- Futures in Stock Market. Futures are derivative financial contracts that allow two parties to agree to buy or sell an asset at a set contract price and future date.

- Types of Futures Contract. If you’re a trader who wants to participate in the stock market, you’ll need to know about futures. ...

- Understanding Futures Contracts. ...

What stock market return should you expect in the future?

Why do you expect long-term returns to be lower than historical averages?

- Low interest rates. Lower inflation affects yields on everything from cash to 30-year Treasury bonds. ...

- Low economic growth. Economic growth and inflation typically go hand in hand. ...

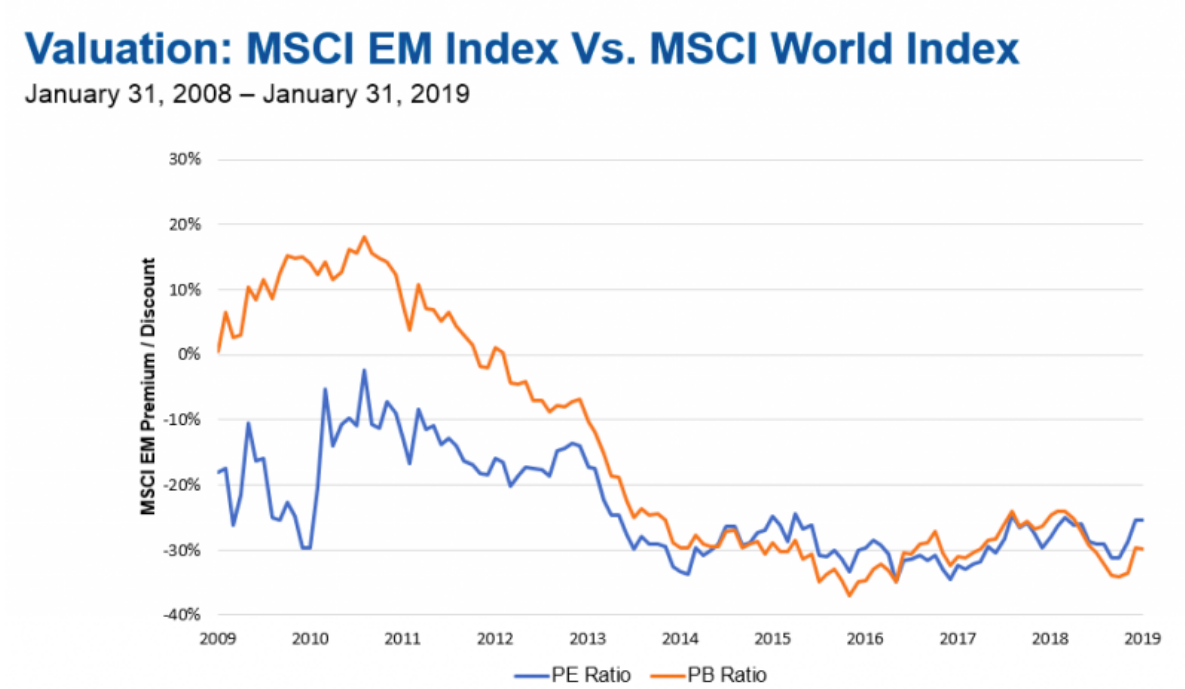

- Equity valuations. Valuations appear to be stretched compared to last March’s levels. ...

What is the best stock on the market?

- Health Care Select Sector SPDR Fund (XLV): This fund tracks the performance of healthcare companies within the S&P 500. ...

- First Trust Nasdaq Food & Beverage ETF (FTXG): FTXG tracks the Nasdaq U.S. ...

- Vanguard Utilities ETF (VPU): VPU tries to duplicate the performance of a utility stock index. ...

How to predict where the market will open?

Key Takeaways

- One of the most reliable indicators of future market direction is a contrarian-sentiment measure known as the put/call options volume ratio.

- On balance, option buyers lose about 90% of the time.

- As often happens when the market gets too bullish or too bearish, conditions become ripe for a reversal.

What are stock futures and how do they work?

- These contracts ensure that the commodity producer receives a fixed sales price, come harvest or selling time.

- In a price drop, the producer does not lose money. He gets the agreed-upon price.

- Producers can limit their risk, in case of a price drop.

- Producers or companies can make better production plans.

What is a future vs stock?

