Should you buy GOOGL stock?

Alphabet (NASDAQ:GOOG.L) has had a rough month with its share price down 11%. But if you pay close attention, you might gather that its strong financials could mean that the stock could ...

Which one to buy GOOG or GOOGL?

- Alphabet stock at a glance.

- Pros of buying.

- Cons of buying.

- The bottom line: Should you buy Alphabet stock?

Why does Google have two stocks?

The short answer is a stock split, but a longer answer is an attempt by the company’s top shareholders —Google co-founders Sergey Brin and Larry Page, along with company chair Eric Schmidt—to...

Is it good to invest in Google stocks?

More from Marketwatch

- Amazon workers at Alabama warehouse get second chance for union vote

- 10-year Treasury yield bounces after Friday’s omicron-sparked slide

- Dow rises over 230 points, Nasdaq rallies nearly 2% Monday, as stock market recovers a portion of Friday's omicron-led selloff

See more

Why is GOOG stock higher than GOOGL?

Why Is GOOG More Than GOOGL? Because A-shares have more voting rights, and these rights have some value, they often trade at a slight premium. In reality, GOOG and GOOGL often trade for just around the same price.

Is GOOG and GOOGL the same stock?

The short answer is a stock split, but a longer answer is an attempt by the company's top shareholders—Google co-founders Sergey Brin and Larry Page, along with company chair Eric Schmidt—to retain as much control of the company as possible. 2 The two tickers represent two different share classes.

What is the difference between Google stock Class A and C?

What Is The Difference Between Class A or C Shares? In short, the two different tickers are associated with two different types of shares. GOOG is the ticker for Alphabet's C shares, whereas GOOGL is the ticker for Alphabet's A shares.

Which stock is splitting GOOG or GOOGL?

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) recently announced a 20:1 stock split that will take place in July 2022. Shareholders of record will receive 19 additional shares for each share held after market close on Friday, July 15th. Alphabet stock will begin trading split-adjusted on Monday, July 18th.

Does it matter if I buy GOOG or GOOGL?

The A class shares have the symbol GOOGL and come with one vote, while the C class shares have the symbol GOOG and come with no voting rights at all. The shares have the same economic interest in Google's business, so other than voting rights there is really no reason to prefer one or the other.

Which one is better to buy GOOG or GOOGL?

There's not much of a difference between owning shares of GOOG or GOOGL at this point. Both shares represent an equal ownership stake in Alphabet. GOOGL shareholders get voting rights and GOOG shareholders don't, but Page and Brin control the company and can outvote even a 100% consensus of Class A public shareholders.

Is Class A or Class C shares better?

Class C shares would work best if you are planning to invest for a limited period of more than one year but less than three. This way, you avoid both front-end and back-end loads. Although your expense ratio will typically be higher than Class A shares, your full investment will gain interest while it is invested.

How much will Google stock be worth in 5 years?

Google Stock Forecast 2024-2028 These five years would bring an increase: Google price would move from $2,957 to $5,457, which is up 85%. Google will start 2024 at $2,957, then soar to $2,984 within the first six months of the year and finish 2024 at $3,321.

Will Google ever pay a dividend?

Google is still very much a growth company. And thanks to its huge size, it now has the financial strength to possibly pay a dividend to shareholders at some point in the future.

What stocks will split in 2022?

Splits for July 2022Company (Click for Company Information)SymbolEx-DateAlphabet Inc Company WebsiteGOOGL7/18/2022CTO Realty Growth Inc Company WebsiteCTO7/1/2022IT Tech Packaging Inc Company WebsiteITP7/8/2022Salisbury Bancorp Inc Company WebsiteSAL7/1/2022

Is Google doing a stock split in 2022?

When is the Google stock split? The Alphabet stock split will be issued on July 15 2022. Shareholders of Alphabet Inc voted to approve the stock split at the company's annual general meeting on June 1. On the 15 July, each shareholder will then own 20 shares for each single share they held before that date.

Is it better to buy a stock before or after it splits?

