Which stocks are trending up?

Stocks Trending up for last five days period in Indian Stock Market. Blue Chip Shares Futures & Option Shares Midcap Shares . Name Symbol Sector Current Price Five days Old Price Price Difference (%) Average Volume (In K) Mahalaxmi Rubtech Ltd. MHLXMIRU: TEXTILE PRODUCTS: 142.25: 89.15:

How to identify trending stocks?

Trading Tips: How To Identify Strong Uptrending Stocks

- Know Stage One Well. The uptrend, also known as the bull market stage, is the next stage after the bottoming stage. ...

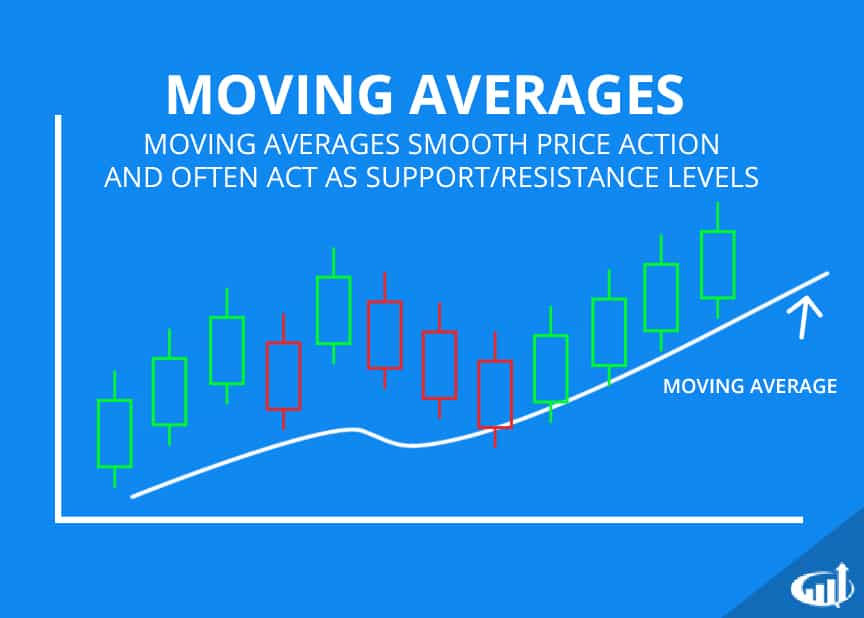

- Moving Average Crossovers. Investors use the moving average (MA) variable in knowing when the trend changes. ...

- Trendlines of Breaking. ...

- Focus on the IBD Relative Strength. ...

- Look at the Sector’s Performance. ...

- Special Considerations. ...

What is the most active stock?

- Narrow down your list. ...

- Pick one index. ...

- Pre-market most active lists can give you a good indication of what's to come during the trading day. ...

- Most active penny stocks may open you up to more risk, so decide if this is worth it.

- The list of most active stocks by dollar volume isn't something most people use unless they have a lot of capital on hand. ...

What are the stock market trends?

Here’s what investors need to keep top of mind as they head into the new year:

- How higher interest rates will affect the stock market.

- Slowing economic growth in 2022.

- How to invest in stocks in 2022.

What makes a stock an uptrend?

An uptrend occurs when a stock makes consecutive higher highs and higher lows, resulting in a price advance which trends higher. Each relative high is above the preceding high, and each relative low is higher than the preceding low.

How do you tell if a stock is in an uptrend?

0:003:194 Ways to Tell if a Stock is in an Uptrend - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd today I want to teach you four ways to tell if a stock is in an uptrend. So the first way is youMoreAnd today I want to teach you four ways to tell if a stock is in an uptrend. So the first way is you want to look for higher highs. And higher lows.

Do you buy or sell in uptrend?

Traders should look to buy at dips during an uptrend (buy low) and sell at peaks during a downtrend (sell high.) Those MAs can also act as dynamic support and resistance levels at which the price tends to bounce off.

Should you buy in an uptrend?

1:354:50How To Buy Stocks When A Market Uptrend Resumes - YouTubeYouTubeStart of suggested clipEnd of suggested clipBecause by the time you might feel fully comfortable in a new Uptrend. Those top stocks are likelyMoreBecause by the time you might feel fully comfortable in a new Uptrend. Those top stocks are likely already going to be too far extended for you to buy them.

What is the 3 day rule in stocks?

The three-day settlement rule The Securities and Exchange Commission (SEC) requires trades to be settled within a three-business day time period, also known as T+3. When you buy stocks, the brokerage firm must receive your payment no later than three business days after the trade is executed.

When should I sell my uptrend?

Understanding an Uptrend An upward trend provides investors with an opportunity to profit from rising asset prices. Selling an asset once it has failed to create a higher peak and trough is one of the most effective ways to avoid large losses that can result from a change in trend.

