10-year, 30-year, and 50-year average stock market returns

| Period | Annualized Return (Nominal) | Annualized Real Return (Adjusted for Inf ... | $1 Becomes... (Nominal) | $1 Becomes... (Adjusted for Inflation) |

| 10 years (2012-2021) | 14.8% | 12.4% | $3.79 | $3.06 |

| 30 years (1992-2021) | 9.9% | 7.3% | $11.43 | $5.65 |

| 50 years (1972-2021) | 9.4% | 5.4% | $46.69 | $6.88 |

What is the lowest stock in the market?

Traders work on the floor of the NYSE. The quick move higher in bond yields is sending a warning about the stock market — especially growth stocks. The benchmark 10-year Treasury has risen about 20 basis points since the start of the year — 1 basis point equals 0.01% — and was at 1.13% Monday.

What is the best month for the stock market?

The average monthly S&P500 stock market returns from 1980 to 2019 were:

- January: +0.82%

- February: +0.29%

- March: +0.96%

- April: +1.51%

- May: +0.97%

- June: +0.02%

- July: +0.79%

- August: -0.15%

- September: -0.70%

- October: +0.92%

What stock market return should you expect in the future?

Why do you expect long-term returns to be lower than historical averages?

- Low interest rates. Lower inflation affects yields on everything from cash to 30-year Treasury bonds. ...

- Low economic growth. Economic growth and inflation typically go hand in hand. ...

- Equity valuations. Valuations appear to be stretched compared to last March’s levels. ...

What is the average dividend yield of the stock market?

There is a way, however, to determine the average dividend yield for the companies included in the major stock market averages, or indexes, which are reasonable illustrations of the broader stock market. A dividend yield illustrates an investment's returns relative to the size of dividend payments and stock price.

What is a good return in the stock market?

Expectations for return from the stock market Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market.

What is the average stock market return over 30 years?

10.72%Looking at the S&P 500 for the years 1991 to 2020, the average stock market return for the last 30 years is 10.72% (8.29% when adjusted for inflation). Some of this success can be attributed to the dot-com boom in the late 1990s (before the bust), which resulted in high return rates for five consecutive years.

What is the average stock market return for 2020?

18.4%The S&P 500's average annual returns over the past decade have come in at around 14.7%, beating the long-term historic average of 10.7% since the benchmark index was introduced 65 years ago....The S&P 500's return can fluctuate widely year to year.YearS&P 500 annual return202018.4%202128.78 more rows•May 26, 2022

What is a good average of return in invested stock?

A good return on investment is generally considered to be about 7% per year. This is the barometer that investors often use based off the historical average return of the S&P 500 after adjusting for inflation.

How much would $8000 invested in the S&P 500 in 1980 be worth today?

To help put this inflation into perspective, if we had invested $8,000 in the S&P 500 index in 1980, our investment would be nominally worth approximately $876,699.23 in 2022.

Will the stock market hit 40000?

The Dow Jones could reach 38,000-40,000 by the end of the year: Trader.

What is the average stock market return over 3 years?

The S&P 500 index is a basket of 500 large US stocks, weighted by market cap, and is the most widely followed index representing the US stock market. S&P 500 3 Year Return is at 50.15%, compared to 40.26% last month and 55.40% last year. This is higher than the long term average of 22.50%.

What is the average return on a 401k?

5% to 8%Many retirement planners suggest the typical 401(k) portfolio generates an average annual return of 5% to 8% based on market conditions. But your 401(k) return depends on different factors like your contributions, investment selection and fees.

What is the average stock market return for the last 5 years?

5, 10, 20, and 30-Year Return on the Stock MarketAverage Rate of ReturnInflation-Adjusted Return5-Year (2017-2021)18.55%15.19%10-Year (2012-2021)16.58%14.15%20-Year (2002-2021)9.51%7.04%30-Year (1992-2021)10.66%8.10%Apr 22, 2022

Is 10% a good ROI?

For stock market investments, anywhere from 7%-10% is usually considered a good ROI, and many investors use the S&P to guide their investment strategy. There are other types of investments you can make and those have different expectations, such as: Government bonds can produce a return of around 5%.

How do you get a 10% return on investment?

