Gamma in Options Explained: What is Gamma in Options?

- Gamma is used to measure the rate of change in delta for a $1 move in the stock

- The value of gamma can be positive as well as negative

- The gamma is at it’s highest point for at-the-money options

- Gamma approaches zero the further out-of-the-money it gets

What does gamma mean in investing?

In options pricing formulas, the Greek letter gamma denotes how responsive an options contract price is to fluctuations in the price of the underlying security. Investors in options may engage in gamma hedging, to limit the risk associated with strong price moves in the underlying security.

What is a gamma squeeze in the stock market?

Related to the short squeeze is something known as a gamma squeeze. A gamma squeeze takes things one step further, forcing additional stock-buying activity due to open options positions on the underlying stock. A gamma squeeze is behind a large part of the recent meteoric rise in the share price of GameStop ( NYSE:GME ). Image source: Getty Images.

What is alpha beta gamma in stock market?

Gamma is the rate that delta will change based on a $1 change in the stock price. So if delta is the “speed” at which option prices change, you can think of gamma as the “acceleration.” Options with the highest gamma are the most responsive to changes in the price of the underlying stock.

What is Gamma in option trading?

- Gamma measures the rate of change for delta with respect to the underlying asset's price.

- All long options have positive gamma and all short options have negative gamma.

- The gamma of a position tells us how much a $1.00 move in the underlying will change an option’s delta.

- We never hold our trades till expiration to avoid increased gamma risk.

What does it mean to buy gamma?

Gamma refers to the rate of change of an option's delta with respect to the change in the price of an underlying stock or other asset's price. Essentially, gamma is the rate of change of the price of an option.

How do you use gamma in trading?

Gammas are linked to whether your option is long or short in the market. So if you are long on a call option or long on a put option then your gamma will be positive. On the other hand, if you are short on a call option or short on a put option then your gamma will be negative.

What is considered high gamma?

Gamma is highest when the Delta is in the . 40-. 60 range, or typically when an option is at-the-money. Deeper-in-the-money or farther-out-of-the-money options have lower Gamma as their Deltas will not change as quickly with movement in the underlying.

How does gamma affect stock price?

How do gamma squeezes work in stock trading? Gamma squeezes can cause spikes and dips in the stock price while the squeeze takes place. Often this squeeze corrects itself, but it can cause short-term turbulence for traders.

Is high gamma good for options?

Gamma is the rate of change for an option's delta based on a single-point move in the delta's price. Gamma is at its highest when an option is at the money, and is at its lowest when it is further away from the money.

Is gamma positive or negative?

Gammas are linked to whether your option is long or short in the market. So if you are long on a call option or long on a put option then your gamma will be positive. But, if you are short on a call option or short on a put option then your gamma will be negative.

How do you read gamma options?

Gamma goes to 0 when Delta has reached 0 (out-of-the-money) or +1 / -1 (in-the-money) at expiration. In other words, a Delta of 0 at expiration means the option is worthless as the market price is more favorable than the strike price.

How do I buy gamma?

How to buy GammaDownload Coinbase Wallet. A self-custody wallet like Coinbase Wallet is required to purchase Gamma. ... Choose a Coinbase Wallet username. ... Securely store your recovery phrase. ... Understand and plan for Ethereum network fees. ... Buy and transfer ETH to Coinbase Wallet. ... Use your ETH to buy Gamma in the trade tab.

What happens when gamma expires?

Gamma is also highest for ATM options closer to expiration. It gets successively lower the more time to expiration an option has. All things being equal, gamma is lower when there's more time to expiration and higher with less time to expiration.

Is gamma squeeze good?

A gamma squeeze could be an opportunity for investors but it can also be risky. Depending on what's driving a short squeeze and the resulting gamma squeeze, they can last for days or weeks or peter out very quickly.

How do you identify gamma squeeze?

3:4122:31How to Spot a Gamma Squeeze Before it Happens | TSLA OptionsYouTubeStart of suggested clipEnd of suggested clipThere's usually going to be another strike price above that strike price that has a matching openMoreThere's usually going to be another strike price above that strike price that has a matching open interest. So say for example if we were to take a look at tesla for next.

What does negative gamma mean?

For a short call with negative Gamma, the Delta will become more negative as the stock rises, and less negative as it drops. Gamma is higher for options that are at-the-money and closer to expiration.

What is gamma in options?

Gamma. The option's gamma is a measure of the rate of change of its delta. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a one point movement of the underlying stock price. Like the delta, the gamma is constantly changing, even with tiny movements of the underlying stock price.

What happens to the gamma of at the money options?

As the time to expiration draws nearer, the gamma of at-the-money options increases while the gamma of in-the-money and out-of-the-money options decreases.