Although futures and stocks do have some things in common, they are based on quite different premises. Futures are contracts with expiration dates, while stocks represent ownership in a company.

What is Future Trading example?

Futures trading is common with commodities. For example, if someone buys a July crude oil futures contract (CL), they are saying they will buy 1,000 barrels of oil from the agreed price upon the July expiration, no matter what the market price is at that time.

Are futures better than stocks?

Key Takeaways While futures can pose unique risks for investors, there are several benefits to futures over trading straight stocks. These advantages include greater leverage, lower trading costs, and longer trading hours.

How do futures affect stock prices?

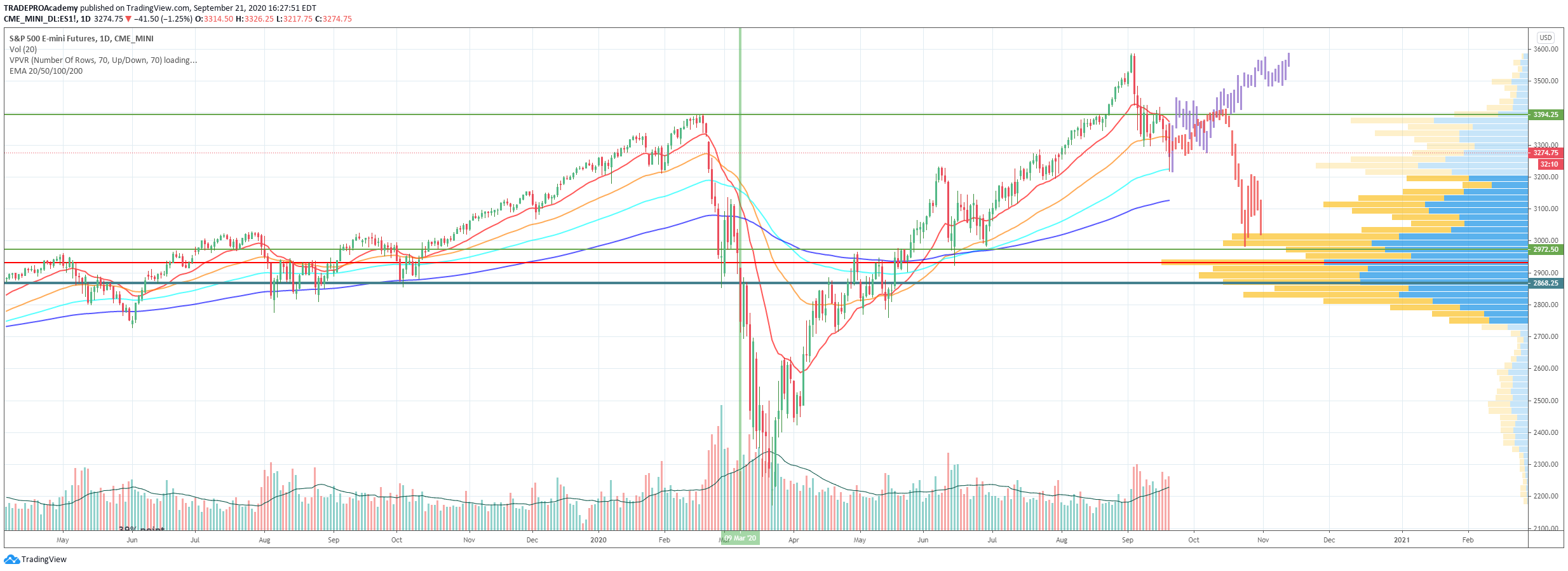

If S&P futures are trending downward all morning, it is likely that stock prices on U.S. exchanges will move lower when trading opens for the day. Once again, the opposite is also true, with rising futures prices suggesting a higher open.

How do you trade futures for beginners?

Open an account with a broker that supports the markets you want to trade. A futures broker will likely ask about your experience with investing, income and net worth. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions.

When should you buy futures?

This usually happens on the date of the contract's expiry. However, many traders also choose to settle before the expiry of the contract. In this case, the futures contract (purchase or sale) is settled at the closing price of the underlying asset as on the expiry date of the contract.

How do you make money on futures?

Futures contracts apply to agricultural commodities, rising and falling as the supply and demand of items such as corn, steel, cotton and oil change. You can make money trading futures if you follow trends, cut your losses and watch your expenses.

Can futures trading make you rich?

