Premarket trading is a trading that occurs on exchanges before the regular market trading hours begin. The pre market stock trading takes place between the hours of 8:00 AM and 9:30 AM. The volumes traded in premarket sessions are usually much lower as compared to regular trading hours. Due to very few participants active before the market ...

Full Answer

When does premarket open stock?

The opening hour for pre-market trades varies with each stock exchange, with some opening as early as 4:00 a.m. EST. Pre-market trades are executed on computer-based systems including alternative trading systems and electronic communications networks, which are operated by brokerage firms.

What is premarket trading, and how does it work?

This is called premarket trading, and it allows investors to buy and sell stocks before official market hours. A major benefit of this type of trading is it lets investors react to off-hour news and events. However, a limited number of buyers and volatile prices can make premarket trading a bit risky for novice investors.

What are pre market stocks?

While pre-IPO markets are potentially lucrative for asset managers, many funds participate on a limited basis or notat all because the lack of price transparency between financial disclosures or funding rounds creates significant hurdles for their risk and NAV reporting.

How to trade during premarket?

- Change from the standard session closing price

- Last Trade and Tick

- Bid and Ask Size

What does it mean when a stock is Premarket?

Pre-market trading is the period of trading activity that occurs before the regular market session. The pre-market trading session typically occurs between 8 a.m. and 9:30 a.m. EST each trading day.

Is it good to buy stocks in premarket?

Stocks can be incredibly volatile during this time BUT there is also more liquidity which will make it easier to get in and out of a trade. If you are new to trading you should avoid trading during this time. It's just too risky and there is plenty of opportunity during normal market hours to capitalize on.

Who can buy in pre market?

The major U.S. exchanges, including the New York Stock Exchange Euronext and Nasdaq, have pre-market trading platforms that allow both institutional investors and individuals like yourself trade shares outside of normal-market hours.

How does a premarket work?

Premarket trading is a trading that occurs on exchanges before the regular market trading hours begin. The pre market stock trading takes place between the hours of 8:00 AM and 9:30 AM. The volumes traded in premarket sessions are usually much lower as compared to regular trading hours.

Can I buy premarket on Robinhood?

With extended-hours trading, you'll be able to trade during pre-market and after-hours sessions. Pre-market will be available 2.5 hours earlier, starting at 7 AM ET. After-hours trading continues for 4 more hours, until 8 PM ET.

Why do stocks go up after hours?

How do stock prices move after hours? Stocks move after hours because many brokerages allow traders to place trades outside of normal market hours. Every trade has the potential to move the price, regardless of when the trade takes place.

How do you buy pre-market?

If you have an online trading account, you can buy stocks pre-market if your brokerage firm offers this option. Designed to match up after-hours buyers and sellers, pre-market trading through an ECN allows you to find your desired stock, enter your order and monitor your purchase to ensure its accuracy.

How do I place a pre-market order?

You can place pre-market orders in Zerodha between 9.00 AM to 9.08 AM only in the Equity segment. The pre-market order window closes anytime between 9.07 AM to 9.08 AM. You can place only limit or market orders using product code MIS or CNC.

When you buy stock after-hours what price do I get?

Typically, price changes in the after-hours market have the same effect on a stock that changes in the regular market do: A $1 increase in the after-hours market is the same as a $1 increase in the regular market.

Why do stocks move before premarket?

Investors like to trade in the pre-market session for the same reason they like to trade in the after-hours trading session…they want to get a leg up on the competition by reacting quickly to news announcements that occur when the regular market is closed.

Can I buy share at 9 am?

Indian stock market trading hours start at 9:15 AM and end at 3:30 PM. However the Indian markets open between 9:00 a.m. and 9:15 a.m. for a pre-open market session. Pre-open market sessions had begun in India in 2010.

Why do traders use premarket trading?

Traders also use premarket trading to try to get ahead of market reactions to breaking news. Overseas events, political instability, and other factors can affect markets or individual securities. For instance, a corporation may release an earnings announcement after the market closes. If the earnings news is considerably different ...

What is pre market trading?

This is called premarket trading, and it allows investors to buy and sell stocks before official market hours. A major benefit of this type of trading is it lets investors react to off-hour news and events. However, a limited number of buyers and volatile prices can make premarket trading a bit risky for novice investors.

