Summary

- A stop-limit order is a trade tool that traders use to mitigate risks when buying and selling stocks.

- A stop-limit order is implemented when the price of stocks reaches a specified point.

- A stop-limit order does not guarantee that a trade will be executed if the stock does not reach the specified price.

Which is better between a limit order vs market order?

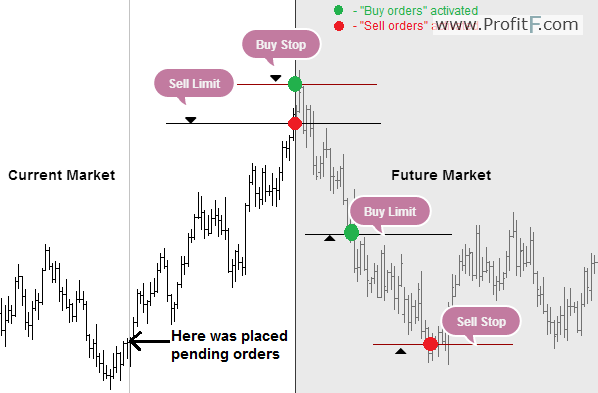

· A stop order tells the broker to wait until the stock reaches $XX per share before proceeding. A limit order tells the broker: Proceed, but don’t go beyond $YY per share. The difference between these two conditions is important and helps explain why a stop-limit, which combines both, offers investors more control over trading prices.

What is the difference between limit and stop orders?

· A stop-limit order, true to the name, is a combination of stop orders (where shares are bought or sold only after they reach a certain price) and limit orders (where traders have a maximum price...

How to use sell limit and sell stop order?

Stop loss and stop limit orders are commonly used to potentially protect against a negative movement in your position. Learn how to use these orders and the effect this strategy may have on your investing or trading strategy.

What is the difference between stop order and limit?

· A stop order is an order to buy or sell a stock at the market price once the stock has traded at or through a specified price (the “stop price”). If the stock reaches the stop price, the order becomes a market order and is filled at the next available market price. If the stock fails to reach the stop price, the order is not executed.

How does a stop limit order work?

A stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Once the stop price is reached, a stop-limit order becomes a limit order that will be executed at a specified price (or better).

What is the difference between a limit order and a stop limit order?

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better; whereas, once a stop order triggers at the specified price, it will be filled at the prevailing price in the market—which means that it could be executed at a price ...

What is a stop limit order to buy example?

The stop-limit order triggers a limit order when a stock price hits the stop level. So you might place a stop-limit order to buy 1,000 shares of XYZ, up to $9.50, when the price hits $9. In this example, $9 is the stop level, which triggers a limit order of $9.50.

Are Stop Limit orders A Good Idea?

Stop-limit orders have further potential risks. These orders can guarantee a price limit, but the trade may not be executed. This can harm investors during a fast market if the stop order triggers, but the limit order does not get filled before the market price blasts through the limit price.

What is an example of a limit order?

A limit order is the use of a pre-specified price to buy or sell a security. For example, if a trader is looking to buy XYZ's stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower.

How do you set a stop limit sell order?

The investor has put in a stop-limit order to buy with the stop price at $160 and the limit price at $165. If the price of AAPL moves above the $160 stop price, then the order is activated and turns into a limit order. As long as the order can be filled under $165, which is the limit price, the trade will be filled.

What is the difference between stop loss and stop limit?

Traders can have more control over their trades by using stop-loss or stop-limit orders. A stop-loss order triggers a market order when a designated price is hit. A stop-limit order triggers a limit order when a designated price is hit.

Do we need to put stop loss everyday?

You cannot set a stop loss for more than a day. However, there are many sites which offer a price alert option. For eg, if you want a stop loss at Rs. 100, set a price alert at Rs 105 so that you can be alerted in time.

What is the 1% rule in trading?

The 1% rule for day traders limits the risk on any given trade to no more than 1% of a trader's total account value. Traders can risk 1% of their account by trading either large positions with tight stop-losses or small positions with stop-losses placed far away from the entry price.

What happens if market opens below stop loss?

The one negative aspect of stop-loss is if a stock suddenly gaps lower below the stop price. The order would trigger, and the stock would be sold at the next available price even if the stock is trading sharply below your stop loss level.

What is a good stop loss for day trading?

A daily stop loss is not an automatic setting like a stop loss you set on a trade; you have to make yourself stop at the amount you set. A good daily stop loss is 3% of your capital, or whatever the average of your profitable days is.

Should stop and limit prices be the same?

