Key Takeaways

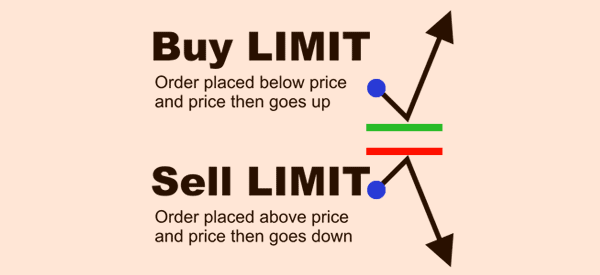

- A limit order sets a price on how much you’re willing to spend when you're buying a stock, as well as the price at which you’re willing to sell.

- You can use limit orders whether you’re buying or selling. ...

- Limit orders might have to wait in line for attention from a stockbroker, slowing down the trading process.

Which is better between a limit order vs market order?

Market orders generally execute immediately, and are filled at the market price. Speed is the main consideration when choosing a market order. Limit orders and stop limit orders only execute when the market reaches the specified limit and/or stop price. For many investors, limit orders can help manage their active trading by automating their ...

What is the difference between market and limit orders?

Market orders give you an instant fill but there’s no guarantee of your fill price. Limit orders lock in your fill price but don’t guarantee you will get filled. They are safer though. Watch our video on a limit order vs market order and their differences when trading.

How to buy limit orders?

Limit Order. In a limit order, the investor has to specify a quantity and the desired price at which he or she wants to make the transaction. Say a share is currently trading at Rs 100 per share but the investor wants to buy it at Rs 95 per share. A limit order of say 10 shares at Rs 95 per share is placed.

What is a trail stop limit order?

Key Takeaways

- Stop-limit orders are a conditional trade that combine the features of a stop loss with those of a limit order to mitigate risk.

- Stop-limit orders enable traders to have precise control over when the order should be filled, but they are not guaranteed to be executed.

- Traders often use stop-limit orders to lock in profits or limit downside losses.

What does a sell limit order do?

A limit order is an order to buy or sell a stock at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. A limit order is not guaranteed to execute.

Does a limit order sell immediately?

Limit order This means that your order may only be filled at your designated price or better. However, you're also directing your order to fill only if this condition occurs. Limit orders allow control over the price of an execution, but they do not guarantee that the order will be executed immediately or even at all.

What triggers a sell limit order?

Limit Orders A limit order is an order to buy or sell a stock for a specific price. 1 For example, if you wanted to purchase shares of a $100 stock at $100 or less, you can set a limit order that won't be filled unless the price you specified becomes available.

How long does a sell limit order last?

Most brokers put a time limit, such as 90 days, on these orders to prevent some long-forgotten order from processing years later.

Why did my sell limit order not execute?

The order only trades your stock at the given price or better. But a limit order will not always execute. Your trade will only go through if a stock's market price reaches or improves upon the limit price. If it never reaches that price, the order won't execute.

Which is better stop or limit order?

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better; whereas, once a stop order triggers at the specified price, it will be filled at the prevailing price in the market--which means that it could be executed at a ...

How do you use a limit order?

Buy limit orders provide investors and traders with a means of precisely entering a position. For example, a buy limit order could be placed at $2.40 when a stock is trading at $2.45. If the price dips to $2.40, the order is automatically executed. It will not be executed until the price drops to $2.40 or below.

What is the difference between sell limit and sell stop?

A Sell Stop Order is an instruction to sell when the market price is lower than the current market price. A Sell Limit Order is an instruction to sell at a Price that's higher, not lower than the current market price.

Can you cancel a limit order?

Investors may cancel standing orders, such as a limit or stop order, for any reason so long as the order has not been filled yet. Limit and stop orders may stand for hours or days before being filled depending on price movement, so these orders can logically be canceled without difficulty.

What happens if you place a limit order above market price?

A buy limit order only executes when the market price of the stock is at or below the order's limit price. So, generally speaking, if you place a buy limit order with a price that's above the market price, the order will execute (perhaps at a better price).

Do limit orders cost more?

Limit orders may cost more and command higher brokerage fees than market orders for two reasons. They are not guaranteed; if the market price never goes as high or low as the investor specified, the order is not executed.

How do you sell a stock when it reaches a certain price?

A stop order, also referred to as a stop-loss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the stop price. When the stop price is reached, a stop order becomes a market order. A buy stop order is entered at a stop price above the current market price.

How Long Does a Limit Order Last?

Try to use day limit orders if you’re day trading. If your brokerage doesn’t offer them, you’ll be fitted with the good-till-canceled kind. Dependi...

Can You Cancel a Limit Order?

Yes, you can and should. You never want to leave an order active and unattended. Chances are you’ll forget about it — until it gets filled when you...

Should I Sell Market or Limit?

I tell every beginning trader to use sell limit orders. I still use them myself. They matter a lot for the volatile penny stock trading that has ma...

What Is a Sell Stop Limit Order Example?

Let’s say you go long on a volatile penny stock. You use a sell stop limit order to protect yourself on the trade. You could set the stop at a 3% l...

Why do you need a limit order?

