Key Takeaways

- A stock buyback occurs when a company buys outstanding shares of its own stock with excess cash or borrowed funds.

- A buyback increases the value of outstanding shares. ...

- One alternative is to pay dividends to investors. ...

- A poorly timed buyback, like when the share price is overvalued, may prove detrimental.

Full Answer

Are stock buybacks a good thing or not?

Mar 09, 2022 · A stock buyback is when a public company uses cash to buy shares of its own stock on the open market. A company may do this to return money to shareholders that it doesn’t need to fund operations...

Does a stock buyback affect the share price?

Jan 12, 2022 · A stock buyback (also known as a share repurchase) is a process when a company buys back its shares from the marketplace, therefore reducing the number of shares that are outstanding. Because there are fewer shares on the market, the value of each share increases, making each investor’s stake in the company greater.

How does stock buy back benefit a large corporation?

Dec 17, 2019 · A stock buyback is when the company that issued the stock in the first place decides to buy back a number of shares from its shareholders. When there are fewer total shares on the market, the value of each share typically appreciates thanks …

What happens when company buys back shares?

What is a stock buyback? In a stock buyback, a publicly traded company reacquires its own shares, reducing the number of shares trading. In terms of mechanics, a company buying back its shares is doing something similar to what investors and traders do every day: seek out willing sellers on the open market.

What does a stock buyback do?

What is a stock buyback and how does it create value? A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares outstanding. In effect, buybacks “re-slice the pie” of profits into fewer slices, giving more to remaining investors.Feb 24, 2022

Is stock buyback a good thing?

Are share buybacks good or bad? As with many things in investing, the answer isn't clear-cut. If the company genuinely has cash to spare, and its shares are arguably undervalued, then a buyback can be a good way to generate benefits for shareholders.Feb 17, 2022

Why would companies buy back stock?

Companies do buybacks for various reasons, including company consolidation, equity value increase, and to look more financially attractive. The downside to buybacks is they are typically financed with debt, which can strain cash flow. Stock buybacks can have a mildly positive effect on the economy overall.

Do I have to sell my shares in a buyback?

Companies cannot force shareholders to sell their shares in a buyback, but they usually offer a premium price to make it attractive.

Does share price increase after buyback?

Companies tend to repurchase shares when they have cash on hand, and the stock market is on an upswing. There is a risk, however, that the stock price could fall after a buyback. Furthermore, spending cash on shares can reduce the amount of cash on hand for other investments or emergency situations.

How does stock buyback affect shareholders equity?

On the balance sheet, a share repurchase would reduce the company's cash holdings—and consequently its total asset base—by the amount of cash expended in the buyback. The buyback will simultaneously shrink shareholders' equity on the liabilities side by the same amount.

How do you profit from stock buybacks?

In order to profit on a buyback, investors should review the company's motives for initiating the buyback. If the company's management did it because they felt their stock was significantly undervalued, this is seen as a way to increase shareholder value, which is a positive signal for existing shareholders.

What is a Stock Buyback?

A stock buyback (or share repurchasing) is when a company buys back its own stock, often on the open market at market value. Much like dividends, a...

Why would a company buy back its own stock?

Stock buyback greatly improves financial ratios, in particular the EPS (earnings per share), which investors use to estimate corporate value. Moreo...

How is stock buyback beneficial for investors?

Reducing the number of shares traded on the open market increases share price, leaving the remaining shareholders with a heftier chunk of the compa...

What are the downsides to share repurchases?

A stock buyback will often follow a successful period, meaning the company will have to buy its own stock at a higher valuation. For investors thou...

Why Would a Company Buy Back Its Shares?

Why Would a Company Buy Back Its Shares?Possible answers lie in another question: “What does a company do with its money?”Typically, there are a fe...

What Are Some Potential Benefits of Share Buybacks for Investors?

What Are Some Potential Benefits of Share Buybacks for Investors?Because buybacks reduce the number of shares outstanding, investors effectively ow...

What Are Some Recent Stock Buyback Examples?

What Are Some Recent Stock Buyback Examples?Share buybacks gained attention in 2020 following reports that Warren Buffett’s Berkshire Hathaway (BRK...

Which Companies Are the Biggest Buyback Participants?

Which Companies Are the Biggest Buyback Participants?In recent years, large technology and financial companies have led the buyback parade.During t...

Why Are Buybacks Controversial, and What Potential Red Flags Can Investors Watch For?

Why Are Buybacks Controversial, and What Potential Red Flags Can Investors Watch For?Buyback announcements are often “well received” by the market,...

The Bottom Line on Buybacks

The Bottom Line on BuybacksBefore buying into buybacks, an investor should pore over a company’s recent financial statement and see how it stacks u...

