A moat is a business’s economic protection from competitors. It can be hard to find an economic moat when you are searching for the best stocks to buy for long-term returns. The best moat stocks are likely to continue to generate high returns, even when the overall economy isn’t performing well.

What does moat mean in stocks?

With regard to all the focus given to the particular argument that the stock market is within a bubble, it is very important point out that not everyone shares that view. In purchase to be effective, a business must have a definite moat, aka a competing advantage that allows it to sustain pricing power in addition to better than average profit margins.

Does that company have a moat?

6 hours ago · MOAT, which follows the Morningstar Wide Moat Focus Index, is the premier exchange traded fund emphasizing wide moat equities. The strategy is relevant at a time of broader market weakness.

What does moat mean in terms of investing?

Oct 06, 2020 · Half a century’s worth of dividend increases is certainly a good indicator of a high-quality dividend growth stock, but it doesn’t necessarily mean the company has a strong moat. When assessing the quality of a company, try to look at a number of different factors (dividend streak, moat rating, debt/credit ratings, financial strength ...

What is the best stock on the market?

Wide Moat Stocks A company whose competitive advantages are strong enough to fend off competition and earn high returns on capital for 20 years or more has a wide moat. Name Ticker Price $ Market...

What does moat stand for?

MOATAcronymDefinitionMOATMissile on Aircraft TestMOATMother of All TripsMOATMicrocircuit Obsolescence Analysis ToolMOATMember Officer Advisor Training6 more rows

Is moat a good investment?

From an investor's view, it is ideal to invest in growing companies just as they begin to reap the benefits of a wide and sustainable economic moat. In this case, the most important factor is the longevity of the moat. The longer a company can harvest profits, the greater the benefits for itself and its shareholders.

What is an example of a moat?

Common economic moats include patents, brand identity, technology, buying power and operational efficiency.Oct 1, 2019

What does narrow moat mean in stocks?

A narrow economic moat is when a firm commands only a slight competitive advantage over competing firms operating in the same or similar type of industry.

Is moat a good ETF?

The MOAT ETF outperformed the S&P 500 in the last decade. We can also consider MOTI or GOAT as potential alternatives to MOAT as the US stock market is extremely overvalued, increasing the risks of setbacks. An economic moat is an important aspect for every long-term investor.Dec 9, 2021

How do I find a company's moat?

Finding Wide-Moat StocksEarnings Performance During Bad Economic Times. See whether the company still seems to be doing well, even when the broad economy is not. ... Cash on Hand. ... Revenues and Profits as Compared to Competitors. ... Dominance of a Single Product. ... Powerful Intellectual Property. ... Name Recognition.

Which companies have the best moats?

Step One: Wide-moat stocks with 5-star and 4-star ratingsCompany NameTickerGuidewire Software IncGWREIntel CorpINTCKellogg CoKLockheed Martin CorpLMT34 more rows•Jan 6, 2022

How do you make a moat?

Companies can build moats by strengthening their brands, achieving economies of scale, or even lobbying for special status from the government. In return, they can receive customer loyalty, pricing power, and legal protections that make it difficult for other companies to compete with them.Jun 23, 2021

Does Target have a moat?

One of the best indicators that a company has a strong moat is if it has a higher gross margin than its competitors. Target has an extremely high gross margin compared to Wal-Mart ( WMT -0.37% ) and Costco ( COST -0.47% ). Data source: 2016 Target annual report.Jun 29, 2017

What is a Morningstar moat?

The Morningstar Economic Moat Rating represents a company's sustainable competitive advantage. A company with an economic moat can fend off competition and earn high returns on capital for many years to come.Jan 26, 2016

What is Morningstar wide moat?

The Morningstar Wide Moat Focus Index tracks companies that earn Morningstar Economic Moat Ratings of wide and that are trading at the lowest current market price to fair value.Jan 11, 2022

Why is the Moat important?

The term economic moat, popularized by Warren Buffett, refers to a business' ability to maintain competitive advantages over its competitors in order to protect its long-term profits and market share from competing firms. Just like a medieval castle, the moat serves to protect those inside the fortress and their riches from outsiders.

Why do companies have moats?

Some of the reasons a company might have an economic moat are more difficult to identify. For example, soft moats may be created by exceptional management or a unique corporate culture. While difficult to describe, a unique leadership and corporate environment may partially contribute to a corporation's prolonged economic success.

What would happen if a lemonade company was a public company?

In this case, if your lemonade company was a public firm, your common stock would probably outperform that of your competition in the long run. As you can see, a company's economic moat represents a qualitative measurement of its ability to keep competitors at bay for an extended period of time.

What is a competitive advantage?

Remember that a competitive advantage is essentially any factor that allows a company to provide a good or service that is similar to those offered by its competitors and, at the same time, outperform those competitors in profits. A good example of a competitive advantage would be a low-cost advantage, such as cheap access to raw materials. Very successful investors such as Buffett have been adept at finding companies with solid economic moats but relatively low share prices .

