Summary

- Market breadth refers to a set of technical indicators that evaluate the price advancement and decline of a given stock index.

- Market breadth is not an isolated indicator. It may also incorporate other technical indicators, such as the volume of trade.

- It enables traders to predict future price reversals in stock indices.

How can Breadth indicators predict stock market movement?

Sep 17, 2020 · Breadth indicators are mathematical formulas that measure the number of advancing and declining stocks, or their volume, to calculate the amount of participation in a market movement.

What are market Breadth indicators?

Aug 21, 2020 · Market breadth, or stock-market breadth, is used in technical analysis to gauge the general direction of the stock market based on all traded stocks. Market breadth divides the number of stocks that have experienced gains by the number of stocks that have experienced losses. A ratio greater than one (Market Breadth > 1) indicates overall stock market gains or a …

What is the best stock on the market?

Apr 04, 2019 · Market breadth is another form of technical analysis used in stock market training. You could say market breadth is the general view of all indicators in technical analysis. It’s used to gauge overall market direction.

How to be profitable in stock market?

Market breadth is a measure of how many stocks are moving the major indexes. It can serve as one indicator of how much staying power a rally is likely to have.

What is a breadth indicator?

What is price breadth?

What is market breadth and depth?

How is stock breadth calculated?

How is market breadth calculated?

This line is the cumulative sum of advances minus decline. The formula for the same is shown below: Breadth Line Value= (No. of Advance Stocks – No of Decline Stocks) + Breadth Line Value of the Previous day.Mar 14, 2022

How do you read stock order books?

- The two prices in the middle are last traded price (1) and mark price (2)

- Price: The prices for sell limit orders are in red (3), and the buy limit orders are in green (4)

- Quantity: Order quantity in USD terms at each order price.

What is market breadth?

Summary. Market breadth refers to a set of technical indicators that evaluate the price advancement and decline of a given stock index. Market breadth is not an isolated indicator. It may also incorporate other technical indicators, such as the volume of trade. It enables traders to predict future price reversals in stock indices.

What is market breadth indicator?

There are several types of market breadth indicators, each of which may be calculated in a different manner. It means that the market information the indicators represent may also vary. For example, some indicators may incorporate the volume of trade. Some may only consider the number of stocks advancing in contrast to the number ...

What is a bullish market?

Bullish and Bearish Professionals in corporate finance regularly refer to markets as being bullish and bearish based on positive or negative price movements. A bear market is typically considered to exist when there has been a price decline of 20% or more from the peak, and a bull market is considered to be a 20% recovery from a market bottom.

What data do traders consider to evaluate whether or not a current trend in the index will continue?

Usually, the data that traders consider to evaluate whether or not a current trend in the index will continue is the data that triggered a price rise or decline over a 52-week period. It is in addition to the number of stocks or the volume of trade of the stock that is undergoing a price rise of decline.

What is stock index?

Stock Index A stock index consists of constituent stocks used to provide an indication of an economy, market, or sector. A stock index is commonly used by investors as. . Market breadth represents the total number of stocks that are increasing in prices as opposed to the number of stocks that are undergoing a decline in their prices.

Why does the stock index rise?

It usually occurs when a small number of shares experience drastic price advancements , which results in a huge impact on the average and hence makes the index rise. Thus, market breadth can reveal such a technicality ...

Why do traders use market breadth?

Traders and investors use market breadth in order to assess the index’s overall health. Market breadth can be a reliable, if not an accurate, indicator of an upcoming price rise in the index. Similarly, it can also provide early warning signs for a future price decline. Market breadth indicators, although useful, ...

What does it mean when the breadth indicator and the stock index diverge?

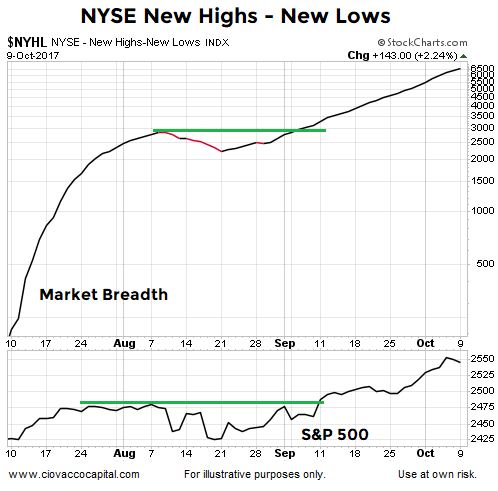

When the breadth indicator and a stock index diverge, that may forewarn of a reversal. Fewer stocks are moving in the stock index's direction. This means the stock index could be setting up to change direction.

