Rotation in the stock market refers to switching from one set of stocks to the other. The thinking in the stock market is that usually a particular set of stocks move together. Therefore, when an external catalyst emerges—positive or negative—investors switch to the sector that is expected to positively benefit from it and vice versa.

What is rotation in the stock market?

Jan. 13 2021, Updated 3:57 p.m. ET Rotation in the stock market refers to switching from one set of stocks to the other. The thinking in the stock market is that usually a particular set of stocks move together.

What is stock rotation or FIFO?

Stock rotation or FIFO (First In First Out) is used across various industries to ensure the oldest goods are sold or used first.

What is sector rotation?

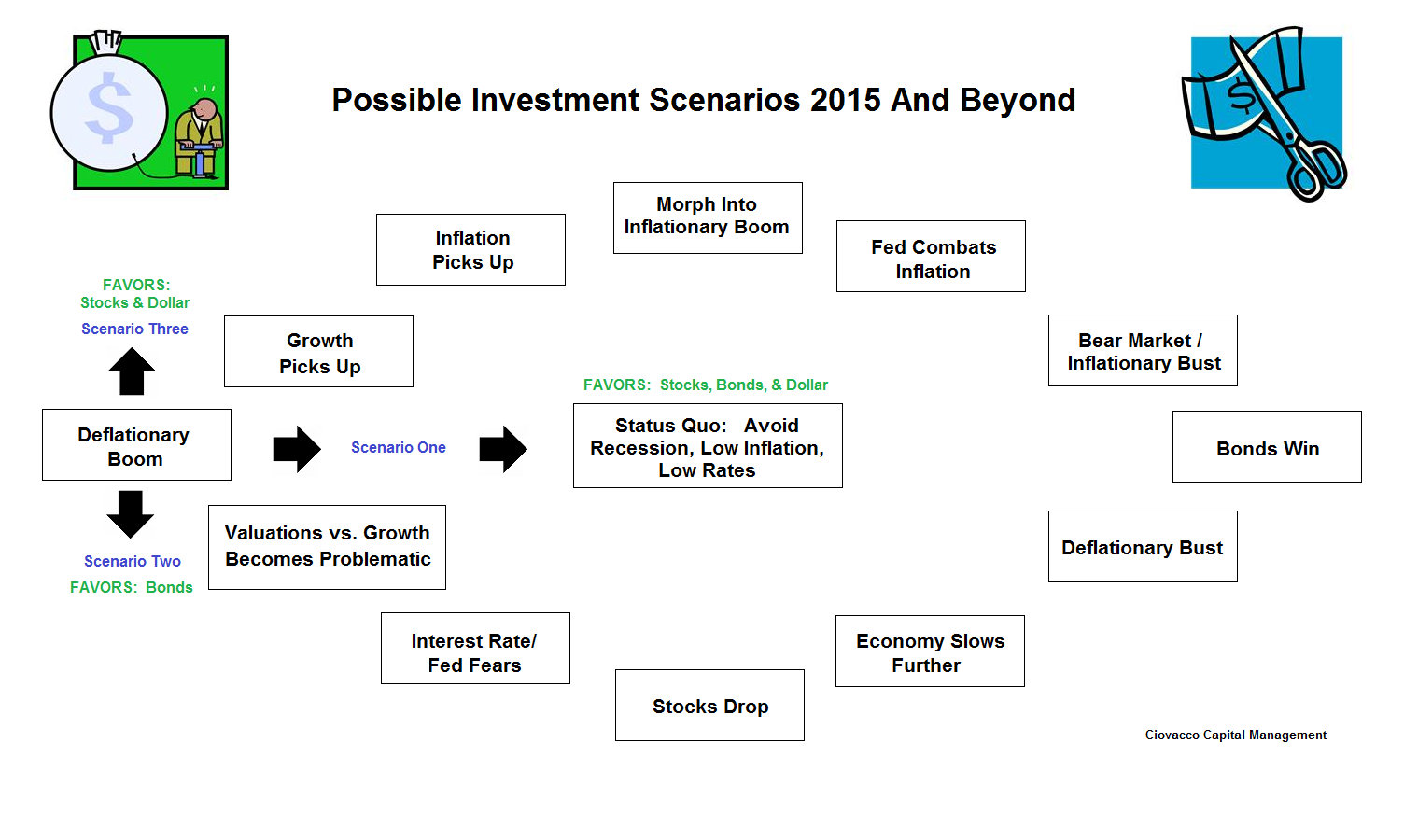

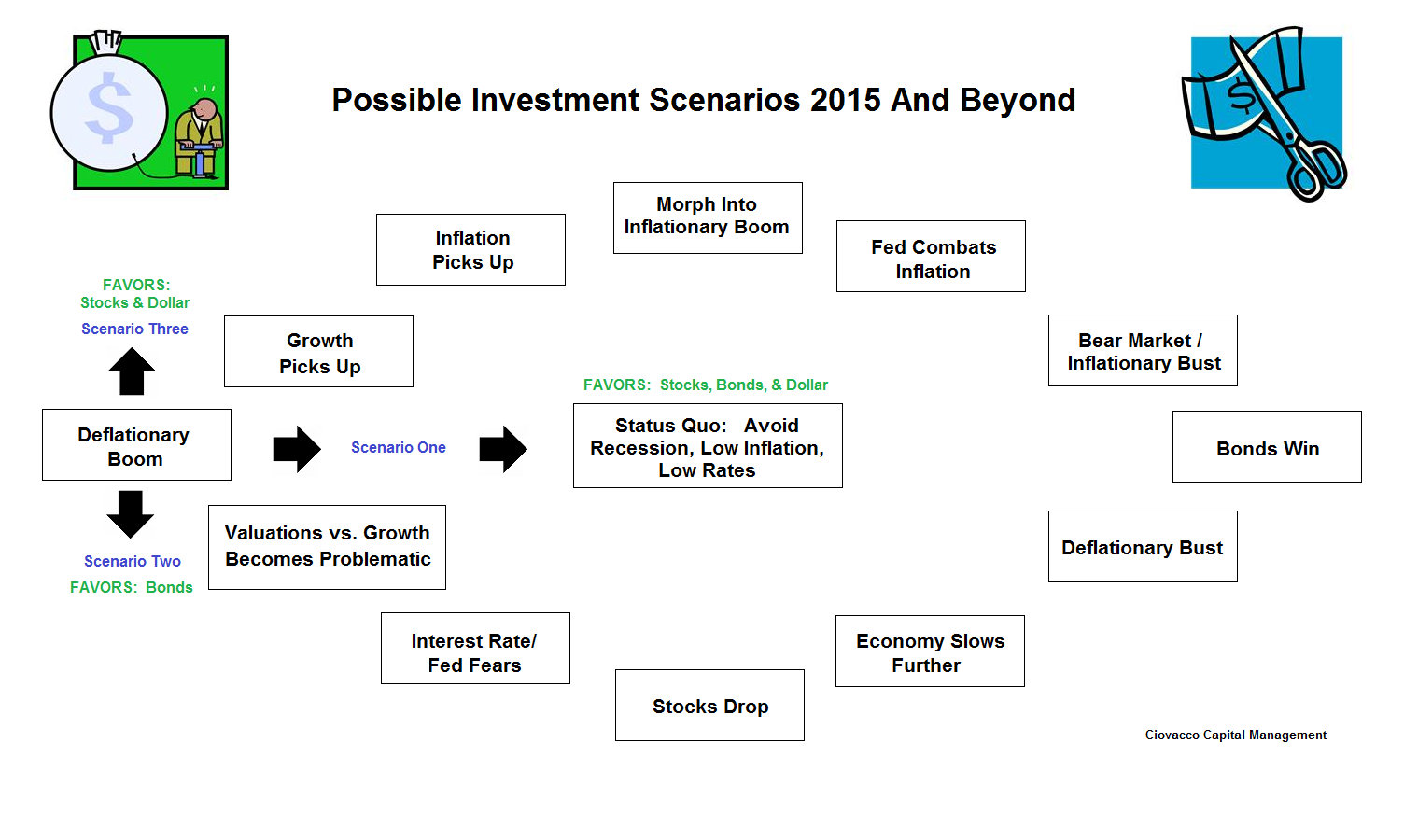

The economy moves in reasonably predictable cycles. Various industries and the companies that dominate them thrive or languish depending on the cycle. That simple fact has spawned an investment strategy that is based on sector rotation.

What is float rotation and how does it work?

Float rotation is a reference to the amount of times a stock’s entire float, or available shares, is traded during a single trading day. It typically occurs on lower float stocks that are trading with exponential volatility. It was coined by Nate Michaud, a professional day trader and purveyor of InvestorsUnderground.com.

What is rotation in the stock market?