What are the basic tenets of modern economics?

One of the basic tenets of modern economics, however, is that, given time, competition will erode any competitive advantages enjoyed by a firm.

Why are economic moats so difficult to express quantitatively?

Economic moats are difficult to express quantitatively because they have no obvious dollar value, but are a vital qualitative factor in a company's long-term success or failure and in the selection of stocks.

How does being big affect a company?

At a certain size, a firm achieves economies of scale. This is when more units of a good or service can be produced on a larger scale with lower input costs. This reduces overhead costs in areas such as financing, advertising, production, etc. Large companies that compete in a given industry tend to dominate the core market share of that industry, while smaller players are forced to either leave the industry or occupy smaller "niche" roles.

What is economic moat?

Key Takeaways. An economic moat is a distinct advantage a company has over its competitors which allows it to protect its market share and profitability. It is often an advantage that is difficult to mimic or duplicate (brand identity, patents) and thus creates an effective barrier against competition from other firms.

Why do companies need an economic moat?

Which is why a business that intends to remain dominant has to establish an economic moat. Economic moat describes a company's competitive advantage derived as a result of various business tactics that allow it to earn above-average profits for a sustainable period of time.

What are intangible assets?

An intangible asset, such as a company crafting a well-known brand name (Nike), pricing power edge (Apple), cost advantages (Walmart), making it costly for customers to switch products (cell phone companies), efficient scale, and network effects are all advantages that businesses can utilize to create a wide economic moat .

Who is Akhilesh Ganti?

Akhilesh Ganti is a forex trading expert who has 20+ years of experience and is directly responsible for all trading, risk, and money management decisions made at ArctosFX LLC. He has earned a bachelor's degree in biochemistry and an MBA from M.S.U., and is also registered commodity trading advisor (CTA).

What is product moat?

Product moat is when a company has a product with a significant market share. There is very little a competition can do about it. As an example, Pidilite in India’s adhesive market has a market share of around 70%. The company has a MOAT for the product. There s very little competition can do to disrupt its position.

Why do companies need a moat?

So a moat allows the company to keep growing for a very long period and continue to gain market share to increase profitability. In the dictionary, a moat means a deep and broad dug that surrounds and protects a castle. Similarly, Moat in business is the advantage one has over the competition.

Who coined the term "moat"?

Understand the term coined by Warren Buffett MOAT in its true sense and then invest in companies that have significant MOAT compare to its competition. If you are in equity markets and follow Warren Buffett , you are more likely to have heard the line.

Does Amazon have a moat?

Similarly, Amazon India has a moat for itself because of the size and scale of the operations of the company. Consider DMart or Avenue Supermarts, which can generate such a volume of sales that they can negotiate the lowest prices from its vendors, resulting in low-cost products in stores. Size does matter.

Is a company with a license to do a specific type of business considered a MOAT?

Similarly, a company having a license to do a specific type of business can be considered a MOAT as well. A company with a license to serve electricity, gas to its customers in a geographic region is a MOAT. However, in India, because the charges are fixed. So it doesn’t allow companies to provide premium services.

Does Maruti Suzuki have a MOAT?

The company has a MOAT for the product. There s very little competition can do to disrupt its position. Similarly, Maruti Suzuki has a market share of 51% in the India car segment. It means every other car sold in the Indian market is from Maruti.

Every Wide Moat Stock in the USA

Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

50 US Wide Moat Stocks From Morningstar Quantitative Ratings

OK, now that I’ve got my warning out of the way, here are the remaining wide moat stocks using Morningstar’s quantitative ratings.

3 Additional Resources

Besides the other articles in my wide moat series, here are three additional resources you might find helpful.

Transparency is our policy. Learn how it impacts everything we do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

How we make money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

How we use your personal data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

How we approach editorial content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view.

What is a company's moat?

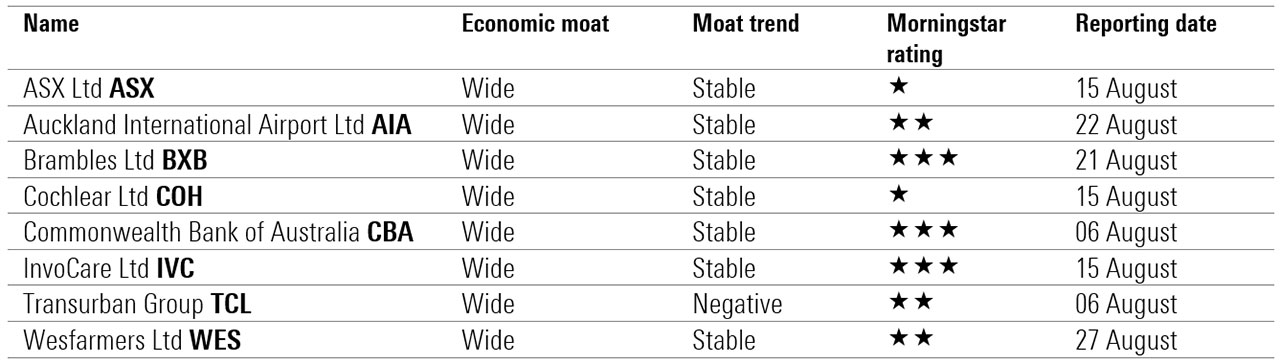

A company whose competitive advantages we expect to last more than 20 years has a wide moat; one that can fend off their rivals for 10 years has a narrow moat; while a firm with either no advantage or one that we think will quickly dissipate has no moat.