What is a stock buyback?

A stock buyback (also known as a share repurchase) is a process when a company buys back its shares from the marketplace, therefore reducing the number of shares that are outstanding. Because there are fewer shares on the market, the value of each share increases, making each investor’s stake in the company greater.

How do stock buybacks work?

Simply put: stock buybacks improve a company’s financial ratios (used by investors to determine the value of a company). By repurchasing its stock, the company decreases its outstanding shares on the marketplace, without actually increasing its earnings.

Why would a company buy back its own stock?

In theory, a company with accumulated cash will pursue stock buybacks because it offers the best potential return for shareholders. Since the market is driven by supply and demand, if there are fewer shares available, the demand, i.e. the price, should go up.

How to make a buyback?

There are two ways companies conduct a buyback: a tender offer or through the open market.

How is stock buyback beneficial for investors?

Unlike cash dividends, stock buybacks do not offer an immediate, direct benefit to shareholders. However, investors do benefit from a company’s stock repurchase as the goal/outcome is generally to raise the company’s stock value. As fewer shares circulate on the market, the more a share is worth.

Downsides to share repurchases

There is some valid criticism about the fact that companies often repurchase their shares after a period of great financial success, typically at a time of high valuation. A company in that situation could end up buying its shares at a price peak, settling for fewer shares for its money, and leaving less in the reserve for when business slows.

Do stock payments benefit the economy?

Even though the primary impact of a stock buyback is to increase the value of that stock, there are numerous benefits to the economy at large. The data show that over half ( 56%) of US citizens now own stock at some capacity, whether it be via pensions, 401ks, or investment accounts, all of which benefit both from dividends and higher stock prices.

What is a stock buyback?

A stock buyback is exactly what it sounds like: The company that issued the stock in the first place decides to buy back a number of shares from its shareholders. This might also be called a share repurchase. The immediate effect of the buyback is a reduction of the total number of outstanding shares on the market.

Why do companies buy back their stock?

One of the most common reasons a company might do a stock buyback is simply to increase the value of each individual stock, especially if the company considers its shares undervalued. Increasing stock prices can send a stock chart’s trend line upward, making the asset look more attractive to new investors.

What is a buyback dividend?

A buyback can be used as an alternative to dividend payments to return cash to shareholders. This method of paying shareholders is typically more resilient to market fluctuations and recessions.

Is it easy to buy back stocks?

Just like almost everything else to do with the stock market, stock buybacks aren’t exactly simple. But once you understand the basics of how they work, you can feel more confident in making decisions about your own portfolio, whether that means participating in a tender offer or factoring in a recent buyback when evaluating whether a stock is worth purchasing.

What is a buyback in accounting?

Critics liken buybacks to an accounting gimmick or a form of financial alchemy because a buyback doesn’t really change a company’s fundamentals; it just changes the number of outstanding shares. In that way, a buyback is akin to a stock split.

Why are buybacks so attractive?

Because buybacks reduce the number of shares outstanding, investors effectively own a bigger piece of the company, Moors pointed out. “That’s one reason buybacks are attractive to investors,” he said. A buyback “effectively increases a company’s earnings per share, as earnings are distributed across fewer shares.”.

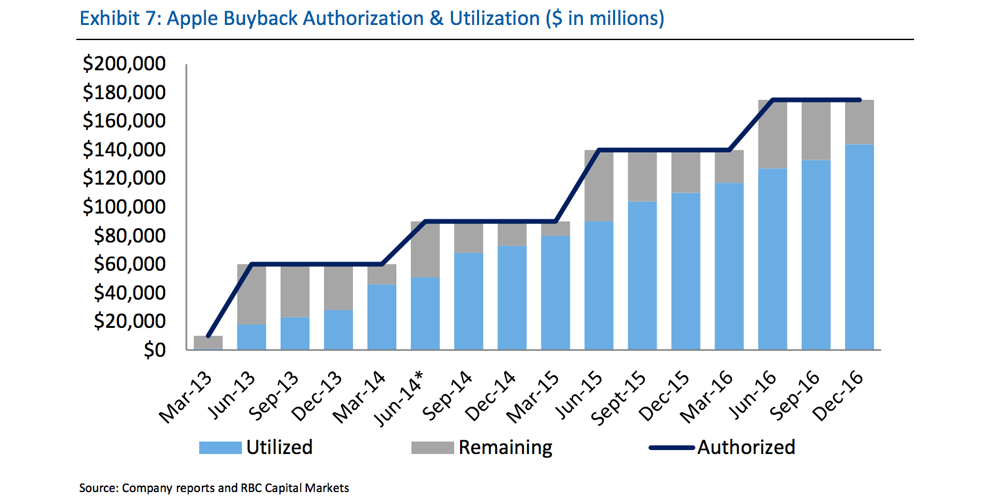

How much did Apple spend on share buybacks?