Based on the numbers, stock splits are not a reason to buy. Stocks that split underperformed in the short term, and do not significantly beat the market in the longer term. In the two weeks immediately following a split, the stocks averaged a loss of 0.43% with only 43% of the returns beating the SPX.

When did Google split its stock?

When did Google go public?

In 2014, Google completed a somewhat unconventional stock split. The move included a 2-for-1 split of the public Class A stock and the creation of a new Class C stock that included no voting rights. The new stock class was created in large part because Page and Brin were concerned that the company’s stock issuance associated with acquisitions and executive compensation would eventually erode their control of the majority of Google’s voting rights.

How much of a stock does an insider own?

Google first went public under the ticker GOOG in 2004. At the time, the company created two classes of stock. Google offered Class A stock to the public. Google co-founders Larry Page and Sergey Brin, along with other Google executive managers and directors, owned Class B stock. Class B stock held 10 times the voting rights of Class A shares, allowing company insiders to maintain control.

Which share class is better for investors to buy?

If you have one common stock share class in which each share represents one vote, maintaining control of the company means owning more than 50% of all shares. However, Alphabet and other companies set up multiple share classes that each come with unique voting rights. Company insiders typically own shares of stock that have more voting rights than shares sold to public investors as a way to maintain control of the company.

What happens to stock when it is an IPO?

When it comes to which share class is better for investors to buy, the answer is: It really doesn’t matter. Investors who want voting rights should opt for GOOGL shares, but they should understand their voting rights are limited given that Page and Brin essentially have full veto power.

When did Google change its name to Alphabet?

Shares of stock typically come with voting rights that allow shareholders to have the last word on any major decisions the company makes. For example, shareholders typically vote to elect board members, to approve policy changes, to issue new securities or to approve merger deals.

Should both classes of stocks continue to trade in tandem?

Google restructured its business and changed its name to Alphabet in 2015, but the reorganization did not impact the three share classes.

How Much Is Google Worth?

Both classes represent equal ownership stakes and should continue to trade in tandem over the long term. (Sean Gallup via Getty Images)

Why is Google giving C shares?

As of November 2021, Alphabet’s market capitalization was around $2 trillion, making it one of the world’s most valuable companies.

When did Google start its corporate structure?

Google plans to continue issuing C shares to finance acquisitions and reward employees, so it's far from clear whether the market will price the C shares at larger discounts in coming years or simply bake in the current difference at a few percentage points.

Is there a difference between A and C shares?

In 2015, Google created a corporate structure under a new holding company and moniker called Alphabet. 3

Does Investopedia include all offers?

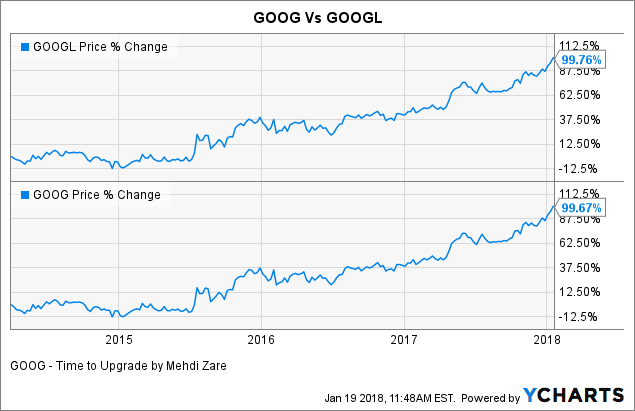

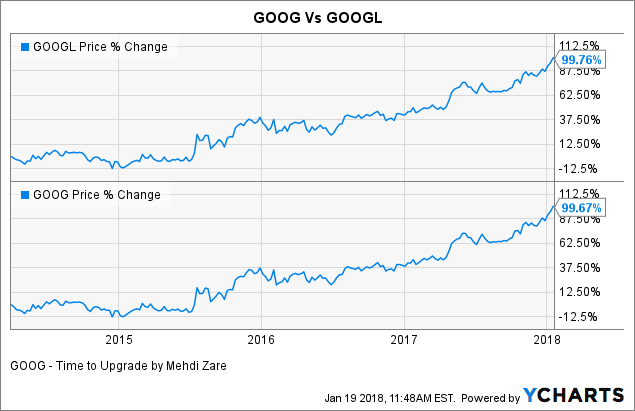

Note that the A shares consistently trade at a premium to the C shares. The difference is not large—perhaps 2% at most—but it is there. Google plans to continue issuing C shares to finance acquisitions and reward employees, so it's far from clear whether the market will price the C shares at larger discounts in coming years or simply bake in the current difference at a few percentage points.