What time does premarket trading start?

Some electronic exchanges accommodate trading as early as 4 a.m. EST. However, most premarket trading in the U.S. takes place from 8 a.m. to 9:30 a.m. EST. Premarket trading is a fairly new development. In 1991, the NYSE responded to around-the-clock global trading by allowing trading after regular market hours.

Why is competition so intense in the premarket hours?

Competition is more intense in the premarket hours because relatively few individual investors trade then. That can put individual investors at a significant disadvantage with professional traders, who have access to more information.

What would trigger premarket interest?

Other events that might trigger premarket interest could include a court ruling in a lawsuit or a change in regulations.

What time does extended hours trading take place?

Today, extended-hours trading in U.S. markets can take place any time between 4 a.m. EST and the opening bell for regular market hours at 9:30 a.m. EST. Trading can also take place after regular markets close. After-hours trading generally occurs from 4 p.m. to 6:30 p.m. EST.

Can premarket prices be volatile?

Prices can be far more volatile than usual in premarket trading . Limited volume can make prices rise and fall more rapidly and steeply than usual. Traders used to more moderate trading could take significant losses from rapid premarket price changes.

What time does pre market trading start?

Pre-market trading typically occurs between 8:00 a.m. and 9:30 a.m., though it can begin as early as 4 a.m. ET. Known collectively as extended trading hours, the pre- and after-market sessions carry several risks: illiquidity, price volatility, and low volume/lack of participants. Pre-market and after-hours trading is done exclusively ...

What is pre market and after hours trading?

Pre-market and after-hours trading are also known collectively as extended trading.

What is after hours trading?

After-hours trading is something traders or investors can use if news breaks after the close of the stock exchange. The changes in share prices during the after-hours are a valuable barometer of the market reacts to the new information released. However, after-hours price changes are more volatile than regular-hours prices: As with the pre-market, ...

What time does the stock market open in 2021?

stock market exchanges—particularly the New York Stock Exchange (NYSE) and Nasdaq—is traditionally open between 9:30 a.m. and 4 p.m. ET (Eastern Time). However, with the adoption of new technology and increased demand for trading, these hours have been extended to include ...

Who is Chad Langager?

Pre- and After-Hours Trading on the NYSE and the Nasdaq. Chad Langager is a co-founder of Second Summit Ventures. He started as an intern at Investopedia.com, eventually leaving for the startup scene.

Is after hours trading more volatile than regular trading?

However, after-hours price changes are more volatile than regular-hours prices: As with the pre-market, illiquidity and lack of volume can be a problem. Institutional investors or certain major investors may choose simply not to participate in after-hours trading, regardless of the news or the event. As a result, it is quite possible ...

Does the NYSE have a quoting service?

Although the NYSE's website does not offer such a detailed service, in terms of depth of information, the quoting service on its site shows you the last movements of the stocks during the off-hours market. Other services like Yahoo Finance will show the last trade made in the pre- and after-hours markets. These services will usually cover all ...

What is a premarket movers?

Premarket movers are the stocks that put in large moves in the premarket session. This may be due to news stories, earnings announcements, large order flow, or social media buzz. Here’s what’s key for skilled traders: these large premarket moves tend to be driven by emotion.

What time does premarket trading start?

Premarket trading is the stock exchange trading activity that occurs before the market officially opens for its regular session at 9:30 a.m. Eastern. Traders can use premarket activity to look for niche trading opportunities.

What is premarket trading?

Premarket trading is a goldmine for some traders and a minefield for others. In this post, we’ll help you better understand premarket trading, how to do it, and the risks…. Let’s get to it!

What does lack of liquidity mean?

On the other hand, the lack of liquidity can mean that when a stock does move, it goes ballistic. That could allow savvy traders to profit. If you’re gonna trade in the premarket session, make sure to take it slow. Be very thorough and selective — follow the tips above.

Why do stock exchanges halt trading?

Exchanges often place a halt on the trading of a stock when a company has some regulatory issues. It can also be if a news announcement is expected or there are discrepancies in the orders. A halt is temporary.

What is news catalyst?

News catalysts include just about any news story that could affect a stock’s price. The news may be about the company or the industry. It could also be broader. Think economic or political news … or even regulatory.

