What Does Buying Stock on Margin Mean?

- Definition. "Margin" is the money you contribute to buy shares on margin. ...

- Margin Account. Before you can try your hand at buying stocks on margin, you have to open a brokerage account that lets you borrow money from the broker.

- Trading Rules. ...

- Margin Calls. ...

How do I buy a stock on margin?

Apr 21, 2021 · Buying on margin means you are investing with borrowed money. Buying on margin amplifies both gains and losses. If your account falls below the maintenance margin, your broker can sell some or all...

What every trader should know about margin?

Jul 06, 2021 · Margin means buying securities, such as stocks, by using funds you borrow from your broker. Buying stock on margin is similar to buying a house with a mortgage. If you buy a house at a purchase price of $100,000 and put 10 percent down, your equity (the part you own) is $10,000, and you borrow the remaining $90,000 with a mortgage.

What does it mean to buy investments on margin?

Jan 15, 2020 · When you buy on margin, you’re buying stock with both your money and the money you’ve borrowed. This allows you to purchase much more than you otherwise would have been able to. Sometimes investors use margin to do things other than buying more stock. For instance, if you think that a stock is being overvalued, you may decide to borrow existing shares of that …

What is margin trading and how does it work?

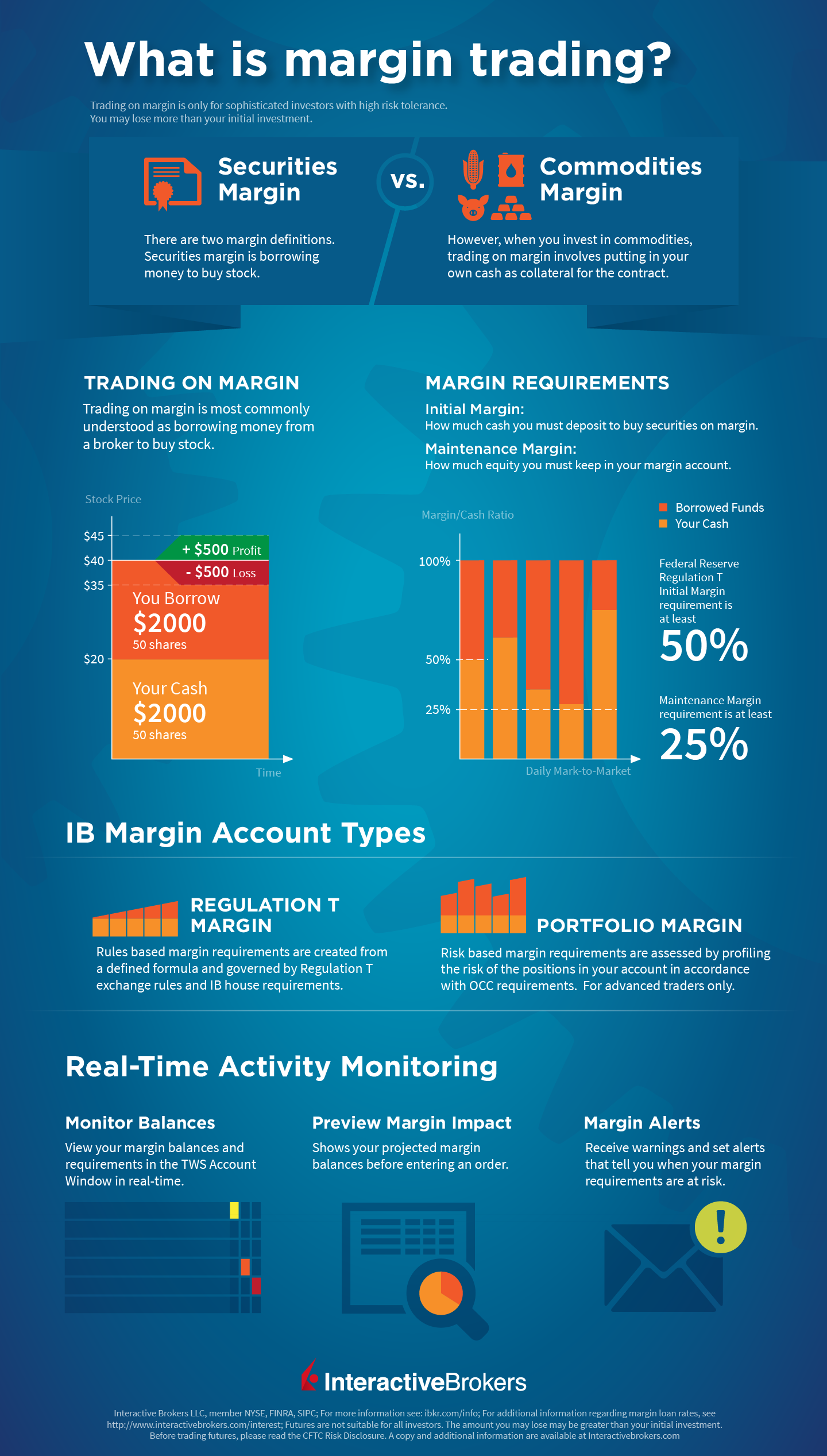

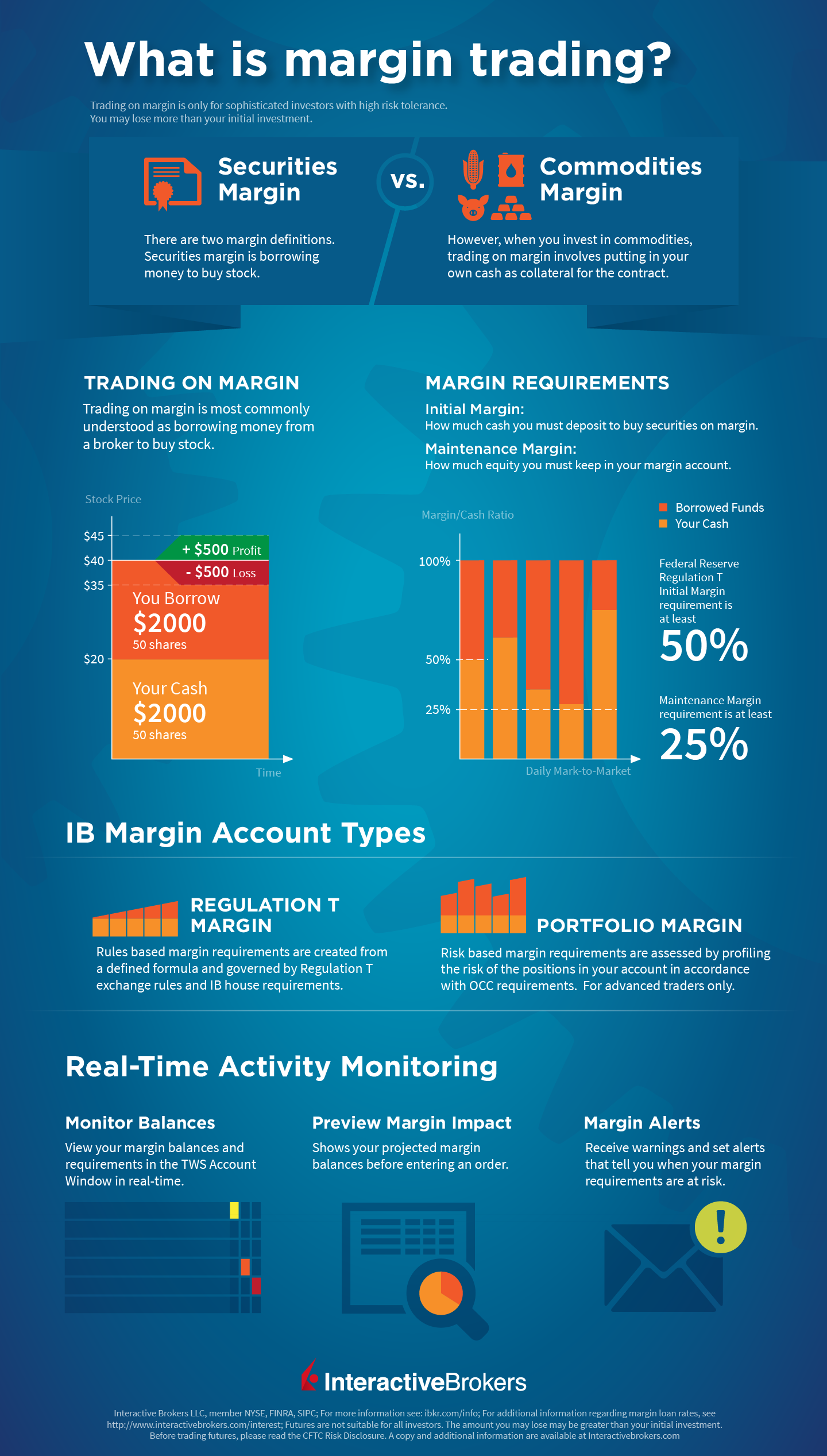

