Important Disclaimer

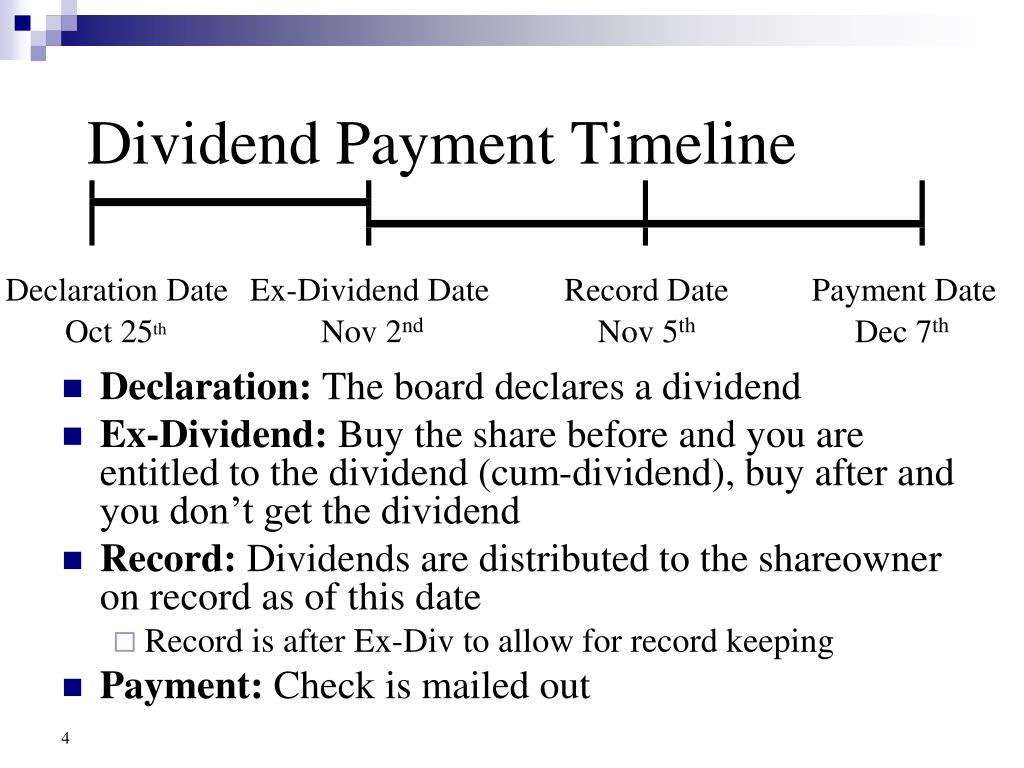

| Date | Dividend Date |

| July 5th | Date of Declaration |

| August 5th | Ex-Dividend Date |

| August 7th | Date of Record |

| September 7th | Payment Date |

How to find dividend date?

- COMPANY NAME

- Bectors Food

- HICS Cements

- Mishtann Foods

- Nureca

- Natco Pharma

- Panchsheel Org

- Platinumone

- Taparia Tools

- Manappuram Fin

What does dividend ex date mean?

In order to be eligible to receive a company’s dividend, shareholders must own the stock prior to the ex-dividend date—in this case, Friday. Shareholders who own EVT as of the end of Thursday’s session are eligible to receive the $0.1626 dividend ...

How does dividend affect share price?

- Liquidity. For paying the dividend, a firm will require access to funds. …

- Repayment of Debt. Companies having a high load of interest-bearing debts may be hesitant to pay dividends. …

- Stability of Profits. …

- Control. …

- Legal Considerations. …

- Inflation. …

- Likely effect of the declaration and quantum of dividend on market prices.

- Other Factors. …

When is Xom next dividend?

When Is XOM Next Dividend Date? It will commence trading ex-dividend on November 10, 2021 for xxon Mobil Corporation (XOM). On December 10, 2021, shareholders will get a cash dividend of $0.88 per share. If you bought XOM before the ex-dividend date, you’re eligible to get the dividend payout in cash today.