Should I buy stock uptrend or downtrend?

Uptrends give traders the opportunity to buy low, sell high, and hopefully continue to profit until the trend reverses. Usually, traders sell the stock when the peaks and troughs no longer break new highs. Downtrends won't lead to profits if you like to go long, but they can be a short seller's dream.

When should I buy a downtrend?

0:566:56When To Buy During A Downtrend | Stocks and Crypto - YouTubeYouTubeStart of suggested clipEnd of suggested clipOrder when the lines are tangled depending on the severity can indicate a retracement or an outrightMoreOrder when the lines are tangled depending on the severity can indicate a retracement or an outright downtrend when the lines are about the cross.

Can you make money on a downtrend?

In stock trading, you can make money from an uptrend or a downtrend. Downtrends tend to move faster than uptrends, which is why you will find some traders who opt to only short sell stocks in order to capitalize on the quick price action. Research shows that stocks can trend more than 30% of the time.

Should I buy a stock when it's up?

Yes, you should invest when the market is down—and when it's up and when it's sideways. Investing is about reaching your financial goals, and that requires keeping your eyes on the prize in all sorts of market conditions.

Should I sell during downtrend?

The Bottom Line During downtrends consider short-selling during the correction. Technical tools and strategies help isolate when a correction may be ending. Utilize a stop-loss order to control risk, and also plan for how to exit a profitable trade, likely using a price target.

What is the difference between uptrend and downtrend?

Traditionally, uptrend lines appear by drawing a straight line through a series of ascending higher troughs (lows). With downtrends, trendlines form by drawing a straight line through a series of descending lower highs.

What is an uptrend in the stock market?

An uptrend is a bullish trend in the market. Prices will continuously increase over a certain period of time. They create higher peaks after peaks and higher troughs after troughs.

What is an uptrend pattern?

The uptrend pattern with strong price fluctuations. These are upward trend patterns that still meet the following conditions: the previous peak and trough are higher than the previous ones. But compared to other uptrend patterns, it is not good-looking. The uptrend pattern with strong price fluctuations.

What are the signals of an upward trend?

They are (i) Bullish reversal candlestick patterns with high accuracy and (ii) Levels (Support/Resistance) formed in an uptrend.

What happens when an uptrend ends?

The previous peak and trough are no longer higher than the previous ones => The upward trend has ended. When an uptrend ends, the market will likely fall into sideways to accumulate bullish momentum. Or it will get into a downtrend.

What is a trend line?

Trendline is a trend line. In an upward trend, the trendline is a straight line connecting troughs. It acts as a support line for the market. And when the price touches the trendline, it will bounce back. In an uptrend, you just need to draw a straight line connecting 3 troughs together. So, we have a bullish trendline.

What happens when the price of a stock rises?

As prices rise and form a new peak, this peak will become a resistance zone. If the price exceeds a peak (breaks out of the resistance) and rises, that resistance will always become a support zone. And I will collectively call them levels. The price falls back, touches this level, and continues to rebound. The uptrend process keeps repeating like that.

How many troughs do you need to draw in an uptrend?

In an uptrend, you just need to draw a straight line connecting 3 troughs together. So, we have a bullish trendline. This is considered the most perfect case.

What is an uptrend in trading?

What is an uptrend? It is the stage in a market cycle when the price is advancing. The price makes a series of higher highs and higher lows. During this time traders will open long positions. Swing traders may open and close many positions during an uptrend. A longer-term trader may hold one position for the duration of the entire uptrend. You can find them on all charts and on all time frames. Let’s take a deeper look to see what it is, how we can spot it, and how to use it to our advantage.

How to tell if a stock is in an uptrend?

By zooming in on the mark-up stage we can see that it is made up of a series of higher highs and higher lows. As the price rises, it stops to take breaks along the way. These breaks are known as pullbacks and they create the lower lows. Stocks often pull back to a moving average. Then the price continues to make a new high. This creates higher highs. Two or more of these higher highs and higher lows confirms an uptrend. Look at the picture below. Notice how the highs and lows resemble a staircase. This is an uptrend. The overall direction of the price is up.

What does it mean when a moving average crosses over a longer timeframe?

This is when moving averages of different time frames cross over each other. When a faster one (shorter timeframe) crosses up over a slower one (longer timeframe) it is a bullish sign, when a faster one crosses down under a slower one it is a bearish sign.

How many stages are there in a stock market cycle?

The price of a stock moves in cycles. Four stages make up one cycle. The accumulation stage, the mark-up stage, the distribution stage, and the markdown stage. An uptrend happens during the second stage or the mark-up. A downtrend happens during the fourth stage or the markdown. Look at the picture below. Notice the four different stages that make up one cycle of the price action.

What happens when the price pulls back and bounces off of a moving average?