Buying on margin is borrowing money from a broker to purchase stock. Margin increases your buying power. An initial investment of at least $2,000 is required (minimum margin). You can borrow up to 50% of the purchase price of a stock (initial margin). Then, why would an investor buy stock on margin? Buying on margin involves borrowing money from a broker to purchase …

Is buying stock on margin a good idea?

When you buy a stock on margin What do you buy it with?

What does buying shares on the margin mean?

What happens if you lose money on margin?

The margin call requires you to add new funds to your margin account. If you do not meet the margin call, your brokerage firm can close out any open positions in order to bring the account back up to the minimum value. This is known as a forced sale or liquidation.

How is margin paid back?

Can you withdraw margin money?

Is margin good for long term investing?

What are the disadvantages of buying stock on margin?

How much margin should I use?

How do you pay margin interest?

How much interest do you pay on margin?

Is margin call on Netflix?

What is a buy on margin?

Buying on Margin is defined as an investor purchases an asset, say stock, home, or any financial instruments and makes a down payment, which is a small portion of asset value, and the balance amount is financed through a loan from the bank or brokerage firm . The asset purchased will serve as collateral for an unpaid amount.

What is an underlying asset?

An Underlying Asset Underlying assets are the actual financial assets on which the financial derivatives rely. Thus, any change in the value of a derivative reflects the price fluctuation of its underlying asset. Such assets comprise stocks, commodities, market indices, bonds, currencies and interest rates. read more.

What is a commodity hedger?

Commodity A commodity refers to a good convertible into another product or service of more value through trade and commerce activities. It serves as an input or raw material for the manufacturing and production units. read more.

What is spread transaction?

In spread transaction, the trades simultaneously buy a contract position on an asset for one maturity month and sell a contract on the same asset for another maturity month. Margin requirements in a derivative contract such as the future are set up by the exchange.

What is day trade?

In a day trade, a trader announces to the broker an intent to close out the position on the same day. In spread transaction, the trades simultaneously buy a contract position on an asset for one maturity month and sell a contract on the same asset for another maturity month.

What does it mean to buy on margin?

What does Buying on Margin Mean? Margin trading, or buying on margin, means offering collateral, usually with your broker, to borrow funds to purchase securities. In stocks.

What does margin trading mean?

Margin trading, or buying on margin, means offering collateral, usually with your broker, to borrow funds to purchase securities. In stocks. Stock What is a stock?

What does "stock" mean in investing?

