentum trading indicator is the moving average convergence divergence (MACD) oscillator. The MACD stock indicators are used to determine the strength, direction and duration of a trend through the relationship between two moving averages.

What does MACD tell you about a stock?

Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. Traders use the MACD to identify when bullish or bearish momentum is high in order to identify entry and exit points for trades.

What is a good number for MACD?

The histogram is positive when the MACD line is above its signal line and negative when the MACD line is below its signal line. The values of 12, 26 and 9 are the typical settings used with the MACD, though other values can be substituted depending on your trading style and goals.

How does a MACD chart work?

The Moving Average Convergence Divergence (MACD) is a technical indicator which simply measures the relationship of exponential moving averages (EMA). The MACD displays a MACD line (blue), signal line (red) and a histogram (green) - showing the difference between the MACD line and the signal line.

Is MACD a good indicator?

Though invented in the seventies, MACD is still considered one of the most reliable momentum traders' indicators. As the name suggests, MACD is all about the convergence and divergence of the two moving averages.

How do you read MACD and RSI?

The RSI calculates average price gains and losses over a given period of time; the default time period is 14 periods with values bounded from 0 to 100. The MACD measures the relationship between two EMAs, while the RSI measures price change in relation to recent price highs and lows.

Which is better MACD or RSI?

The MACD proves most effective in a widely swinging market, whereas the RSI usually tops out above the 70 level and bottoms out below 30. It usually forms these tops and bottoms before the underlying price chart. Being able to interpret their behaviour can make trading easier for a day trader.

How do you read a MACD signal?

Learning From MACD The MACD has a positive value (shown as the blue line in the lower chart) whenever the 12-period EMA (indicated by the red line on the price chart) is above the 26-period EMA (the blue line in the price chart) and a negative value when the 12-period EMA is below the 26-period EMA.

When should you buy MACD?

At its most basic level, MACD generates four signals: Buy: When the MACD line crosses above the zero line, it's bullish. Buy: When the MACD line crosses above the nine-day signal line, it's bullish. Sell: When the MACD line crosses below the zero line, it's bearish.

How do you analyze MACD indicators?

1:063:20Understanding MACD Moving Average Convergence DivergenceYouTubeStart of suggested clipEnd of suggested clipNow let us discuss as to how do this indicator gives us a buy and sell signals. We also refer to theMoreNow let us discuss as to how do this indicator gives us a buy and sell signals. We also refer to the charts while understanding each of the concepts. Better first is the zero line so when the MACD

Do professional traders use MACD?

Momentum is one of the most important concepts use to generate strategies by professional traders. As momentum accelerates the price of an asset can break out or break down, signally to traders that a trend is beginning.

How do you trade with MACD?

The strategy is to buy – or close a short position – when the MACD crosses above the zero line, and sell – or close a long position – when the MACD crosses below the zero line. This method should be used carefully, as the delayed nature means that fast, choppy markets would often see the signals issued too late.

What is a bullish MACD crossover?

A bullish crossover occurs when the MACD turns up and crosses above the signal line. A bearish crossover occurs when the MACD turns down and crosses below the signal line.

Who invented the MACD?

The moving average convergence divergence (MACD) index was invented by Gerald Appel in the 1970s. Appel designed the MACD as a technical analysis t...

What is the difference between MACD and RSI?

While the moving average convergence divergence (MACD) indicator measures the difference between two separate exponential moving averages (EMAs), t...

What is the best time frame for MACD?

There is no one best time frame to use the MACD index in. The MACD provides insight on potential divergence within any given time frame on a chart....

Why do you avoid trading on MACD?

Users of the MACD generally avoid trading in this situation or close positions to reduce volatility within the portfolio. Divergence between the MACD and the price action is a stronger signal when it confirms the crossover signals.

What does it mean when the MACD line crosses from above to below the signal line?

The further below the zero line the stronger the signal. When the MACD line crosses from above to below the signal line, the indicator is considered bearish. The further above the zero line the stronger the signal. During trading ranges the MACD will whipsaw, with the fast line crossing back and forth across the signal line.

When MACD turns down from below zero, is it bullish?

Secondly, when MACD turns up from below zero it is considered bullish. When it turns down from above zero it is considered bearish. When the MACD line crosses from below to above the signal line, the indicator is considered bullish. The further below the zero line the stronger the signal.

What is a moving average convergence?

The Moving Average Convergence/Divergence indicator is a momentum oscillator primarily used to trade trends. Although it is an oscillator, it is not typically used to identify over bought or oversold conditions. It appears on the chart as two lines which oscillate without boundaries. The crossover of the two lines give trading signals similar to a two moving average system.

What is MACD in stocks?

The MACD is a technical indicator that measures the difference between bullish and bearish momentum. It helps to identify overbought and oversold conditions and trends in stocks, commodities, currencies, and other securities.

MACD indicator explanation

Moving Average Convergence Divergence is known as MACD. The main idea behind the MACD is to identify momentum shifts in a stock’s price.