In a regular stop order, if the price triggers the stop, a market order will be entered. If the order is a stop-limit, then a limit order will be placed conditional on the stop price triggered. Thus, a stop-limit order will require both a stop price and a limit price, which may or may not be the same.

Can I place a stop loss and limit order at the same time?

Yes, as far as the market is concerned, you can submit a limit order to sell at a good price and stop-loss to sell the same asset at a bad price.

What is stop limit order?

Summary. A stop-limit order is a trade tool that traders use to mitigate risks when buying and selling stocks. A stop-limit order is implemented when the price of stocks reaches a specified point. A stop-limit order does not guarantee that a trade will be executed if the stock does not reach the specified price.

What is a stop limit in stock trading?

A stop price and a limit price are then set once the trader specifies the highest price they are willing to pay per stock. The stop price is a price that is above the market price of the stock, whereas the limit price is the highest price that a trader is willing to pay per share.

What is stop price?

A stop price is a price at which the limit order to sell is activated, whereas the limit price is the lowest price that the trader is willing to accept. A sell stop order tells the market maker/broker to sell the stocks if the price decreases to the stop point or below, but only if the trader earns a specific price per share.

How does a stop limit order work?

A stop-limit order provides greater control to investors by determining the maximum or minimum prices for each order. When the price of the stock achieves the set stop price, a limit order is triggered, instructing the market maker to buy or sell the stock at the limit price. It helps limit losses by determining the point at which the investor is unwilling to sustain losses.

Why is a stop limit order not executed?

A stop-limit order does not guarantee that the trade will be executed, because the price may never beat the limit price. If the limit order is attained for a short duration, it may not be executed when there are other orders in the queue that utilize all stocks available at the current price.

What does "after hours" mean in stock market?

After Hours Trading After hours trading refers to the time outside regular trading hours when an investor can buy and sell securities.

What does it mean when a stock price reaches $55?

It means that once the price reaches $55, the trade is executed, and the order is turned into a market order. Market Order Market order is a request made by an investor to purchase or sell a security at the best possible price. It is executed by a broker or brokerage service. .

How do stop-limit orders work?

In the case of a stop-loss order with a stop price of $XX per share, this doesn’t mean the investor necessarily will get $XX per share. It simply means that once the price drops to $XX, the broker must begin selling—even if the market price continues to fall below $XX.

Why traders use stop-limit orders

Buy stop-limits are frequently used by short sellers—investors who profit when shares decline— as a way to protect gains or stem losses from this risky and expensive strategy.

The drawbacks of using stop-limits

While potential benefits of using stop-limits are demonstrated from the model scenarios above, less obvious are the drawbacks and the limitations of this strategy. Let’s look at some of them, sticking with Tesla and our investor, Jane.

3 Things to consider before using a stop-limit strategy

How long does the investor want an order to be in effect? A single trading day? Several days? Weeks, months? If it was a one-day order, he needs to decide whether to extend the order time or enter a new order, to maintain his boundaries on buying or selling.

The bottom line

The stop-limit strategy is not particularly useful for active traders, who have their eye on the market constantly and are making quick buying and selling decisions, often for small price movements.

What is a stop order in stock trading?

When you place a limit order or stop order, you tell your broker you don't want the market price (the current price at which a stock is trading); instead, you want your order to be executed once the stock price matches a price that you specify. There are two primary differences between limit and stop orders. The first is that a limit order uses ...

What are the risks of a stop limit order?

A stop-limit order has two primary risks: no fills or partial fills. It is possible for your stop price to be triggered and your limit price to remain unavailable. If you used a stop-limit order as a stop loss to exit a long position once the stock started to drop, it might not close your trade.

What does stop on quote mean?

Many brokers now add the term "stop on quote" to their order types to make it clear that the stop order will only be triggered once a valid quoted price in the market has been met. For example, if you set a stop order with a stop price of $100, it will be triggered only if a valid quote at $100 or better is met.

Why do you stop an order?

A stop order avoids the risks of no fills or partial fills, but because it is a market order, you may have your order filled at a price much higher than you were expecting.

What happens when you put a stop order?

If the order is a stop-limit, then a limit order will be placed conditional on the stop price being triggered.

What is a limit order?

Limit Orders. A limit order is an order to buy or sell a stock for a specific price. 1 For example, if you wanted to purchase shares of a $100 stock at $100 or less, you can set a limit order that won't be filled unless the price you specified becomes available. However, you cannot set a plain limit order to buy a stock above ...

What happens if you sell 500 shares at a stop price?

For example, if you wanted to sell 500 shares at a limit price of $75, but only 300 were filled, then you may suffer further losses on the remaining 200 shares.

What is a stop limit order?