The terms "stock", "shares", and "equity" are used interchangeably. , this can also mean purchasing on margin by using a portion of open trade profits on positions in your portfolio to purchase additional stocks. This practice allows investors to obtain greater exposure to more securities than they could own otherwise with cash only.

What does "stock" mean in stock market?

, this can also mean purchasing on margin by using a portion of open trade profits on positions in your portfolio to purchase additional stocks.

What is it called when you own stock?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably.

What is buying on margin?

Buying on margin is the purchase of a stockor another security with money that you’ve borrowed from your broker. It’s an example of using leverage, which means utilizing borrowed money to increase your potential profit.

Why do investors use margin?

This allows you to purchase much more than you otherwise would have been able to. Sometimes investors use margin to do things other than buying more stock. For instance, if you think that a stock is being overvalued, you may decide to borrow existing shares of that stock through your broker, then immediately sell them.

What does margin call mean?

A margin call often means that your investments haven’t gone the way you wanted them to.

What to do if stock is overvalued?

For instance, if you think that a stock is being overvalued, you may decide to borrow existing shares of that stock through your broker, then immediately sell them. If the price does indeed fall, you’ll then buy the shares back at a lower price, return them and keep the difference.

Can you buy stock on margin?

The Federal Reserve Board won’t let you buy stock on margin unless you put up at least 50 percent of the money. Brokers can ask for more. In fact, if a stock looks especially risky, a broker might refuse to let you buy it on margin. The Financial Industry Regulatory Authority requires investors to have at least $2,000 or 100 percent of the value of a trade in their accounts to buy on margin, whichever is less. Sometimes brokers want more. Day traders, for example, might have to have $25,000 in their margin accounts.

Where is W D Adkins?

Based in Atlanta, Georgia, W D Adkins has been writing professionally since 2008. He writes about business, personal finance and careers. Adkins holds master's degrees in history and sociology from Georgia State University. He became a member of the Society of Professional Journalists in 2009.

What does it mean to buy on margin?

Buying on margin means borrowing money from your brokerage company and using that money to buy stocks. It is no different than taking out a loan to buy stocks. If the stock price goes up, you can repay the loan with the gain. If the stock price goes down, you will have to repay the loan with additional cash to top up your trading account.

Is buying on margin risky?

The high potential for loss during a stock market downturn makes buying on margin particularly risky for even the most experienced investors. Most individual investors primarily focus on stocks and bonds. For them, buying on margin introduces an unnecessary level of risk.

What happens if a stock goes up?

If the stock price goes up, you can repay the loan with the gain. If the stock price goes down, you will have to repay the loan with additional cash to top up your trading account. In other words, you’re simply taking out a loan, buying stocks with the lent money, and eventually repaying that loan at a later date.

What is maintenance margin?

A maintenance margin is required by the broker, which is a minimum balance that must be retained in the investor’s brokerage account. Suppose an investor deposits $25,000 and the maintenance margin is 50%, or $12,500. If the investor’s equity dips below $12,500, the investor may receive a margin call.

What is 50% margin?

A 50% initial margin allows you to buy up to twice as much stock as you could with just the cash in your account. As a result, you can make significantly more gains by using a margin account than by trading from a pure cash position. What really matters is whether your stock rises or not.

Can you buy options on margin?

Other securities, such as options contracts, have traditionally been purchased using all cash. Buyers of options can now buy equity options and equity index options on margin.

What is leverage in investing?

It’s all about leverage. Just as companies borrow money to invest in projects, investors can borrow money and leverage the cash they invest. Leverage amplifies every point that a stock goes up. If you pick the right investment, margin can dramatically increase your profit.

What does it mean to buy stocks on margin?

Given active investors tend to underperform, buying stocks on margin means an investor is magnifying their underperformance by going into debt to buy stocks. Using margin to buy stocks when stocks are going up works well until it doesn’t. The average investor tends to be too emotional for his or her own good.

Why do investors buy stocks on margin?