How to read MACD on a trading chart?

The MACD is an indicator used for identifying trends and reversals. The 12, 26, 9 formula stood the test of time and has been widely adopted due to its effectiveness at predicting stock price movements.

How to calculate MACD

The first step is to obtain the MACD (Moving Average Convergence Divergence) indicator values. For that, we need two-time series. They can be obtained from opening price candles or previous closing candles – it’s up to you which one you will choose.

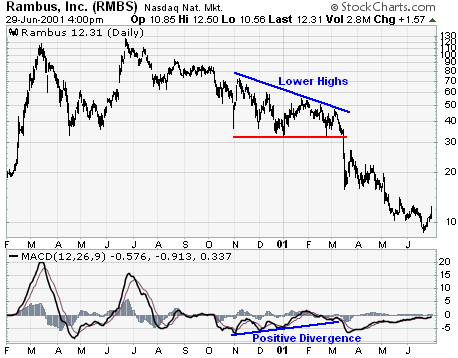

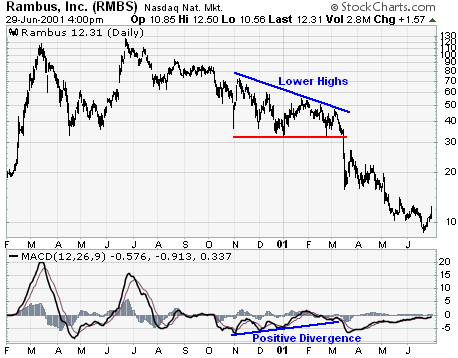

How to spot an upcoming change in trend with the MACD

As I mentioned earlier, It shows the relationship between two moving averages, one short-term and one long-term. The signal line of the MACD is simply the EMA of difference between those moving averages, which oscillates above/below zero for both bullish/bearish signals.

Using the MACD Histogram for both entry and exit

You can also use the Histogram to generate trading signals or buy/sell alerts. But divergence trading is the best way to use MACD. Now Let’s focus on the histogram position-

How to use the Moving Average Convergence Divergence as a trading strategy

Now we can dive into the MACD divergence and trading strategy. Try to avoid choosing every price pick or bottom for divergence. Instead, choose the moment when the price is going higher or lower; in other words, spot the swing high or swing low while trending.

What is MACD indicator?

The MACD indicator can help you spot powerful signals like a crossover or a divergence. Learning to use it for accurately predicting the formation of new trends will significantly improve your trading. The start of a trend is usually where most of the money is made after all.

How to set MACD on chart?

The first indicates the number of periods used for the calculation of the shorter (faster) EMA. The second reveals the number for the longer (slower) EMA, while the third is the difference between both.

What is the MACD divergence?

Divergence describes a situation in which the MACD line and the price of the instrument move in the opposite direction. Due to its limitations, you should analyze the MACD divergence cautiously and always in addition to other signals. That is because it can often produce false positives (i.e., indicate a potential trend reversal which never materializes afterward). Aside from that, it rarely manages to predict all reversals that take place. In a nutshell, the MACD divergence can predict a number of reversals that don’t happen, as well as miss out on the real ones.

What happens if the MACD crosses above the zero line?

If the MACD crosses above the zero line and becomes positive, then we have a bullish crossover. If it crosses below it and becomes negative, then we have a bearish crossover. On the chart below, you will see examples of bullish and bearish zero line crossovers taking place several times during the observed period.

What is a crossover on a MACD?

Crossovers are crucial signals that the MACD can help you identify. A crossover happens when the MACD line crosses above or below the zero or the signal line. The MACD can help you identify both the signal line crossover and the zero line crossover with relatively high accuracy.

What does it mean when the MACD crosses below zero?

The crossing point – if the MACD crosses above zero, then the signal is bullish. If it crosses below zero, then it indicates that bears are overtaking the market. Where it turns from – if the MACD turns down from above zero, then this is a bear signal.

What does a positive MACD line mean?

Each of these lines has a separate value. A MACD line with a positive value indicates that the shorter EMA is above the longer EMA. The further the shorter EMA is from the longer one, the bigger the increase in the positive value of the MACD line. This is an indication of mounting upside momentum.

When does the MACD histogram increase?

When a stock, future, or currency pair is moving strongly in a direction, the MACD histogram will increase in height. When the MACD histogram does not increase in height or begins to shrink, the market is slowing down and might be warning of a possible reversal.

Why is the MACD histogram shrinking?

The MACD histogram is shrinking in height. This occurs because there is a change in direction or a slowdown in the stock, future, bond, or currency trend. When that occurs, the MACD line is getting closer to the MACD signal line.

Is there a time frame for MACD?

There is no one best time frame to use the MACD index in. The MACD provides insight on potential divergence within any given time frame on a chart. The best time frame to use with the MACD depends on the type of trade, instrument, and stock that you’re interested in creating and executing a strategy for.

What is the MACD?

