Key Takeaways

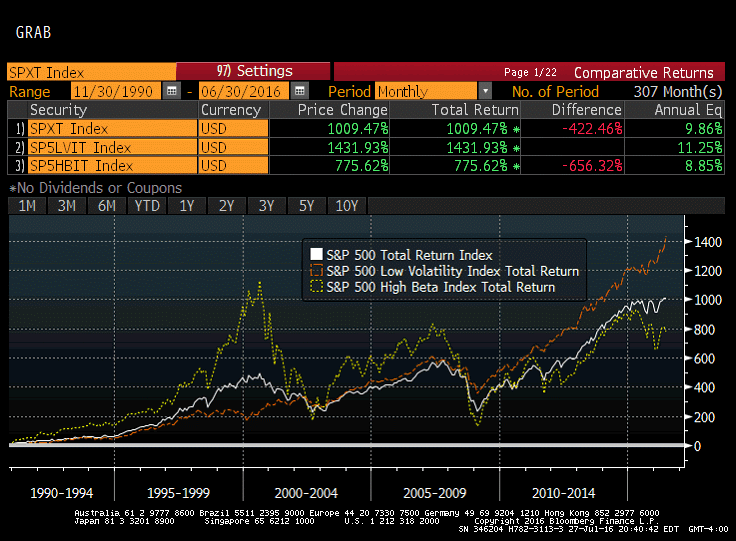

- High beta stocks are those that are positively correlated with returns of the S&P 500, but at an amplified magnitude.

- Because of this amplification, these stocks tend to outperform in bull markets, but can greatly underperform in bear markets.

- Here, we look at 3 of the highest beta stocks among the S&P 500 companies in 2019 as illustrative examples.

Full Answer

What would be considered a high beta on a stock?

Nov 15, 2020 · A high beta index is a basket of stocks that exhibits greater volatility than a broad market index such as the S&P 500 Index. The S&P 500 High Beta Index is the most well-known of these indexes. It...

Which stocks have the highest beta?

Nov 16, 2021 · Whether the stock beta is high or low depends on the market performance too. If the stock beta is higher than 1, the stock is considered a high-beta stock. When the stock beta is lower than 1, it is considered a low-beta stock. High beta stocks The listed companies that have a beta coefficient of more than 1 are termed to be high beta stocks.

What stock has the highest beta?

A beta of 2.0 means the stock moves twice as much as the S&P 500. A beta of 0.0 means the stocks moves don’t correlate with the S&P 500. A beta of -1.0 means the stock moves precisely opposite the S&P 500. The higher the Beta value, the more volatility the stock or portfolio should exhibit against the benchmark.

Are high beta stocks a smart buy?

High Beta Stocks Beta is the result of a calculation that measures the relative volatility of a stock in correlation to a particular standard. For U.S. stocks that standard is usually, but not always, the S&P 500. Beta is a form of regression analysis and it can be useful for investors regardless of their risk tolerance.

What is considered high beta stock?

A high-beta stock, quite simply, is a stock that has been much more volatile than the index it's being measured against. A stock with a beta above 2 -- meaning that the stock will typically move twice as much as the market does -- is generally considered a high-beta stock.Aug 21, 2014

Is a high beta in stocks good?

High-beta stocks are supposed to be riskier but provide higher return potential; low-beta stocks pose less risk but also lower returns.

What does a stock beta of 1.5 mean?

Roughly speaking, a security with a beta of 1.5, will have move, on average, 1.5 times the market return. [More precisely, that stock's excess return (over and above a short-term money market rate) is expected to move 1.5 times the market excess return).]

Is a stock beta of 1.3 good?

If a stock has a beta above 1, it's more volatile than the overall market. For example, if an asset has a beta of 1.3, it's theoretically 30% more volatile than the market. Stocks generally have a positive beta since they are correlated to the market.

What is a good portfolio beta?

