How much is an EEM stock worth?

One share of EEM stock can currently be purchased for approximately $49.00. How much money does iShares MSCI Emerging Markets ETF make? iShares MSCI Emerging Markets ETF has a market capitalization of $29.02 billion.

What does Eem stand for?

EEM | A complete iShares MSCI Emerging Markets ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. EEM | A complete iShares MSCI Emerging Markets ETF exchange traded fund overview by MarketWatch.

Why should you invest in EEM fund?

EEM tracks an index of emerging-market firms weighted by market cap. EEM one of the early entrants to provide exposure to large- and midcap emerging market equities. The fund matches the market well.

Who owns iShares MSCI Emerging Markets ETF's (Eem) stock?

iShares MSCI Emerging Markets ETF trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "EEM." Who are iShares MSCI Emerging Markets ETF's major shareholders? iShares MSCI Emerging Markets ETF's stock is owned by a variety of institutional and retail investors.

What is an EEM ETF?

INVESTMENT OBJECTIVE The iShares MSCI Emerging Markets ETF seeks to track the investment results of an index composed of large- and mid-capitalization emerging market equities.

What stocks make up the EEM?

EEM Top 10 Holdings[View All]Taiwan Semiconductor Manufacturing Co., Ltd. 6.61%Samsung Electronics Co., Ltd. 3.84%Tencent Holdings Ltd. 3.78%Alibaba Group Holding Ltd. 2.49%Reliance Industries Limited 1.45%Meituan Class B 1.33%Vale S.A. 1.03%China Construction Bank Corporation Class H 1.03%More items...

What companies are in EEM ETF?

Top 10 HoldingsCompanySymbolTotal Net AssetsTaiwan Semiconductor Manufacturing Co. Ltd.TSMWF6.48%Tencent Holdings Ltd.TCTZF4.00%Samsung Electronics Co. Ltd.SSNLF3.69%Alibaba Group Holding Ltd.BABAF2.85%6 more rows

Is EEM a buy?

Emerging markets fit in with the super cycle and the weaker US dollar and cyclicality. EEM was breaking out two weeks ago and is worth buying now.

How many holdings are in EEM?

Top 10 Holdings (24.93% of Total Assets)NameSymbol% AssetsTencent Holdings Ltd007004.33%Alibaba Group Holding Ltd Ordinary Shares099883.93%Samsung Electronics Co Ltd005930.KS3.83%Meituan036901.57%6 more rows

What is the difference between EEM and IEMG?

Both EEM and IEMG are ETFs. EEM has a lower 5-year return than IEMG (2.04% vs 3.3%). EEM has a higher expense ratio than IEMG (0.68% vs 0.09%). Below is the comparison between EEM and IEMG.

What region is EEM?

EemEem AmerCountryNetherlandsRegionUtrechtPhysical characteristicsSourceValleikanaal, Heiligenbergerbeek12 more rows

Is iShares owned by BlackRock?

iShares is a collection of exchange-traded funds (ETFs) managed by BlackRock, which acquired the brand and business from Barclays in 2009. The first iShares ETFs were known as World Equity Benchmark Shares (WEBS) but have since been rebranded.

What is the best emerging market fund?

10 Best Emerging Markets ETFsVanguard FTSE Emerging Markets ETF (VWO) ... iShares MSCI Emerging Markets ETF (EEM) ... iShares Core MSCI Emerging Markets ETF (IEMG) ... Schwab Emerging Markets Equity ETF (SCHE) ... SPDR Portfolio Emerging Markets ETF (SPEM) ... Invesco RAFI Strategic Emerging Markets ETF (ISEM)More items...

What is MSCI iShares?

The iShares MSCI USA Quality Factor ETF seeks to track the investment results of an index composed of U.S. large- and mid-capitalization stocks with quality characteristics as identified through certain fundamental metrics.

Is iShares MSCI Emerging Markets ETF a good dividend stock?

iShares MSCI Emerging Markets ETF pays an annual dividend of $0.97 per share and currently has a dividend yield of 2.32%. View iShares MSCI Emergi...

Who are iShares MSCI Emerging Markets ETF's key executives?

iShares MSCI Emerging Markets ETF's management team includes the following people: Robert H. Silver , Independent Chairman of the Board (Age 58)...

Who are some of iShares MSCI Emerging Markets ETF's key competitors?

Some companies that are related to iShares MSCI Emerging Markets ETF include iShares Core U.S. Aggregate Bond ETF (AGG) , iShares Russell 2000 ET...

What other stocks do shareholders of iShares MSCI Emerging Markets ETF own?

Based on aggregate information from My MarketBeat watchlists, some companies that other iShares MSCI Emerging Markets ETF investors own include Al...

What is iShares MSCI Emerging Markets ETF's stock symbol?

iShares MSCI Emerging Markets ETF trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "EEM."

Who are iShares MSCI Emerging Markets ETF's major shareholders?

iShares MSCI Emerging Markets ETF's stock is owned by a number of institutional and retail investors. Top institutional shareholders include BlackR...

