Where can I buy Clov shares?

Clover Health (NASDAQ:CLOV) is a on a mission to improve every life. In the near future, America’s healthcare system may be in dire need of Clover’s technology-enabled solutions. That …

What does Clov stand for?

Apr 12, 2022 · CLOV | Complete Clover Health Investments Corp. Cl A stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

Is Clover health investments (Clov) stock shorted?

Apr 19, 2022 · Clover Health Investments' stock is owned by a number of retail and institutional investors. Top institutional shareholders include Cutler Group LP (0.00%). Company insiders that own Clover Health Investments stock include Chamath …

Will Clov stock turn green again late February?

Apr 12, 2022 · Real-time trade and investing ideas on Clover Health CLOV from the largest community of traders and investors.

What type of stock is Clov?

Class A Common StockClass A Common Stock (CLOV)

What is prediction for Clov stock?

Stock Price Forecast The 6 analysts offering 12-month price forecasts for Clover Health Investments Corp have a median target of 3.25, with a high estimate of 7.00 and a low estimate of 2.50. The median estimate represents a +5.69% increase from the last price of 3.08.

What does Clov company do?

operates as a medicare advantage insurer in the United States. The company through its Clover Assistant, a software platform that provides preferred provider organization and health maintenance organization health plans for medicare-eligible consumers. It also focuses on non-insurance businesses.

Who owns Clov stock?

Top 10 Owners of Clover Health Investments CorpStockholderStakeShares ownedThe Vanguard Group, Inc.6.75%25,566,805Baillie Gifford & Co.2.06%7,787,680Two Sigma Investments LP1.75%6,609,628PNC Bank, NA (Investment Manageme...1.68%6,361,9176 more rows

Should I hold Clov stock?

The consensus among Wall Street research analysts is that investors should "hold" Clover Health Investments stock. A hold rating indicates that analysts believe investors should maintain any existing positions they have in CLOV, but not buy additional shares or sell existing shares.

What is Nio price target?

NIO Inc (NYSE:NIO) The 28 analysts offering 12-month price forecasts for NIO Inc have a median target of 33.22, with a high estimate of 86.02 and a low estimate of 23.93. The median estimate represents a +93.83% increase from the last price of 17.14.

How does Clover Health make money?

How Does Clover Health Make Money? While Clover could dabble in commercial insurance in the future, the company's revenue is almost entirely derived from government-sponsored payments. Clover also makes commissions from reinsurance agreements (less than 1% of revenue in FY20).Jul 16, 2021

