Motley Fool stock picks fall under three main categories, each which serves its own purpose. Starter Stocks (Foundational Stocks) Starter stocks (also referred to as foundational stocks) are stocks that you can use to build a strong foundation for your portfolio.

Full Answer

What is Motley Fools latest stock pick?

This is one of the Fool’s “home run” or “double down” alerts — an ad that’s not dated, but that makes the point that the relatively few stocks that get recommended by both of the Gardner brothers at the Motley Fool are unusually great stocks (the brothers are David and Tom, who together founded the Fool and run both the company and the flagship Motley Fool Stock Advisor).

Is Motley Fool worth it?

The company has so much cash that it’s been rewarding shareholders by repurchasing many shares. During its third quarter, it bought back more than $14 billion worth of its stock, and announced a $50 billion increase to its share repurchase program. (The Motley Fool owns shares of and has recommended Meta Platforms.

Is Motely fool a reliable source?

Yes, the Motley Fool is a reliable service. Like any stock advisory service, it has made a few mistakes in its 27 years of operation. The Foolish Four recommendations in the early 2000s nearly bankrupted the company.

What is Motley Fool total income?

Who Is the Motley Fool? About Us; Investing Philosophy ... you'll face taxes on Social Security if your provisional income reaches $25,000 and you're a single tax-filer, or if your provisional ...

What are good starter stocks?

Best stocks to buy for a starter portfolio:Berkshire Hathaway Inc. (BRK.B)Alphabet Inc. (GOOG, GOOGL)Microsoft Corp. (MSFT)Apple Inc. (AAPL)Visa Inc. (V)Amazon.com Inc. (AMZN)BlackRock Inc. (BLK)JPMorgan Chase & Co. (JPM)More items...

Is joining Motley Fool a good idea?

If you want to discover high-quality growth and blue chip stocks with huge upside potential over the coming 3–5+ years, and you want to learn how to invest wisely along the way, then the Motley Fool is absolutely worth joining.

How do beginners invest in stocks with little money?

One of the best ways for beginners to get started investing in the stock market is to put money in an online investment account, which can then be used to invest in shares of stock or stock mutual funds. With many brokerage accounts, you can start investing for the price of a single share.

Is Motley Fool legitimate?

Yes, the Motley Fool is completely legit. The company seeks to make people happy, make them laugh, and make a lot of money for their customers. You don't have to spend a ton of money on a subscription service to get started.

Which stock advisor is best?

Who has the Best Stock Picking Record?Motley Fool Stock Advisor – Best Stock Advisor Service.Motley Fool Rule Breakers: Best Stock Advice Subscription for Growth Stocks.Motley Fool's Everlasting Stocks. ... Seeking Alpha – Best for Investment Research + Stock Recommendations.More items...

How much money do I need to invest to make $1000 a month?

Assuming a deduction rate of 5%, savings of $240,000 would be required to pull out $1,000 per month: $240,000 savings x 5% = $12,000 per year or $1,000 per month.

How should a 2021 invest in stocks beginners?

Open a Brokerage AccountStep 1: Decide How Much Help You'll Need From Your Brokerage. There are many different kinds of brokerage accounts, all with their own pros and cons. ... Step 2: Apply To Open Your Brokerage Account. You're almost there! ... Step 3: Fund Your Account & Start Trading Stocks.

Where should a beginner start investing?

Here are six investments that are well-suited for beginner investors.401(k) or employer retirement plan.A robo-advisor.Target-date mutual fund.Index funds.Exchange-traded funds (ETFs)Investment apps.

Where is Matt from Motley Fool?

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Follow him on Twitter to keep up with his latest work!

What happens if you invest in the wrong stock?

Investing in the wrong type of stock can make your portfolio's value look like a roller coaster and can even cause you to lose your entire investment. With that in mind, here's what you'd be wise to stay away from at first: Rapidly growing companies: This is especially true for companies that have yet to turn a profit.

Is online stock trading free?

Also, be aware that while basic online stock trading is generally free at all major brokerages, many have other fees you should know about, and some have minimum investment amounts.

Investing in companies with a strong advantage can be a smart strategy

Whether you're a new investor or a seasoned professional, building a strong portfolio is critical. That means asking yourself certain questions: How many stocks should I buy? What types of stocks should I own? How would I feel if my portfolio dropped 20% in value?

1. Apple

Apple is the most valuable company in the world, with a market capitalization of over $2 trillion. Its brand name is essentially gold in the consumer electronics market, and the company has an installed base of 1.65 billion devices around the globe. That gives Apple a big advantage.