Is premarket trading risky?

Overall, you should know that premarket trading is riskier than regular session trading. It’s all too easy to get trapped in a position with no way out. Premarket vs. After-Hours. Apart from the premarket and regular trading sessions, there’s also an after-hours session.

What time do you trade in the pre market?

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may also move more quickly in this environment.

What time does the pre market indicator come out?

The Pre-Market Indicator is calculated based on last sale of Nasdaq-100 securities during pre-market trading, 8:15 to 9:30 a.m. ET. And if a Nasdaq-100 security does not trade in the pre-market, the calculation uses last sale from the previous day's 4 p.m. closing price.

What Is Pre-Market and After-Hours Trading?

Where to Find Off-Hours Market Data

- The first place investors should look to find information about pre-market and after-hours activity is their brokerage account's data service if they have one. Brokerage information services often provide the most detailed off-hours market tradingdata, and they usually come free with a brokerage account. Investors will often be able to not only trade within this time period but also …

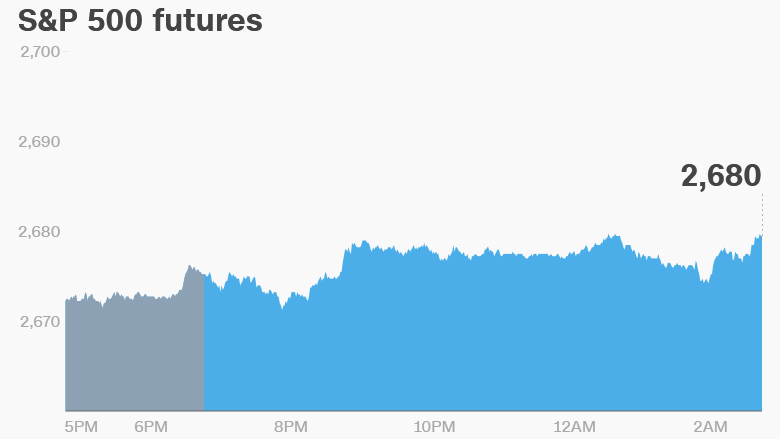

The Pre-Market Hours

- The pre-market is a period of trading activity that occurs before the regular market opens. Though its trading session typically occurs between 8 a.m. and 9:30 a.m. ET each trading day, several direct-access brokersallow access to pre-market trading to commence as early as 4 a.m. However, very little activity occurs for most stocks so early in the ...

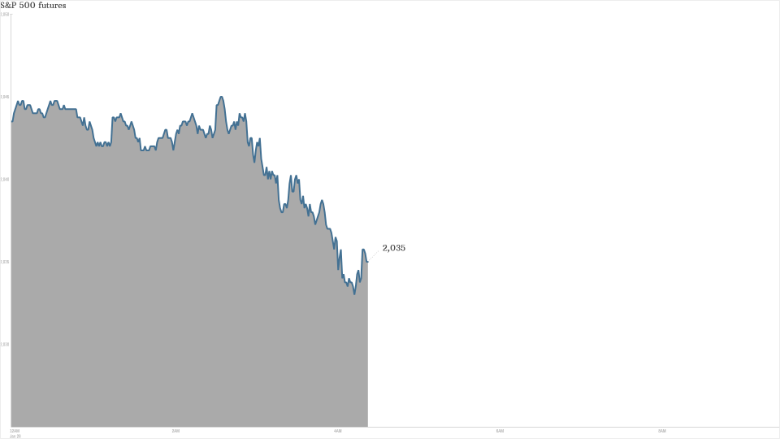

The After-Market Hours

- The New York Stock Exchange introduced after-market trading in June 1991 by extending trading hours by an hour. The move was a response to increased competition from international exchanges in London and Tokyo and private exchanges, which offered more hours of trading. Today, after-hours trading starts at 4 p.m. ET and can run as late as 8 p.m., although volume typi…

The Bottom Line

- Pre-market and after-hours trading is conducted outside of regular trading hours through ECNs that match buyers with sellers. Though they enable traders to react to news items that occur outside of regular trading hours, pre-market and after-hours trading carries several risks, such as illiquidity and price volatility. Such trading also enables traders to trade based on news items, su…