Common stock represents owning part of a company and often betting on its growth, while bonds and preferred stock are more about getting steady, reliable rates of return. Bonds and preferred stock are more attractive as overall interest rates go down. Many investors like to own some of all three to diversify their portfolios. Bond Investing

What are the differences between stocks and bonds?

Legal Resources

- 1. A Summary of the Key Points. ...

- 1.1 Participating Institutions. The Intra-Market Connect scheme involves arrangements for bond trading, registration, depository, clearing and settlement.

- 1.2 Qualified Investors. ...

- 1.3 Eligible Bonds. ...

- 3. ...

- 3.1 Nominee Accounts. ...

- 3.2 Bond Settlement. ...

How to determine your ratio of stocks to bonds?

Within these three classes there are subclasses:

- Large-cap stocks: Shares issued by companies with a market capitalization above $10 billion.

- Mid-cap stocks: Shares issued by companies with a market capitalization between $2 billion and $10 billion.

- Small-cap stocks: Companies with a market capitalization of less than $2 billion. ...

How to understand stocks and bonds?

- Jeff Gundlach predicts inflation will remain elevated in 2022, and forecasts a steep dollar decline.

- The DoubleLine Funds chief compared the boom in growth stocks this year to the dot-com bubble.

- The investor expects the US tapering of federal stimulus to shake markets and temper economic growth.

What is the difference between stock and bond valuation?

What Are the Differences Between Stocks and Bonds?

- Stocks Represent Ownership. Stocks are simply ownership shares of corporations. ...

- Bonds Represent Debt. Bonds, on the other hand, are debt. ...

- The Difference for Investors. Each share of stock represents an ownership stake in a corporation. ...

- Frequently Asked Questions (FAQs) What percentage of my portfolio should be in stocks vs. bonds? ...

Which is better common stock or bonds?

Bonds are safer for a reason⎯ you can expect a lower return on your investment. Stocks, on the other hand, typically combine a certain amount of unpredictability in the short-term, with the potential for a better return on your investment.

Why bonds Are Better Than stocks?

Bonds tend to be less volatile and less risky than stocks, and when held to maturity can offer more stable and consistent returns. Interest rates on bonds often tend to be higher than savings rates at banks, on CDs, or in money market accounts.

Is bonds riskier than stocks?

The bond market is no exception to this rule. Bonds in general are considered less risky than stocks for several reasons: Bonds carry the promise of their issuer to return the face value of the security to the holder at maturity; stocks have no such promise from their issuer.

Can bonds lose money?

If interest rates increase, previously issued bonds lose value because an investor can buy new bonds with the same maturity date and receive a higher yield (and income stream). Long-term bonds will experience greater losses compared with short-term bonds when interest rates increase.

What is the difference between a stock and a bond?

Key Differences. A stock is a financial instrument issued by a company depicting the right of ownership in return for funds provided as equity. A bond is a financial instrument issued for raising an additional amount of capital.

Why are bonds issued by the government?

Bonds issued by the government are extensively used and also depicts the financial stability of the country. If the yields offered are less it means the nation is in a good position to pay off its debt and does not need everyone to lend to them and vice-versa.

What is bond loan?

Bonds are actually loans that are secured by a specific physical asset. It highlights the amount of debt taken with a promise to pay the principal amount in the future and periodically offering them the yields at a pre-decided percentage. In this article, we shall understand the importance of Stocks vs Bonds and the differences between them.

Is a stock an equity or debt?

Stocks are treated as equity instruments whereas bonds are debt instruments. Debt Instruments Debt instruments provide finance for the company's growth, investments, and future planning and agree to repay the same within the stipulated time. Long-term instruments include debentures, bonds, GDRs from foreign investors.

Do stockholders have to pay DDT?

The stock market has a secondary market in place ensuring centralized trading as opposed to bonds in which trading is done Over the Counter (OTC). Stockholders may have to pay DDT (Dividend distribution tax) in case of the returns received which can further curtail the returns received but bonds are not exposed to such tax burdens.

Do bondholders get voting rights?

Bondholders are creditors to the company and do not get voting rights. The risk factor is high in stocks since the returns are not fixed or proportional ...

Do bonds have fixed returns?

On the other hand, bonds have fixed returns that have to be paid irrespective of the performance of the borrower since it is a debt amount.

What happens when you buy a stock?

When you buy a stock, you become a part-owner of the business. However, bonds represent debt, meaning that you are effectively lending money that must be paid back to you, with interest. Companies can sell stocks and bonds to investors to raise money for various purposes.