As the price pulls back and bounces off of a moving average a long-term trader may use this as an opportunity to add to their position.

What does it mean when the price crosses the 50 day moving average?

When the price crosses down over the 50-Day moving average (the yellow line) it signals the end of the trend and a sell.

Is the stock market unpredictable?

The stock market can be unpredictable. The information in these articles is here only to give you an edge. Trading systems do not work 100% of the time. It is up to you to use risk management. You can lose money in the market and if you decide to participate you do so at your own risk. For a good cross-reference to this information please click here.

How to identify an uptrend?

One of the easiest ways to identity an ‘Uptrend’ is to see if the stock is going above its previous high and not falling below its previous low.

What does it mean when a stock goes up?

When the stock goes up, it goes above its previous high. When it falls, it doesn’t fall below its previous low. This is called ‘ Higher Highs Higher Lows’. Some important points: 1. Always buy stocks that are in an uptrend. Buying stocks that are in downtrend is like swimming against the tide at the beach.

When the price moves in the opposite direction i.e downwards, the stock is said to be in a?

When the price moves in the opposite direction i.e downwards, the stock is said to be in a ‘Down Trend’ .

Should long term investors look at long term trends?

6. Long term investors should look at long term trends i.e select monthly chart. Medium term investors should ideally analyse the trend on weekly chart. More on the different types of charts in another article.

Can a stock fall to 50?

It’s the same with stocks. A stock that has fallen from 100 to 80, can also fall to 50 or lower. Inexperienced investors, especially, will keep averaging downwards and wait for reversal. These kind of stocks will test your patience and you won’t be able to make real money out of them.

Can you use only one strategy in a bull market?

Good and profitable trader / active investor do not use only one trading strategy (like buy pullback for any stocks). Such strategy works well in bull market but fails in bear market or in sideways market.

Is a pullback as strong as a rising move?

Corrections (pullbacks) are not as strong as rising moves. There are higher highs (HH) and higher lows (HL) on the chart. Volume during rising periods is higher than during corrections. You can find them on this example: As you can see, moving averages can help you visually identify an uptrend during your trend analysis.

Can moving averages help you identify uptrends?

As you can see, moving averages can help you visually identify an uptrend during your trend analysis.

Is it safe to trade bullish stock picks?

If you are in a bull market then it is safe to trade bullish stock picks for a long trade. You can use bullish swing trading strategies. If we are in sideways market then you can trade both directions, i.e. bullish trades and bearish trades.

What is an uptrend in the stock market?

What is an Uptrend & Downtrend in the Stock Market? In the stock market, an uptrend is any stock price that is continuing to make new highs over time. In a downtrend, a stock price is making new lows over a given time period. The length of the price move defines whether the uptrend or downtrend is a short, medium, or long-term trend.

Why do you buy a stock in an uptrend?

Why? If you buy a stock (go long) in an uptrend, you are more likely to make money on it.

What is the difference between uptrend and downtrend?

There are 3 types of stock price trends. The uptrend means that the price is moving upwards, and the downtrend means the stock price is moving downwards. The final trend is a consolidation or lateral move, meaning the price is moving sideways. Uptrend: The stock or index is moving up, making new highs or higher highs.

Why do we use moving averages?

We can use moving averages to quickly assess if the market is in an up or downtrend and on what time frame. To do this, we need to set up three moving averages on a chart.

How many uptrends and downtrends can you see on a 50 day moving average?

Using the 50-day moving average, we can observe 6 distinct uptrends and downtrends. Each is clearly visible when the stock price is above or below the green line.

How to set up a long term moving average?

Set up a long-term moving average: Add the Moving Average indicator and set it to 200. Set the color to white. This is the moving average of 200 days of price history.

How to find trend of stock?

There is a simple process for assessing the trend of any stock. Simple plot 3 moving average indicators with different lengths onto a stock chart. I suggest 50, 100, and 200-day moving averages. You can then easily visualize the stock’s trend and the time-period of that trend.

Understanding An Uptrend

- An upward trend provides investors with an opportunity to profit from rising asset prices. Selling an asset once it has failed to create a higher peak and trough is one of the most effective ways to avoid large losses that can result from a change in trend. Some technical traders utilize trendlin…

Trading Uptrends

- There are many techniques for analyzing and trading an uptrend. Looking only at price action is one way. Using tools such as trendlines and technical indicatorsanother. Two common price action trading strategies—which can be confirmed or invalidated with additional input from technical tools and indicators—are to buy when the price pulls backduring an uptrend, or to buy …

Example of Analyzing and Trading An Uptrend

- The following Meta (formerly Facebook) Inc. chart shows numerous examples of potential trades using support or penetration of resistance on increasing volume. A moving average has been added to aid in finding possible support areas. Several longshave been highlighted with arrows that show a break of resistance on increased volume. The price consolidated while in an overall …