For example, a portfolio with an overall beta of +0.7 would be expected to earn 70% of the market's return under normal circumstances. Portfolios, however, can also have betas greater than 1.0, such that a portfolio with a beta of +1.25 would be expected to earn 125% of the market's return and so on.Nov 30, 2018

Do high beta stocks outperform?

Low-beta stocks tend to rise or fall by less. Investment theory holds that, in order to induce investors to incur high-beta stocks' additional risk, they must over time produce a greater return. But in practice, according to this new research, high-beta stocks tend to outperform in just one week per quarter.Oct 4, 2020

What does a beta of 0.7 mean?

A fund with a beta of 0.7 has experienced gains and losses that are 70% of the benchmark's changes. A beta of 1.3 means the total return is likely to move up or down 30% more than the index. A fund with a 1.0 beta is expected to move in sync with the index."

What is the lowest beta stock?

Low Beta Dividend Stocks with High YieldsPhillips 66 Partners LP (NYSE:PSXP) Dividend Yield as of January 26: 8.18% ... Lumen Technologies, Inc. (NYSE:LUMN) ... Broadmark Realty Capital Inc. (NYSE:BRMK) ... DallasNews Corporation (NASDAQ:DALN) Dividend Yield as of January 26: 9.24% ... Chimera Investment Corporation (NYSE:CIM)Feb 7, 2022

Should alpha be high or low?

Alpha shows how well (or badly) a stock has performed in comparison to a benchmark index. Beta indicates how volatile a stock's price has been in comparison to the market as a whole. A high alpha is always good.

Which is more riskier beta or 1.2 Why?

A beta of less than 1 means that the security will be less volatile than the market. A beta of greater than 1 indicates that the security's price will be more volatile than the market. For example, if a stock's beta is 1.2, it's theoretically 20% more volatile than the market" (2015).

What does a beta of 0.6 mean?

Teva Pharmaceutical Industry's 2.49 beta, for example, indicates that the stock is expected to be more than twice as volatile than the market, while Intel's beta of 0.6 means the stock will typically move at a rate that's only about half that the broader market (data from Yahoo Finance, June 13, 2019).Mar 12, 2021

Can beta of a stock be negative?

Negative beta: A beta less than 0, which would indicate an inverse relation to the market, is possible but highly unlikely. Some investors argue that gold and gold stocks should have negative betas because they tend to do better when the stock market declines. Beta of 0: Basically, cash has a beta of 0.

Why are high beta stocks important?

Understanding beta and its uses can be important for growth investors seeking to identify the best-performing stocks at large. Below we take a look at the market’s highest beta stocks with the highest returns.

What is high beta?

High beta stocks are those that are positively correlated with returns of the S&P 500, but at an amplified magnitude. Because of this amplification, these stocks tend to outperform in bull markets, but can greatly underperform in bear markets. Here, we look at 3 of the highest beta stocks among the S&P 500 companies in 2019 as illustrative examples.

How much is AMD worth in 2020?

In 2019, shares of AMD more than doubled in value—its market cap as of June 2020 is $53 billion. 1 2 Despite its bullish run, the company remained riskier than most S&P 500 stocks, with a beta of 2.12. 2.

What is beta in stock market?

Beta is a statistical measure of a stock's relative volatility to that of the broader market (typically the S&P 500), where it can be interpreted as a measure of riskiness. A stock's beta is arrived at using regression analysis that infers the correlation in price changes in the stock to the S&P 500.

What does a beta of 1.0 mean?

Therefore, a beta of 1.0 indicates that a stock’s volatility is parallel to that of the market, and so will often move in tandem with the index and at the same magnitudes. A beta of above 1.0 means that the stock will have greater volatility than the market and a beta less than 1.0 indicates lower volatility. ...

What is United Rentals?

