What are Level II quotes?

The Players

- Market Makers (MM) These are the players who provide liquidity in the marketplace. ...

- Electronic Communication Networks (ECN) Electronic communication networks are computerized order placement systems. ...

- Wholesalers (Order Flow Firms) Many online brokers sell their order flow to wholesalers. ...

- The Ax. ...

What is Level II trading platform?

The 5 best Level 2 trading platforms in the UK

- SharePad (Best overall Level 2 trading platform)

- ShareScope (Best Level 2 trading platform for professional traders)

- IG L2 Dealer (Best Level 2 trading platform for cheap live prices)

- London South East

- ADVFN

Where to see Level II Stock?

Level 2 data is available only for a limited number of symbols. Make sure that you are connected to the broker. This data is coming from the broker, so it's important to have it connected. In the DOM window, you can have level 2 data for the traded symbols from the following brokers: TradeStation, CQG, AMP, Tradovate, iBroker and Alor.

What is the NASDAQ level II?

The Nasdaq closed with a gain of 0.05% at 14,942.83 after falling more than 2% earlier in the day ... but settled back below that level later in the day. On Sunday, Goldman Sachs projected the Federal Reserve will hike rates four times in 2022, signaling ...

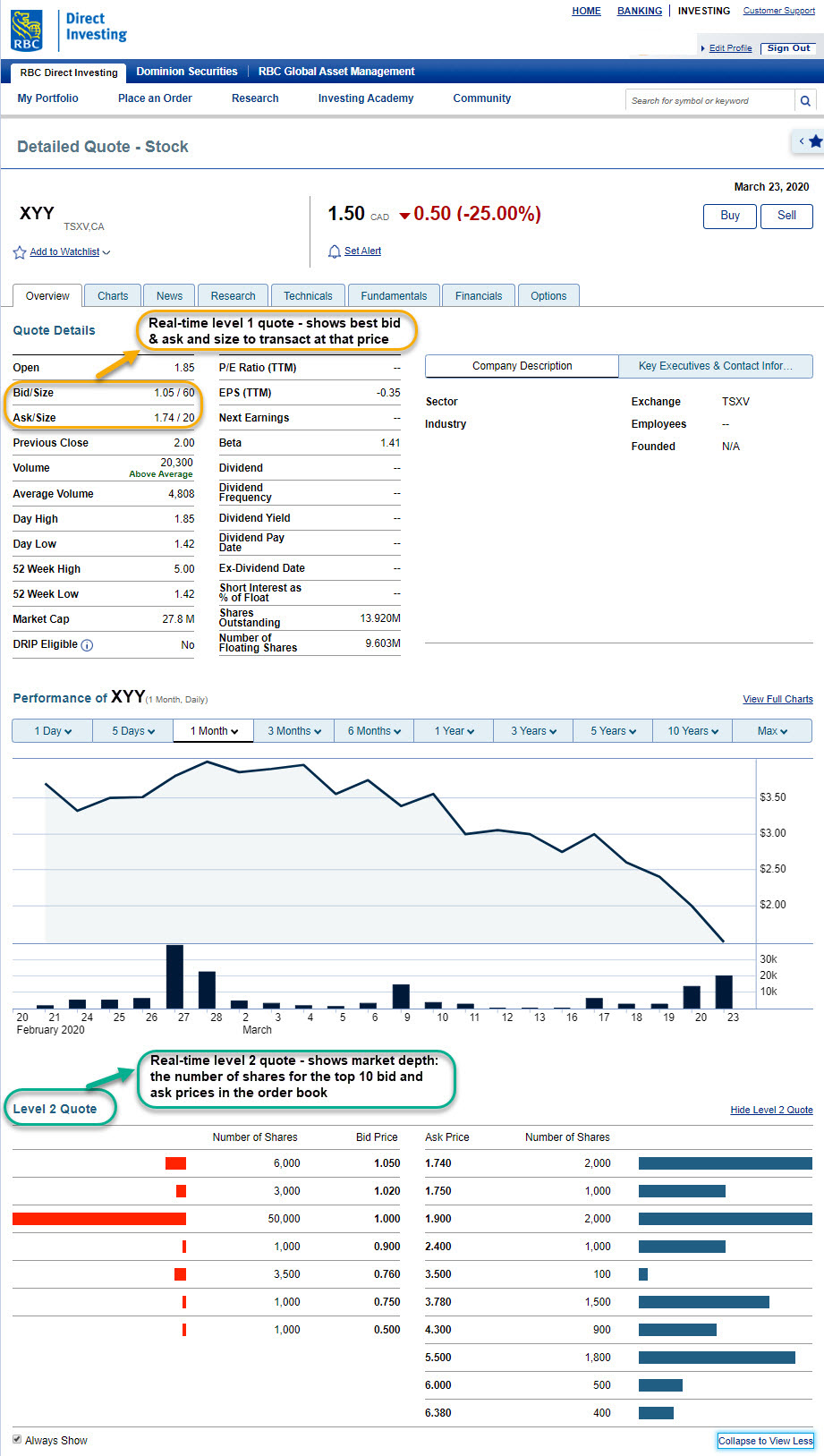

What is the difference between Level 1 and Level 2 quotes?

Quote Levels Level 1 quotes provide basic price data for a security including the best bid and ask price + size on each side. Level 2 quotes provide more information than Level 1 quotes by adding market depth. Level 2 shows market depth typically up to the 5-10 best bid and offer prices.

What is a real time level 2 quote?

Real-Time Level 2 Quotes refers to all broker-dealer bid/ask quote prices and size in a security, in real time. Real-time Level 2 Quotes are important because investors want to see the available liquidity in a security. They also give investors the confidence that they are receiving the best price for their investment.

Where can I find level 2 stock quotes?