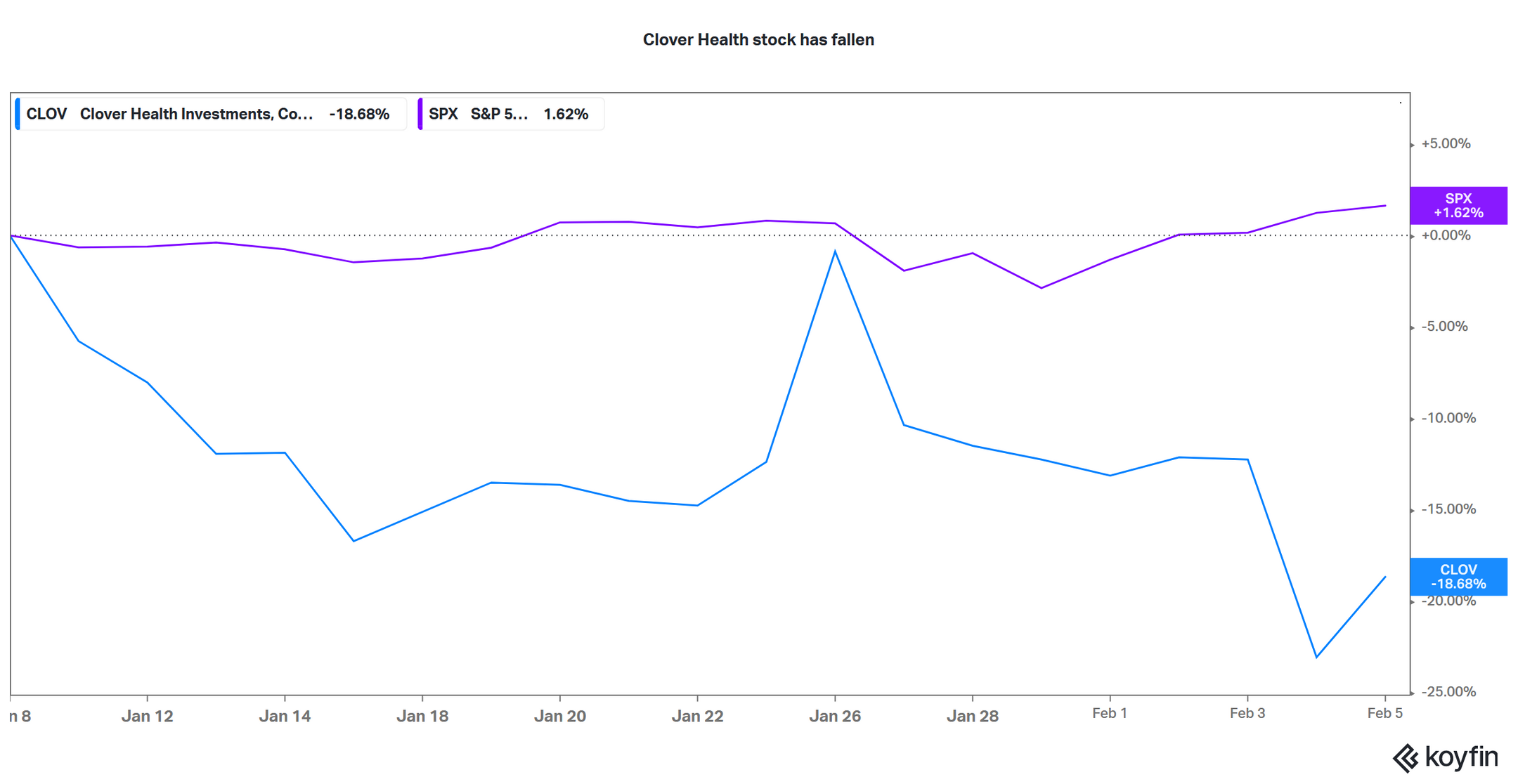

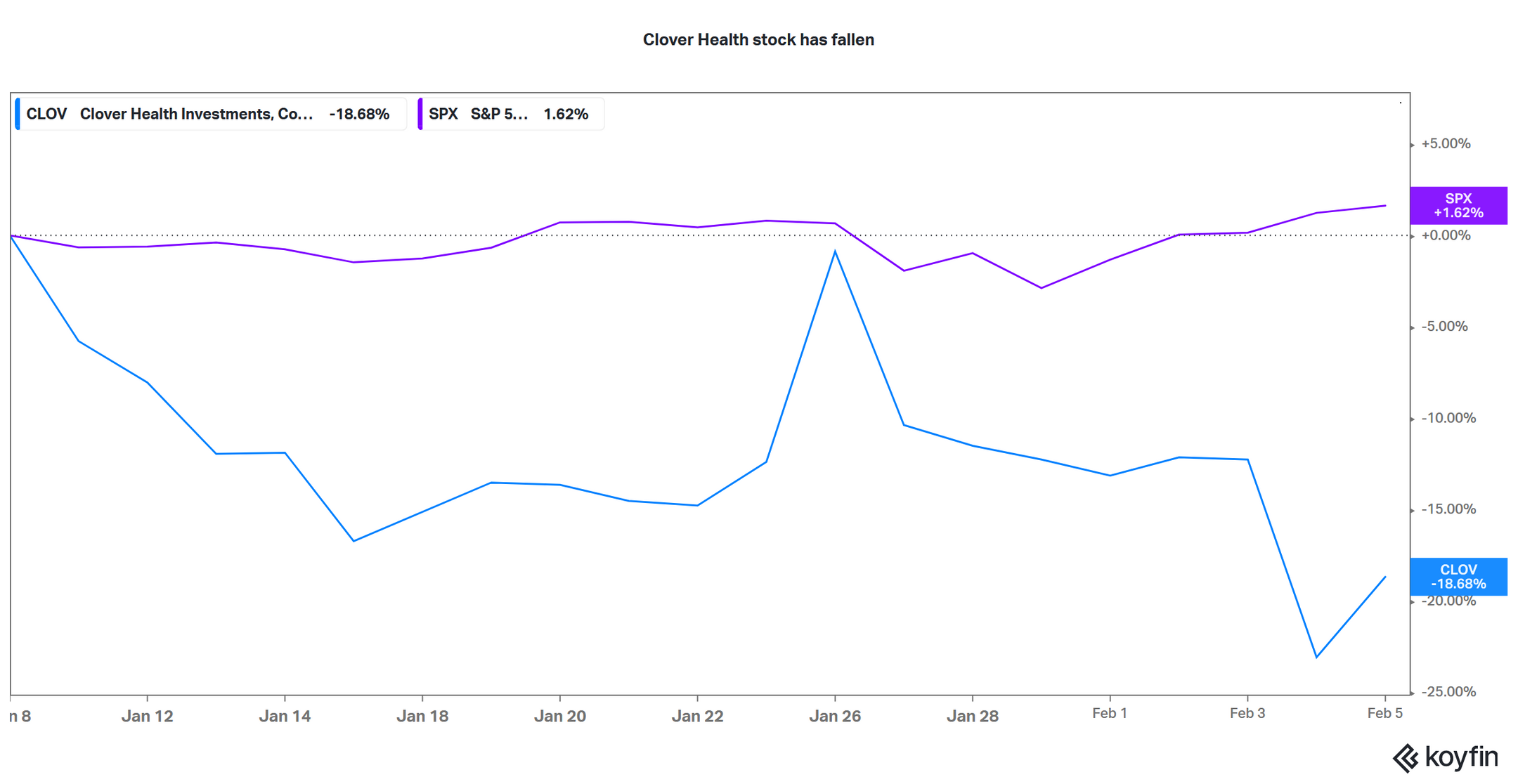

Why is Clover Health stock down?

Key Points. Clover Health is trying to disrupt the Medicare insurance market. The company went public through a SPAC in 2020 but is struggling to manage its costs. The stock is down over 50% since its SPAC merger.Dec 3, 2021

What makes Clover Health different?

At Clover, we see healthcare differently. With $0 premiums, $0 copays for primary care providers (PCPs) and preferred generic drugs, the same low copays in- and out-of-network, home visits with a personal clinical care team, and additional benefits, you get more with Clover than any other insurance plan.

How many shares of Clov exist?

CLOV has 473.27 million shares outstanding. The number of shares has increased by 372.84% in one year.

Does Vanguard own Clov?

Vanguard Group Inc ownership in CLOV / Clover Health Investments Corp Class A. 2022-02-09 - Vanguard Group Inc has filed an SC 13G/A form with the Securities and Exchange Commission (SEC) disclosing ownership of 25,887,351 shares of Clover Health Investments Corp Class A (US:CLOV).

How many Clov shares does citadel own?

2022-02-14 - Citadel Advisors Llc has filed a 13F-HR form disclosing ownership of 3,589,146 shares of Clover Health Investments Corp Class A (US:CLOV) with total holdings valued at $13,352,000 USD as of 2021-12-31.

Is Clover Health Investments a buy right now?

8 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Clover Health Investments in the last twelve months. There are cu...