Additionally, a limit order can be useful if a trader is not watching a stock and has a specific price in mind at which they would be happy to buy or sell that security. Limit orders can also be left open with an expiration date.

What is market order?

Market orders are transactions meant to execute as quickly as possible at the present or market price. Conversely, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Buying stocks can be thought of with an analogy to buying a car.

What is the limit for XYZ stock?

If the trader is looking to sell shares of XYZ’s stock with a $14.50 limit, the trader will not sell any shares until the price is $14.50 or higher. By using a buy limit order the investor is guaranteed to pay the buy limit order price or better, but it is not guaranteed that the order will be filled. A limit order gives a trader more control ...

What happens if an asset does not reach the specified price?

If the asset does not reach the specified price, the order is not filled and the investor may miss out on the trading opportunity. This can be contrasted with a market order, whereby a trade is executed at the prevailing market price without any price limit specified.

Can you buy stocks with a car?

Buying stocks can be thought of with an analogy to buying a car. With a car, you can pay the dealer’s sticker price and get the car. Or you can negotiate a price and refuse to finalize the deal unless the dealer meets your price. The stock market can be thought of to work in a similar way.

Can limit orders be filled?

A limit order is not guaranteed to be filled, however. Limit orders control execution price but can result in missed opportunities in fast-moving market conditions. Limit orders can be used in conjunction with stop orders to prevent large downside losses. 2:43.

What is limit order in stock market?

Updated July 31, 2020. When managing your stock market trades, many techniques and methods exist to help you make a profit or reduce a loss. One of these tools is called a "limit order.". It helps you control how much you spend or make on a trade, by placing points on a transaction that will cause an automatic stop of the activity ...

What is a limit order?

A limit order sets a price on how much you’re willing to spend when you're buying a stock, as well as the price at which you’re willing to sell. You can use limit orders whether you’re buying or selling. They work on both sides of a transaction.

How to trade limit order?

Your broker will ask you to specify five components when placing any kind of trade, and that is where you'll identify the trade as a limit order: 1 Transaction type (buy or sell) 2 Number of shares 3 Security being bought or sold 4 Order type (where you'll specify that this is a limit order rather than a market order or another type of order not discussed on in this piece) 6 5 Price

Why do limit orders get their name?

A limit order gets its name because using one effectively sets a limit on the price you are willing to pay or accept for a given stock.

What happens if the stock price rises?

If the stock rises above that price before your order is filled, you could benefit by receiving more than your limit price for the shares . If the price falls, and your limit price isn't reached, the transaction won't execute, and the shares will remain in your account.

What to keep in mind when placing a limit order?

One thing to keep in mind with limit orders is that they may or may not go to the top of the list for execution by your stockbroker. If the price on your limit order is the best ask or bid price, it will likely be filled very quickly.

Why do buyers use limit orders?

Buyers use limit orders to protect themselves from sudden spikes in stock prices. Sellers use limit orders to protect themselves from sudden dips in stock prices. The opposite of a limit order is a market order.

What is a limit order?

A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price. In essence, a limit order tells your broker that you'd like to buy or sell a security, but only if the price of the security hits your desired target. A broker with these instructions only ...

Why do investors use limit orders?

Investors use limit orders when they are concerned that a stock's price might suddenly change by a significant amount or when they are not overly interested in executing a trade right away. The total price paid might be considered more important than the speed of trade execution.

How much does a GTC limit on Berkshire stock expire?

You can submit a GTC limit order to sell five shares of your Berkshire stock at $325 per share, and the trade will automatically execute if Berkshire's share price rises to that level within the next 60 days. If the share price remains below $325, then the GTC limit order expires.

What is the Foolish take on limit orders?

The Foolish take on limit orders. Deciding what types of trades to place can be challenging for beginning investors. The approach we take at The Motley Fool is to avoid limit orders and instead almost always use market orders, mainly because they are simple to establish and they make sure a trade executes right away.

What is stop loss order?

A stop-loss order sets only a threshold price that triggers a stock purchase or sale, while a stop-limit order executes a stock purchase or sale only when the stock's price is between two specified values. Investors use limit orders to buy or sell a stock at a preferred price or better, and they use stop orders to cap their potential losses on ...

When does a day limit expire?

A day limit order, as the name implies, expires at the end of the trading day. An investor usually set a day limit order at or around the bid price -- the highest price they are willing to pay for a stock -- if they're submitting a buy order. An investor using a day order who wants to sell a stock sets the limit price near the ask price, ...

What is a limit order?

A buy limit order executes at the given price or lower. A sell limit order executes at the given price or higher. The order only trades your stock at the given price or better. But a limit order will not always execute. Your trade will only go through if a stock’s market price reaches or improves upon the limit price.

When to use limit orders?

Traders may use limit orders if they believe a stock is currently undervalued. They might buy the stock and place a limit order to sell once it goes up. Conversely, traders who believe a stock is overpriced can place a limit order to buy shares once that price falls.

Why are limit orders important?

Limit orders are increasingly important as the pace of the market quickens. According to CNN, computer algorithms execute more than half of all stock market trades each day. Limit orders that restrict buying and selling prices can help investors avoid portfolio damage from wild market swings such as investors have seen with shares ...