Level2StockQuotes.com - Free Level 2 Stock Quotes, Stock Charts and Most Active Stocks - For AMEX, NASDAQ, and NYSE Stocks - Features level 2 quotes, live stock charts, stock market watch list and most active stocks for NASDAQ, NYSE and AMEX stocks.

What is Level 2 option trading?

Level two trades are what allow investors to actually buy options contracts and go long either calls or puts. There is no risk to the broker in these trades, as options cannot be purchased on margin, but investors can experience a total loss of their investment if the contract expires worthless.

What is Level II on TD Ameritrade?

Level II is a thinkorswim gadget that displays best ask and bid prices for each of the exchanges making markets in stocks, options, and futures. It is essentially a real-time ordered list of best bids and asks of an underlying that allows instant order placement.

What is Level 3 in stock trading?

A level III quote is pricing information about a security provided by a trading service. It includes the real-time bid price, ask price, quote size, price of the last trade, size of the last trade, high price for the day, and the low price for the day.

Do you need Level 2 to day trade?

Level 2 can be a very valuable tool to have as a day trader. When you are looking at breakout setups like a Gap-and-Go, and you see a lot of sellers on the ask, then you can reasonably assume that if those sellers get bought up, prices will likely pop higher.

How do you read a Level 2 stock?

What Is Level 2 Market Data?Bid price: The highest price a buyer is willing to pay.Bid size: The amount traders are looking to buy at the bid price.Ask price: The lowest price a seller will sell for.Ask size: The amount traders are looking to sell at the ask price.Last price: The price of the most recent trade.More items...•

Does Fidelity have Level 2 quotes?

Level 2 quotes aren't available on the mobile app yet, but can be accessed through Active Trader Pro: go.fidelity.com/4cdl Thanks! No matter how often you trade, Fidelity has the trading tools and features you need to help uncover and act on new opportunities.

How do you use Level 2?