When is Clover Health Investments' next earnings date?

Clover Health Investments is scheduled to release its next quarterly earnings announcement on Monday, May 16th 2022. View our earnings forecast fo...

What guidance has Clover Health Investments issued on next quarter's earnings?

Clover Health Investments updated its FY 2022 earnings guidance on Wednesday, March, 16th. The company provided earnings per share guidance of for...

What price target have analysts set for CLOV?

8 equities research analysts have issued 1-year price objectives for Clover Health Investments' stock. Their forecasts range from $2.50 to $10.00....

Who are Clover Health Investments' key executives?

Clover Health Investments' management team includes the following people: Mr. Vivek Garipalli , Co-Founder, CEO & Chairman of Directors (Age 42)...

Who are some of Clover Health Investments' key competitors?

Some companies that are related to Clover Health Investments include UnitedHealth Group (UNH) , Anthem (ANTM) , Cigna (CI) , Humana (HUM) , Ce...

What is Clover Health Investments' stock symbol?

Clover Health Investments trades on the NASDAQ under the ticker symbol "CLOV."

Who are Clover Health Investments' major shareholders?

Clover Health Investments' stock is owned by a number of retail and institutional investors. Top institutional shareholders include Baillie Gifford...

Which institutional investors are selling Clover Health Investments stock?

CLOV stock was sold by a variety of institutional investors in the last quarter, including Susquehanna International Group LLP, IMC Chicago LLC, Ci...