When volatility is low, the gamma of at the money options is high?

When volatility is low, the gamma of at-the-money options is high while the gamma for deeply into or out-of-the-money options approaches 0. This phenomenon arises because when volatility is low, the time value of such options are low but it goes up dramatically as the underlying stock price approaches the strike price .

When is the gamma at its peak?

It generally is at its peak value when the stock price is near the strike price of the option and decreases as the option goes deeper into or out of the money.

When volatility is high, does gamma increase?

When volatility is high, gamma tends to be stable across all strike prices. This is due to the fact that when volatility is high, the time value of deeply in/out-of-the-money options are already quite substantial. Thus, the increase in the time value of these options as they go nearer the money will be less dramatic and hence the low and stable gamma.

What are the Greek alphabets used for in options trading?

In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. They are known as "the greeks".... [Read on...]

What is gamma in stock?

Gamma is an investment term associated with the “Greeks.”. The Greeks are a set of terms that are used to describe various positions when trading options.

Why do investors get gamma squeezes?

A gamma squeeze happens when investors hike stock prices because option sellers have to hedge their trades on them. This is how it's used in the market.

Why is Gamma squeeze important?

Gamma squeezes can create opportunities for investors when they happen but it’s important to keep the risks in mind. The GameStop gamma squeeze provides a great example of how much timing matters when attempting to take advantage of this kind of strategy.

How long does a gamma squeeze last?

Depending on what’s driving a short squeeze and the resulting gamma squeeze, they can last for days or weeks or peter out very quickly. For that reason, timing plays an important part in determining whether a gamma squeeze results in a profit or a loss for your investment portfolio.

What is gamma squeeze?

A gamma squeeze is an extreme example of this, in which investor buying activity forces a stock’s price up. Gamma squeezes are often associated with options trading and they can be problematic for investors who don’t fully understand how they work. A financial advisor can provide valuable advice about gamma squeezes and options trading.

Why do gamma squeezes occur?

Gamma squeezes can occur as the result of widespread speculation about where a stock’s price may be headed. For example, if a company is struggling financially then institutional investors may decide to short the stock in the belief that the price will fall.

What is a short squeeze in stock?

Investors who own the stock may feel “squeezed” by rapidly changing prices and as a result, they change their positions in the stock. A short squeeze is a specific type of stock squeeze. With a short squeeze, an increase in stock prices can force people who ...

Which banks use gamma research?

Nomura , JPM, Morgan Stanley and other banks all produce gamma research for their clients.

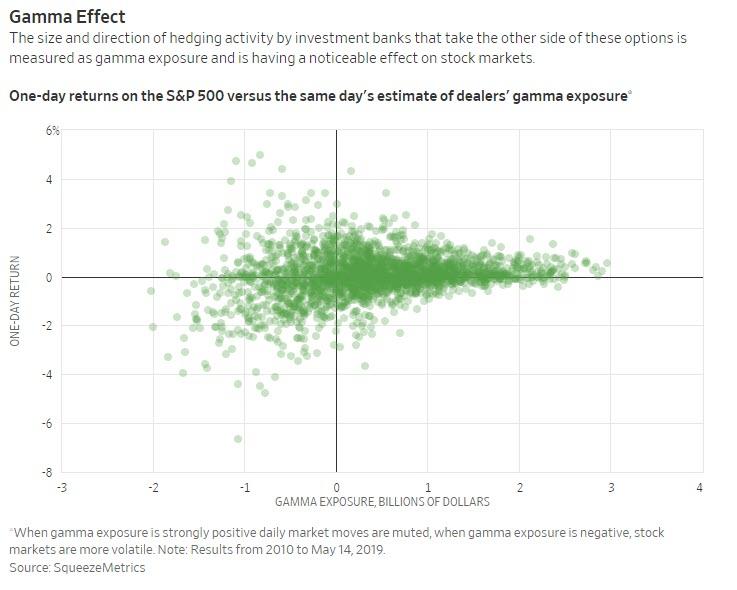

Is gamma correlated with S&P 500?

Large market gamma is highly correlated to small movement in the S&P 500.

Why is gamma calculated as 1?

So because the risk and volatility of both the underlying asset and the option are the lowest when both are at the money, gamma is calculated as 1 at the price. It gets smaller as it moves in either direction. That’s a little hard to wrap your head around if you aren’t an experienced options trader.

What is gamma indicator?

Gamma is one of the essential indicators known as ‘the Greeks’ that options traders use to determine the volatility and risk associated with purchasing a specific options contract. Gamma calculates the rate of change for the price of the option’s delta.

What Triggers a Gamma Squeeze?