How long do you have to hold a stock to get the dividend?

Briefly, in order to be eligible for payment of stock dividends, you must buy the stock (or already own it) at least two days before the date of record and still own the shares at the close of trading one business day before the ex-date.

What is the purpose of ex-dividend date?

The ex-dividend date, or ex-date for short, is one of four stages that companies go through when they pay dividends to their shareholders. The ex-dividend date is important because it determines whether the buyer of a stock will be entitled to receive its upcoming dividend.

Do you have to hold stock after ex-dividend date?

The ex-dividend date is the first day of trading in which new shareholders don't have rights to the next dividend disbursement. However, if shareholders continue to hold their stock, they may qualify for the next dividend. If shares are sold on or after the ex-dividend date, they will still receive the dividend.

Should I buy before or after ex-dividend?

If you own a stock and want to make sure you get the next dividend payment, don't sell the stock until the ex-dividend date or later. If you buy a stock and want to make sure you get the next dividend payment, buy the stock before the ex-dividend date.

Will I get dividend if I buy on ex-date?

If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend.

What happens if I sell my shares after ex-dividend date?

Investors who sell after the ex-dividend date will receive the current dividend payment but won't receive future payments unless they buy shares again before the next ex-dividend date for the next payment.

Why do stock prices fall on ex-dividend date?

After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Dividends paid out as stock instead of cash can dilute earnings, which can also have a negative impact on share prices in the short term.

Can I sell a stock on the record date and still get the dividend?

Record Date Selling. While it is possible to sell company stock one day before the record date and still receive the dividend, the loss on the stock will probably equal or exceed the dividend amount.

What is an ex-dividend date?

A stock's ex-dividend date, or "ex-date," is the first trading day where an upcoming dividend payment is not included in a stock's price. In order to receive that dividend, investors must purchase shares before the ex-dividend date.

How long after the ex dividend date is the stock paid?

For stocks, the date of record is always two trading days after the ex-dividend date. Pay date: This is the date when the dividend is actually paid to shareholders, and is generally several days (or even weeks) after the date of record.

When will Wells Fargo stock drop?

In order for a shareholder to be eligible to receive the dividend payment, he or she must own shares as of May 3 or earlier. On May 4, Wells Fargo's stock price can be expected to drop by approximately $0.38, in addition to any price drop or increase that occurs as a result of market activity.

Do you get dividends if you buy before the ex dividend date?

Investors who buy shares before the ex-dividend date are entitled to the upcoming dividend payment, while those who acquired shares on or after this date are not. From a seller's perspective, as long as you sell your shares on or after the ex-dividend date, you'll still receive the next dividend, whether or not you own shares when it is actually ...

What is ex dividend date?

The procedures for stock dividends may be different from cash dividends. The ex-dividend date is set the first business day after the stock dividend is paid ...

What happens if you buy stock on ex-dividend date?

If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend. Here is an example: Declaration Date. Ex-Dividend Date.

How long after dividend is paid is the ex-dividend date deferred?

In these cases, the ex-dividend date will be deferred until one business day after the dividend is paid.

What is the record date of a dividend?

They are the "record date" or "date of record" and the "ex-dividend date" or "ex-date.". When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend.

When does XYZ declare dividends?

Tuesday, 10/3/2017. On September 8, 2017, Company XYZ declares a dividend payable on October 3, 2017 to its shareholders. XYZ also announces that shareholders of record on the company's books on or before September 18, 2017 are entitled to the dividend. The stock would then go ex-dividend one business day before the record date.

When can you sell stock without being obligated to deliver additional shares?

Thus, it is important to remember that the day you can sell your shares without being obligated to deliver the additional shares is not the first business day after the record date, but usually is the first business day after the stock dividend is paid .

What is an ex dividend?