You indeed can become rich from futures trading. The great liquidity in most futures markets, the ease of access, great short-selling opportunities, and high leverage, all make futures some of the most flexible and useful securities out there.

Can you live off futures trading?

Not accounting for commissions and slippage, these strategic frameworks show that it is theoretically possible to make a living trading E-mini futures. Given a solid success rate and positive risk versus reward scenario, long-run profitability is attainable.

What do futures tell us?

Futures look into the future to "lock in" a future price or try to predict where something will be in the future; hence the name. Since there are futures on the indexes (S&P 500, Dow 30, NASDAQ 100, Russell 2000) that trade virtually 24 hours a day, we can watch the index futures to get a feel for market direction.

What are stock futures for dummies?

Futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set future date for a set price. Futures contracts, or simply "futures," are traded on futures exchanges like the CME Group and require a brokerage account that's approved to trade futures.

Do futures predict prices?

Index Futures Predict the Opening Direction The local equity markets will probably rise, and investors may anticipate a stronger U.S. market, too. If they buy index futures, the price will go up.

What is future trading in Indian stock market with example?

Futures Price: This is your buying price per share. The price of a futures contract tracks the price of the underlying asset (in our case stocks) and is generally higher. For example: The price of 1 futures contract of Reliance Industries is Rs 2,186. The price of 1 futures contract of State Bank of India is Rs 386.75.

How much money is required for future trading?

How much funds do I need to trade futures? Trading in futures contracts involves margin payment. The volume of margin will depend on the stake size. However, most brokers will ask for at least 10 percent upfront margin to place a trade.

How do you make money trading futures?

Futures contracts apply to agricultural commodities, rising and falling as the supply and demand of items such as corn, steel, cotton and oil change. You can make money trading futures if you follow trends, cut your losses and watch your expenses.

What is forward contract give an example of it?

Forward contracts can involve the exchange of foreign currency and other goods, not just commodities. For example, if oil is trading at $50 a barrel, the company might sign a forward contract with its supplier to buy 10,000 barrels of oil at $55 each every month for the next year.

What is market futures?

Market futures allow traders to trade the direction of the underlying equity index, hedge equity positions and be used as a lead indicator for the markets and stocks. Unlike options that can expire worthless when out of the money, expiring market futures are rolled over into the next expiration month contract. ...

When do futures expire?

Market futures contracts expire on the third Friday of each quarterly month, starting from March. Expiring contracts are rolled over to the next expiration month on the second Thursday of the week.

What is fair value in market futures?

The fair value is based on what the market futures contract should be priced at based on the current cash value of the underlying index.

Do equity futures own the S&P 500?

Equity index futures don’t actually own any components of the index but instead tracks with the movement of the underlying index. In fact, they actually tend to lead the index moves. Market futures are incredibly liquid, especially the S&P 500 contracts.

What are some examples of futures markets?

Examples of futures markets are the New York Mercantile Exchange (NYMEX), the Kansas City Board of Trade, the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBoT), Chicago Board Options Exchange (CBOE) and the Minneapolis Grain Exchange.

How are futures markets regulated?

In the U.S. futures markets are largely regulated by the commodities futures clearing commission (CFTC), with futures contracts standardized by exchanges. Today, the majority of trading of futures markets occurs electronically, with examples including the CME and ICE. Unlike most stock markets, futures markets can trade 24 hours a day.

Why are futures contracts made?

Futures contracts are made in an attempt by producers and suppliers of commodities to avoid market volatility. These producers and suppliers negotiate contracts with an investor who agrees to take on both the risk and reward of a volatile market. Futures markets or futures exchanges are where these financial products are bought ...

What happens to the investor if the price of coffee goes higher than a certain price?

If the price of coffee goes higher than a certain price, the investor gets to keep profits. For the roaster, if the price of green coffee goes above an agreed rate, the investor pays the difference and the roaster gets the coffee at a predictable rate.

Which futures market has its own clearing house?

Some of the biggest futures markets that operate their own clearing houses include the Chicago Mercantile Exchange, the ICE, and Eurex.

Can futures be created?

Futures contracts can be made or "created" as long as open interest is increased, unlike other securities that are issued. The size of futures markets (which usually increase when the stock market outlook is uncertain) is larger than that of commodity markets, and are a key part of the financial system.

What is stock futures?