Which institutional investors are selling iShares MSCI Emerging Markets ETF stock?

EEM stock was sold by a variety of institutional investors in the last quarter, including Goldman Sachs Group Inc., Maverick Capital Ltd., Citigrou...

Which institutional investors are buying iShares MSCI Emerging Markets ETF stock?

EEM stock was purchased by a variety of institutional investors in the last quarter, including Bridgewater Associates LP, JPMorgan Chase & Co., Pru...

How do I buy shares of iShares MSCI Emerging Markets ETF?

Shares of EEM can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull...

Market 'getting repriced' on Russia conflict, Fed policy expectations: Strategist

Supply chain inflations would be 'more worrisome than a short-term conflict' in Ukraine: Schwab CEO

Emily Bowersock Hill, Bowersock Capital Partners Founding Partner, and Ryan Payne, Payne Capital Management President and podcast host, join Yahoo Finance to discuss how markets are responding to geopolitical risks, economies reopening, and Fed policy.

Signals & Forecast

Schwab Asset Management CEO and CIO Omar Aguilar joins Yahoo Finance Live to talk about the market outlook amid Russia-Ukraine tensions, volatility in energy markets, the Fed's interest rate hikes, and inflationary pressures in other regions.

Support, Risk & Stop-loss

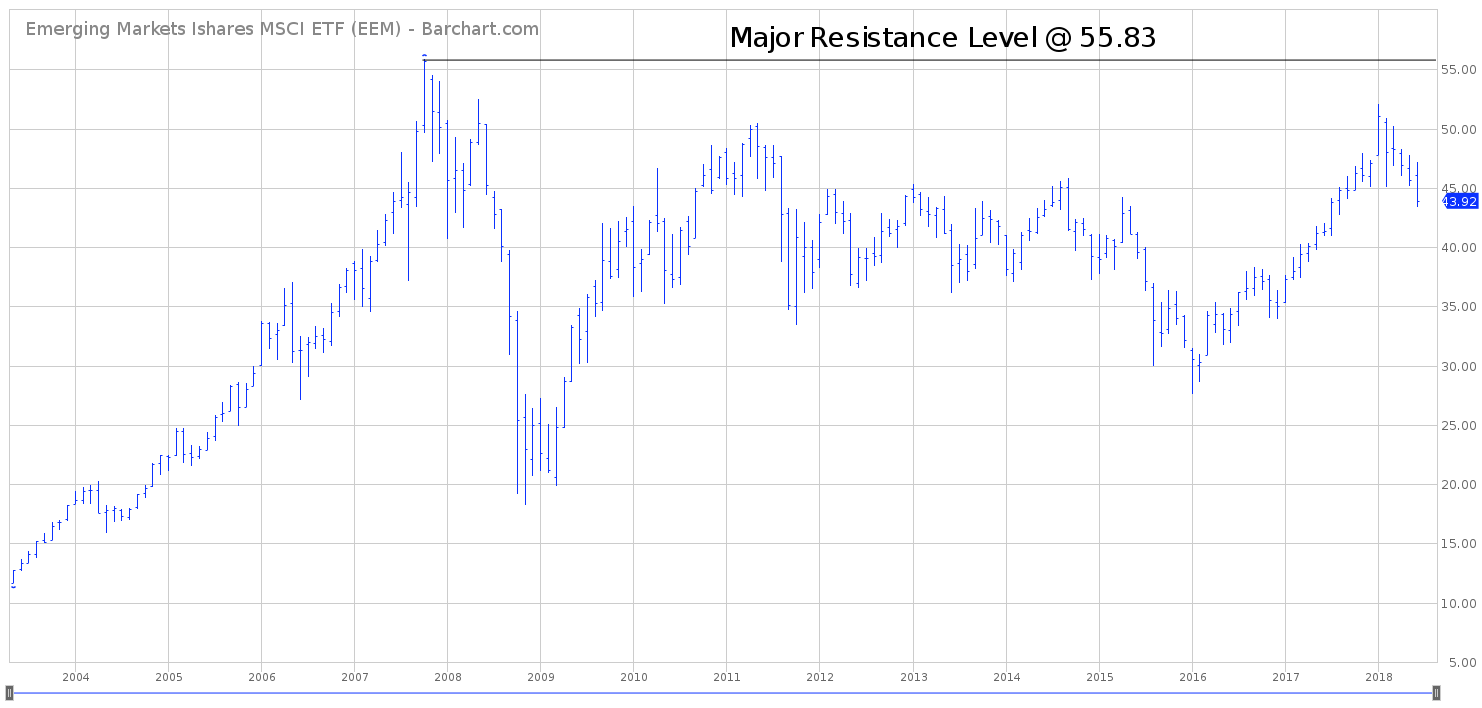

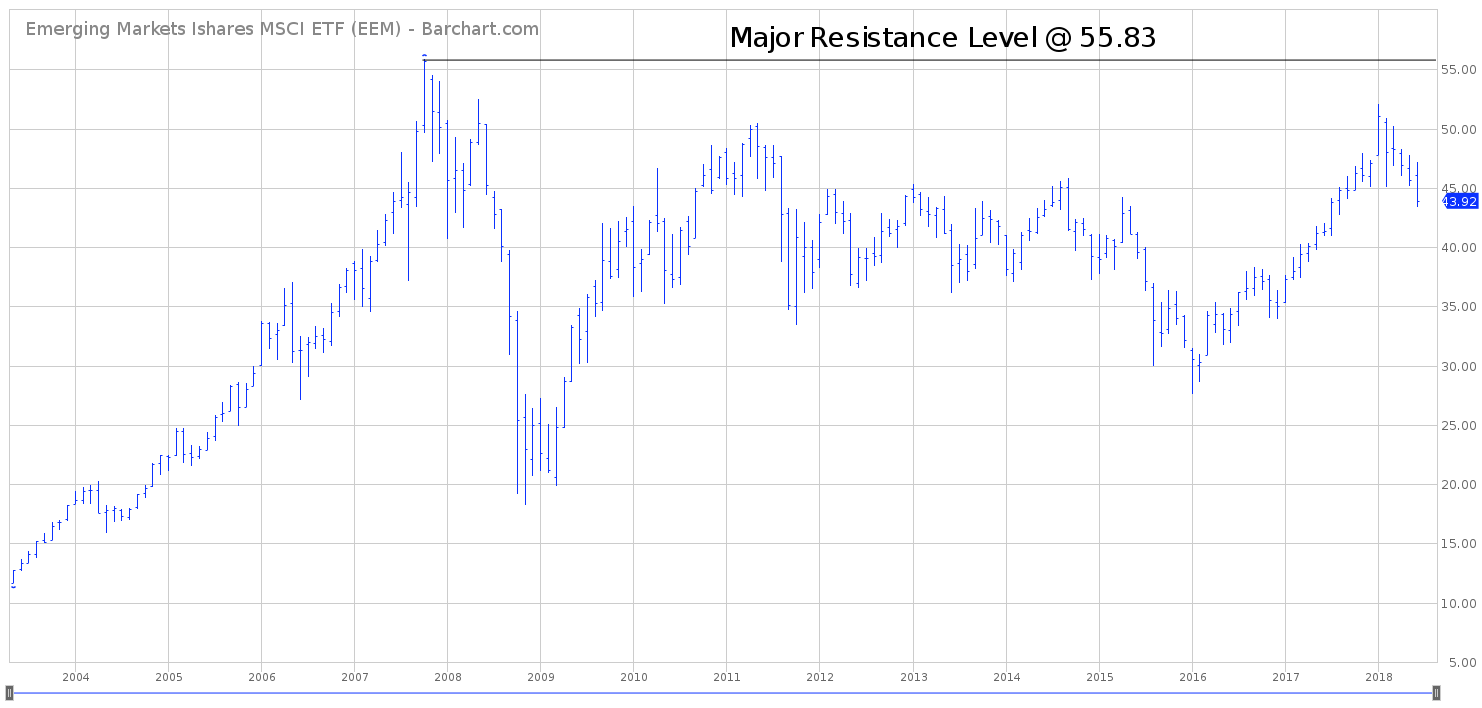

There are mixed signals in the ETF today. The ISHARES MSCI EMERGING MARKETS ETF holds sell signals from both short and long-term moving averages giving a more negative forecast for the stock. Also, there is a general sell signal from the relation between the two signals where the long-term average is above the short-term average.

