Inverse exchange traded funds, or bearish ETFs, allow investors to profit from downward moves in select indexes or sectors without directly shorting stocks. A reverse stock split would appear to hurt inverse ETFs, because reverse splits inflate the price of the stock undergoing the split.

Full Answer

Is reverse split good for stock?

Per-share price bumping is the primary reason why companies opt for reverse stock splits, and the associated ratios may range from 1-for-2 to as high as 1-for-100. Reverse stock splits do not impact a corporation's value, although they are usually a result of its stock having shed substantial value.

Do you lose money on a reverse stock split?

In some reverse stock splits, small shareholders are "cashed out" (receiving a proportionate amount of cash in lieu of partial shares) so that they no longer own the company's shares. Investors may lose money as a result of fluctuations in trading prices following reverse stock splits.

What does a reverse stock split mean for an investor?

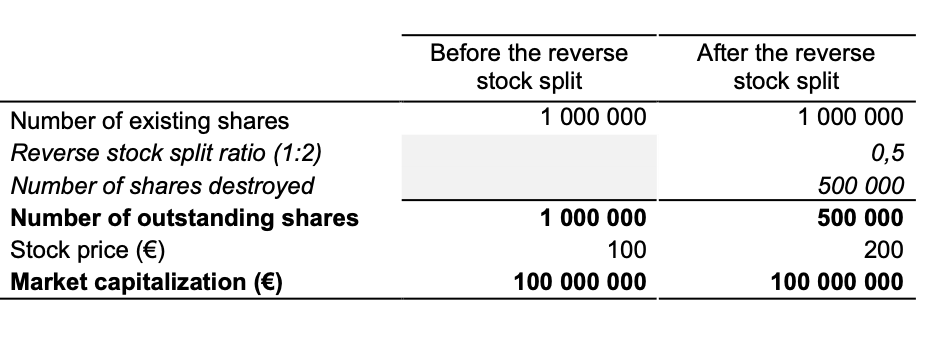

A reverse stock split occurs when a publicly traded company divides the number of outstanding shares by a certain amount. This serves to decrease the number of outstanding shares and increase the price per share of those outstanding shares.

Should I sell my stock before a reverse split?

Splits are often a bullish sign since valuations get so high that the stock may be out of reach for smaller investors trying to stay diversified. Investors who own a stock that splits may not make a lot of money immediately, but they shouldn't sell the stock since the split is likely a positive sign.

Should I buy before or after a reverse stock split?

Each individual stock is now worth $5. If this company pays stock dividends, the dividend amount is also reduced due to the split. So, technically, there's no real advantage of buying shares either before or after the split.

Is it better to buy before or after a stock split?

Should you buy before or after a stock split? Theoretically, stock splits by themselves shouldn't influence share prices after they take effect since they're essentially just cosmetic changes.

Do stocks go up after a split?

In almost all cases, after a stock split, the number of shares that are held by a shareholder increase. The caveat in this regard is the fact that the price per share reduce, because the shareholders now get more shares for the given price. The market capitalization in this regard stays the same.

What happens to leftover shares in a reverse split?

Sometimes a reverse stock split means a shareholder has fractional shares. For example, if you have 100 shares before a reverse stock split and the split is one-for-three your shares will be 33.33. In most cases, the company will enter your shares at 33 and you will get the remainder in cash.

Does a stock split hurt shareholders?

When a stock splits, it has no effect on stockholders' equity. During a stock split, the company does not receive any additional money for the shares that are created. If a company simply issued new shares it would receive money for these, which would increase stockholders' equity.

Are stock splits good for shareholders?

A stock split allows a company to break each existing share into multiple new shares without affecting its market capitalization (total value of all its shares) or each investor's stake in the company. A stock split can be a good sign for both current and prospective shareholders.

What is reverse stock split?

A reverse stock split, as opposed to a stock split, is a reduction in the number of a company’s outstanding shares in the market. It is typically based on a predetermined ratio. For example, a 2:1 reverse stock split would mean that an investor would receive 1 share for every 2 shares that they currently own.

Why do companies reverse split?

Reasons for a Reverse Stock Split. There are several reasons why a company would conduct a reverse stock split: 1. Minimum stock price imposed by exchanges. For exchanges, there is a requirement to remain above a minimum share price. On the New York Stock Exchange.

What journal entry is required for a reverse stock split?

Journal Entries for a Reverse Stock Split. The only journal entry required for a reverse stock split is a memorandum entry to indicate that the numbers of shares outstanding have decreased.