Stock futures offer a wider array of creative investments than traditional stocks. Hedging with stock futures, for example, is a relatively inexpensive way to cover your back on risky stock purchases. And for high-risk investors, nothing is as potentially lucrative as speculating on the futures market.

How do stock futures work?

Here's how it works. There are two basic positions on stock futures: long and short. The long position agrees to buy the stock when the contract expires. The short position agrees to sell the stock when the contract expires.

How much does IBM stock cost on April 1?

You enter into a futures contract to sell 100 shares of IBM at $50 a share on April 1 for a total price of $5,000. But then the value of IBM stock drops to $48 a share on March 1. The strategy with going short is to buy the contract back before having to deliver the stock.

What happens when you buy a stock future?

When you buy or sell a stock future, you're not buying or selling a stock certificate. You're entering into a stock futures contract – an agreement to buy or sell the stock certificate at a fixed price on a certain date.

What is the advantage of investing in stock futures?

The advantage is that the broker is well-versed in the most effective investment strategies for stock futures. The disadvantage is that you'll have to pay a management fee for his or her services. An even more conservative strategy for investing in stock futures is to use a commodity pool.

What is the advantage of futures?

The chief advantage of stock futures is the ability to buy on margin. Investing on margin is also called leveraging, since you're using a relatively small amount of money to leverage a large amount of stock. For example, if you have $1,200 to invest, you might be able to buy only 10 shares of IBM stock.

How to hedge futures?

Another way to hedge stock futures investments is through something called a spread. A calendarspread is when you go both short and long – which we learned about earlier – on the same stock future with two different delivery dates. For example, you could enter into two different contracts involving IBM stock.

What is stock futures?

Stock futures are contracts to buy or sell a stock for a certain price on a future date. Stock futures should not be confused with options. Stock futures have both buyers and sellers who must enter into an agreement with fixed prices and expiration dates.

Why do people use stock futures?

This is because investing in a single stock future as a standalone security can be a risky investment. Stock futures can be a valuable part of a complete investment strategy.

What happens if one of these stock futures suffers a loss?

If one of these stock futures suffers a loss, the other might give you the reward of a gain because the stock futures are in the same market. Matched pair spread: This method is similar to an intermarket spread. You would enter a futures contract to buy shares in 2 companies that are direct competitors.

What is the purpose of the Commodity Futures Trading Commission?

The Commodity Futures Trading Commission was created by Congress in 1974 to regulate the futures market . This agency ensures the integrity of the futures market pricing. Any brokerage firms that engage in futures trading are regulated by the Commodity Futures Trading Commission.

What happens when you buy a stock future?

When you buy or sell a stock future, you enter into a stock future contract. This contract is an agreement to buy or sell the stock certificate at a fixed price on a specific future date. The contract will expire on the set future date. Stock futures differ from a traditional stock purchase. When you purchase a stock future, you never own the stock.

What is hedging in investing?

That’s exactly what hedging is in relation to investing. If you use this strategy, you will take both a long and short position on a specific stock. This provides security to the investor because even if the stock price goes down, you can make up at least some of the money on the futures market.

What is a short position in stock market?

Short: A short position is an agreement to sell the stock when the contract expires. You’d take the short position if you think the stock price will be lower in 3 months than it is today. When you buy or sell a futures contract, you only need to pay for a percentage of the contract’s price. Usually, you will pay from 10% to 20% of the price ...

Futures in Stock Market

- Futures are derivative financial contracts that allow two parties to agree to buy or sell an asset at a set contract price and future date. It’s a financial instrument that can be used for commodities, stocks, bonds, and other assets. The party agreeing to buy the asset in the futures contract is said to be “long,” while the party agreeing to sell ...

Types of Futures Contract

- If you’re a trader who wants to participate in the stock market, you’ll need to know about futures. There are many different types of futures contracts, and each has its own unique features and risks.

Understanding Futures Contracts

- Now that you understand what futures are and how they work, you may be wondering if they’re right for you. If you’re thinking about trading, there are a few things you should keep in mind. 1. Make sure you understand the risks involved. Futures contracts can be volatile, and the specific price of an asset can move up or down unexpectedly. 2. Do your research. Be sure to understan…

What Are Futures in The Stock Market? Final Thoughts

- Futures can be a great way to invest in the stock market. They can be used to hedge against risk, trade on leverage, and short sell. With proper risk management, you can trade safely and avoid losses. When used correctly, futures can be a great tool for investors, but it’s important to learn about the risks and benefits before trading.