Does Google allow investors to buy its stock?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Why are GOOG shares more expensive than GOOG?

The upshot is that Google allows investors to buy a very large share of its equity. Control of the company, though, not so much. Some investors are willing to accept that because Google, like Apple Inc. ( AAPL) and Facebook Inc. ( FB ), is very much a bet on its founders and executives. Other companies may be like that as well, but, in Silicon Valley, it's particularly salient because so many firms are based on one person's big idea.

What is the parent company of Google?

Because GOOGL (class A) stock owners have voting rights, the shares tend to cost slightly more than GOOG (class C).

What about class B stock?

Google parent company Alphabet, Inc has two types of stock that you can buy:

How much has Google gained in the last 5 years?

The third type of stock is class B shares, of which there are 46.5 million outstanding.

What does it mean when you own a few shares?

As you can see from the chart, GOOG has gained 152.29% in the last five years, while GOOGL has gained 150.06%.

Does it matter which stock you buy?

However, as a retail investor, the relatively few shares you own means that your vote won’t make much of a difference. This is particularly relevant given that the company’s founders and directors own all the class B shares with over 60% of the voting power.

When did Google split its stock?

So if all you care about is stock price gain or a (possible) future dividend, then it doesn't matter which one you buy.

When did Google go public?

In 2014, Google completed a somewhat unconventional stock split. The move included a 2-for-1 split of the public Class A stock and the creation of a new Class C stock that included no voting rights. The new stock class was created in large part because Page and Brin were concerned that the company's stock issuance associated with acquisitions and executive compensation would eventually erode their control of the majority of Google's voting rights.

How much of a stock does an insider own?

Google first went public under the ticker GOOG in 2004. At the time, the company created two classes of stock. Google offered Class A stock to the public. Google co-founders Larry Page and Sergey Brin, along with other Google executive managers and directors, owned Class B stock. Class B stock held 10 times the voting rights of Class A shares, allowing company insiders to maintain control.

Which share class is better for investors to buy?

If you have one common stock share class in which each share represents one vote, maintaining control of the company means owning more than 50% of all shares. However, Alphabet and other companies set up multiple share classes that each come with unique voting rights. Company insiders typically own shares of stock that have more voting rights than shares sold to public investors as a way to maintain control of the company.

What happens to stock when it is an IPO?

When it comes to which share class is better for investors to buy, the answer is: It really doesn't matter. Investors who want voting rights should opt for GOOGL shares, but they should understand their voting rights are limited given that Page and Brin essentially have full veto power.

When did Google change its name to Alphabet?

Shares of stock typically come with voting rights that allow shareholders to have the last word on any major decisions the company makes. For example, shareholders typically vote to elect board members, to approve policy changes, to issue new securities or to approve merger deals.

Do public companies have one class of stock?

Google restructured its business and changed its name to Alphabet in 2015, but the reorganization did not impact the three share classes.

When did Google split its stock?

Most public companies only have one class of common stock , but there are plenty of examples of companies with multiple share classes. There are a couple of reasons a company might choose a seemingly more complicated share structure involving multiple classes, but the most common reason involves insiders maintaining control of the company.

When did Google go public?

In 2014, Google completed a somewhat unconventional stock split. The move included a 2-for-1 split of the public Class A stock and the creation of a new Class C stock that included no voting rights. The new stock class was created in large part because Page and Brin were concerned that the company’s stock issuance associated with acquisitions and executive compensation would eventually erode their control of the majority of Google’s voting rights.

