Stock transfer agent

A stock transfer agent or share registry or Transfer Agency is a company, usually a third party unrelated to stock transactions, which cancels the name and certificate of the shareholder who sold the shares of stock, and substitutes the new owner's name on the official master shareholder listing. Stock transfer agent is the term used in the United States and Canada. Share registry is used in the United Ki…

Where can I get a stock transfer form?

Stock Transfer Form (fillable) - from 1st Formations Author: Rachel Craig Subject: Download a free stock transfer form from 1st Formations, the company setup specialists in the UK. Keywords: Stock transfer form Created Date: 20151124164738Z

How to record transfer of shares?

Record the transfer on the corporate record books. In addition to changing the title on the share certificates, the corporate record books should also be updated to reflect the change in share ownership by adding an entry to the stock ledger that lists the current shareholders.

How to transfer shares of stock to another person?

How to Transfer Shares of Stock to Another Person

- Understanding Stock Transfers. When you purchase a stock, you receive what's called a stock certificate, which is a legal document proving your ownership of the shares.

- First Steps For Completing the Transfer. ...

- Understanding the Gift Tax. ...

- Tax Impact to Recipient. ...

How do you transfer stocks to another person?

In order to transfer stock properly, there are several steps that need to be taken:

- Find out if the S corporation has a shareholders' agreement in place

- Determine the correct price for the stock. ...

- The next step is determining whether the party you wish to sell your shares to is allowed to own stock in that company. ...

What is a stock transfer form used for?

A stock transfer form transfers shares from one person to another. If you use a stock transfer to buy stocks and shares for £1,000 or less you do not normally have to pay any Stamp Duty. New Stamp Duty processes were introduced on 25 March 2020.

Is a stock transfer form necessary?

A stock transfer form does not need to be submitted to Companies House. However, a company director must update the company's statutory register of shareholders in order to record the details of the share transfer.

What are the documents required for stock transfer?

Header: The stock transfer document should carry the heading as 'STN or Delivery Challan' with an appropriate value in case of an Intra-state or Local movement and the heading 'Invoice' with applicable tax details for inter-state goods movement.

How do I complete a stock transfer form?

How to complete a stock transfer form in 10 Steps1 Consideration money. ... 2 Full name of Undertaking. ... 3 Full description of Security. ... 4 Number or amount of Shares, Stock or other security. ... 5 Name(s) and address of registered holder(s) ... 6 Signature(s) ... 7 Name(s) and address of person(s) receiving the shares.More items...•

Is a stock transfer form filed at Companies House?

To legally sell or transfer ownership of shares, a Stock Transfer Form must be completed. There is no need to notify Companies House at the time of any transfer – you simply need to report the changes on the next annual confirmation statement.

Is a stock transfer form a legal document?

A share transfer form, also called a stock transfer form, is a legal form used to transfer shares in a company from an existing shareholder to a new person or company.

Are stock transfers taxable?

There are no tax implications for the recipient when the shares are transferred, but you may face a gift tax if the value of the stock transfer exceeds a certain amount.

How do I transfer stock from one branch to another?

You can transfer stock to other branch as outward by recording it as a Sales – Delivery Challan.Go to Sales > Delivery Challan.Create new Delivery Challan from Main Branch to Branch A by choosing 'Branch A' as customer in 'Customer field'.

How do I make an electronic bill for a stock transfer?

No e-way bill is required to be generated—PART-A. A.1 GSTIN of Recipient. A.2 Place of Delivery. A.3 Invoice or Challan Number. A.4 Invoice or Challan Date. A.5 Value of Goods. A.6 HSN Code. A.7 Reason for Transportation. A.8 Transport Document Number.PART-B. B. Vehicle Number.Also Read:

How long does a stock transfer take?

Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. This is called the delivery process.

Can shares be transferred without a stock transfer form?

Transfer of shares The instrument of transfer of a share may be in any usual form or in any other form which the directors may approve and shall be executed by or on behalf of the transferor and, unless the share is fully paid, by or on behalf of the transferee.

Can a stock transfer form be signed electronically?

It is possible for a stock transfer form to be validly executed under hand using an electronic signature. A document is generally understood to have been executed under hand if it has been signed by, or on behalf of, the parties to it (rather than executed as a deed).

When will stamp duty be introduced?

New Stamp Duty processes were introduced on 25 March 2020. Where Stamp Duty is paid on a stock transfer form since then, that instrument is duly stamped for all purposes. You do not need to resubmit any documents to be stamped under the previous physical stamping system.

Do you need to fill out a certificate for stock transfer?

You do not need to fill in either certificate where no consideration is given for the shares or if you’re claiming a relief from Stamp Duty. If you’re claiming a relief you’ll need to send the completed stock transfer form, together with details of the relief you’re claiming to HMRC for them to consider the relief claim.

Do you have to pay stamp duty if you buy shares in a UK company?

If you buy shares in a UK company while you’re abroad, you still have to pay Stamp Duty, and get the transfer documents stamped. If you do not do this within the time limits you may have to pay a penalty and interest. If you buy foreign shares you do not have to pay Stamp Duty.

When to use stock transfer form?