What happens if you set your buy limit too low?

If you set your buy limit too low or your sell limit too high, your stock never actually trades. Let’s say Widget Co. is currently trading at $15 per share and you set your limit order to buy at $10. The stock dips down to $11 but never goes lower before returning to a $14 per share. If you set your buy limit higher, ...

When do traders use stop limit orders?

Traders use stop-limit orders when they are not actively monitoring the market, and the order helps trigger a buy or sell order when the security reaches a specified point. Once the price is attained, the order is automatically triggered. The following are the two main stop-limit orders that traders place: 1. Buy Stop Limit.

What is stop limit order?

Summary. A stop-limit order is a trade tool that traders use to mitigate risks when buying and selling stocks. A stop-limit order is implemented when the price of stocks reaches a specified point. A stop-limit order does not guarantee that a trade will be executed if the stock does not reach the specified price.

What is stop price?

A stop price is a price at which the limit order to sell is activated, whereas the limit price is the lowest price that the trader is willing to accept. A sell stop order tells the market maker/broker to sell the stocks if the price decreases to the stop point or below, but only if the trader earns a specific price per share.

How does a stop limit work?

A buy stop limit is used to purchase a stock if the price hits a specific point. It helps traders control the purchase price of stock once they’ve determined an acceptable maximum price per share. A stop price and a limit price are then set once the trader specifies the highest price they are willing to pay per stock. The stop price is a price that is above the market price of the stock, whereas the limit price is the highest price that a trader is willing to pay per share.

What does "after hours" mean in stock market?

After Hours Trading After hours trading refers to the time outside regular trading hours when an investor can buy and sell securities.

What does it mean when a stock price reaches $55?

It means that once the price reaches $55, the trade is executed, and the order is turned into a market order. Market Order Market order is a request made by an investor to purchase or sell a security at the best possible price. It is executed by a broker or brokerage service. .

What happens if you exceed the $60 limit?

If the limit order is capped at $60, the order is processed after reaching $55, and if it exceeds $60, it is not fulfilled . 2. Sell Stop Limit. A sell stop limit is a conditional order to a broker to sell the stock when its price falls up to a specific price – i.e., stop price.

What Is A Limit Order?

How Limit Orders Work

- A limit order is the use of a pre-specified price to buy or sell a security. For example, if a trader is looking to buy XYZ’s stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower. If the trader is looking to sell shares of XYZ’s stock with a $14.50 limit, the trader will not sell any shares until the price is $14.50 or higher. By using a buy limit order the investor i…

Limit Order Example

- A portfolio manager wants to buy Tesla Inc's (TSLA) stock but believes its current valuation at roughly $750 per share is too high and would like to buy the stock should it fall to a specific price. The PM instructs his traders to buy 10,000 shares of Tesla should the price fall below $650, good 'til canceled.The trader then places an order to buy 10,000 shares with a $650 limit. Should the s…

Limit Orders vs. Market Orders

- When an investor places an order to buy or sell a stock, there are two main execution options in terms of price: place the order "at market" or "at limit." Market orders are transactions meant to execute as quickly as possible at the present or market price. Conversely, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Buying stocks can be though…

How A Limit Order Works

- A limit order is an instruction for a broker to buy a stockor other security at or below a set price, or to sell a stock at or above the indicated price. In essence, a limit order tells your broker that you'd like to buy or sell a security, but only if the price of the security hits your desired target. A broker with these instructions only execute...

Day Limit Order

- Investors use a day limit order to make sure they get the best possible stock priceon a given trading day. A day limit order, as the name implies, expires at the end of the trading day. An investor usually set a day limit order at or around the bid price -- the highest price they are willing to pay for a stock -- if they're submitting a buy order. An investor using a day order who wants to …

Good-'Til-Canceled Limit Order

- A GTC limit order carries an investor's buy or sell instructions forward until one of three events occurs: 1. The trade executes. 2. The investor instructs the broker to cancel the limit order. 3. The GTC limit order automatically expires, which at most brokerages occurs after 60 calendar days. If a stock reaches the limit price at any time when a GTC limit order is active, then the broker exec…

Limit Order Examples

- To better understand limit orders, here are a few examples. Imagine that you have $130 in available cash in your brokerage account. On a day the market is losing value, you decide you would like to buy shares in the techgiant Apple(NASDAQ:AAPL), which at that time is trading for around $130.50 per share. Instead of spending the day monitoring Apple's stock price in the hop…

Limit Orders vs. Stop Orders

- A stop order differs somewhat from a limit order and can be a stop-loss order or stop-limit order. Both types of stop orders instruct a broker to sell a stock (or buy shares to cover a short position) if your loss on the stock reaches a certain value. A stop-loss order sets only a threshold price that triggers a stock purchase or sale, while a stop-limit order executes a stock purchase or sale onl…

The Foolish Bottom Line

- Deciding what types of trades to place can be challenging for beginning investors. The approach we take at The Motley Fool is to avoid limit orders and instead almost always use market orders, mainly because they are simple to establish and they make sure a trade executes right away. Using limit orders is unnecessary for investors focused on buying and holding quality companie…