Stop-Limit Order is a combination of Stop and Limit order, which helps to execute trade more precisely wherein it gives a trigger point and a range. Say you want to buy when the stock price reaches $50 and you buy till it is $55. So the Stop-Limit order gets triggered when the price reaches $50, and it will continue to buy till the price remains below $55.

Why is stop limit order important?

A stop-limit order is very helpful if your prediction is correct. There are several scenarios where this order never gets triggered or fulfilled. So it requires precise judgment and prediction to place this order.

What happens when you put a stop price and limit price?

It may happen that the Stop price will be triggered, and due to high volatility, it will cross the limit price too quickly; this, in turn, will leave you with a partially filled order or with no fill order.

How to stop a trade when price becomes unfavorable?

To prevent trades happening at unfavorable prices, we put a Stop-Limit order. It will stop the trade when price becomes unfavorable either in BUY or SELL.

What does limit mean in trading?

Limit:- Limit means range; Stop will indicate the starting point of the trade, and limit will indicate the closing point of the trade.

What is bulk trading?

Mutual Funds A mutual fund is an investment fund that investors professionally manage by pooling money from multiple investors to initiate investment in securities individually held to provide greater diversification, long term gains and lower level of risks. read more.

What is stop limit order?

A stop-limit order, true to the name, is a combination of stop orders (where shares are bought or sold only after they reach a certain price) and limit orders (where traders have a maximum price for which they'll buy shares or a minimum price for which they'll sell them). This means there are two prices involved in a stop-limit order.

How does a stop loss order differ from a stop limit order?

How does a stop-loss order differ from a stop-limit order? A stop-loss order is another way of describing a stop order in which you are selling shares. If you're selling shares, you put in a stop price at which to start an order, such as the aforementioned $30 shares once they dip down to $28. Unlike the stop-limit order, there is no limit price. A market order is simply initiated.

Why stop loss when selling shares?

If you're selling shares of a widely-traded company, it may not make too much of a difference whether you use stop-limit or stop-loss because an order is more likely to go through by the time the limit price is reached.

What does it mean to put a stop price at $30?

You put in a stop price at $30. In a stop order, that would mean that once the shares hit $30 your order is triggered and turned into a market order. But with a stop-limit order, you can also put a limit price on it. If you have a limit price of $32, that is the most you're willing to pay for a share. If the shares reach $30 and an order can be ...

What is a buy stop order?

A buy stop order is triggered when the stock hits a price, but if its moving faster than expected, without a limit price you may end up paying quite a bit more than you anticipated when you first placed the order.

What happens if stop limit order expires?

Ultimately, that's the biggest risk on a stop-limit order: it's possible that it won't execute. That's especially risky when selling a stock. What if the order expires before the order is executed, or if the stock dips below your limit price? You're still stuck with a stock in a downturn. You may wait it out and hope it goes back up to your limit price, but after the order expires or is cancelled you may have to use a general market order or stop order to sell it for far, far less than you had wanted to.

What happens if you sell 300 shares?

If you are looking to sell 300 shares, and the price drops below your limit price after only 200 shares were sold, the other 100 are unfilled . This is a risk that is common with stop-limit orders, and one that you should know is a distinct possibility before deciding to place your order.

Why are trailing stop orders risky?

Note: Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors .

What is stop loss?

Stop loss and stop limit orders are commonly used to potentially protect against a negative movement in your position. Learn how to use these orders and the effect this strategy may have on your investing or trading strategy.

What is stop order?

What is a stop order, and how is it used? A stop order is an order to buy or sell a stock at the market price once the stock has traded at or through a specified price (the “ stop price”). If the stock reaches the stop price, the order becomes a market order and is filled at the next available market price.

What is the difference between a stop order and a stop order?

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better; whereas, once a stop order triggers at the specified price, it will be filled at the prevailing price in the market—which means that it could be executed ...

What is the limit price of a stock when it drops to $133?

A trader who wants to buy the stock when it dropped to $133 would place a buy limit order with a limit price of $133 (green line). If the stock falls to $133 or lower, the limit order would be triggered and the order would be executed at $133 or below. If the stock fails to fall to $133 or below, no execution would occur.

How does a limit order work?

What is a limit order and how does it work? 1 A trader who wants to purchase (or sell) the stock as quickly as possible would place a market order, which would in most cases be executed immediately at or near the stock’s current price of $139 (white line)—provided that the market was open when the order was placed and barring unusual market conditions. 2 A trader who wants to buy the stock when it dropped to $133 would place a buy limit order with a limit price of $133 (green line). If the stock falls to $133 or lower, the limit order would be triggered and the order would be executed at $133 or below. If the stock fails to fall to $133 or below, no execution would occur. 3 A trader who wants to sell the stock when it reached $142 would place a sell limit order with a limit price of $142 (red line). If the stock rises to $142 or higher, the limit order would be triggered and the order would be executed at $142 or above. If the stock fails to rise to $142 or above, no execution would occur.