During the second quarter, Apple ( AAPL) spent $17.6 billion on share buybacks, the most among S&P 500 companies, according to S&P Dow Jones Indices. Apple was followed by T-Mobile ( TMUS) at $17.2 billion, Google parent Alphabet ( GOOGL) at $6.9 billion, and Microsoft ( MSFT) at $5.8 billion.

How to invest in a company?

Typically, there are a few choices: 1 The company could invest profits and cash back into the business through capital expenditures. 2 It could buy other companies, pay dividends to shareholders, or keep profits in a cash reserve. 3 The company could use its cash to buy back its own shares.

What is a stock buyback?

A stock buyback occurs when a company buys back its shares from the marketplace. The effect of a buyback is to reduce the number of outstanding shares on the market, which increases the ownership stake of the stakeholders. A company might buyback shares because it believes the market has discounted its shares too steeply, to invest in itself, ...

How is a buyback taxed?

Traditionally, a major advantage that buybacks had over dividends was that they were taxed at the lower capital-gains tax rate. Dividends, on the other hand, are taxed at ordinary income tax rates when received. 1 Tax rates and their effects typically change annually; thus, investors consider the annual tax rate on capital gains versus dividends as ordinary income when looking at the benefits.

How does a share buyback affect the balance sheet?

First, share buybacks reduce the number of shares outstanding. Once a company purchases its shares, it often cancels them or keeps them as treasury shares and reduces the number of shares outstanding in the process. Moreover, buybacks reduce the assets on the balance sheet, in this case, cash.

Why are stock options the opposite of repurchases?

Stock options have the opposite effect of share repurchases as they increase the number of shares outstanding when the options are exercised.

Why do shares shoot up when you buy back?

It is often the case, however, that the announcement of a buyback causes the share price to shoot up because the market perceives it as a positive signal.

How do companies return their wealth to shareholders?

There are several ways in which a company can return wealth to its shareholders. Although stock price appreciation and dividends are the two most common ways, there are other ways for companies to share their wealth with investors.

Does buyback increase ROA?

Moreover, buybacks reduce the assets on the balance sheet, in this case, cash. As a result, return on assets (ROA) increases because assets are reduced; return on equity (ROE) increases because there is less outstanding equity . In general, the market views higher ROA and ROE as positives.

What is a buyback in stock market?

A buyback is when a corporation purchases its own shares in the stock market . A repurchase reduces the number of shares outstanding, thereby inflating (positive) earnings per share and, often, the value of the stock.

Why do companies buy back shares?

Companies buy back shares for a number of reasons, such as to increase the value of remaining shares available by reducing the supply or to prevent other shareholders from taking a controlling stake .

Why is a corporation not required to repurchase shares?

A corporation is not obligated to repurchase shares due to changes in the marketplace or economy. Repurchasing shares puts a business in a precarious situation if the economy takes a downturn or the corporation faces financial issues it cannot cover.

What does a share repurchase do?

The share repurchase reduces the number of existing shares, making each worth a greater percentage of the corporation. The stock’s earnings per share (EPS) thus increases while the price-to-earnings ratio (P/E) decreases or the stock price increases.

How does a company fund a buyback?

A company can fund its buyback by taking on debt, with cash on hand, or with its cash flow from operations. An expanded share buyback is an increase in a company’s existing share repurchase plan. An expanded share buyback accelerates a company’s share repurchase plan and leads to a faster contraction of its share float.

Why do companies reduce the number of shares outstanding?

Reducing the number of shares outstanding on the market increases the proportion of shares owned by investors. A company may feel its shares are undervalued and do a buyback to provide investors with a return.

What happens if a company only pays 30% of its profits in the form of dividends?

As a simplified example, if a company only pays out 30% of its profits in the form of dividends, its earnings can plunge by as much as 70% and there will still be enough money coming in to sustain the dividend. On the other hand, buybacks are a far less scrutinized form of returning capital.

What percentage of stock buybacks take place on the open market?

Roughly 95% of stock buybacks take place on the open market. Open market buybacks have the ability to move a stock's price. Basic supply and demand economics says that a surge in demand (like a company wanting to buy back millions of shares at once) puts upward pressure on the price of an asset.

How much did Wells Fargo return in 2018?

As one example, Wells Fargo returned a total of $25.8 billion of capital to shareholders in 2018. $17.9 billion of this was in the form of stock buybacks thanks to a huge buyback authorization currently in effect, while the other $7.9 billion was paid directly to investors as dividends.

