How to find the historical PE ratio for any stock?

Apr 03, 2022 · So, what is a good PE ratio for a stock? A “good” P/E ratio isn’t necessarily a high ratio or a low ratio on its own. The market average P/E ratio currently ranges from 20-25, so a higher PE above that could be considered bad, while a lower PE ratio could be considered better. However, the long answer is more nuanced than that.

What is the highest PE ratio?

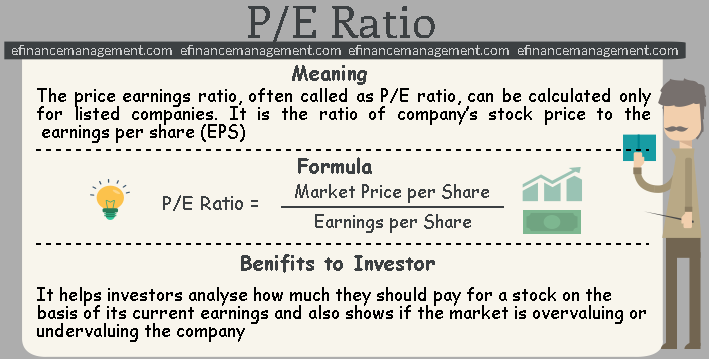

Mar 11, 2022 · P/E ratio, or price-to-earnings ratio, is a quick way to see if a stock is undervalued or overvalued. And so generally speaking, the lower the P/E ratio is, the better it is for both the business and potential investors. The metric is the stock price of a company divided by its earnings per share. You shouldn’t compare P/E ratios of different kinds of companies, like a …

What is the market average PE ratio?

Dec 07, 2021 · Therefore, there is no such thing as a “good” PE ratio. When the ratio is high, one can say the company shares are either too expensive or growth prospects are bright. When it is low, there could be a value play or the company’s future is not too positive. Even the average P/E varies across companies in a wide range of industries.

What is a good P/E ratio?

Nov 11, 2019 · At the stock market, there is a wide range of companies trading at a price-to-earnings ratio from below 1, to stocks that hold a P/E multiple within the hundreds. It would be extremely vague to say that those stocks, that have the lowest p/e are better investments than those that are trading at the highest P/E ratios.

What is a good share PE ratio?

As far as Nifty is concerned, it has traded in a PE range of 10 to 30 historically. Average PE of Nifty in the last 20 years was around 20. * So PEs below 20 may provide good investment opportunities; lower the PE below 20, more attractive the investment potential.

Is 30 a good PE ratio?

A P/E of 30 is high by historical stock market standards. This type of valuation is usually placed on only the fastest-growing companies by investors in the company's early stages of growth. Once a company becomes more mature, it will grow more slowly and the P/E tends to decline.

Is it better to have a higher or lower PE ratio?

Many investors will say that it is better to buy shares in companies with a lower P/E because this means you are paying less for every dollar of earnings that you receive. In that sense, a lower P/E is like a lower price tag, making it attractive to investors looking for a bargain.

What is a reasonable PE ratio for a growth stock?

So, many value-focused investors shun stocks with a P-E ratio of, say, 20 or more . But growth-stock investors should have no problem buying a stock with a P-E ratio of even 50 or higher, as long as it meets the criteria laid out in IBD's CAN SLIM investing system.Apr 1, 2013

Is a PE ratio of 10 good?

A P/E ratio of 10 might be pretty normal for a utility company, while it might be exceptionally low for a software business. That's where the industry PE ratios come into play.Apr 3, 2022

What is Tesla's PE ratio?

The PE ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure. Tesla PE ratio as of April 11, 2022 is 209.28.

Is a small PE ratio good?

While a low P/E ratio might indicate a cheap stock that has the potential for significant growth, it could also indicate a company that is floundering in the market and is about to go under. P/E ratios are only one indicator of a company's financial well-being.May 16, 2019

Why PE ratio is important?

The P/E ratio is used by investors to determine the market value of a stock as compared to the company's earnings. Long story short, the P/E shows what the market is willing to pay today for a stock based on its past or future earnings.Jun 23, 2021

Is PE ratio high good?

A higher PE suggests high expectations for future growth, perhaps because the company is small or is an a rapidly expanding market. For others, a low PE is preferred, since it suggests expectations are not too high and the company is more likely to outperform earnings forecasts.Mar 27, 2019

Why is Ebay PE so low?

EBAY's 12-month-forward PE to Growth (PEG) ratio of 1.69 is considered a poor value as the market is overvaluing EBAY in relation to the company's projected earnings growth due. EBAY's PEG comes from its forward price to earnings ratio being divided by its growth rate.Jul 23, 2021

How do you know if a stock is overvalued?

A stock is thought to be overvalued when its current price doesn't line up with its P/E ratio or earnings forecast. If a stock's price is 50 times earnings, for instance, it's likely to be overvalued compared to one that's trading for 10 times earnings.

Whats a good dividend yield?

What is a good dividend yield? In general, dividend yields of 2% to 4% are considered strong, and anything above 4% can be a great buy—but also a risky one. When comparing stocks, it's important to look at more than just the dividend yield.

Bottom Line

It’s a good idea for investors to understand the P/E ratio and how to use it to evaluate share prices. But it’s only one of many available metrics. It shouldn’t be used alone, and it shouldn’t be used to compare companies that are in different businesses. That said, it is a handy way of seeing if a stock is a bargain or not.

Tips to Become a Better Investor

Financial advisors often have years of experience managing investments, making them great partners for anyone looking to improve their portfolio. To find local advisors that meet your specific needs, use SmartAsset’s free matching tool. If you’re ready to build a better portfolio, get started now.

Growth Versus Value Debate

Much like the entire business, the value of the stock is linked to the ability of the company to generate cash. A low P/E ratio of stocks suggests a value orientation. The P/E ratio also indicates market expectations regarding future stock performance. Higher P/E ratios suggest more growth expectations for the company.

The Big Picture

As economies mature, inflation rises. Certain industries like banks work well as they charge higher rates on products. On the other hand, towards the end of the recession, interest rates are low, and banks earn less revenue.

Conclusion: Calculating the PE Ratio

Calculating a justified P/E ratio could be the way out too, apart from seeing the big picture. But the fact remains that P/E ratio is one of many metrics for evaluating stocks. It may seem like an important ratio but basing your decision to invest only on this metric has negative consequences.