About Clover Health Investments

Headlines

Clover Health Investments, Corp. operates as a Medicare Advantage insurer in the United States. The company through its software platform provides preferred provider organization and health maintenance organization health plans for Medicare-eligible consumers. Clover Health Investments, Corp.

Signals & Forecast

Thinking about buying stock in Arrival SA, Clover Health Investments, Arbutus Biopharma, Aterian, or Brinker International?

Support, Risk & Stop-loss

There are mixed signals in the stock today. The Clover Health Investments, Corp. stock holds a buy signal from the short-term moving average; at the same time, however, the long-term average holds a general sell signal.

Is Clover Health Investments, Corp. stock A Buy?

Clover Health Investments, Corp. finds support from accumulated volume at $2.45 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Insiders are positive buying more shares than they are selling in Clover Health Investments, Corp

Clover Health Investments, Corp. holds several positive signals, but we still don't find these to be enough for a buy candidate. At the current level, it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development.

Golden Star Signal

In the last 64 trades there were 231.32 million shares bought and 138.32 million shares sold. The last trade was done 27 days ago by Reynoso Jamie L. who bough 15.77 thousand shares. The large amount of stocks bought compared to stocks sold indicate that the insiders believe there is a potential good upside.

Top Fintech Company

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

Recent results

featured in The Global Fintech Index 2020 as the top Fintech company of the country.

Wall Street is not impressed

Clover reported first quarter earnings on May 17, and it looks like the company still has work to do. Although the stock’s rally to a peak of $22 per share happened after earnings, the results themselves have been mixed at best.

Other theses

The most recent Wall Street research reports have not been bullish. The latest analyses from Wall Street on CLOV were two downgrades from neutral to sell. Some of the skepticism appears to be related to the company’s financial performance.

Reasons to be bullish

Many apes believe that the company's shares price action has been influenced by dark pool activities, as they claim that institutional players and high-frequency traders (particularly those on the short side of the trades) benefit from the lack of transparency.

Twitter speaks

Fundamentally, the company’s innovative business model in the Medicare Advantage segment through data-driven and artificial intelligence-enabled software is a key reason to invest in Clover. Opportunities seem to exist for the stock to fly high in the long term.

What is Clover Health Investments' current short interest?

Shares of Clover Health finished the month of July almost 35% lower. In your opinion, what is stopping the stock from going to the moon? Follow @WStreetMemes on Twitter and vote on the poll below!

What is a good short interest ratio for Clover Health Investments?

Short interest is the volume of Clover Health Investments shares that have been sold short but have not yet been closed out or covered. As of January 31st, investors have sold 27,950,000 shares of CLOV short. Learn More on Clover Health Investments' current short interest.

Which institutional investors are shorting Clover Health Investments?

The short interest ratio, also known as the "days to cover ratio", is calculated by dividing the number of shares of a stock sold short divided by its average trading volume. A short interest ratio ranging between 1 and 4 generally indicates strong positive sentiment about a stock and a lack of short sellers.

Is Clover Health Investments' short interest increasing or decreasing?

As of the most recent reporting period, the following institutional investors, funds, and major shareholders have reported short positions of Clover Health Investments: Simplex Trading LLC, Walleye Trading LLC, Susquehanna International Group LLP, Citadel Advisors LLC, Bluefin Capital Management LLC, Skaana Management L.P., Parallax Volatility Advisers L.P., Wolverine Trading LLC, Bank of America Corp DE, IMC Chicago LLC, Concourse Financial Group Securities Inc., Simplex Trading LLC, National Bank of Canada FI, and Cutler Group LP.

Which stocks are the most shorted right now?

Clover Health Investments saw a increase in short interest in January. As of January 31st, there was short interest totaling 27,950,000 shares, an increase of 6.5% from the previous total of 26,250,000 shares. Changes in short volume can be used to identify positive and negative investor sentiment.

What does it mean to sell short Clover Health Investments stock?

As of the most recent reporting period, the following stocks had the largest short interest positions: Advanced Micro Devices, Inc. ($7.80 billion), S&P Global Inc. ($7.56 billion), Charter Communications, Inc. ($5.90 billion), Palo Alto Networks, Inc. ($3.22 billion), Lucid Group Inc ($2.77 billion), Rivian ($2.70 billion), Wayfair Inc.

How does a short squeeze work against Clover Health Investments?

Short selling CLOV is an investing strategy that aims to generate trading profit from Clover Health Investments as its price is falling. Clover Health Investments' stock is trading down $0.03 today.