To sell shares of stock, a limit order is used to ensure the shares are sold at a certain price or better. A limit order is set with a sell price above the current market price of the stock. If the share price rises to the limit price, the order will be triggered and the shares sold.

What does limit mean when buying stock?

- How does a limit order work?

- How long do limit orders last?

- What's a limit order price?

- Why do investors use limit orders?

- What are the risks of limit orders?

- What's the difference between a limit order and a market order?

- What are the differences between limit orders and stop orders?

- What is a limit order vs. stop-limit order?

- Things to consider

How to sell stock on limit price orders?

Key Takeaways

- A limit order sets a price on how much you’re willing to spend when you're buying a stock, as well as the price at which you’re willing to sell.

- You can use limit orders whether you’re buying or selling. ...

- Limit orders might have to wait in line for attention from a stockbroker, potentially slowing down the trading process.

What is a stop order limit?

Stop-limit order. A stop-limit is a combination order that instructs your broker to buy or sell a stock once its price hits a certain target, known as the stop price, but not to pay more for the stock, or sell it for less, than a specific amount, known as the limit price.

What is a sell limit and sell stop?

The drawbacks of using stop-limits

- No execution. The sell stop-limit order was given to the broker, but nothing happened. Because if Tesla’s market price dropped below $600, the broker didn’t sell.

- Slippage. On the day Jane placed her order, Tesla opened for trading at $625 per share. ...

- Market hours. The investor calls the broker at 4:30 p.m. ...

Is it better to market sell or limit sell?

Limit orders set the maximum or minimum price at which you are willing to complete the transaction, whether it be a buy or sell. Market orders offer a greater likelihood that an order will go through, but there are no guarantees, as orders are subject to availability.

What is a limit sell example?

For example, if a trader is looking to buy XYZ's stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower. If the trader is looking to sell shares of XYZ's stock with a $14.50 limit, the trader will not sell any shares until the price is $14.50 or higher.

When would you use limit sell order?

Go with a limit order when:You want to specify your price, sometimes much different from where the stock is.You want to trade a stock that's illiquid or the bid-ask spread is large (usually more than 5 cents)You're trading a high number of shares (for example, more than 100)

How do limit orders make money?

A buy limit order is an order to purchase an asset at or below a specified price, allowing traders to control how much they pay. By using a limit order to make a purchase, the investor is guaranteed to pay that price or less. While the price is guaranteed, the order being filled is not.

How Long Does a Limit Order Last?

Try to use day limit orders if you’re day trading. If your brokerage doesn’t offer them, you’ll be fitted with the good-till-canceled kind. Dependi...

Can You Cancel a Limit Order?

Yes, you can and should. You never want to leave an order active and unattended. Chances are you’ll forget about it — until it gets filled when you...

Should I Sell Market or Limit?

I tell every beginning trader to use sell limit orders. I still use them myself. They matter a lot for the volatile penny stock trading that has ma...

What Is a Sell Stop Limit Order Example?

Let’s say you go long on a volatile penny stock. You use a sell stop limit order to protect yourself on the trade. You could set the stop at a 3% l...

What is a sell limit order?

A sell limit order is a minimum price you set for selling a stock. Think of it as a trader’s way of being a good negotiator. When you’re making a deal, you don’t say, “I’ll sell for whatever the going rate is.”. You find out the rate, then kick it up a notch to what you think the market can stand.

What is a stop loss order?

This is just a bit more jargon to confuse newbies. One more wrinkle — the trailing stop limit order. This is a stop order that moves in parallel to the stock price. It only becomes fixed when the stock reverses its movement.

Do you have to leave a window between market price and limit?

Otherwise, there’s a chance the stock will have dropped past your limit in the time it took you to place the order. This will cause your order to go unfilled. There’s also the risk of a partial fill for a poorly traded stock.

Is selling limit orders risky?

Market orders can be risky, especially if you trade penny stocks like I do. Trading can be unpredictable in a lot of ways. When you use sell limit orders, you protect yourself from price fluctuations. Those can quickly turn your small gains into big losses. I only like price fluctuations when they work in my favor.

What is the limit for XYZ stock?

If the trader is looking to sell shares of XYZ’s stock with a $14.50 limit, the trader will not sell any shares until the price is $14.50 or higher. By using a buy limit order the investor is guaranteed to pay the buy limit order price or better, but it is not guaranteed that the order will be filled. A limit order gives a trader more control ...