What happens when a company decides to spin off its business?

When a company decides to spin off its business, it may do a reverse stock split to maintain its company’s share price post-spinoff. For example, Hilton Hotels planned to spin off two businesses to its shareholders (Park Hotels & Resorts and Hilton Grand Vacations).

What is penny stock?

Penny Stock A penny stock is a common share of a small public company that is traded at a low price. The specific definitions of penny stocks may vary among countries.

What is the largest stock exchange in the world?

New York Stock Exchange (NYSE) The New York Stock Exchange ( NYSE) is the largest securities exchange in the world, hosting 82% of the S&P 500, as well as 70 of the biggest. , a company would risk being delisted if its share price closed below $1.00 for 30 consecutive trading days.

When are stock dividends issued?

Stock dividends are primarily issued in lieu of cash dividends when the company is low on liquid cash on hand. Weighted Average Shares Outstanding Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period.

Why is reverse stock split important?

Reverse stock splits boost the share price enough to avoid delisting. 2.

What happens if you reverse a stock split?

A reverse stock split causes no change in the market value of the company or market capitalization because the share price also changes. So, if the company had 100 million shares outstanding before the split, the number of shares in circulation would equal 1 million following the split.

What happens if a company's stock price falls too low for options to be traded on it?

If a company's stock price falls too low for options to be traded on it, the shares might lose interest from hedge funds and wealthy institutional investors who invest billions of dollars in the market and hedge their positions via options.

Why do companies reverse split?

A reverse stock split can be a red flag that a company is in financial trouble because it boosts the price of otherwise low-value shares. Reverse splits are often motivated by a desire to prevent the company's shares or options from being delisted from exchanges and to boost public perception.

What is a 2:1 split?

So, in a 2:1 stock split, each share of stock would be split into two shares, with the result being a decrease in the price per share.

Why are higher priced stocks good?

Higher-priced stocks tend to attract more attention from market analysts, and this is viewed as good marketing. 4. To avoid delisting from options exchanges. Typically, a company's share price must be greater than $5 for options to be traded on the stock.

Is a reverse stock split a negative signal?

Reverse stock splits can also be a negative signal to the market. As mentioned above, a company is more likely to undergo a reverse stock split if its share price has fallen so low that it is in danger of being delisted.

What is reverse stock split?

What is a reverse stock split? A reverse stock split is a situation where a corporation's board of directors decides to reduce the outstanding share count by replacing a certain number of outstanding shares with a smaller number. Reverse stock splits work the same way as regular stock splits but in reverse. A reverse split takes multiple shares ...

What is a stock split?

Stock splits are most commonly associated with positive news, as they typically happen when a stock has performed quite well, and they generally result in an increased number of shares owned by each investor . But those splits, officially called forward stock splits, are only one variety. It's also possible for a company to complete ...

Why do companies reverse split?

A company does a reverse split to get its share price up . The most common reason for doing so is to meet a requirement from a stock exchange to avoid having its shares delisted. For example, the New York Stock Exchange has rules that allow it to delist a stock that trades below $1 per share for an extended period.

What does reverse split mean?

It is simply a change in the stock structure of a business and doesn't change anything related to the business itself. That said, a reverse split is usually taken as a sign of trouble by the market. In rare cases, a reverse split buys a company the time it needs to get back on track.

Is a reverse stock split a good sign?

The bottom line on reverse stock splits. Despite the occasional success story, reverse splits aren't usually a good sign for a stock. Still, they don't have to be a death knell, either. Because reverse stock splits have no fundamental impact on a company, it's more important to look at the financial health of a stock to assess whether ...

What happens when a company reverses its stock split?

When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share.

Why do companies reverse split?

A company may declare a reverse stock split in an effort to increase the trading price of its shares – for example, when it believes the trading price is too low to attract investors to purchase shares, or in an attempt to regain compliance with minimum bid price requirements of an exchange on which its shares trade.

Do I need to file a proxy statement for reverse stock split?

Depending on the particular facts, companies pursuing a reverse stock split may also be required to file a proxy statement on Schedule 14A, if shareholder approval is required, or a Schedule 13E-3, if the reverse stock split will result in the company “ going private .”. Corporate filings can be found on EDGAR .”. Featured Content.

Does the SEC have authority over reverse stock splits?

