A redemption agreement sometimes called a stock redemption agreement, is a legally binding agreement between shareholders of a company. It allows parties to specify the terms in which they may buy, sell, or transfer shares of a company. These agreements may include partners, shareholders, or LLC members.

Full Answer

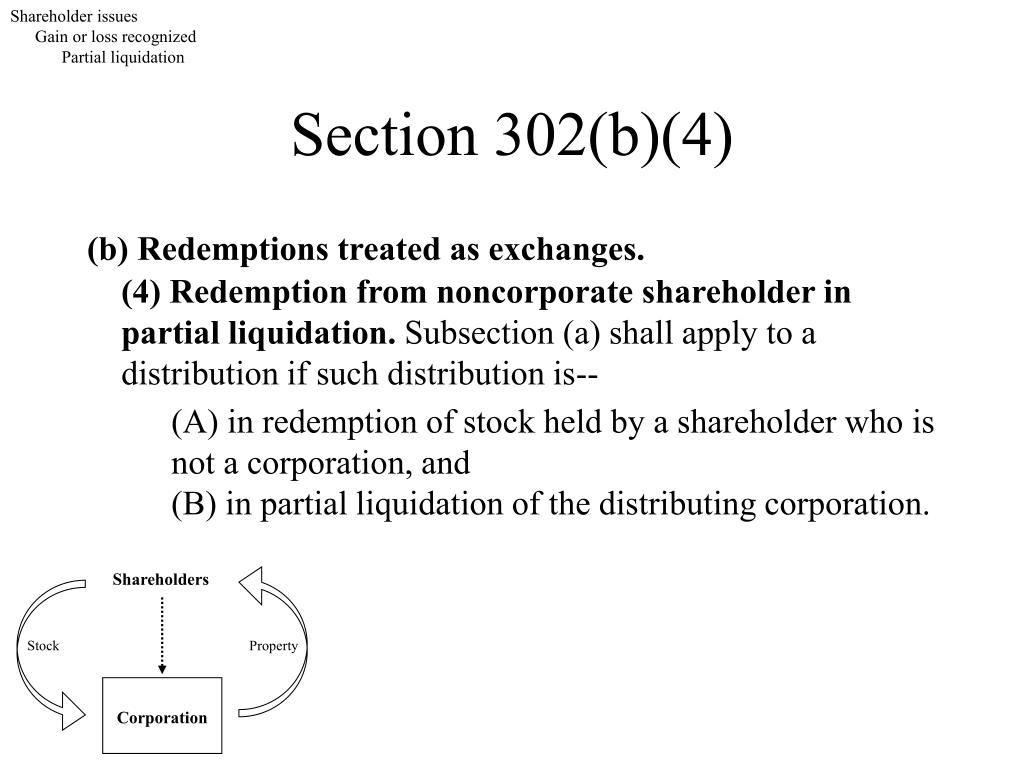

When are redemptions are treated as dividends?

A redemption agreement sometimes called a stock redemption agreement, is a legally binding agreement between shareholders of a company. It allows parties to specify the terms in which they may buy, sell, or transfer shares of a company. These agreements may include partners, shareholders, or LLC members. A redemption agreement is one of two most common buy and …

What is a repurchase agreement example?

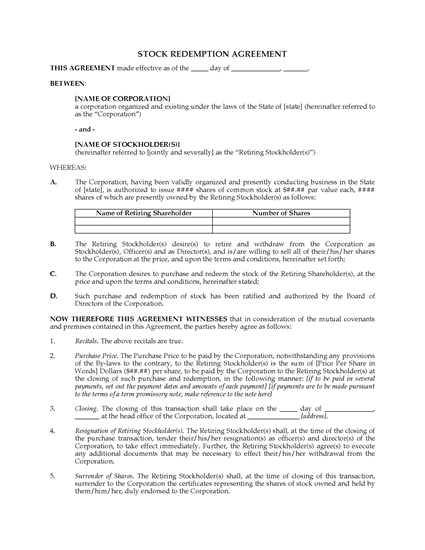

Stock-redemption agreements are a type of buy and sell agreement between a corporation and a stockholder, designed to protect investors and the business from ending up in an unfavorable position. It outlines how shares will be reassigned and the specific redemption rights of each party in the event of an owner leaving the business.