United Rentals is the largest equipment rental company in the world, servicing customers mainly in the United States and Canada. Founded in 1997, URI now owns nearly 700,000 pieces of heavy equipment for rent, worth nearly $15 billion. 6 7 However, the company operates in a highly cyclical and commoditized industry and is greatly impacted by small changes in demand that can arise from contractions in the construction or building industries, among others. The stock thus had a beta of 2.28. 8

What does volatility mean in stocks?

Volatility is usually an indicator of risk and higher betas mean higher risk while lower betas mean lower risk. Thus, stocks with higher betas may gain more in up markets but also lose more in down markets.

How to calculate beta?

Here’s an example of the data you’ll need to calculate Beta: 1 Risk-free rate (typically Treasuries at least two years out) 2 Your asset’s rate of return over some period (typically one year to five years) 3 Your benchmark’s rate of return over the same period as the asset

What is Booking Holdings?

Booking Holdings is an online travel services giant. It is a large-cap stock with a market capitalization of $100 billion, and provides services to consumers and local partners in more than 220 countries and territories. The company operates six major brands: Booking.com, Priceline, agoda, Rentalcars.com, KAYAK, and OpenTable.

What is CAPM in investing?

The Capital Asset Pricing Model, or CAPM, is a common investing formula that utilizes the Beta calculation to account for the time value of money as well as the risk-adjusted returns expected for a particular asset. Beta is an essential component of the CAPM because without it, riskier securities would appear more favorable to prospective investors as their risk wouldn’t be accounted for in the calculation.

How long has Boeing been in business?

The company has been in business since 1916. In the last 100+ years, the aerospace and defense company has gone from making canvas and wood airplanes to producing today’s advanced planes, with Boeing helping to drive some of that change.

What is a lrcx?

Lam Research Corporation (LRCX) Lam Research Corporation designs, manufacture, markets, refurbishes, and services semiconductor processing equipment used to fabricate integrated circuits around the world. Lam is a major supplier of wafer fabrication equipment and services to the semiconductor industry.

Should investors take risk into account when selecting from prospective investments?

Investors must take risk into account when selecting from prospective investments. After all, if two securities are otherwise similar in terms of expected returns but one offers a much lower Beta, the investor would do well to select the low Beta security as it would offer better risk-adjusted returns.

Do high beta stocks outperform?

High Beta stocks are not a sure bet during bull markets to outperform, so investors should be judicious when adding high Beta stocks to a portfolio, as the weight of the evidence suggests they are more likely to underperform during periods of market weakness.

What is high beta stock?

High Beta Stocks. Beta is the result of a calculation that measures the relative volatility of a stock in correlation to a particular standard . For U.S. stocks that standard is usually, but not always, the S&P 500. Beta is a form of regression analysis and it can be useful for investors regardless of their risk tolerance.

What is beta analysis?

Beta is a form of regression analysis and it can be useful for investors regardless of their risk tolerance. Beta is considered one of the few data points that can be beneficial for practitioners of fundamental analysis and technical analysis. This page lists stocks that have unusually high beta calculations.

What is the beta of the S&P 500?

The beta of the S&P 500 is 1. The simplest explanation for this is that in establishing a benchmark, you’re dividing one thing by itself and that will always equal 1. Therefore, knowing the beta of the S&P 500 is 1, investors can interpret the beta of a particular stock in the following ways:

What does a beta of 1 mean?

A beta of 1 also means that price movement will probably be very similar. In other words, if you were to overlay the stock’s price movement over the S&P 500, the two lines would look very similar. Beta of less than 1: This means a stock is not very correlated with the market.

What does a negative beta mean?

Beta of less than 0 (i.e. a negative beta): This means a stock is inversely correlated to the market. The tendency of the stock is to move in the opposite direction as the market. The higher the negative number, the more volatile the stock. As you can see, beta is all about its relationship to the number 1.

What is smart beta?

A smart beta strategy can be used to minimize the risk impact of high beta stocks. This type of strategy might combine something passive and more stable, like a dividend investing strategy, with active trading in order to minimize losses from the most volatile stocks in the fund.

What is covariance in stock market?