What is the Moat Trend Rating?

Morningstar also assigns a Moat Trend rating of positive, stable, or negative, depending on whether a company’s sources of moat are growing stronger or getting weaker. The Morningstar Economic Moat Rating can help you uncover companies that will provide superior long-term returns.

What is Morningstar economic moat rating?

The Morningstar Economic Moat Rating represents a company's sustainable competitive advantage. A company with an economic moat can fend off competition and earn high returns on capital for many years to come. The Morningstar Economic Moat Rating represents a company's sustainable competitive advantage. A company with an economic moat can fend ...

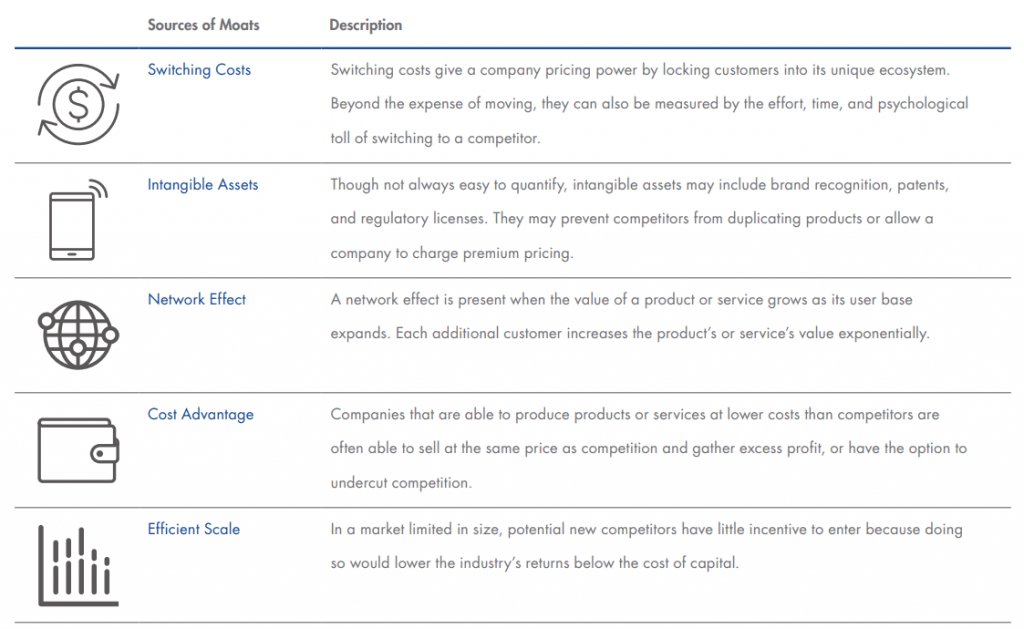

What is switching cost?

Switching costs are those obstacles that keep customers from changing from one product to another. The network effect occurs when the value of a good or service increases for both new and existing users as more people use that good or service.

What are intangible assets?

Intangible assets are things such as patents, government licenses, and brand identity that keep competitors at bay. A company with a cost advantage can produce goods or services at a lower cost, allowing them to undercut their competitors or achieve higher profitability.

What Is An Economic Moat?

Understanding An Economic Moat

Illustrative Example

- A company with a wide moat is likely worth investing in. It is often profitable in both good times and bad, and can bounce back after bad news. It's likely also dominant in its field. Knowing where to find firms with wide moats and how to invest in their stocks can be a key part of building a strong portfolio.

Creating An Economic Moat

What Is An Economic Moat?

- Remember that a competitive advantage is essentially any factor that allows a company to provide a good or service that is similar to those offered by its competitors and, at the same time, outperform those competitors in profits. A good example of a competitive advantage would be a low-cost advantage, such as cheap access to raw materials. Very successful investors such as …

Understanding An Economic Moat

- Let's return to the example of a low-cost advantage. Suppose you have decided to make your fortune by running a lemonade stand. You realize that if you buy your lemons in bulk once a week instead of every morning, you can reduce your expenses by 30%, allowing you to undercut the prices of competing lemonade stands. Your low prices lead to an increase in the number of cust…

Sources of Economic Moats

- There are several ways in which a company creates an economic moat that allows it to have a significant advantage over its competitors. Below, we will explore some different ways in which moats are created.