What does it mean when the breadth indicator is rising?

Typically, when a breadth indicator is rising, and the stock index is rising, it shows there is strong participation in the price rise. This means the price rise is more likely to sustain itself. The same concept applies to a falling breadth indicator and a falling stock index value. When the breadth indicator and a stock index diverge, ...

Why is breadth indicator odd?

Certain breadth indicators may also generate odd readings because of their calculation method . On Balance Volume may jump or decline significantly, for example, if there is a huge volume day but the price finishes only marginally higher or lower. The price barely moved, but the indicator could move a great deal.

What is the up/down ratio?

Up/Down Volume Ratio which is rising stock volume divided by falling stock volume.

Is the market neutral in February?

The Force Index (at the bottom) shows a strong bearish sentiment in early February during the market drop and relatively weak bullish sentiment throughout the entire period. On Balance Volume shows bullish volume during the February and March recovery and moderate volume in the months following. These indicators suggest that the market is relatively neutral between April and June.

Is breadth cumulative or non-cumulative?

Some breadth indicators are cumulative, with each day's value added or subtracted from the prior value. Others are non-cumulative, with each day or period providing its own data point. One of the simplest breath indicators is the Advance/Decline Line. It's a cumulative indicator where net advances ...

Does Investopedia include all offers?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

What is market breadth?

Market breadth is a useful technical analysis tool for helping traders understand index markets. It can give them a sense of whether recent market movements reflect broad-based trends or whether large movements by a few stocks are skewing the overall numbers.

How does market breadth affect the stock market?

If a few shares in an index have large price movements up or down , this can affect the average and shift the entire index, even if the majority of stocks in the index are going in the opposite direction. The direction of an index is not always an accurate representation of the performance of individual securities that are in the index.

What is breadth indicator?

Market breadth indicators are mathematical formulas that show how many stocks in a particular market or stock index are increasing in price compared to how many are declining in price. It’s useful for understanding the current and predicted movements of stock indices and analyzing stocks and understanding how broad-based a rally or pullback might be.

Why is market breadth important?

Since market breadth can show the direction of the overall market, traders use it to assess the health of the index as well as the broader market. However, market breadth indicators aren’t always completely accurate, and they can’t be used as predictions of market changes or price reversals.

What is the technical indicator of market breadth?

One technical indicator often used with market breadth is volume of trade. Volume of trade is the number of shares of a particular stock within an index traded within a particular period of time. Generally, traders look at a period of 52 weeks, or one year. It’s important to look at trading volume of individual stocks because if a stock has a high volume of trade then its price movements have a large impact on the overall index.

What is a positive breadth?

If the majority of stocks in an index are increasing in value, this is called positive market breadth, and the index is said to be in confirmation in this circumstance. This is a bullish indicator that shows that the overall market is in a rising trend and is likely to continue going up in value.

How to determine the breadth of the market?

Determining the breadth of the market requires using a set of technical indicators to assess the price and movement of the index. Stock indices are groups of stocks and securities, grouped based on an industry, region, company size, or other factors.

What is market breadth?

Market breadth is another form of technical analysis used in stock market training. You could say market breadth is the general view of all indicators in technical analysis. It’s used to gauge overall market direction. In essence, it uses multiple technical indicators to confirm a trend. Learning how to use technical analysis to trade can be very ...

Why is market breadth important?

Market breadth is there to confirm that the market is in a strong trend, whether up or down. That’s why a change in one of the internal indicators is pretty significant. Those indicators move in the direction of the trend. So when one of them moves in a different direction, pay attention because it’s an important warning signal.

What are the indicators of a stock?

Volume, advance/decline and new highs/lows are the indicators that make up the internal indicators. Volume is extremely important to trading. Trading stocks with little to no volume is hard to do. You end up waiting forever for a move.

What is the market?