Investors buy stocks on margin to try and boost returns. Margin investors are so certain of a stock’s potential that they are willing to go into debt to try and earn a return much greater than the margin interest rate. Let’s say you use $100,000 to buy 10,000 shares of a $10 stock. A year later, the stock rises to $15.

Is buying stocks on margin bad?

In general, buying stocks on margin is a bad idea. However, the idea of buying stocks on margin has increased due to a long bull market and a drop in interest rates. More people are trying to get rich as quickly as possible thanks to what we see and hear on the internet. Let’s quickly review why buying stocks on margin is a suboptimal move.

Can you become emotional when buying stocks on margin?

Given your gains and losses are amplified when you buy stocks on margin, you might become an emotional wreck during particularly volatile days. Your mood swings may negatively affect your relationships with your partner and children.

What does 50% margin mean?

When people say they are on 50% margin, it actually means they’ve purchased double their cash buying power in stocks.

Can you have a bad day at work?

It’s already difficult to compartmentalize a bad day at work with your home life. It’s practically impossible if you have a bad day at work and a bad day in the market on margin. If you don’t get a sense of joy when your stocks go up during good times, you will feel the pain of losing money much more during bad times.

What happens if you buy on margin?

But if you bought on margin, you'll lose 100 percent, and you still must come up with the interest you owe on the loan. In volatile markets, investors who put up an initial margin payment for a stock may, from time to time, be required to provide additional cash if the price of the stock falls.

Why do investors use margin?

Investors generally use margin to increase their purchasing power so that they can own more stock without fully paying for it. But margin exposes investors to the potential for higher losses. Here's what you need to know about margin.

How to open a margin account?

Margin accounts can be very risky and they are not suitable for everyone. Before opening a margin account, you should fully understand that: 1 You can lose more money than you have invested; 2 You may have to deposit additional cash or securities in your account on short notice to cover market losses; 3 You may be forced to sell some or all of your securities when falling stock prices reduce the value of your securities; and 4 Your brokerage firm may sell some or all of your securities without consulting you to pay off the loan it made to you.

Is margin account risky?

Margin accounts can be very risky and they are not suitable for everyone. Before opening a margin account, you should fully understand that: You can lose more money than you have invested; You may have to deposit additional cash or securities in your account on short notice to cover market losses;

What is margin agreement?

The margin agreement states that you must abide by the rules of the Federal Reserve Board, the New York Stock Exchange, the National Association of Securities Dealers, Inc., and the firm where you have set up your margin account. Be sure to carefully review the agreement before you sign it.

Which regulators regulate margin trading?

The Federal Reserve Board and many self-regulatory organizations (SROs), such as the NYSE and FINRA, have rules that govern margin trading. Brokerage firms can establish their own requirements as long as they are at least as restrictive as the Federal Reserve Board and SRO rules.

How much do you need to deposit before trading on margin?

Before trading on margin, FINRA, for example, requires you to deposit with your brokerage firm a minimum of $2,000 or 100 percent of the purchase price, whichever is less. This is known as the "minimum margin." Some firms may require you to deposit more than $2,000 .

Buying on Margin Example

Characteristics of Buying An Asset on Margin

Types of Buying on Margin

Advantages

Disadvantages

Conclusion

- Buying on Margin involves a minimum investment amount to be deposited in a margin account and allows a trader/investor to borrow the balance from a broker. The account is adjusted daily to reflect gains and losses. Margins are an essential aspect which allows a trader to trade in various financial products, such as futures, options as well as stock...

Recommended Articles

Example of Buying on Margin

- The broker will assess an investor regarding his creditworthiness and risk. After an assessment, the broker will set an “initial margin” requirement and a “maintenance margin.” The initial margin will differ depending on the instrument traded. If the broker sets an initial margin of 50% for one lot position @$100 AAPL, then the investor needs 50% t...

Benefits and Risks of Margin Buying

Additional Resources