Why is my limit order not filled?

Note, even if the stock reaches the specified limit price, your order may not be filled, because there may be orders ahead of yours that eliminate the availability of shares at the limit price. (Limit orders are generally executed on a first-come, first served basis.) Also note that with a limit order, the price at which the order is executed can be lower than the limit price, in the case of a buy order, or higher than the limit price, in the case of a sell order.

What is market order?

What is a market order and how do I use it? A market order is an order to buy or sell a stock at the market’s current best available price. A market order typically ensures an execution, but it does not guarantee a specified price. Market orders are optimal when the primary goal is to execute the trade immediately.

What happens if a stock fails to reach the stop price?

If the stock fails to reach the stop price, the order is not executed. A stop order may be appropriate in these scenarios: When a stock you own has risen and you want to attempt to protect your gain should it begin to fall.

Why do you put a stop order on a stock?

Investors generally use a buy stop order in an attempt to limit a loss or to protect a profit on a stock that they have sold short. A sell stop order is entered at a stop price below the current market price. Investors generally use a sell stop order in an attempt to limit a loss or to protect a profit on a stock that they own.

What is stop loss order?

A stop order, also referred to as a stop-loss order, is an order to buy or sell a stock once the price of the stock reaches a specified price, known as the stop price. When the stop price is reached, a stop order becomes a market order. A buy stop order is entered at a stop price above the current market price. Investors generally use a buy stop order in an attempt to limit a loss or to protect a profit on a stock that they have sold short. A sell stop order is entered at a stop price below the current market price. Investors generally use a sell stop order in an attempt to limit a loss or to protect a profit on a stock that they own.

Why do you use a stop order?

Investors generally use a sell stop order in an attempt to limit a loss or to protect a profit on a stock that they own. Before using a stop order, investors should consider the following: The stop price is not the guaranteed execution price for a stop order. The stop price is a trigger that causes the stop order to become a market order.

What is trailing stop?

A trailing stop order is a stop or stop limit order in which the stop price is not a specific price. Instead, the stop price is either a defined percentage or dollar amount, above or below the current market price of the security (“trailing stop price”). As the price of the security moves in a favorable direction the trailing stop price adjusts ...

Can you trigger a trailing stop order with last sale?

As with stop and stop-limit orders, different trading venues may have different standards for determining whether the stop price of a trailing stop order has been reached. Some exchanges use only last-sale prices to trigger a trailing stop order, while other venues use quotation prices. Investors should check with their brokerage firms to determine which standard would be used for their trailing stop orders.

Can you buy stop limit orders through brokerage firms?

Stop, stop-limit, and trailing stop orders may not be available through all brokerage firms. Investors should contact their firm to determine which orders are available for buying and selling stocks, and their firms’ specific policies regarding these types of orders.

Can a stop limit order be executed?

As with all limit orders, a stop-limit order may not be executed if the stock’s price moves away from the specified limit price, which may occur in a fast-moving market. The stop price and the limit price for a stop-limit order do not have to be the same price.

What is stop loss order?

A stop-loss order sets only a threshold price that triggers a stock purchase or sale, while a stop-limit order executes a stock purchase or sale only when the stock's price is between two specified values. Investors use limit orders to buy or sell a stock at a preferred price or better, and they use stop orders to cap their potential losses on ...

What is a limit order?

A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price. In essence, a limit order tells your broker that you'd like to buy or sell a security, but only if the price of the security hits your desired target. A broker with these instructions only ...

How to limit downside risk?

For example, let's say you buy a stock for $100 and want to limit your downside risk to around 10%. You can establish a stop-loss order that executes at $90, meaning that your broker will automatically sell the stock if the stock's price falls to $90 or less. If the stock's price is volatile or its market liquidity is low, then you may anticipate rapid price movements that bring the stock's price to well below $90 before your broker can execute a stop-loss order. You can avoid locking in losses greatly in excess of 10% by instead establishing a stop-limit order, which only executes when the stock's price is between, say, $90 and $89.50. Using a stop-limit order enables you to continue to hold a stock you believe will regain its worth.

What is a limit order for Berkshire Hathaway?

Based on your research, you peg Berkshire's intrinsic value at $325 per class B share . You are open to selling half of your shares when Berkshire's class B stock trades for that price, although currently the stock is trading for less than $300 per share. You can submit a GTC limit order to sell five shares of your Berkshire stock at $325 per share, and the trade will automatically execute if Berkshire's share price rises to that level within the next 60 days. If the share price remains below $325, then the GTC limit order expires.