2. Axon Enterprise

Axon has a noble mission: to protect life. With that in mind, the company provides hardware and software solutions that help public safety officials and law enforcement officers work more safely, transparently, and productively.

3. Mastercard

Mastercard operates the third-largest payments network in the world. And while many investors may associate the company with credit and debit cards, it has expanded beyond these core products. So it's important to understand exactly how Mastercard makes money.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

If you are just starting your investing journey, these three stocks can anchor a beginner's portfolio

Investors just starting out are often deluged with information about which stocks are best, making it difficult to find quality stocks that can serve as a foundation for a portfolio.

1. Amazon: The dominant e-commerce company

Amazon ( AMZN -1.57% ) is one of the most prominent companies globally and is the leading U.S. e-commerce retailer, controlling roughly half of all the e-commerce business in the United States.

2. Alphabet: The search engine king

Alphabet ( GOOG -0.82% ) ( GOOGL -0.45% ) is a technology conglomerate known best for Google Search, the internet search engine that maintains a 92% share of global searches. It also owns YouTube, Google Cloud (a cloud-computing business), several enterprise software operations, Google Maps, Waymo self-driving cars, and more.

3. Nvidia: Leading tech into the future

Nvidia ( NVDA -1.07% ) develops graphics processing units (GPUs) and system semiconductor chips that are used in gaming and a variety of commercial uses, including artificial intelligence, cloud-computing and data-center storage, autonomous driving, high-performance computing, and more.

Here's the bottom line

Beginning investors would be well served by trying to build their portfolio around quality stocks from quality companies. Amazon, Alphabet, and Nvidia are robust businesses that generate a lot of cash and have opportunities to continue growing despite their already large size. That makes these three tech stocks a good place to start.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

About the Motley Fool

The Motley Fool is one of the most well-known investment companies. The company was founded in 1993 by Tom and David Gardner and has since become one of the most popular sources for investment advice.

Motley Fool Stock Picking Services

When Motley Fool launched in 1993, the site featured investment commentary from Tom and David Gardner. The brothers shared their “foolish” investing strategies in a way that resonated with casual retail investors. Readers loved the content but wanted more. They wanted the Gardner brothers to tell them exactly which stocks to buy and when.

Motley Fool Stock Picking Methodology

Motley Fool stock picks have beaten the market for almost two decades for one main reason: they are driven by an effective investing methodology. We could write an entire article on this methodology, but for the sake of simplicity, we will break it down to a few key principles:

Motley Fool Stock Pick Categories

Motley Fool stock picks fall under three main categories, each which serves its own purpose.

Motley Fool Stock Picks

Motley Fool is famous for stock picks. So, what makes these picks so great?

Motley Fool Stock Picks (FAQ)

New members can get access to Motley Fool Stock Advisor for $99/year (discounted from $199/year).

How much is Motley Fool stock up in 2019?

In addition, their 2019 stock picks are up 111% ; their 2018 stock picks are up 208%; their 2017 stocks are up 188% and amazingly their 216 stock picks are up 373%. The Motley Fool has done so well because they have quickly identified stocks each year that will perform well in the current environment.

When will the Motley Fool send out their stock picks for 2019?

If you subscribed to the Motley Fool Stock Advisor service, on January 2, 2019, you would have also received an email of their “Top Stock Picks For 2019.”. The Motley Fool created this list based on shares that made huge gains over the previous year AND also had the potential for BIG PROFITS in 2019.

What is the average return on Motley Fool stock picks for 2020?

Motley Fool FACT: The average return of their 2020 stock picks is 93% as of July 3, 2021; their 2019 picks are up 130% and 2018 picks are up 232%. Their next pick comes out Thursday. New users can save 50% now and get their next 24 stock picks in real-time for only $99/year.

What is Motley Fool Stock Advisor?

Founded in 1993 by brothers Tom and David Gardner, Motley Fool, or simply "The Fool," is an online platform offering financial and investing guidance.

How does Motley Fool Stock Advisor Work?