How Do I Earn a 10% Rate of Return on Investment?Invest in Stocks for the Long-Term. ... Invest in Stocks for the Short-Term. ... Real Estate. ... Investing in Fine Art. ... Starting Your Own Business (Or Investing in Small Ones) ... Investing in Wine. ... Peer-to-Peer Lending. ... Invest in REITs.More items...

How do you get a 20% return?

You can get 20% ROI (or more) by (i) buying a cash-flowing blog, (ii) investing in real estate using debt to enhance your returns, (iii) purchasing a profitable absentee business (e.g., laundromats, FedEx routes, etc.) or (iv) buying high cash-flowing assets like vending machines and ATMs.

Why is the S&P 500 considered the market?

To investors, the S&P 500 Index is referred to as “the market.” This is because it consists of 500 large publicly traded companies in the United States. As such, investing in the S&P 500 is considered the trusted path for investors around the globe.

Do you lose money when you trade?

When you trade often, you’ll spend a lot of time losing money. No matter how much experience you have, the more you trade, the more money you lose in taxes and commissions.

Does Bankrate have a calculator?

Bankrate has a calculator tool. We used it to determine the figures in our example of how to reach your retirement plan investment financial goals.

Average stock market returns

In general, when people say "the stock market," they mean the S&P 500 index. The S&P 500 is a collection -- referred to as a stock market index -- of just over 500 of the largest publicly traded U.S. companies. (The list is updated every quarter with major changes annually.) While there are thousands more stocks trading on U.S.

10-year, 30-year, and 50-year average stock market returns

Let's take a look at the stock market's average annualized returns over the past 10, 30, and 50 years, using the S&P 500 as our proxy for the market.

Stock market returns vs. inflation

In addition to showing the average returns, the table above also shows useful information on stock returns adjusted for inflation. For example, $1 invested in 1972 would be worth $46.69 today.

Historical Return on Investment

The stock market as we know it today was established in 1792, but analysts have really only tracked market returns for the last 100 years or so. The aggregate average return over that time? A nice round 10%.

Consider Incremental Return Over Time

The 10% stock market average is a figure accounted over roughly a century. However, if you look at a stock chart over the past 100 years, you’ll see a pattern of exponential growth. The market has, in fact, grown at a more rapid pace in recent years. This makes calculating average return on stocks a bit trickier.

Security Type Affects Total Return

Another important factor to remember about a 10% average is that it’s a broad market average. It accounts for total market return. This is an accurate benchmark if you invest in a broad-market index fund. However, if you invest in a specific sector or type of security, you’ll need a different benchmark.

Track the Real Rate of Return

One of the best practices for any investor is to track their current rate of return against the market’s current performance. If you’re indexed, the numbers should be the same, indicating that you’re pacing the market. For those seeking to beat the market, consider a few indicators:

Remember, the Market is Dynamic

10% is a nice round number that anyone can understand as they seek to pace or beat the average return on stocks. But it’s important to look at real numbers to get a sense of how well the market is actually performing. If the market is down 4% and you’re up 5%, you’re still beating the average, if only for that day, week or month.

What is average return?

What is an Average Return? Average return is the mathematical average of a sequence of returns that have accrued over time. In its simplest terms, average return is the total return over a time period divided by the number of periods.

What is the average growth rate?

The average growth rate is used to assess an increase or decrease in the value of an investment over a period of time. The growth rate is computed using the growth rate formula:

Why is annualized return used?

An average annual return is commonly used to measure returns of equity investments. However, because it compounds, the annual average return is typically not considered an ideal analysis metric; hence, it is infrequently used to evaluate changing returns. Also, the annualized return is computed using a regular mean.

What is it called when you own stock?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably. or security.

Does the average return account for different projects?

Despite its preferences as an easy and effective measure for internal returns, the average return has several pitfalls. It does not account for different projects that might require different capital outlays.

Average annual return of the S&P 500

Over the long term, the average historical stock market return has been about 7% a year after inflation. Looking at long periods of time rather than any one year shows something else—remarkable consistency.

10-year, 30-year, and 50-year average stock market returns

Knowing that the market has boom years and inevitable slumps, it’s useful to look at the market’s average returns over the longer term.

Market timing

Statistically, investors who try to time the market or trade their way to fortune with short-term moves overwhelmingly earn returns that fail to match the S&P 500. Plus, this kind of strategy often takes up a disproportionate amount of the investor’s time and results in fees and taxes that eat into returns.