Ex-dividend describes a stock that is trading without the value of the next dividend payment. The ex-dividend date or "ex-date" is the day the stock starts trading without the value of its next dividend payment. Typically, the ex-dividend date for a stock is one business day before the record date, meaning that an investor who buys ...

What happens if you buy stock on ex-dividend date?

Since buyers aren't entitled to the next dividend payment on the ex-date, the stock will be adjusted lower by the amount of dividend by the exchange. 1. When a company decides to declare a dividend, its board ...

What is the declaration date?

Declaration date: The declaration date, also known as the announcement date, is the date when a company's board of directors announces a dividend distribution. This is an important date, as any change in the expected dividend payment can cause the stock to rise or fall quickly as traders adjust to new expectations.

When did Walmart pay dividends?

The payment went to shareholders who had purchased Walmart stock prior to the ex-date of December 5, 2019. The company had previously declared the dividend on February 19, 2019, and the record date was set as December 6, 2019. 2 Only shareholders who had purchased Walmart stock prior to the ex-date were entitled to the cash payment.

Why does an ex-date occur before the record date?

The ex-date occurs before the record date because of the way stock trades are settled. When a trade occurs, the record of that transaction isn't settled for one business day. This is known as the " T+1 " settlement.

Should I buy a stock before the ex-date?

However, because the price of the stock drops by about the same value of the dividend, buying a stock right before the ex-date shouldn't result in any profits.

Can a stock drop if it has a dividend?

On average, a stock can be expected to drop by a little less than the dividend amount. Given that stock prices move on a daily basis, the fluctuation caused by small dividends may be difficult to detect. The effect on stocks from larger dividend payments can be easier to observe.

What is ex dividend date?

The ex-dividend date is an investment term that determines which stockholders are eligible to receive declared dividends. When a company announces a dividend, the board of directors. Board of Directors A board of directors is a panel of people elected to represent shareholders.

How long before the ex dividend date?

The U.S. Securities and Exchange Commission sets the ex-dividend date to one day before the record date, so that buy and sell information is captured before the record date. The time difference between the dividend record date and ex-dividend date allows the necessary time to prepare paperwork and electronic records.

What is dividend declaration date?

The dividend declaration date is the date when the board of directors announces that they will pay a dividend to shareholders. Stockholders Equity Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus. . Most often, the company will issue a press release and/or publish ...

What happens if a buyer purchases company shares before the ex-dividend date?

If a buyer purchases company shares before the ex-dividend date, the buyer is entitled to receive the dividend payments. This is because the buy information is submitted to the transfer agent before the record date. The company will count the buyer as one of the existing shareholders. In the event that the buyer purchases the shares after ...

What is dividend in stock market?

Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend. . The ex-dividend date is determined based on a stock exchange’s rules ...

When did XYZ pay dividends?

On April 10, 2018, Company XYZ announced dividend payouts to its shareholders. The company announced the dividend payment date to be June 10, 2018. The date of record for shareholders captured on the company’s books is Monday, April 30, 2018. This means the ex-dividend date, one business day before the record date, will be Friday, April 27, 2018. The announcement includes the following important dates:

Can a buyer receive dividends if he purchases shares after the record date?

The company will count the buyer as one of the existing shareholders. In the event that the buyer purchases the shares after that date, the buy information will not be submitted to the transfer agent before the record date. They will therefore not be entitled to receive dividends.

What is the ex dividend date?

What is the Ex-Dividend Date? Ex-dividend date is the date till which the investor has to complete his purchase of the underlying stock to get the eligible dividend on the date listed for dividend payment and such date is generally decided as per the rules of stock exchange which says that it should occurs one business day prior to record date.

What happens if you buy stock before the ex dividend date?

If you purchase the stock on or after this date, you will not receive the dividend.

What is a declaration date?

Declaration Date – The day the company reports its earnings, they also “declare” their cash dividend. Cash Dividend Cash dividend is that portion of profit which is declared by the board of directors to be paid as dividends to the shareholders of the company in return to their investments done in the company.