Stock transfer forms are usually used when buying and selling of stocks take place. These forms help in transferring the ownership of the stocks from the seller to the buyer. Thus, the target audience for stock transfer forms is:

When a person wishes to sell his stocks whose certificate he may have misplaced or lost, can

Usually, when a person wishes to sell his stocks whose certificate he may have misplaced or lost, he can use this form to transfer the stocks to the new owner.

Why do people invest in stocks?

People usually invest in stocks on various companies and corporate houses with a view of making a profit and to increase their wealth. While selling the stocks, they are required to fill in a form and sign it to transfer the ownership to the buyer. It is for this purpose that a Transfer Forms is used. The seller needs to fill in the details of the ...

When are shares transferred to you?

When any shares are transferred to you as a security for a loan; Shares that were held as security for a loan that are now transferred back to you when you repay the loan; Any transfer made by a liquidator as settlement to shareholders when a company is wound up.

How many addresses should be entered for a joint stock transfer?

Only one address should be entered, which for a joint shareholding should be that of the first named joint shareholder. If someone other than the named shareholder is transferring the shares, please also write the capacity in which they will be signing the stock transfer form.

How many directors are required to sign a corporate shareholder agreement?

for and on behalf of NewCo Limited ): Two directors. One director and the company secretary.

Is stamp duty chargeable on stock transfer?

Certificate 2 of the stock transfer form should be completed in the following scenarios where stamp duty is not chargeable: Shares you receive as a gift and that you don’t pay any money or other consideration for; Shares you receive from your spouse or civil partner when you marry or enter into a civil partnership;

What is a stock transfer form?

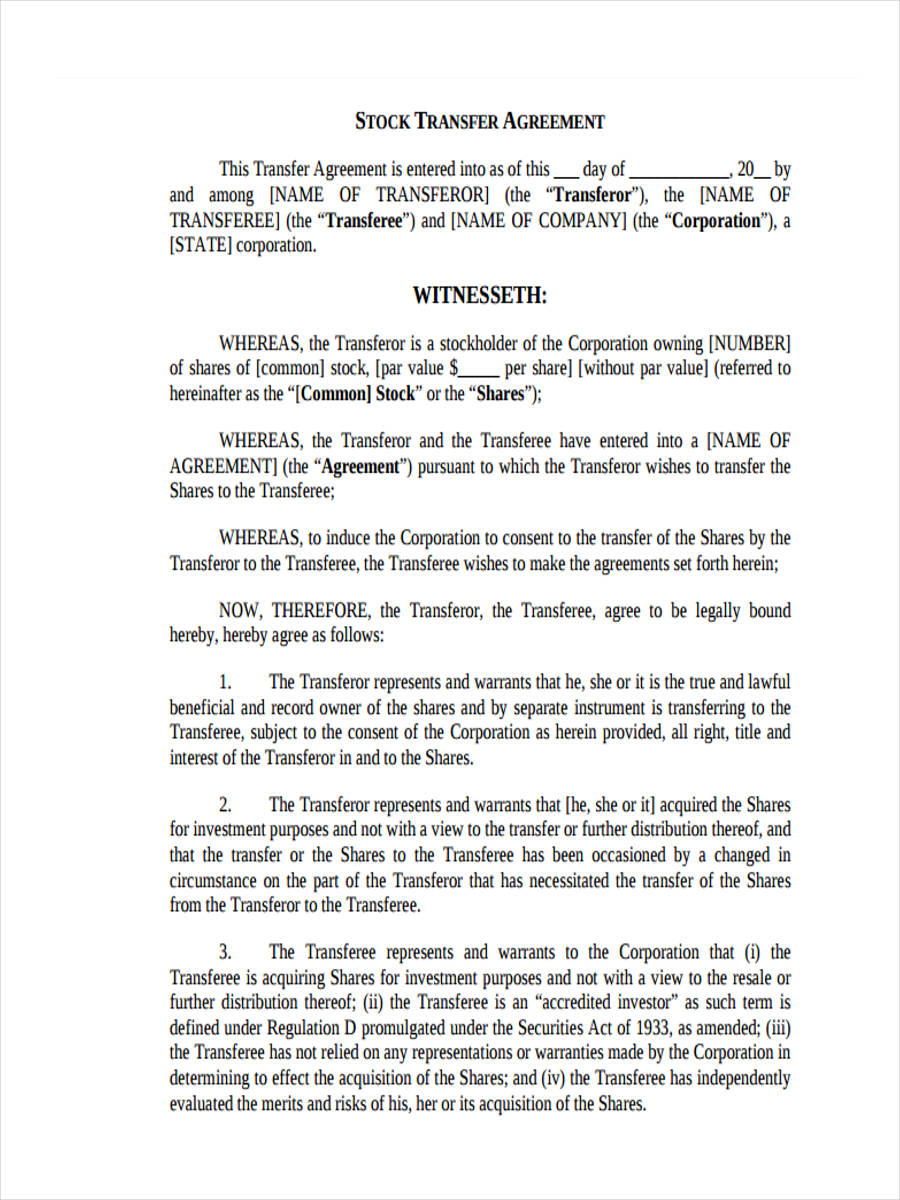

A stock transfer form is legal document that transfers the shares of one person to another. In the conveyancing process, shares can be transferred to the buyer from the seller's management company. All of the shares that are transferred between the seller and the buyer will be conducted using this form.