Why do you need a limit order?

Additionally, a limit order can be useful if a trader is not watching a stock and has a specific price in mind at which they would be happy to buy or sell that security. Limit orders can also be left open with an expiration date.

What happens if an asset does not reach the specified price?

If the asset does not reach the specified price, the order is not filled and the investor may miss out on the trading opportunity. This can be contrasted with a market order, whereby a trade is executed at the prevailing market price without any price limit specified.

What is market order?

Market orders are transactions meant to execute as quickly as possible at the present or market price. Conversely, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Buying stocks can be thought of with an analogy to buying a car.

Can you buy stocks with a car?

Buying stocks can be thought of with an analogy to buying a car. With a car, you can pay the dealer’s sticker price and get the car. Or you can negotiate a price and refuse to finalize the deal unless the dealer meets your price. The stock market can be thought of to work in a similar way.

Can limit orders be filled?

A limit order is not guaranteed to be filled, however. Limit orders control execution price but can result in missed opportunities in fast-moving market conditions. Limit orders can be used in conjunction with stop orders to prevent large downside losses. 2:43.

Why do investors use limit orders?

Investors use limit orders when they are concerned that a stock's price might suddenly change by a significant amount or when they are not overly interested in executing a trade right away. The total price paid might be considered more important than the speed of trade execution.

What is a limit order?

A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price. In essence, a limit order tells your broker that you'd like to buy or sell a security, but only if the price of the security hits your desired target. A broker with these instructions only ...

How much does a GTC limit on Berkshire stock expire?

You can submit a GTC limit order to sell five shares of your Berkshire stock at $325 per share, and the trade will automatically execute if Berkshire's share price rises to that level within the next 60 days. If the share price remains below $325, then the GTC limit order expires.

What is the Foolish take on limit orders?

The Foolish take on limit orders. Deciding what types of trades to place can be challenging for beginning investors. The approach we take at The Motley Fool is to avoid limit orders and instead almost always use market orders, mainly because they are simple to establish and they make sure a trade executes right away.

When does a day limit expire?

A day limit order, as the name implies, expires at the end of the trading day. An investor usually set a day limit order at or around the bid price -- the highest price they are willing to pay for a stock -- if they're submitting a buy order. An investor using a day order who wants to sell a stock sets the limit price near the ask price, ...

What is stop loss order?

A stop-loss order sets only a threshold price that triggers a stock purchase or sale, while a stop-limit order executes a stock purchase or sale only when the stock's price is between two specified values. Investors use limit orders to buy or sell a stock at a preferred price or better, and they use stop orders to cap their potential losses on ...

What is a limit order?

A buy limit order executes at the given price or lower. A sell limit order executes at the given price or higher. The order only trades your stock at the given price or better. But a limit order will not always execute. Your trade will only go through if a stock’s market price reaches or improves upon the limit price.

What happens if you set your buy limit too low?

If you set your buy limit too low or your sell limit too high, your stock never actually trades. Let’s say Widget Co. is currently trading at $15 per share and you set your limit order to buy at $10. The stock dips down to $11 but never goes lower before returning to a $14 per share. If you set your buy limit higher, ...

When to use limit orders?

Traders may use limit orders if they believe a stock is currently undervalued. They might buy the stock and place a limit order to sell once it goes up. Conversely, traders who believe a stock is overpriced can place a limit order to buy shares once that price falls.

Why are limit orders important?

Limit orders are increasingly important as the pace of the market quickens. According to CNN, computer algorithms execute more than half of all stock market trades each day. Limit orders that restrict buying and selling prices can help investors avoid portfolio damage from wild market swings such as investors have seen with shares ...

Understanding Limit Orders

Market orders and limit orders are the most common ways to trade stocks and other securities, and they each have specific advantages and disadvantages. Luckily, all the top stock brokers for beginners have limit orders, so traders don’t need to worry about missing a good trade.

How Do Limit Orders Work?

Limit orders are useful tools when learning how to purchase stocks. Limit orders allow buyers and sellers to set the price at which a trade will be executed. For buyers, the limit price is the maximum price they will purchase a security. For sellers, the limit price is the minimum at which they will sell a security.