The market is a tug of war between buyers and sellers. It’s one of the stock market basics . As a result, the market can get choppy. Hence using techniques like market breadth to help you find a direction.

Why is point and figure charting important?

Point and figure charting removes time from the equation. It’s typically more useful in long term investing because time isn’t really a factor. You’re ok holding throughout all the price movement in the market.

Can the stock market move without technical indicators?

Without them the stock market doesn’t move. However, they can manipulate the market to their advantage; especially for day trading. Hence the importance of knowing how to read technical indicators and patterns for yourself as opposed to following Level 2 which shows market maker moves.

Is the market bullish or bearish?

As a result, the market has a bullish bias. The opposite is also true. If more stocks are falling than rising, market breadth and depth would tell you that a bearish bias is in place. In fact, this strategy differs from technical analysis because it looks to have all indicators moving in the same direction.

Why use breadth indicators?

Surely, breadth indicators can provide much-needed clarity for investors and lead to more stable and savvy investment outcomes. As long as investors stick to the script and use breadth indicators as gauges on whether money is going in or out of the market, and not which stocks or other securities are garnering the most money, ...

What is a security that ends the day higher called?

Security or index that ends the trading day higher is an “advancing issue” and may be regarded as a bullish market indicator. Security or index that ends the day lower is a “declining issue” and may be considered a bearish market indicator. Market breadth indicators can also track other key trading criteria, like the number ...

Can breadth indicators predict the market?

If you use breadth indicators, make sure you read them as a broad perspective on the market; they cannot predict the performance of any given individual security.

What Does Market Breadth indicate?

- Traders and investors use market breadth in order to assess the index’s overall health. Market breadth can be a reliable, if not an accurate, indicator of an upcoming price rise in the index. Similarly, it can also provide early warning signs for a future price decline. Market breadth indicators, although useful, do not always give an accurate pict...

Market Breadth and Volume of Trade

- Sometimes, the simple price rises or declines in a stock index are not a reliable indicator of the price performance of securitiesMarketable SecuritiesMarketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company. The issuing company creates these instruments for the express purpos…

Types of Market Breadth Indicators

- There are several types of market breadth indicators, each of which may be calculated in a different manner. It means that the market information the indicators represent may also vary. For example, some indicators may incorporate the volume of trade. Some may only consider the number of stocks advancing in contrast to the number of stocks declining. Others may compar…

Related Readings

- CFI is the official provider of the globalCommercial Banking & Credit Analyst (CBCA)™Program Page - CBCAGet CFI's CBCA™ certification and become a Commercial Banking & Credit Analyst. Enroll and advance your career with our certification programs and courses.certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career…

What Is Breadth Ratio?

- If the majority of stocks in an index are increasing in value, this is called positive market breadth, and the index is said to be in confirmation in this circumstance. This is a bullish indicatorthat shows that the overall market is in a rising trend and is likely to continue going up in value. The opposite also holds true. If the majority of stocks are decreasing in value, this is referred to as n…

How Is Market Breadth Used by Investors?

- One way institutional and retail investorsuse market breadth is to reveal underlying market conditions that may not be immediately apparent from looking at the current price movement of an index on a chart. If a few shares in an index have large price movements up or down, this can affect the average and shift the entire index, even if the majority of stocks in the index are going …

Types of Market Breadth Indicators

- Market breadth indicators are mathematical formulas used to measure how many stocks are rising and falling within an index, as well as their trading volume. Investors use them to discover market sentiment, predict whether an index is likely to rise or fall in the future, and to assess the strength of an upward or downward price trend. Traders use t...

Limitations and Downsides of Market Breadth

- Although market breadth indicators are a valuable tool for traders, they do have some limitations. They can help investors decide what trades to make, but they do not serve as accurate predictions of the future. They don’t always show upcoming reversals or price confirmations, and are just one tool in analyzing a stock. Every trading situation is different, so the same indicators can’t be equ…

The Takeaway

- Market breadth is a useful technical analysis tool for helping traders understand index markets. It can give them a sense of whether recent market movements reflect broad-based trends or whether large movements by a few stocks are skewing the overall numbers. If you’re interested in starting to trade and build a portfolio, SoFi Invest® brokerage platformis a great trading app to u…