What is the biggest risk in investing grade bonds?

The biggest risk with investment-grade bonds is inflation and interest rates. If inflation increases, then the par value of the bond will have less purchasing power in the future. If interest rates go up, then the value of the bond also goes down because other investors are then willing to pay less for it.

How do stocks and funds return money to investors?

Both stocks and funds can return money to investors through dividend payments, which are usually paid out quarterly. However, unlike bonds, the dividends are not guaranteed and can be increased, decreased, or even cut entirely if the company feels that it needs to preserve cash.

What is the principal of a bond?

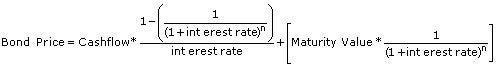

Bonds have a principal called the par value, which is to be paid in full to the investor on the date that the bond expires, called the maturity date. Between issuance and maturity, the bondholder receives regular interest payments. The interest rate is termed the coupon of the bond, expressed as a percentage yield.

Why do investors care about stocks?

Stock investors care about investing in good companies because that means that the stock prices are likely to go up. They want to buy stocks in companies that have consistent revenue and profit growth, so picking good companies with solid growth potential is essential.

How often do bonds pay interest?

Bonds can pay interest annually, twice a year, quarterly, or even monthly. There are also so-called zero-coupon bonds, which pay no interest at all. Bonds issued by the US government (termed treasuries) pay interest twice per year. For example, a 10-year treasury bond might have a par value of $10,000 and a 2% coupon.

Why do companies sell their shares?

Companies sell their shares to raise money. Same as with bonds, companies issue stocks to raise money from investors. When a company’s stock is sold on a stock exchange for the first time, it happens through a process called initial public offering (IPO).

What is the difference between a stock and a bond?

Stocks give you partial ownership in a corporation, while bonds are a loan from you to a company or government. The biggest difference between them is how they generate profit: stocks must appreciate in value and be sold later on the stock market, while most bonds pay fixed interest over time.

How do bonds and stocks make money?

To make money from stocks, you’ll need to sell the company’s shares at a higher price than you paid for them to generate a profit or capital gain.

Why are bonds sold on the market?

Bonds can also be sold on the market for capital gains if their value increases higher than what you paid for them. This could happen due to changes in interest rates, an improved rating from the credit agencies or a combination of these.

What happens if you sell stock?

In this instance, if you sold them, you’d lose money. Stocks are also known as corporate stock, common stock, corporate shares, equity shares and equity securities. Companies may issue shares to the public for several reasons, but the most common is to raise cash that can be used to fuel future growth.

What is a bond?

Bonds are a loan from you to a company or government. There’s no equity involved, nor any shares to buy. Put simply, a company or government is in debt to you when you buy a bond, and it will pay you interest on the loan for a set period, after which it will pay back the full amount you bought the bond for.

What does it mean to own stock?

Stocks represent partial ownership, or equity, in a company. When you buy stock, you’re actually purchasing a tiny slice of the company — one or more "shares." And the more shares you buy, the more of the company you own. Let’s say a company has a stock price of $50 per share, and you invest $2,500 (that's 50 shares for $50 each).

What is corporate bond?

A company’s ability to pay back debt is reflected in its credit rating, which is assigned by credit rating agencies like Moody’s and Standard & Poor’s. Corporate bonds can be grouped into two categories: investment-grade bonds and high-yield bonds. Investment grade. Higher credit rating, lower risk, lower returns.

What is the difference between stock and bond?

Stocks and bonds are two different ways for an entity to raise money to fund or expand its operations. Stocks are simply ownership shares of corporations. When a company issues stock, it is selling a piece of itself in exchange for cash. 1

What does it mean when someone buys stock?

A person who buys a stock is buying an actual share of the company, which makes them a partial owner. That is why stock is also referred to as "equity. " This applies to both established companies and IPOs that are new to the market.

What does each share of stock represent?

Each share of stock represents an ownership stake in a corporation. That means that the owner shares in the profits and losses of the company, although they are not responsible for its liabilities. Someone who invests in the stock can benefit if the company performs very well, and its value increases over time.

What is bond debt?

3. A government, corporation, or other entity that needs to raise cash will borrow money in the public market.

Is a bond more risky than a stock?

They also are less risky than stocks. While their prices fluctuate in the market—sometimes quite substantially in the case of higher-risk market segments—the vast majority of bonds tend to pay back the full amount of principal at maturity, and there is much less risk of loss than there is with stocks. 3.