Why Use Limit Orders?

Limit orders give traders more control when buying and selling securities in a volatile market. If a stock price is rising and falling like a wolf on a trampoline, placing a limit order is less risky than placing a market order.

Problems with Limit Orders

Unfortunately, limit orders are not the panacea for all trades. Not only can buyers and sellers miss out on a trade if the stock fails to reach the limit price, but less desirable trades can be executed if a buyer or seller spends too much time away from the screen and a price rises or falls above or below their limit.

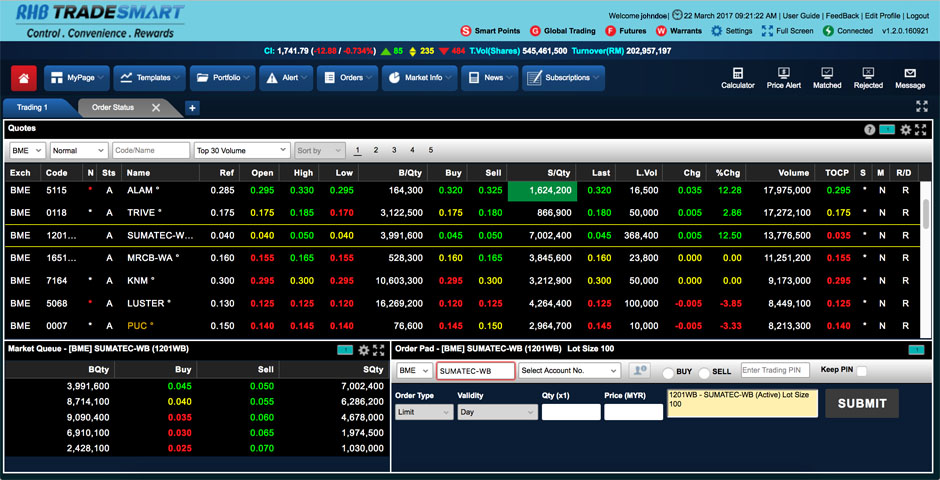

How to Place a Limit Order

As retail investors continue to enter the market after the GameStop frenzy, there have been a record number of trading app downloads. No matter what platform or device a trader uses, placing an order requires the same general information. However, since interfaces look different across platforms and devices, placing an order can be tricky.

Limit Order vs. Stop Order

A stop order allows traders to buy or sell a security if it reaches a specified “stop” price. Yes, this sounds familiar, but rest assured this is not Groundhog Day. Stop orders are similar to limit orders and are sometimes referred to as stop-loss orders .

What is a Stop-Limit Order?

A stop-limit order is a hybrid of a stop and a limit order. The stop price is the price at which the trade is triggered, but rather than being executed as a market order, which risks taking a greater loss, a limit price is included. The limit price is the lowest price a trader is willing to sell.

When do traders use stop limit orders?

Traders use stop-limit orders when they are not actively monitoring the market, and the order helps trigger a buy or sell order when the security reaches a specified point. Once the price is attained, the order is automatically triggered. The following are the two main stop-limit orders that traders place: 1. Buy Stop Limit.

What is stop limit order?

Summary. A stop-limit order is a trade tool that traders use to mitigate risks when buying and selling stocks. A stop-limit order is implemented when the price of stocks reaches a specified point. A stop-limit order does not guarantee that a trade will be executed if the stock does not reach the specified price.

What is stop price?

A stop price is a price at which the limit order to sell is activated, whereas the limit price is the lowest price that the trader is willing to accept. A sell stop order tells the market maker/broker to sell the stocks if the price decreases to the stop point or below, but only if the trader earns a specific price per share.

How does a stop limit work?

A buy stop limit is used to purchase a stock if the price hits a specific point. It helps traders control the purchase price of stock once they’ve determined an acceptable maximum price per share. A stop price and a limit price are then set once the trader specifies the highest price they are willing to pay per stock. The stop price is a price that is above the market price of the stock, whereas the limit price is the highest price that a trader is willing to pay per share.

What does "after hours" mean in stock market?

After Hours Trading After hours trading refers to the time outside regular trading hours when an investor can buy and sell securities.

What does it mean when a stock price reaches $55?