Covariance helps measure how closely individual stocks move relative to the overall market or index. If the direction of their momentum, the beta will be positive. If their momentum is oppositional, the beta will be negative. Variance is a measure of the momentum of the stock market, relative to its mean.

What is a high beta stock?

What are high-beta stocks? A high-beta stock, quite simply, is a stock that has been much more volatile than the index it's being measured against. A stock with a beta above 2 -- meaning that the stock will typically move twice as much as the market does -- is generally considered a high-beta stock.

What does beta mean in stock market?

What beta means. Beta measures how much a stock price tends to move in either direction compared to a benchmark. Typically, that benchmark is the broader stock market or S&P 500, but it can also be an industry or an index of companies similar in size. Beta is a measure of volatility, not a measure of risk.

What does a beta of 1 mean?

A stock with a beta of 1 has moved in lockstep with its benchmark over the measured period of time. A beta of less than 1 means the stock was less volatile than its benchmark, while a number greater than 1 means it was more volatile, exaggerating the benchmark's moves. Meanwhile, a stock with a negative beta tends to move in ...

Is beta a measure of safety?

While beta can be a helpful metric when used in combination with other tools, remember that it's only a measure of past volatility against an index -- not a measure of safety. When researching any stock, study the whole business, looking for durable advantages.

What is beta in stocks?

What Is Beta? Beta is a measure of a stock's volatility in relation to the overall market. By definition, the market, such as the S&P 500 Index, has a beta of 1.0, and individual stocks are ranked according to how much they deviate from the market.

Why is beta important?

To followers of CAPM, beta is useful. A stock's price variability is important to consider when assessing risk. If you think about risk as the possibility of a stock losing its value, beta has appeal as a proxy for risk. Intuitively, it makes plenty of sense.

What is beta in CAPM?

Beta is a component of the capital asset pricing model (CAPM), which is used to calculate the cost of equity funding. The CAPM formula uses the total average market return and the beta value of the stock to determine the rate of return that shareholders might reasonably expect based on perceived investment risk.

What is risk in investing?

The well-worn definition of risk is the possibility of suffering a loss. Of course, when investors consider risk, they are thinking about the chance that the stock they buy will decrease in value. The trouble is that beta, as a proxy for risk, doesn't distinguish between upside and downside price movements. For most investors, downside movements are a risk, while upside ones mean opportunity. Beta doesn't help investors tell the difference. For most investors, that doesn't make much sense.

What does value investor mean?

A value investor would argue that a company represents a lower-risk investment after it falls in value —investors can get the same stock at a lower price despite the rise in the stock's beta following its decline.

Why does beta change over time?

A stock's beta will change over time because it compares the stock's return with the returns of the overall market. Benjamin Graham, the "father of value investing," and his modern advocates tried to spot well-run companies with a "margin of safety"—that is, an ability to withstand unpleasant surprises.

How to calculate beta?

The formula for calculating beta is the covariance of the return of an asset with the return of the benchmark divided by the variance of the return of the benchmark over a certain period.

Beta and Risk

Investing in High Beta Stocks

- High beta stocks can be great investments in bull markets since they are expected to outperform the S&P 500 by a marginal amount. They do however require a great deal of active management due to their market sensitivity. These are highly volatile and therefore risky investments in isolation. Thus, in the case of a bear market reversal, these stocks...

Historical Examples of High-Beta Stocks

- Below, we look at three stocks from the year 2019 as historical examples of stocks with betas of around 2.5, and which were members of the S&P 500 index. Note that these historical examples are for informational purposes only to give insight into how high-beta stocks typically behave, and are intended as investment advice.

The Bottom Line

- High beta stocks require a great deal of active management. They are also often small to mid-cap stocks that are maturing with significant volatility around new announcements. All three of the stocks here are in the small-cap realm with Largo and California Resources pushing into the mid-cap territory. Each has a few growth catalysts that have helped to propel their returns. Keep in m…