What is dividend buyback?

Buybacks are a large part of the profit-allocation strategies of many publicly traded companies. Here's a rundown of how stock buybacks work, why companies may choose to buy back shares, ...

How much has the buyback rate been used for job creation?

Twenty percent has been used for job creation, and just 6% has been used for the benefit of existing workers. To be fair, there are sold arguments to be made that buybacks help the economy as well, by giving investors higher net worth, which can then increase their financial health, borrowing ability, confidence, etc.

How much tax do you pay on dividends?

Though most U.S. stock dividends meet the definition of " qualified dividends ," this still translates to a 15% or 20% dividend tax rate for the majority of investors. On the other hand, you don't pay tax on capital gains until you sell the investment.

What is put option?

Put options are contracts that allow their holders to sell shares of their stock at a specified price before a predetermined expiration date. By selling put options, companies receive an up-front premium payment and agree to buy back stock if it falls below the contract price (also known as the strike price).

What is a stock buyback?

A stock buyback occurs when a company buys outstanding shares of its own stock with excess cash or borrowed funds. This reduces the total number of shares available; it also increases the value of the shares that remain. Learn how and why companies do stock buybacks, the different types of buybacks, and whether buybacks are good for investors.

Why are buybacks bad?

Some have argued that firms repurchase shares to meet short-term goals at the expense of long-term ones. 2. Another drawback is that companies open up vulnerabilities when they go into debt to purchase stock.

What is dividend payment?

A dividend payment represents cash in hand for an investor or more shares of a stock for those who reinvest dividends. A share buyback provides no immediate return to an investor. But it could prove to increase the company’s value while deferring tax consequences. 4

What is the alternative to paying dividends?

One alternative is to paying dividends to investors. This can be in the form of cash or additional shares of stock. A poorly timed buyback, like when the share price is overvalued, may prove detrimental.

How do companies return value to investors?

Another way for a company to return value to its investors is through stock buybacks. In a stock buyback, a company buys shares of its own stock. Then, it either permanently removes them from circulation or retains them for resale to the market in the future. Decreasing the total shares of stock outstanding increases the ownership stake ...

How long is stock taxed?

Taxed as ordinary income if you held the stock for less than a year. Taxed as long-term capital gains if held for at least a year, but those making less than $80,000 may not pay any taxes. Often taxed as ordinary income, resulting in higher tax rates compared to capital gains taxes. Investor liquidity.

Is a share buyback good or bad?

Whether a share buyback is good or bad for individual investors is not a simple question. Many variables factor into the answer: the share price at the time of purchase, whether better investment options exist, and whether an investor prefers dividends.

What is a stock buyback?

Stock buybacks refer to the repurchasing of shares of stock by the company that issued them. A buyback occurs when the issuing company pays shareholders the market value per share and re-absorbs that portion of its ownership that was previously distributed among public and private investors .

How does a stock buyback affect credit?

A stock buyback affects a company's credit rating if it has to borrow money to repurchase the shares. Many companies finance stock buybacks because the loan interest is tax-deductible. However, debt obligations drain cash reserves, which are frequently needed when economic winds shift against a company. For this reason, credit reporting agencies view such-financed stock buybacks in a negative light: They do not see boosting EPS or capitalizing on undervalued shares as a good justification for taking on debt. A downgrade in credit rating often follows such a maneuver.

What happens when a stock is undervalued?

If a stock is dramatically undervalued, the issuing company can repurchase some of its shares at this reduced price and then re- issue them once the market has corrected, thereby increasing its equity capital without issuing any additional shares.

Why do companies do buybacks?

Companies do buybacks for various reasons, including company consolidation, equity value increase, and to look more financially attractive. The downside to buybacks is they are typically financed with debt, which can strain cash flow. Stock buybacks can have a mildly positive effect on the economy overall.

How much does a company's EPS increase if it repurchases 10,000 shares?

If it repurchases 10,000 of those shares, reducing its total outstanding shares to 90,000, its EPS increases to $111.11 without any actual increase in earnings. Also, short-term investors often look to make quick money by investing in a company leading up to a scheduled buyback.

How many shares did Bank of America buy back in 2017?

However, as of the end of 2017, Bank of America had bought back nearly 300 million shares over the prior 12-month period. 2 Although the dividend has increased over the same period, the bank's executive management has consistently allocated more cash to share repurchases rather than dividends.

What banks were hit by the Great Recession?

One of the hardest-hit banks during the Great Recession was Bank of America Corporation (BAC). The bank has recovered nicely since then, but still has some work to do in getting back to its former glory.