Why the market is geared toward long-term investments

History tells us that the stock market has increased more years than it has fallen. This is a basic truth that is helpful for those who are beginning to invest; it’s also what leads us to that long-term return of an annualized historical average return of 7%.

What is the average annualized return of the S&P 500?

Between 2000 and 2019, the average annualized return of the S&P 500 Index was about 8.87%. In any given year, the actual return you earn may be quite different than the average return, which averages out several years' worth of performance. You may hear the media talking a lot about market corrections and bear markets:

How does down year affect the market?

The market's down years have an impact, but the degree to which they impact you often gets determined by whether you decide to stay invested or get out. An investor with a long-term view may have great returns over time, while one with a short-term view who gets in and then gets out after a bad year may have a loss.

How much money would you lose if you invested $1,000 in an index fund?

If you invested $1,000 at the beginning of the year in an index fund, you would have 37% less money invested at the end of the year or a loss of $370, but you only experience a real loss if you sell the investment at that time.

When does a bear market occur?

A bear market occurs when the market goes down over 20% from its previous high. Most bear markets last for about a year in length. 1 .

When to look at rolling returns?

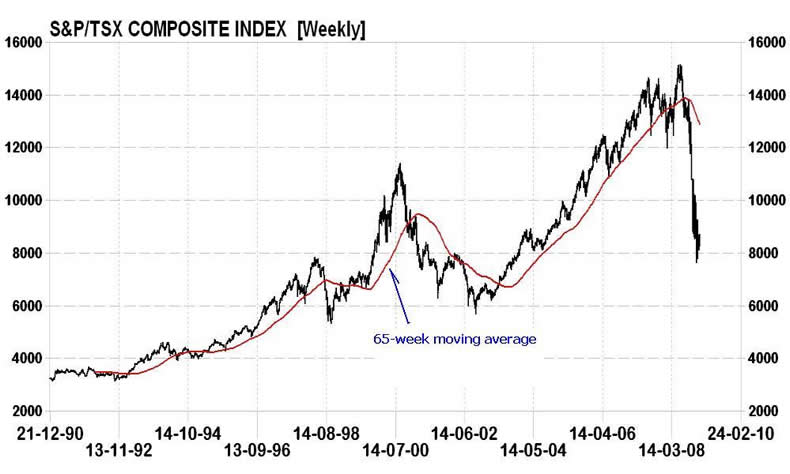

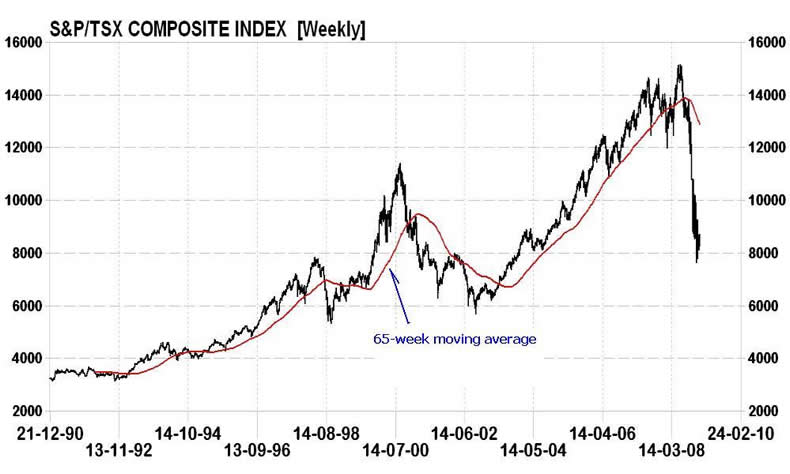

You can alternatively view returns as rolling returns, which look at market returns of 12-month periods, such as February to the following January, March to the following February, or April to the following March. Check out these graphs of historical rolling returns, for a perspective that extends beyond a calendar year view.

Is the stock market cruel?

On the other hand, if you try and use the stock market as a means to make money fast or engage in activities that throw caution to the wind, you'll find the stock market to be a very cruel place. If a small amount of money could land you big riches in a super short timespan, everybody would do it.

Can you stay out of stocks during a bear market?

No one knows ahead of time when those negative stock market returns will occur. If you don't have the fortitude to stay invested through a bear market, then you may decide to either stay out of stocks or be prepared to lose money, because no one can consistently time the market to get in and out and avoid the down years.