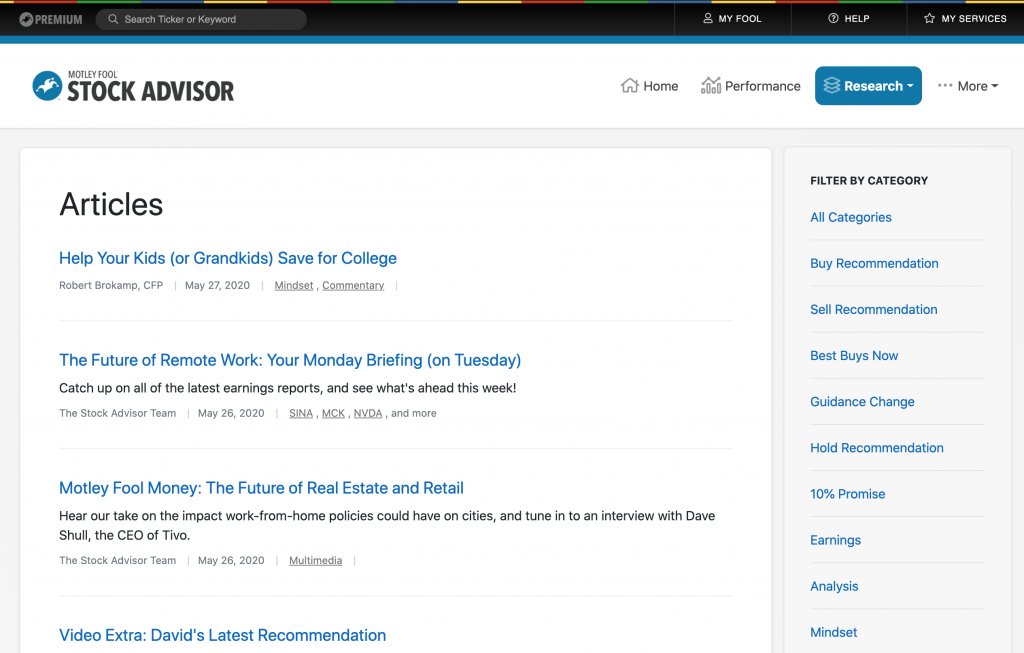

Motley Fool's business model works like any other stock newsletter subscription. Once you sign up for Stock Advisor, you instantly receive their two stock picks for that month, and for each month moving forward. You also get instant access to all of their previous recommendations as well.

Features

As we previously noted, the Stock Advisor subscription gets you Dave and Tom's top two stock picks each month and 10 timely new buys selected from over 300 stocks. Here's what else you get:

Motley Fool Stock Advisor

The Fool offers different packages as well. Review the prices and perks for these subscriptions to see which one fits your financial goals:

Motley Fool Stock Advisor Picks

Since the service's inception in 2002, The Fool advertises that an equal-weighted portfolio of its Stock Advisor picks returned a total of 551% vs. just 129% for the S&P 500 index.

How Much Does the Motley Fool Stock Advisor Cost?

If you look on their website, you can see that Motley Fool actually offers a few dozen different subscription packages.

Customer Service

Motley Fool is generally easy to reach and tries to do right by their customers, as evidenced by their 30-day money-back guarantee for anyone not happy with their stock picks.

Coca-Cola

- Famed beverage giantCoca-Cola (KO0.61%) is one of the most well-known stocks among retail investors, and for a good reason. Coca-Cola's product distribution across the world puts its sodas, water, teas, and coffees in so many stores and restaurants that most consumers have almost certainly enjoyedone of Coca-Cola's beverages. KO Revenue (TTM) data ...

Procter & Gamble

- Investing in the products you use daily can be a great investment strategy, which has proven true with Procter & Gamble (PG-0.72%). The company's household products include brands like Bounty, Old Spice, Febreze, and hundreds more. Like Coca-Cola, consumers buy Procter & Gamble's productsregardless of the state of the economy because people generally won't cut hy…

3M

- Notice a theme here? This list features companies whose products penetrate the daily lives of consumers everywhere. Industrial conglomerate 3M (MMM-0.84%) isn't as evident as the first two, but the same lesson applies. The company's products are used across industries worldwide, from adhesives for manufacturing products to Post-it notes used in the office to the N95 masks used …

Johnson & Johnson

- Healthcare is one of the most critical aspects of society and an industry virtually guaranteed to grow as humanity strives to live longer and healthier. Johnson & Johnson (JNJ-0.36%)plays a role in that; from Tylenol to Band-Aids, its consumer products, medical devices, and pharmaceutical drugs are sold throughout the world. JNJ Revenue (TTM) data by YCharts Johnson & Johnson i…

McDonald's

- Most people love a guilty pleasure, and restaurant chain McDonald's (MCD-0.34%) has been flipping cheap and delicious burgers since the 1950s. Today, the company is an international food giant with 38,000 locations across more than 100 countries. McDonald's is a franchise businessthat sells its branding rights to restaurant operators, who pay the company rent on the …

One Key Takeaway

- These companies certainly aren't offering shiny new technology, but their products are things you see in everyday life, are simple to understand, and have proven records of success that go back decades. For investors just starting on their journey for passive income, these stocks can be building blocks that you can count on.