What does DNR stand for?

Jan 21, 2022 · A do not reduce (DNR) order is a type of order with a specified price that does not get adjusted when the underlying security pays a cash dividend. Since a cash dividend reduces the assets of the...

What does DNR mean on a GTC order?

Do Not Reduce Order (DNR Order) Limit order to buy or to sell, or a stop limit order to sell that is not to be reduced by the amount of an ordinary cash dividend on the ex-dividend date. A "do not...

What is a do-not-reduce (DNR) order?

Sep 04, 2020 · DNR Stock Risk In general the stock tends to have very controlled movements and therefore the general risk is considered very low. However, be aware of low or falling volume and make sure to keep an eye on the stock During the last day, the stock moved $0 between high and low, or 0%. For the last week the stock has had a daily average volatility of 0%

How do I place a DNR order with my broker?

What does DNR mean on TD Ameritrade?

do not reduceA do not reduce (DNR) order is a type of order with a specified price that does not get adjusted when the underlying security pays a cash dividend.

What is Aon and DNR?

All or None/Do Not Reduce (AON/DNR) A condition that can be placed on a sell request requiring that the sell request can only be used as a Good 'til Cancel limit sell request.

What is stock validity day end?

A EoD validity order or 'Day' order is an order placed to Buy or Sell that automatically expires or is automatically cancelled if the order is not executed on the day it was placed. It is one of several different duration order types that determines how long the order is in the system before it gets canceled.Nov 29, 2016

Are limit orders guaranteed?

A limit order is not guaranteed to execute. A limit order can only be filled if the stock's market price reaches the limit price. While limit orders do not guarantee execution, they help ensure that an investor does not pay more than a pre-determined price for a stock.Mar 10, 2011

What does Fok mean on TD Ameritrade?

Fill or killFill or kill (FOK) is a conditional type of time-in-force order used in securities trading that instructs a brokerage to execute a transaction immediately and completely or not at all.

What is IOC in demat account?

An immediate or cancel order (IOC) is an order to buy or sell a security that attempts to execute all or part immediately and then cancels any unfilled portion of the order.

Why do stock orders expire?

Limit order after or before market hours: Some brokers will also allow a limit order for buying or selling before or after market hours. The order will expire if unexecuted in the next trading session after the order is placed.

What is sell stop limit?

A stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Once the stop price is reached, a stop-limit order becomes a limit order that will be executed at a specified price (or better).Jul 13, 2017

What is Col validity?

Cancel On Logout at User level (COL) A tool which cancels all outstanding orders in case of a logout from the trading system whether voluntary or involuntary based on the member's preference.Feb 6, 2017

What is the best order type when buying stock?

Market orders are optimal when the primary goal is to execute the trade immediately. A market order is generally appropriate when you think a stock is priced right, when you are sure you want a fill on your order, or when you want an immediate execution.Mar 5, 2021

Is it better to buy limit or market?

Limit orders set the maximum or minimum price at which you are willing to complete the transaction, whether it be a buy or sell. Market orders offer a greater likelihood that an order will go through, but there are no guarantees, as orders are subject to availability.

Do limit orders affect stock price?

If the investor wants to use a limit order, he or she will set a cap on the highest price they are willing to pay for a share and indicate when the limit order will expire. In order for limit orders to execute, the market price must fall to the limit order price.Nov 30, 2007

Signals & Forecast

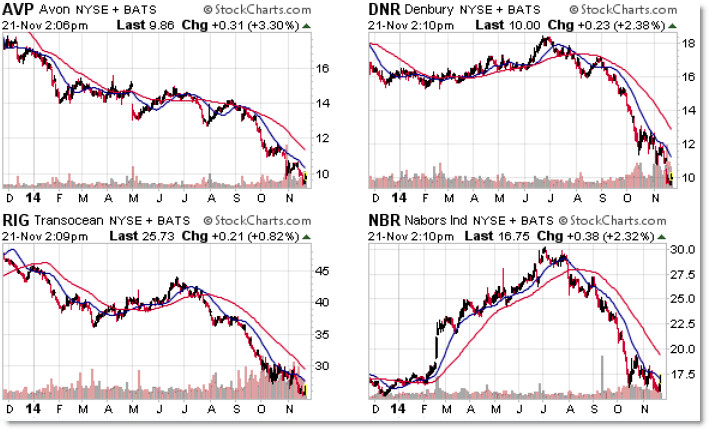

There are few to no technical positive signals at the moment. The Denbury Resources Inc stock holds sell signals from both short and long-term moving averages giving a more negative forecast for the stock. Also, there is a general sell signal from the relation between the two signals where the long-term average is above the short-term average.

Support, Risk & Stop-loss

Denbury Resources Inc finds support from accumulated volume at $0.24 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Is Denbury Resources Inc stock A Buy?

Denbury Resources Inc holds several negative signals and this should be a sell candidate, but due to the general chance for a turnaround situation it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development.

What stocks does MarketBeat like better than Denbury Resources?

Wall Street analysts have given Denbury Resources a "N/A" rating, but there may be better buying opportunities in the stock market. Some of MarketBeat's past winning trading ideas have resulted in 5-15% weekly gains. MarketBeat just released five new stock ideas, but Denbury Resources wasn't one of them.

How were Denbury Resources' earnings last quarter?

Denbury Resources Inc. (NYSE:DNR) posted its earnings results on Monday, May, 18th. The oil and natural gas company reported $0.06 earnings per share for the quarter, beating the Thomson Reuters' consensus estimate of $0.02 by $0.04.

Who are some of Denbury Resources' key competitors?

Some companies that are related to Denbury Resources include ConocoPhillips (COP), EOG Resources (EOG), Pioneer Natural Resources (PXD), Devon Energy (DVN), Continental Resources (CLR), Diamondback Energy (FANG), Marathon Oil (MRO), Cimarex Energy (XEC), Cabot Oil & Gas (COG), EQT (EQT), PDC Energy (PDCE), Range Resources (RRC), Matador Resources (MTDR), Southwestern Energy (SWN) and SM Energy (SM).#N#View all of DNR's competitors..

What other stocks do shareholders of Denbury Resources own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Denbury Resources investors own include Rex Energy (REXX), Chesapeake Energy (CHKAQ), (OAS), Callon Petroleum (CPE), Crocs (CROX), General Electric (GE), Whiting Petroleum (WLL), Plug Power (PLUG), Advanced Micro Devices (AMD) and Abraxas Petroleum (AXAS).

What is Denbury Resources' stock symbol?

Denbury Resources trades on the New York Stock Exchange (NYSE) under the ticker symbol "DNR."

What is Denbury Resources' stock price today?

One share of DNR stock can currently be purchased for approximately $0.24.

How much money does Denbury Resources make?

Denbury Resources has a market capitalization of $122.06 million and generates $1.27 billion in revenue each year. The oil and natural gas company earns $216.96 million in net income (profit) each year or $0.40 on an earnings per share basis.