What does redemption of shares mean?

STOCK REDEMPTION AGREEMENT . This Stock Redemption Agreement (this “Agreement”) is made effective as of June 30, 2008 (the “Effective Date”), by and among Noble Manufacturing Group, Inc., a Michigan corporation (“Noble Manufacturing”), Noble International, Ltd., a Delaware corporation (“Noble International”) (each is individually referred to as “Seller”, and …

What is a legal purchase agreement?

A stock redemption agreement is an agreement between a shareholder and a corporation for the corporation to repurchase that shareholder’s stock, effectively buying out the shareholder. Upon the buy-out, the shares are then absorbed back into the corporation’s authorized shares, but are thereafter considered to be unissued.

Why do we need a stock redemption agreement?

Stock-redemption agreements are a worthwhile consideration for any parties involved in acquiring shares in a business, to protect the shareholder and to keep the company intact. They detail the process in which the stockholder can be bought out in the event of death, retirement, disability, or other forms of incapacitation. Lawyers will need to draft the legally binding document, following a set structure and using legal terminology to ensure it holds up and that both parties receive the agreed stock redemption.

What warranty does a corporation have on stock redemption?

Corporation Warranties: Similarly, the corporation will provide a warranty that the redemption agreement will not conflict with any other laws or contracts in place that could restrict the redemption of stock.

What is a stockholder warrant?

Shareholder Warranties: The stockholder will provide assurance that they are the sole owner of the stocks in the discussion by providing appropriate transfer and release documentation. This prevents any potential conflict.

What is acceptance at the end of a document?

Acceptance: At the end of the document, there will be an acceptance which requires a signature from both parties to agree to the terms and conditions.

Who initiates a contract?

Most transactions start with one party submitting a letter of intent to the other detailing their request. Both the buyer and seller can initiate drafting the contract, but it is usually the buyer, as they benefit most from the protection covered by the contract.

What is severability in a contract?

Severability: This section explains that if any of the agreement is proven to be invalid, all other sections of the document are upheld and remain legally binding.

How does a stock redemption plan work?

In a stock redemption plan funded by life insurance, each business owner is party to an agreement where the business purchases a life policy on the life of each business owner in an amount equaling their ...

What is a buy sell agreement?

A stock redemption or entity buy-sell agreement is a binding agreement that is implemented by the owner’s of a business to facilitate the orderly transition of a business interest in the event of the death, disability or retirement of a business owner. With a stock redemption plan, the company agrees to purchase the interest ...

What happens when you buy a deceased owner's shares?

Once a deceased owner’s shares are purchased, the remaining owner’s do not receive an increase in their cost basis for tax purposes. Effective use of a properly funded entity buy-sell agreement will assure an efficient transition for your business. Without an established funded plan, your business will experience significant costs ...

What is an entity agreement?

The entity agreement outlines the terms of the sale and establishes a formula for determining the actual sales price of the stock based on the company’s valuation. It also obligates the company to purchase the departing owner’s shares while at the same time mandating that the departing owner or her heirs sell their business interest back to ...

Is a stock redemption tax deductible?

Tax issues with stock redemption plans include: Life insurance policy premiums are not tax deductible to the business. Any death benefit proceeds received by the business are generally received income tax free. If the business is properly valued, the value defined in the buy-sell may likely be binding when calculating the estate tax value ...

Why is it important to have a redemption agreement?

Carefully drafted Redemption Agreements can guard the remaining members against being burdened with untested or unknown successors and can minimize the potential for disputes and stress among the co-owners caused by the uncertainty of a departing owner . However, these types of agreements should be periodically reviewed for feasibility. For example, feasibility is important to ensure that the company has sufficient funding to redeem the shares – and also for practicality, to confirm that the terms and conditions still meet the owners’ and company’s needs and objectives.