What is a stock power?

Stock power is a legal power of attorney form that transfers the ownership of certain shares of a stock to a new owner. A stock power transfer form usually is only required when an owner opts to take physical possession of securities certificates, rather than holding securities with a broker.

Do companies need to receive a copy of a stock transfer?

Companies House does not need to receive a copy of the stock transfer form; however, the company registrar (usually a company director or the company secretary) should update the company register to record the details of the share transfer and also retain a copy of the stock transfer form along with any resolutions ...

What is a share transfer form?

The Share Transfer Form (also called the Share Transfer Instrument) is a standard document required for the transfer of shares in a company. It is used when a shareholder intends to sell or transfer their company shares to another party. It outlines the particulars of the party selling or transferring (the transferor) their shares to another ...

What is a share in a company?

Shares are fixed identifiable units of capital that represents a member's stake in a company. Once a party holds shares in a company, that party becomes a member of the company with the right to transfer and transmit the shares.

What is a stock transfer certificate?

When you purchase a stock, you receive what's called a stock certificate, which is a legal document proving your ownership of the shares. If you decide to transfer your shares to someone else, you'll have to perform a stock transfer using a stock transfer form.

Do you have to pay gift tax on a stock transfer?

This means you can apply the excess of the value of the stock transfer against the unified credit and not have to pay a gift tax although you'll still have to file a gift-tax return.

Do you pay capital gains tax on gift shares?

Although you avoid the gift tax, the recipient will have to pay a capital gains tax if she makes a profit off the shares. In general, the IRS uses your cost basis to establish cost basis for the recipient if she sells the shares for a gain.

How Stock Is Moved

Common stock shares are most often transferred from one broker to another by a software-based system known as the Automated Customer Account Transfer Service (ACATS). 2 Prior to ACATS, a manual transfer system was used, which took far longer and was prone to human error. 3

After Moving Brokers

Once the stock has been transferred, Firm B is responsible for all reporting to the shareholder. Brokers are required to provide clients with a financial statement at least once every quarter. 5 Experts also recommend that customers maintain proper records and make their own calculations to double-check that all assets are properly transferred.

Limitations for Moving Assets

There are several types of securities that cannot go through the ACATS system. Annuities bought through insurance companies cannot transfer through the system. 2 1 To transfer the agent of record on an annuity, the client must fill out the correct form to make the change and initiate the process.

How does an ACATS transfer work?

Here's how an ACATS transfer works: Start the process by filling out a transfer initiation form with your new broker. This form should be available online, but you can call your new broker if you need help.

Is it hard to transfer stocks?

Transferring stocks isn't hard, but if you don't do it correctly, you could cost yourself money. To avoid that, you need to know the right and the wrong way to transfer stock between brokers.

Do online brokers pay transfer fees?

Note that some brokers sell proprietary investments, such as their own mutual fund, that they won't allow you ...

Can you transfer stock to a new broker?

Note that some brokers sell proprietary investments, such as their own mutual fund, that they won't allow you to transfer to a new broker. Your new broker will notify you of any assets that can't be transferred. Even small discrepancies can delay the process when you transfer stock between brokers.

Can you sell off your brokerage account and get taxable capital gains?

If you're transferring a standard taxable brokerage account (as opposed to a retirement account like an IRA) and you sell off your assets, you'll generate taxable capital gains on any profits you've earned. And that's true even if you turn around and buy back the exact same investments with your new broker.

Should I transfer stocks between brokerage accounts?

The right brokerage account is critical to get the most out of your investments. Once you're ready to switch over, you can transfer stocks between brokers so that you still have your previous investments. Transferring stocks isn't hard, but if you don't do it correctly, you could cost yourself money. To avoid that, you need to know the right and ...

Completing The Form

- When you complete a stock transfer form you need to give all the details of the sale including: 1. the shares being transferred (the quantity, class and type, for example 100 ordinary shares, ABC Limited) 2. the buyer 3. the seller You also need to provide the value of what you paid for the shares in: 1. cash 2. other stock and shares 3. debt This ...

How to Get Your Form Stamped

- Following the introduction of new Stamp Duty processes on 25 March 2020 you should not post your form to HMRC. You can choose email to submit your Stamp Duty notification documents to us. You should be aware and accept that there are risks in using email, including: 1. emails sent over the internet or other insecure network may be intercepted 2. an unencrypted email can be in…

What Happens Next

- We’ll check your form

- Confirm we have received payment

- Send you a letter that will:

Reliefs and Exemptions

- There are some share transactions that qualify for reliefs or exemptions. They can reduce the amount of Stamp Duty you pay or are exempt from Stamp Duty altogether.

Refunds

- If you pay too much Stamp Duty on a transaction you may be able to claim a refund. Refunds must be claimed within 2 years of the date of the stamped document. If the document is undated, a refund can be claimed within 2 years of first execution. Email your request to: [email protected] why you think a refund is due and provide the: 1. stamp…