When the outlook is positive, economically sensitive companies perform better and investors are prompted to buy their shares. If the outlook turns sour, investors may sell out of those companies and swap into investments that can better weather economic downturns. This practice is known as sector rotation.

How do you determine stock rotation?

Here are ways to spot sector rotation: Scan the IBD industry group rankings at IBD Data Tables at Investors.com. Compare the current ranking with the rankings three and six weeks ago to detect shifts. MarketSmith also displays rankings one week ago, as well as three and six months earlier.

What is rotation strategy?

The rotation strategy is used as a way to capture returns from market cycles and to diversify holdings over a specified holding period. In essence, the rotation strategy for stocks is a method of trading whereby a trader moves money from stocks that are out of trend to trendy (hot) stocks using a top-down approach.

How long does a sector rotation take?

Markets tend to anticipate the sectors that will perform best, often three to six months before the business cycle starts up. This requires more homework than just buying and holding stocks or mutual funds, but less than is required to trade individual stocks.

What is the main rule of stock rotation?

The golden rule in stock rotation is FIFO 'First In, First Out'.... The golden rule in stock rotation is FIFO 'First In, First Out'. What is stock rotation? If food is taken out of storage or put on display, it should be used in rotation.

What are the benefits of stock rotation?

The goal is to avoid losses due to getting close to (or past) the sell by dates, deterioration, obsolescence, etc. Expressed another way, to rotate the stock of goods on hand means that the physical flow of goods will result in the first or oldest goods being sold first.

What is rotational buying?

Rotational Trading (RT) is a medium term technique that takes advantage of a well-documented market anomaly whereby rapid long term price increases are often followed by a continued move in the same direction.

What is ETF rotation?

One of the most sensible is an ETF rotation strategy which periodically rotates money out of ETFs where momentum has slowed into ETFs showing strong momentum or offer better value. These are rules based strategies which combine elements of investing and trading to lower volatility and improve returns.

Does sector rotation strategy work?

Some investors believe that sector rotation strategy can be a profitable approach to investing. A sector rotation strategy may work in a given year when the economy behaves more or less predictably. However, it is difficult if not impossible to produce consistent longer-term returns with this strategy.

Is sector investing a good investment?

Sector investing can help you capture thematic trends without shouldering much stock-specific risk. And, given their wide range of correlations to the broad equity market, sectors also can potentially improve diversification for a core US equity exposure.

What is market timing strategy?

Timing the market is a strategy that involves buying and selling stocks based on expected price changes. Prevailing wisdom says that timing the market doesn't work; most of the time, it is very challenging for investors to earn big profits by correctly timing buy and sell orders just before prices go up and down.

What is the meaning of rotation in the stock market?

Rotation in the stock market refers to switching from one set of stocks to the other. The thinking in the stock market is that usually a particular set of stocks move together. Therefore, when an external catalyst emerges—positive or negative—investors switch to the sector that is expected to positively benefit from it and vice versa.

Why is the stock market rotating?

Why there is rotation in the stock market. The rotation in the stock market can happen due to many reasons. An external catalyst might emerge that could lead to the rotation. For example, in 2020, due to the emergence of the coronavirus pandemic, investors rotated from travel, tourism, and other "out and about" stocks to ...

How long does a stock rotation last?

The rotation is visible when a previously struggling sector starts outperforming. Rotations can last for weeks, months, or even years. Source: Pixabay.

Why do investors seek new investing phases?

Why investors seek new investing phases. With new investing phases come new opportunities. As a new investing phase emerges, investors can dump the heavily-favored sectors for out of favor sectors. This is also important for them as they get the opportunity to buy stocks at relatively cheaper levels if they can identify the trend in time. ...

What is sector rotation?

Sector rotation is the movement of money invested in stocks from one industry to another as investors and traders anticipate the next stage of the economic cycle. The economy moves in reasonably predictable cycles. Various industries and the companies that dominate them thrive or languish depending on the cycle.

How many stages are there in the stock market?

The Market Cycle in Four Stages. The stock markets don't move with the economic cycle. They move in anticipation of the economic cycle, or at least they try to. The market cycle can be divided into four stages: Market bottom: A long-term low point is reached. Bull market: The market rallies from the market bottom.

Is the market cycle ahead of the economic cycle?

That means the market cycle is usually well ahead of the economic cycle. We know the start, middle, and end of every economic cycle since the mid-1800s. Predicting the next one is harder. 1.