What is the Foolish take on limit orders?

The Foolish take on limit orders. Deciding what types of trades to place can be challenging for beginning investors. The approach we take at The Motley Fool is to avoid limit orders and instead almost always use market orders, mainly because they are simple to establish and they make sure a trade executes right away.

Why do investors use limit orders?

Investors use limit orders when they are concerned that a stock's price might suddenly change by a significant amount or when they are not overly interested in executing a trade right away. The total price paid might be considered more important than the speed of trade execution.

When does a day limit expire?

A day limit order, as the name implies, expires at the end of the trading day. An investor usually set a day limit order at or around the bid price -- the highest price they are willing to pay for a stock -- if they're submitting a buy order. An investor using a day order who wants to sell a stock sets the limit price near the ask price, ...

How Stop-Limit Orders Work

Why Traders Use Stop-Limit Orders

- Traders use stop-limit orders when they are not actively monitoring the market, and the order helps trigger a buy or sell order when the security reaches a specified point. Once the price is attained, the order is automatically triggered. The following are the two main stop-limit orders that traders place:

Risks of A Stop-Limit Order

- While a stop-limit order can limit losses and guarantee a trade at a specified price, there are some risks involved with such an order. The risks include:

More Resources

- Thank you for reading CFI’s guide on Stop-Limit Order. To help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful: 1. Buy Side vs Sell SideBuy Side vs Sell SideBuy Side vs Sell Side. The Buy Side refers to firms that purchase securities and include investment managers, pension funds, and hedge fund…

Limit Orders vs. Stop Orders: An Overview

Limit Orders

- A limit order is an order to buy or sell a stock for a specific price.1For example, if you wanted to purchase shares of a $100 stock at $100 or less, you can set a limit order that won't be filled unless the price you specified becomes available. However, you cannot set a plain limit order to buy a stock above the market price because a better price is already available. Similarly, you ca…

Stop Orders

- Stop orders come in a few different variations, but they are all effectively conditional based on a price that is not yet available in the market when the order is originally placed. When the future price is available, a stop order will be triggered, but depending on its type, the broker will execute them differently.2 Many brokers now add the term "stop on quote" to their order types to make it …

Stop-Limit Orders

- A stop-limit order consists of two prices: a stop price and a limit price. This order type can activate a limit order to buy or sell a security when a specific stop price has been met.2For example, imagine you purchase shares at $100 and expect the stock to rise. You could place a stop-limit order to sell the shares if your forecast was wrong. If y...

Features

How Does It Work?

- Two prices are provided for Stop-Limit Order. When you see that a particular stock is trading in the market and you feel that the stock price will rise in the future, then you tend to buy it. You just can’t buy it at any price; then, it may happen that you are buying it at a price that will not give you enough margin during the sell and you will en...

When to Use Stop-Limit Order?

- In Bulk trading, especially for Mutual FundsMutual FundsA mutual fund is a professionally managed investment product in which a pool of money from a group of investors is invested across assets such as equities, bonds, etcread more and Institutional InvestorsInstitutional InvestorsInstitutional investors are entities that pool money from a variety of investors and indivi…

Example of Stop-Limit Order

- Alibaba Group Holdings is trading in NYSE at $200. Say an HNI is planning to buy 100,000 shares of Alibaba. The HNI thinks that the share price will increase, but he is not so sure about this. So he has planned to start buying the shares if it shows movement and reaches $205. So for this, he will have to put a stop order at $205. Now it may happen that the share price after reaching $205 sta…

Risk

- In case of highly volatile stocks, say you have put a Stop price and a limit price. It may happen that the Stop price will be triggered, and due to high volatility, it will cross the limit price too quickly; this, in turn, will leave you with a partially filled order or with no fill order.

Benefits

- Helps to execute order only at favorable prices

- Helps to break the trade and hence too much SELL/BUY pressure is avoided

Drawbacks

- Price may move too quickly, and order may not be fulfilled at all

- Favorable price may not return ever

Conclusion

- A stop-limit order is very helpful if your prediction is correct. There are several scenarios where this order never gets triggered or fulfilled. So it requires precise judgment and prediction to place this order.

Recommended Articles

- This has been a guide to what is Stop Limit Order. Here we discuss the features and example of a stock limit order, how does it work along with its risk and drawbacks. You can learn more about finance from the following articles – 1. What is Short Selling? 2. Position Trading 3. Algorithmic Trading 4. Pre-Market Trading