How long does it take to settle a stock on August 20, 2017?

However, the settlement period is for 3 days. So to be on record date by August 20, 2017, one has to buy shares 3 days before the record date. This date is termed as “cum-dividend date.”. In the above example, the “cum-dividend date” is August 17, 2017.

When does Steward Financial Corp start trading?

We see in the above image that Steward Financial Corp will start trading ex-dividend on July 31, 2018.

Can you receive dividends if you buy stock before the ex-dividend date?

If the purchase of the stock is made on or after its ex-dividend date, that particular stockholder is not liable to receive any dividend benefits. While, if the purchase of stock is made before the ex-dividend date, the buyer of the stock is eligible to receive the announced dividend.

What is an ex dividend date?

The ex-dividend date is the date that a stock begins trading absent of the value of its next dividend payout. Stocks that are sold on or after this date are considered to be ex-dividend. So an investor who buys the stockon the ex-date or after wouldn’t be able to receive any upcoming dividend.

Why do you need to know the ex dividend date?

It’s important to know the ex-dividend date before you invest to ensure that you’ll receive a dividend payment. In simple terms, the ex-dividend date marks the end of a cutoff period in which you can purchase ...

Can dividends be used for retirement?

If you’re close to retirement or already retired, for instance, you may rely on dividend payouts from stocks you own to supplement withdrawals from a 401(k) or Social Security benefits.

Can you buy shares after the ex dividend date?

If you happen to buy shares on or after the ex-dividend date, you won’t get the dividend payment for that period. But remember that you can benefit from future dividend payments as long as you’re on the company’s books as a shareholder. Tips for Investing.

What is the ex dividend date?

In order to capture or receive a dividend, investors must own a stock, ETF or mutual fund before a certain date. This is called the ex-dividend date. Holding a stock- through settlement- before... In order to capture or receive a dividend, investors must own a stock, ETF or mutual fund before a certain date. This is called the ex-dividend date.

What happens if you buy a stock before the ex-dividend date?

In a nutshell, if you buy a dividend stock before the ex-dividend date, then you will receive the next upcoming dividend payment. If you purchase the stock on or after the ex-dividend date, you will not receive the dividend.

What happens if ABC pays out dividends?

Payment Date. On the actual ex-dividend date, the stock will drop by the amount of the dividend, so if stock ABC is paying out a dividend or $0.30 per share, its stock price will generally fall by that amount. Note that depending on how the market moves on that particular day the latter point does not always hold.

What Is ex-dividend?

Understanding Ex-Dividend

- A stock trades ex-dividend on and after the ex-dividend date (ex-date). If a trader purchases a stock on its ex-dividend date or after, they will not receive the next dividend payment. Since buyers aren't entitled to the next dividend payment on the ex-date, the stock will be adjusted lower by the amount of dividend by the exchange.1 When a company decides to declare a dividend, its board …

Example of Ex-Dividend

- For example, Walmart (WMT) paid $0.53 per share dividend on Jan. 2, 2020. The payment went to shareholders who had purchased Walmart stock prior to the ex-date of Dec. 5, 2019. The company had previously declared the dividend on Feb. 19, 2019, and the record date was set as Dec. 6, 2019.2Only shareholders who had purchased Walmart stock prior to the ex-date were ent…

Other Considerations

- On average, a stock can be expected to drop by a little less than the dividend amount. Given that stock prices move on a daily basis, the fluctuation caused by small dividends may be difficult to detect. The effect on stocks from larger dividend payments can be easier to observe. If a company issues a dividend in stock instead of cash (or the cash dividend is 25% or more of the …

Key Dividend-Related Dates

- The ex-dividend date is surrounded by other important dates in the dividend distribution process. 1. Declaration date: The declaration date, also known as the announcement date, is the date when a company's board of directors announces a dividend distribution. This is an important date, as any change in the expected dividend payment can cause the stock to rise or fall quickly as trade…