5:0624:56[UPDATED 2022] How to Use Level 2 data and Time and Sales while Day ...YouTubeStart of suggested clipEnd of suggested clipSo on the level 2 we can see the market maker the price. And the shares. Available that's level oneMoreSo on the level 2 we can see the market maker the price. And the shares. Available that's level one data. Now level two data is when you can go ahead and see let's go to crop.

How do I get to Level 2 on Robinhood?

It doesn't include data on orders from other stock markets, trading venues, brokers, or Robinhood. Where can I find Level II market data? You can find the Level II market data for securities traded on Nasdaq on the security's detail page. On mobile, tap the arrow next to the current trading price.

What is level2?

Level 2 (or Level II) is the electronic order book for listed stocks, which can be accessed by traders and investors through subscription-based services. Level 2 shows a ranked list of the best bid and ask prices, orders from all market makers and market participants, and order sizes.

What is level 2 on the NASDAQ?

First introduced in 1983 as the Nasdaq Quotation Dissemination Service (NQDS), Level 2 is a subscription-based service that provides real-time access to the NASDAQ order book. It is intended to display market depth and momentum to traders and investors. 1 .

What is the first column in a level 2 quote?

This column identifies the four-letter identification for market makers. The second column is Bid or the price that the market maker is willing to pay for that stock. The third column is Size. This column is the number of orders placed by the market maker at that size.

What is level 1 in trading?

Level 1 offers enough information to satisfy the needs of most investors, providing the inside or best bid and ask prices. 2 However, active traders often prefer Level 2 because it displays the supply and demand of the price levels beyond or outside of the national best bid offer (NBBO) price.

Why do traders place similar orders?

Once they have identified hidden orders from L2 quotes, traders can place similar orders because institutional investor action will help support and resistance levels for that stock's price.

What does it mean when a stock moves up?

If a lot of trades are executed when a buyer agrees to the seller’s price, it’s generally a good indicator that the stock will move up a bit. On the buy side, you might see several orders getting filed. This can mean that the stock is heading lower, since sellers are rushing to get rid of their shares at lower prices.

What is the indicator of buying action?

Indicator of buying action. By looking at the type of market participants involved, you can tell what kind of buying is taking place within a particular security: retail or institutional. Usually, one or the other is dominant.

What is the most important market maker?

They’re required to buy when nobody else is buying and to sell when nobody else is selling. The most important market maker is called the ax. You can figure out who the ax is by watching the Level 2 action for a few days. The market maker consistently dominates the price action.

What Is Level 2 Stock Quotes

Many investors like to use quotes in predicting stock values and their performance. For some, the price of a single share is not enough information. Using Level 2 quotes, traders can get real-time prices on individual stocks or entire portfolios.

Level 1 Vs Level 2 Market Data

Level 1 data is the most basic level of information that traders can get. This includes real-time prices and volume, while Level 2 data offer additional insight into the market. As a result, Level 1 data is cheaper than Level 2 data, but it lacks valuable information about order flow.

Free Real-Time Level 2 Quotes

Scanz software is a powerful tool for investment analysis. Investors can access Real-Time Level 2 Quotes and market data on all stocks listed on the exchanges.

View Level 2 Stock Quotes on Scanz Software

Scanz Software is an advanced stock scanner that provides level 2 market maker data you may find helpful when you are trading.

Key Takeaways

The stock trading game has become more competitive than ever, and the stakes are high. To get an edge over other traders, you need access to level 2 stock quotes. With this data, you can see which stocks are being bought and sold at what price.

What is level 1 and level 2?

Some of the information the screens display are the same, including the stock’s last trading price, the current bid and ask price, the daily high and low and the trading volume. The ask price is the price for which you could immediately buy the stock. The bid price is the price for which you could immediately sell the stock.

What is liquidity information in stocks?

Stock liquidity information tells you how fast buy and sell orders are executed and how fast new orders enter the marketplace. Stocks with a large number of traders have higher liquidity than stocks with only a few traders.