Although the SEC has authority over a broad range of corporate activity, state corporate law and a company’s articles of incorporation and by-laws generally govern the company’s ability to declare a reverse stock split and whether shareholder approval is required.

What is reverse stock split?

Reverse stock split refers to the process of boosting a company’s stock price by reducing the number of its outstanding shares. It is attained by combining some of the existing shares in the market and simultaneously raising their value in the same ratio.

Why do companies split their stock?

The primary reason for splitting a share into new ones is to lower its cost. It enhances its affordability to potential investors. On the other hand, companies use reverse stock split to inflate the per-share value when their stock price is constantly falling.

Why is USO stock falling?

The share price could fall due to the underperformance of a company that is reporting constant losses. Increased debts, scams, or recession could also severely affect a firm’s profits and stock price. USO had reported unrealized losses of $726 million in March 2020.

What are the advantages of reverse split?

Apart from delisting, the following are advantages of the reverse split.#N#Match Stock Price of Competitors: If the competitor company’s share value is relatively high, it will appear more attractive. The split will help the company secure an equivalent share price to stay in investors’ good books.

What is dividend distribution?

Dividend Dividend is that portion of profit which is distributed to the shareholders of the company as the reward for their investment in the company and its distribution amount is decided by the board of the company and thereafter approved by the shareholders of the company. read more. .

What is shareholder in stock?

Shareholders A shareholder is an individual or an institution that owns one or more shares of stock in a public or a private corporation and, therefore , are the legal owners of the company . The ownership percentage depends on the number of shares they hold against the company's total shares. read more. better.

What is stock exchange?

Stock Exchange Stock exchange refers to a market that facilitates the buying and selling of listed securities such as public company stocks, exchange-traded funds, debt instruments, options, etc., as per the standard regulations and guidelines—for instance, NYSE and NASDAQ. read more. .

Why is reverse stock split bad?

Here’s why: The number one reason for a reverse split is because the stock exchanges—like the NYSE or Nasdaq—set minimum price requirements for shares that trade on their exchanges.

When did Citi reverse split?

Citi probably had the most famous reverse split—a 1 for 10 reverse split in May 2011. Citi became a $40 stock and is now trading at $70. The split was billed as “returning value to the shareholders.”.

Why won't institutional investors invest in stocks?

Savvy institutional investors won’t invest in the stock just because its price suddenly soared, and it will have a hard time raising capital if its balance sheet is poor. Shorters, who follow reverse stock splits and target those stocks, began to put pressure on the stock price, sending it tumbling.

Do penny stocks reverse split?

Most—although not all—reverse splits are seen in small penny stocks that have not been able to attain steady profitability and create value for their shareholders. I found that was the case in most of the biotechs’ recent reverse stock splits.

Is Xerox stock split a reverse split?

It could raise Xerox’s standing among institutional investors and research analysts. It could also lower Xerox’s standing among other investors. Some investors are repelled by reverse stock split. They view a reverse stock split as an insincere strategy for raising the share price.

Why do reverse stock splits happen?

Reverse stock splits occur when a publicly traded company deliberately divides the number of shares investors are holding by a certain amount, which causes the company’s stock price to increase accordingly. However, this increase isn’t driven by positive results or changes to the company. Rather, the stock price rises because of basic math.

Why do companies do reverse stock splits?

Why companies perform reverse stock splits. The most obvious reason for companies to engage in reverse stock splits is to stay listed on major exchanges. On the New York Stock Exchange, for example, if a stock closes below $1 for 30 consecutive days, it could be delisted.

What happens if a company times a reverse stock split?

In this instance, the reverse stock split was a success for both the company and its shareholders.

What happens if a stock price is too low?

If a company’s share price is too low, it’s possible investors may steer clear of the stock out of fear that it’s a bad buy; there may be a perception that the low price reflects a struggling or unproven company. To fight this problem, a company may use a reverse stock split to increase its share price.

What happens to the market capitalization of a company during a reverse stock split?

During a reverse stock split, the company’ s market capitalization doesn’t change, and neither does the total value of your shares. What does change is the number of shares you own and how much each share is worth. If you own 50 shares of a company valued at $10 per share, your investment is worth $500. In a 1-for-5 reverse stock split, you would ...

Is a reverse stock split a red flag?

In either instance, a reverse stock split could be a red flag to investors, but this isn’t always the case. Here are two basic outcomes of a reverse stock split: Positive. Often, companies that use reverse stock splits are in distress. But if a company times the reverse stock split along with significant changes that improve operations, ...