It means that once the price reaches $55, the trade is executed, and the order is turned into a market order. Market Order Market order is a request made by an investor to purchase or sell a security at the best possible price. It is executed by a broker or brokerage service. .

What happens if you exceed the $60 limit?

If the limit order is capped at $60, the order is processed after reaching $55, and if it exceeds $60, it is not fulfilled . 2. Sell Stop Limit. A sell stop limit is a conditional order to a broker to sell the stock when its price falls up to a specific price – i.e., stop price.

What Is A Limit Order?

How Limit Orders Work

- A limit order is the use of a pre-specified price to buy or sell a security. For example, if a trader is looking to buy XYZ’s stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower. If the trader is looking to sell shares of XYZ’s stock with a $14.50 limit, the trader will not sell any shares until the price is ...

Limit Order Example

- A portfolio manager wants to buy Tesla Inc's (TSLA) stock but believes its current valuation at roughly $750 per share is too high and would like to buy the stock should it fall to a specific price. The PM instructs his traders to buy 10,000 shares of Tesla should the price fall below $650, good 'til canceled.The trader then places an order to buy 10,000 shares with a $650 limit. Should the s…

Limit Orders vs. Market Orders

- When an investor places an order to buy or sell a stock, there are two main execution options in terms of price: place the order "at market" or "at limit." Market orders are transactions meant to execute as quickly as possible at the present or market price. Conversely, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Buying stocks can be though…

Limit Orders vs. Stop Orders: An Overview

Limit Orders

- A limit order is an order to buy or sell a stock for a specific price.1For example, if you wanted to purchase shares of a $100 stock at $100 or less, you can set a limit order that won't be filled unless the price you specified becomes available. However, you cannot set a plain limit order to buy a stock above the market price because a better pric...

Stop Orders

- Stop orders come in a few different variations, but they are all effectively conditional based on a price that is not yet available in the market when the order is originally placed. When the future price is available, a stop order will be triggered, but depending on its type, the broker will execute them differently.2 Many brokers now add the term "stop on quote" to their order types to make it …

Stop-Limit Orders

- A stop-limit order consists of two prices: a stop price and a limit price. This order type can activate a limit order to buy or sell a security when a specific stop price has been met.2For example, imagine you purchase shares at $100 and expect the stock to rise. You could place a stop-limit order to sell the shares if your forecast was wrong. If you set the stop price at $90 an…

How A Limit Order Works

- A limit order is an instruction for a broker to buy a stockor other security at or below a set price, or to sell a stock at or above the indicated price. In essence, a limit order tells your broker that you'd like to buy or sell a security, but only if the price of the security hits your desired target. A broker with these instructions only execute...

Day Limit Order

- Investors use a day limit order to make sure they get the best possible stock priceon a given trading day. A day limit order, as the name implies, expires at the end of the trading day. An investor usually set a day limit order at or around the bid price -- the highest price they are willing to pay for a stock -- if they're submitting a buy order. An investor using a day order who wants to …

Good-'Til-Canceled Limit Order

- A GTC limit order carries an investor's buy or sell instructions forward until one of three events occurs: 1. The trade executes. 2. The investor instructs the broker to cancel the limit order. 3. The GTC limit order automatically expires, which at most brokerages occurs after 60 calendar days. If a stock reaches the limit price at any time when a GTC limit order is active, then the broker exec…

Limit Order Examples

- To better understand limit orders, here are a few examples. Imagine that you have $130 in available cash in your brokerage account. On a day the market is losing value, you decide you would like to buy shares in the techgiant Apple(NASDAQ:AAPL), which at that time is trading for around $130.50 per share. Instead of spending the day monitoring Apple's stock price in the hop…

Limit Orders vs. Stop Orders

- A stop order differs somewhat from a limit order and can be a stop-loss order or stop-limit order. Both types of stop orders instruct a broker to sell a stock (or buy shares to cover a short position) if your loss on the stock reaches a certain value. A stop-loss order sets only a threshold price that triggers a stock purchase or sale, while a stop-limit order executes a stock purchase or sale onl…

The Foolish Bottom Line

- Deciding what types of trades to place can be challenging for beginning investors. The approach we take at The Motley Fool is to avoid limit orders and instead almost always use market orders, mainly because they are simple to establish and they make sure a trade executes right away. Using limit orders is unnecessary for investors focused on buying and holding quality companie…