How much of a stock does an insider own?

Google first went public under the ticker GOOG in 2004. At the time, the company created two classes of stock. Google offered Class A stock to the public. Google co-founders Larry Page and Sergey Brin, along with other Google executive managers and directors, owned Class B stock. Class B stock held 10 times the voting rights of Class A shares, allowing company insiders to maintain control.

Which share class is better for investors to buy?

If you have one common stock share class in which each share represents one vote, maintaining control of the company means owning more than 50% of all shares. However, Alphabet and other companies set up multiple share classes that each come with unique voting rights. Company insiders typically own shares of stock that have more voting rights than shares sold to public investors as a way to maintain control of the company.

What happens to stock when it is an IPO?

When it comes to which share class is better for investors to buy, the answer is: It really doesn’t matter. Investors who want voting rights should opt for GOOGL shares, but they should understand their voting rights are limited given that Page and Brin essentially have full veto power.

When did Google change its name to Alphabet?

Shares of stock typically come with voting rights that allow shareholders to have the last word on any major decisions the company makes. For example, shareholders typically vote to elect board members, to approve policy changes, to issue new securities or to approve merger deals.

Do public companies have one class of stock?

Google restructured its business and changed its name to Alphabet in 2015, but the reorganization did not impact the three share classes.

How many votes does it take to own a GOOGL stock?

Most public companies only have one class of common stock , but there are plenty of examples of companies with multiple share classes. There are a couple of reasons a company might choose a seemingly more complicated share structure involving multiple classes, but the most common reason involves insiders maintaining control of the company.

Why Did Google Stock Split?

Owning a share of GOOGL equates to one vote. However, owning one share of class B stock equates to 10 votes.

When did Google split?

Originally, Google stock existed purely as GOOGL, which refers to class A shares. These shares have traded on Wall Street since the company’s 2004 IPO. Class B stock also existed since then as well, but this is private stock with much greater voting power.

What was the class B stock before the stock split?

The stock split was announced initially as far back as 2012, and it took effect in 2014. Since then, investors have been scratching their heads at whether GOOG or GOOGL is the right stock for their portfolio. At the time, the split was not particularly well received, with investors worrying about the company hoarding voting power from shareholders.

When did Google rebrand to Alphabet?

Prior to the stock split, there was one class of shares for outside investors, GOOGL. The other class of shares, class B shares, were (and still are) privately held shares for insiders, founders and other especially relevant figures.

Is Google stock split a thin line?

Beyond this barrier to entry, the restructuring of Google into the broader Alphabet makes a case for a new stock split. In 2015, the company reconsolidated as Alphabet. As Larry Page described the company at the time of the rebrand, it is an ecosystem of many different companies, rather than one entity:

Does Google have voting rights?

Most stock splits take a simpler route and see new shares issued. However, Google was able to tread a thin line between lowering share prices and keeping voting power centralized with its split. Page and Brin were able to retain control over the company, and the split — while controversial — proved effective at cutting prices down. Here’s what you need to know:

Why is Goog stock trading at a premium?

GOOG shares don’t come with any voting rights; these are class C shares.

How many Google shares are there in 2019?

Usually, GOOGL's stock price is trading at a premium to GOOG stock because GOOGL shareholders have voting rights. However, the price difference is often less than 1 percent of the stock price. GOOG stock has gained 1,152 percent in the last five years, while GOOGL stock has gained 1,124 percent.

Does it matter which stock you buy?

According to Alphabet’s annual report for 2019, there were 299.9 million GOOGL and 341.0 million GOOG shares outstanding. GOOGL stockholders can take part in the decision-making process at Alphabet’s shareholder meetings like executive compensation packages or new product releases, while GOOG stockholders can’t participate.

Does Google pay dividends?

If you are only considering the stock price appreciation or a potential dividend payout, it doesn’t matter which stock you purchase. Both GOOGL and GOOG stocks will generate similar returns over a longer period of time. If you want to have voting rights at Alphabet’s shareholder meetings, then go with GOOGL stock.