Interpretation. As its name implies, the MACD is all about the convergence and divergence of the two moving averages. Convergence occurs when the moving averages move towards each other. Divergence occurs when the moving averages move away from each other. The shorter moving average (12-day) is faster and responsible for most MACD movements.

Which is faster, the MACD or the longer MACD?

The shorter moving average (12-day) is faster and responsible for most MACD movements. The longer moving average (26-day) is slower and less reactive to price changes in the underlying security. The MACD line oscillates above and below the zero line, which is also known as the centerline.

How does a MACD divergence form?

Divergences form when the MACD diverges from the price action of the underlying security. A bullish divergence forms when a security records a lower low and the MACD forms a higher low. The lower low in the security affirms the current downtrend, but the higher low in the MACD shows less downside momentum. Despite decreasing, downside momentum is still outpacing upside momentum as long as the MACD remains in negative territory. Slowing downside momentum can sometimes foreshadow a trend reversal or a sizable rally.

What does a negative MACD mean?

Positive values increase as the shorter EMA diverges further from the longer EMA. This means upside momentum is increasing. Negative MACD values indicate that the 12-day EMA is below the 26-day EMA. Negative values increase as the shorter EMA diverges further below the longer EMA.

Why does MACD fluctuate above zero?

The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. Traders can look for signal line crossovers, centerline crossovers and divergences to generate signals. Because the MACD is unbounded, it is not particularly useful for identifying overbought and oversold levels.

What is a moving average divergence oscillator?

Developed by Gerald Appel in the late seventies, the Moving Average Convergence/Divergence oscillator (MACD) is one of the simplest and most effective momentum indicators available. The MACD turns two trend-following indicators, moving averages, into a momentum oscillator by subtracting the longer moving average from the shorter one. As a result, the MACD offers the best of both worlds: trend following and momentum. The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. Traders can look for signal line crossovers, centerline crossovers and divergences to generate signals. Because the MACD is unbounded, it is not particularly useful for identifying overbought and oversold levels.

Which is more sensitive, MACD or MACD?

Chartists looking for more sensitivity may try a shorter short-term moving average and a longer long-term moving average. MACD (5,35,5) is more sensitive than MACD (12,26,9) and might be better suited for weekly charts. Chartists looking for less sensitivity may consider lengthening the moving averages.

What is MACD stock?

The MACD stock indicators are used to determine the strength, direction and duration of a trend through the relationship between two moving averages. Sorry for the long-winded answer, but the MACD indicator throws a solid punch.

What do fundamental traders look for in a stock?

For starters, fundamental traders look at companies’ earnings announcements, cash flow statements, long-term stock charts and analysts upgrades and downgrades.

What are the most common indicators used in trading?

At this point, it’s safe to say, the most common indicators we use are momentum (RSI, MACD), trend indicators, volume, VWAP, volatility, relative volume and float.

What is fundamental trading?

Fundamental traders are the “buy and hold” investor. You may be a fundamental trader and not even know it. Likewise, if you hold long-term investments, that’s you. Maybe you have a financial planner or an investment advisor who does the fundamental analysis for you. Either way, you or your licensed financial advisor looks at ...

Understanding the MACD Histogram

A MACD chart consists of three elements: the MACD line, a signal line, and a histogram, charted around a horizontal axis known as the baseline. The MACD chart is usually graphed just below the security's price chart, so that price movements can be compared with changes in the MACD chart.

How to Read the MACD Histogram

Traders use the MACD histogram to identify potential trend reversals and price swings. When the histogram is positive (i.e., above the baseline) that means that the MACD is higher than its nine-day average, signifying a recent increase in upward momentum. When the histogram is below the baseline, the MACD is lower than its nine-day average.

Example of MACD Histogram

The following chart demonstrates one potential way to read the MACD histogram. The top curve represents the price chart for a hypothetical security, along with a set of trendlines. The middle chart is a MACD line and histogram, centered around a baseline. The lower histogram represents the volume for each trading period.

The Bottom Line

This example should demonstrate how observing the MACD histogram can help anticipate changes in trends in both short-term and long-term price momentum. It is important for traders to learn to recognize these trends and not bet against them. Fighting a trend is a sure way to get pummeled.

1. Price Growing

The stock price is in growth mode, almost doubling in the first quarter.

2. Looks for Negative Divergence

The trick with MACD is to look at the trend; it is a powerful indicator when you compare the direction of the MACD Mountains with the Price Movement.

3. The Price Declining

Here we see a sharp decline in price for the rest of 2008 until November. Using a trend line to show this helps us visualize the direction easier.

4. Looks for Positive Divergence

At the same time, the price is declining we actually see a longer-term Positive Divergence occurring from June to December. This essentially means that the “Gas in the tank of the sellers is slowly reducing.”

5. See the Buy Signal

MACD broke through the line of resistance: here we see the MACD breaking sharply past its previous high. I plotted a Trend Line in Orange to show this clearly.