So a gamma squeeze begins with a stock that has large short positions as AMC and GameStop did. Then a tide of investors believes the price of the stock will actually rise. Which is contrary to the existing short positions. But instead of just buying shares, the bullish investors also need to buy short-dated call options on the stock. This puts pressure on the short positions, as the call/put ratio becomes increasingly inflated.

What happens when the gamma squeeze stops?

Once the momentum of the gamma squeeze stops, the downside is often much faster than the squeeze itself. This is one of the fundamental problems with these coordinated social media squeezes. Retail investors believe that only institutional investors lose.

How much is Gill's position in GameStop worth?

At the height of the squeeze, Gill’s position was worth $48 million. But he exhibited diamond hands and held through the rise and subsequent fall of GameStop’s stock price. Finally, in April of 2021, when the call options were set to expire, Gill exercised all of them, giving him a position in GameStop of 200,000 shares that were valued at more than $30 million.

What is gamma squeeze?

What is a Gamma Squeeze? It’s basically short selling on steroids. When you’re shorting a stock, you believe the price of the stock is going down. So you sell a stock without owning shares, to cover when it reaches its bottom or support. When you’re adding Gamma in there, you’re referring to the option trades on that stock.

What Is a Squeeze in Investing?

Before diving into the specifics of a short squeeze and a gamma squeeze, let’s first discuss what a squeeze means when it comes to investing in stocks.

What does gamma mean in options?

In options pricing formulas, the Greek letter gamma denotes how responsive an options contract price is to fluctuations in the price of the underlying security. Investors in options may engage in gamma hedging, to limit the risk associated with strong price moves in the underlying security.

What is the gamma effect?

The gamma effect or gamma trap is making it more difficult to determine if market prices fully reflect current news or events, as Helen Thomas, founder of Blonde Money, a U.K.-based research firm, told the Journal. “Dealer hedging behavior is creating pockets of sensitivity in the markets,” she said, adding, “If Trump tweets something about China when the S&P is at one level, it doesn’t matter. But if he does it when it’s, say, 20 points lower, it’s panic stations.”

How does the price swing in an option contract affect the gamma?

Price swings in options contracts tend to be wider than moves in the prices of their underlying assets. Moreover, option price swings usually get even wider as the contract's expiration date draws closer, or as the value of the underlying asset approaches the option strike price, or exercise price. The wider the price swing in the options contract is compared to the price swing in the underlying asset, the higher gamma will be.

Where does gamma come from?

To understand gamma, you first have to get a handle on an option's delta (another Greek), which represents the expected change in the price of an option based on changes in the price of the underlying stock. For instance, if a call option has a delta of 0.2, its price is expected to rise about $0.20 for a $1 rise in the underlying stock. An option's delta will change based on how far away the stock price is from the exercise price of the option, and in which direction.

What happens when gamma squeezes reverse?

And when they reverse, the move in the opposite direction can be just as gut-wrenching (if not more so) than the initial squeeze itself was. Either way, volatility during and immediately after a gamma squeeze is usually extreme, and predictability goes straight out the window.

What happens when the delta of a stock is higher?

The higher the delta, the larger a stock position the market maker will need in order to have an effective hedge against open options positions. As a result, as delta changes, market makers with open options positions are often forced to buy or sell the underlying stock to keep their own books properly hedged. Large amounts of that forced buying or selling activity is what creates a gamma squeeze.

Why do investors short stocks?

Because of the potential for a short squeeze, some investors who short stocks don't simply sell a stock, but rather they cover their shorts by buying long, offsetting, out-of-the-money calls (i.e. exercise price of the call is above the price shares trade at when the calls were purchased). Say an investor shorted 100 shares of GameStop at $10 per share back in October 2020. That investor could have bought a $15 call option to cover that bet for a fairly cheap price back then.

Can gamma be used to force selling pressure?

Just as they can force buying pressure, they can also force selling pressure. Recall that gamma is based on the slope of that delta chart above, and that chart has the steepest slope (and thus, the most gamma) at exactly the option's strike price.

Does Chuck Saletta have a position in any of the stocks mentioned?

Questioning an investing thesis -- even one of our own -- helps us all think critically about investing and make decisions that help us become smarter, happier, and richer. Chuck Saletta has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Long Gamma Example

In this table, the positions with positive gamma are said to be long gamma. As you can see here, long gamma positions benefit when the stock price moves in favor of the position because the directional exposure of the position grows in the same direction as the stock price.

Short Gamma Example

The positions with negative gamma are said to be “short gamma.” As you can see here, short gamma positions are harmed when the stock price moves against the position because the directional exposure of the position grows in the opposite direction as the stock price movements.

Passage of Time and Its Effects on The Gamma

Changes in Volatility and Its Effects on The Gamma

Continue Reading...