Do stocks and bonds fluctuate?

Typically, stocks and bonds do not fluctuate at the same time. 4 5. If seeing a stock price fall quickly would cause you to panic, and/or if you are close to retiring and may need the money soon, then a mix with more bonds could be the better option for you.

What is the difference between a bond rating and a bond rating?

This rating—expressed through a letter grade—tells investors how much risk a bond has of defaulting. A bond with a "AAA" or "A" rating is high-quality, while an "A"- or "BBB"-rated bond is medium risk. Bonds with a BB rating or lower are considered to be high-risk. 3 4

What is bond market?

The bond market is where investors go to trade (buy and sell) debt securities, prominently bonds, which may be issued by corporations or governments. The bond market is also known as the debt or the credit market. Securities sold on the bond market are all various forms of debt. By buying a bond, credit, or debt security, ...

What is underwriting in bond market?

In the bond market, an underwriter buys securities from the issuers and resells them for a profit. Participants: These entities buy and sell bonds and other related securities. By buying bonds, the participant issues a loan for the length of the security and receives interest in return.

Why do bonds fall?

Bonds, on the other hand, are more susceptible to risks such as inflation and interest rates. When interest rates rise, bond prices tend to fall. If interest rates are high and you need to sell your bond before it matures, you may end up getting less than the purchase price.

What is mortgage bond?

A mortgage bond is a type of security backed by pooled mortgages, paying interest to the holder monthly, quarterly, or semi-annually.

What are the risks of investing in stocks?

When it comes to stocks, investors may be exposed to risks such as country or geopolitical risk (based on where a company does business or is based), currency risk, liquidity risk, or even interest rate risks, which can affect a company's debt, the cash it has on hand, and its bottom line.

What is the function of the stock market?

The primary function of the stock market is to bring buyers and sellers together into a fair, regulated, and controlled environment where they can execute their trades. This gives those involved the confidence that trading is done with transparency, and that pricing is fair and honest.

Why do investors use bonds?

Investors use bonds as a diversifier among stock investments, and to generate income. Diversification reduces risk and maximizes returns because you have invested in assets that react differently to market conditions. Traditionally, bonds have been presented as an investment that moves in the opposite direction of stocks.

Do you lose capital when you sell stocks?

When you invest in stocks you do not actually lose the capital until you sell. If you have enough income from the dividends and other sources such as a pension, and you do not need to sell, you will regain your capital if/when the market comes back. With bonds, this is trickier.

Do government bonds have a negative correlation to stocks?

According to a Morningstar, Inc. research report, government bonds have a negative correlation to stocks but corporate bonds do not . Investors with a longer time horizon will be better suited to stick with the right asset allocation than to try and time the market. In a low interest-rate environment, investors tend to favor stocks instead of bonds.

Do corporate bonds lose value?

This means that as stocks lose value, corporate bonds most likely will also lose value. The bonds will typically not go down as much as stocks, which have little downside protection, but the overall portfolio will still decrease. Because of this correlation, you may not be better off running to bonds. To make the final decision you should look ...

Do you lose capital when you own a bond?

If you are using a mutual fund or ETF for your bond investing you may or may not lose capital, it is up to the decisions the fund manager makes. It is out of your control.

Is it better to invest in corporate bonds or dividend stocks?

If you need your investments to produce income, then it is important to decide if corporate bonds or dividend stocks are a better place for you to be. In a low interest-rate environment, investors tend to favor stocks instead of bonds. However, low-interest rates cannot be sustained forever. When rates eventually rise, the face value ...

What is the difference between bonds and stocks?

The difference between stocks and bonds. The difference between stocks and bonds is that stocks are shares in the ownership of a business, while bonds are a form of debt that the issuing entity promises to repay at some point in the future.

Why do you convert to stock?

Converting to stock also gives a former bond holder the right to vote on certain company issues. Both stocks and bonds may be traded on a public exchange.

Is it riskier to invest in stocks or bonds?

This means that stocks are a riskier investment than bonds. Periodic payments. A company has the option to reward its shareholders with dividends, whereas it is usually obligated to make periodic interest payments to its bond holders for very specific amounts.

Can bonds be traded on a public exchange?

Both stocks and bonds may be traded on a public exchange. This is a common occurrence for larger publicly-held companies, and much more rare for smaller entities that do not want to go through the inordinate expense of going public.

Is a stock a riskier investment than a bond?

This means that stocks are a riskier investment than bonds. Periodic payments. A company has the option to reward its ...