What is transfer or ownership interest?

Likewise, a Transfer or ownership interest agreement generally provides that a departing owner must transfer his or her ownership interest to designated individuals or entities. Redemption Agreements generally address who can purchase or redeem the departing owner’s interest and the price-or method to determine the price-of such interest.

Why is the redeemed shareholder denied the sole shareholder beneficial tax treatment?

Because the redeemed shareholder held 100% of the stock both before and after the redemption , the Court denied the sole shareholder beneficial tax treatment. The Court also made clear that the business purpose of pro rata distributions is irrelevant in this determination.

What is the letter ruling 201918009?

75-502 discuss the before-and-after stock percentages held by the redeemed shareholder in their analyses. However, in Letter Ruling 201918009 the IRS merely states that the shareholder's ownership was reduced, with no explicit reference to whether the reduction was meaningful. Instead, taxpayers are left to ponder the significance of a diverse list of facts surrounding the transaction itself, none of which have much to do with the shareholder's economic interest in the redeeming corporation.

Is a redemption an isolated transaction?

First, the IRS makes two key points: The redemption was an isolated transaction, and no other shareholder is obligated to purchase any of the redeemed stock. These factors imply that the redemption was not made pursuant to an overall plan, and no other shareholders were redeemed simultaneously.

Is a redemption a capital loss?

If the redemption would result in a loss on the stock, it is a capital loss, so the IRS may consider recharacterizing the transaction as essentially equivalent to a dividend to reach its desired result: the less tax-favorable ordinary loss.

Does a redeemed shareholder receive notes?

Second, the IRS noted the redeemed shareholder received fair market value for his stock and will not receive notes or other obligations from the redeeming corporation. By including these factors in its analysis, the IRS indicated that the type of consideration received by the redeemed shareholder is important in determining whether a redemption is essentially equivalent to a dividend. In Rev. Proc. 2019-3, the IRS stated that it will no longer issue rulings concerning whether Sec. 302(b) applies when the consideration received by a redeemed shareholder consists of the redeeming corporation's promise to pay that is based either on future earnings or notes payable secured by the shareholder's stock.

What is the advantage of redeemable shares?

One advantage of issuing redeemable shares is that it gives a company flexibility if they choose to buy back shares at a later date.

What is a repurchase of stock?

Repurchases are when a company that issued the shares repurchases the shares back from its shareholders. During a repurchase or buyback, the company pays shareholders the market value per share. With a repurchase, the company can purchase the stock on the open market or from its shareholders directly. Share repurchases are a popular method ...

Why do companies repurchase their stock?

A company may choose a repurchase over a redemption for several reasons. When the stock is trading below the call price of redeemable shares, the company can obtain the shares for a lower cost per share by buying them from shareholders through a stock repurchase. The company might offer, as an incentive, to repurchase the shares at a higher price than the current market, but below the call price of the redeemable shares. When a company enacts a redemption, the call price will typically be at or above the current market price, otherwise shareholders could incur a loss.

What is the call price for a preferred stock?

A company has issued redeemable preferred stock with a call price of $150 per share and has chosen to redeem a portion of them. However, the stock is trading at $120 in the market. The company's executives might choose to repurchase the shares rather than pay the $30-per-share premium associated with the redemption. If the company is unable to find willing sellers, it can always use the redemption as a fallback.

How does the number of shares affect the stock price?

The number of outstanding shares can also affect the stock price. A reduction in shares would lead to an increase in the share price due to the smaller supply now available.

Why do you buy shares?

Another reason to purchase shares is to regain majority shareholder status, which is obtained by owning more than 50% of the outstanding shares. A majority shareholder can dominate voting and exercise heavy influence over the direction of the company.

Why is the amount of shares traded in the secondary market always a concern for a corporation?

The amount of shares trading in the secondary market is always a concern for a corporation. This is so because the amount affects the earnings per share (EPS). EPS is an indicator of a company's profitability. Reducing the amount of outstanding stock on the secondary market increases the EPS and therefore the corporation appears more profitable.