Is ISHARES MSCI EMERGING MARKETS ETF ETF A Buy?

ISHARES MSCI EMERGING MARKETS finds support from accumulated volume at $47.61 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

About ISHARES MSCI EMERGING MARKETS ETF

ISHARES MSCI EMERGING MARKETS holds several negative signals and we believe that it will still perform weakly in the next couple of days or weeks. We, therefore, hold a negative evaluation of this ETF.

Golden Star Signal

The investment seeks to track the investment results of the MSCI Emerging Markets Index. The fund generally invests at least 80% of its assets in the securities of its underlying index and in depositary receipts representing securities in its underlying index.

Top Fintech Company

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

What Is an Emerging Market ETF?

featured in The Global Fintech Index 2020 as the top Fintech company of the country.

Understanding an Emerging Market ETF

An emerging market ETF is an exchange-traded fund (ETF) that focuses on the stocks of emerging market economies, such as Latin America, Asia, and Eastern Europe.

Advantages and Disadvantages of an Emerging Market ETF

Emerging market ETFs are composed of emerging market stocks, which can offer compelling growth opportunities over time for investors. Many investors with longer time horizons simply cannot afford to miss out on the higher returns offered by some emerging market economies.

Investing in an Emerging Market ETF

Many investors value the diversification benefits of emerging market ETFs in addition to their ability to generate a return. Because they invest in equities in emerging markets, emerging market ETFs tend to be less correlated to U.S. equities than other ETFs that primarily feature equities in their lineups.