What Is a Stock Market Bubble?

- The Start of a Stock Market Bubble When investors believe most stocks in a given sector are priced too low, they race to buy the best stocks, index funds, ...

- The Bubble Begins to Inflate As a child, you likely held a brightly colored wand, dipped it in soapy water, and blew through a circle on the end of ...

- The Bubble Bursts

Full Answer

Which are the 5 stages of a stock market bubble?

Jan 23, 2022 · “Stock market bubble” is a term that’s used when the market appears exceptionally overvalued, driven by a combination of heightened enthusiasm, unrealistic expectations, and reckless speculation. The dot-com bubble and housing market bubble are two notable examples of this phenomenon. Understanding what market bubbles are and why they …

How to survive a stock market bubble?

Mar 03, 2022 · What Does A Bubble Mean In The Stock Market? Bubble economics refers to the rapid increase of economic values, usually the price of assets, that occurs during such an economic cycle. After rapid inflation, a quick decrease in value is experienced, which, depending on the type, often refers to a bubble burst or a “crash”.

What are the consequences of a stock market bubble?

Apr 20, 2021 · A stock market bubble—also known as an asset bubble or a speculative bubble—is when prices for a stock or an asset rise exponentially over a period of time, well in excess of its intrinsic value....

What are the signs of a stock market crash?

Feb 24, 2022 · A stock market bubble generally refers to a situation where the prices of stocks far exceed their intrinsic or fundamental value. Bubbles are typically driven by investors overcome with optimism...

What does bubbles mean in stock market?

Key Takeaways. A bubble is an economic cycle that is characterized by the rapid escalation of market value, particularly in the price of assets. This fast inflation is followed by a quick decrease in value, or a contraction, that is sometimes referred to as a "crash" or a "bubble burst."

What happens after a stock market bubble?

A range of things can happen when an asset bubble finally bursts, as it always does, eventually. Sometimes the effect can be small, causing losses to only a few, and/or short-lived. At other times, it can trigger a stock market crash, and a general economic recession, or even depression.

How do you know if a stock has bubbles?

Stock market bubbles can occur in two ways.The first type of a market bubble comes when the asset is rapidly expanding. You can often see this with the stock chart rising in a near parabolic fashion.The second type of a market bubble occurs over a prolonged period of time.

How do you invest in a bubble?

That's why it's vital to think long term and invest for the long term. Buy solid companies and then take advantage of downturns and buy them when a bubble bursts....How to avoid losing money when a market bubble burstsAvoid bubble stocks. ... Own stock in non-bubble companies. ... Buy value stocks. ... Buy solid companies.Feb 16, 2022

Should you pull your money out of stock market?

If you pull your money out now and prices surge, you'll miss out on those gains. If you reinvest later, you could end up paying even more if prices have continued to increase. On the other hand, if you wait too long to sell, you could lose money if prices have dropped substantially.Feb 24, 2022

How does an investor behave during bubble?

A bubble is a fast rise in an asset's price followed by a contraction. Bubbles happen when the price is not justified by the asset itself but rather by the over-exuberant behavior of investors. When there are no more investors willing to pay the overinflated price, people panic and sell and the bubble bursts.

What caused the 2000 stock market crash?

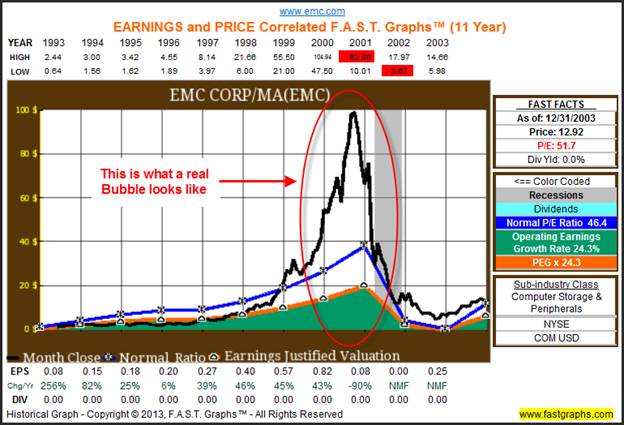

What caused the 2000 stock market crash? The 2000 stock market crash was a direct result of the bursting of the dotcom bubble. It popped when a majority of the technology startups that raised money and went public folded when capital went dry.

WILL IT sector bubble burst soon?

Yes, it is a bubble. But it may last some time since it is part of a global bubble blown by major central banks printing money massively to combat the Covid-induced recession. They aim to keep interest rates close to zero. No policy reversal is imminent, so the bubble is not about to burst.Jan 23, 2021

What is a stock market bubble?

What is the Stock Market Bubble? Stock Market Bubble is the phenomena where the prices of the stock of the companies do not reflect the fundamental position of the company and because of this, there is a divide between the real economy and the financial economy caused either due to irrational exuberance of the market participants ...

Why do stocks bubble?

This is one of the most important reasons that lead to stock market bubbles because this is the reason why the gorge between the financial and real economy widens. When the market participants are not ready to accept the challenges that the real economy is facing and are still buying the stocks of companies that are underperforming in an expectation that they will gain when these companies do well, it leads to inflation in stock prices and creates a bubble.

What happens when the bubble inflates beyond the threshold?

Crash of Market: As explained above, there comes a time when the bubble inflates beyond the threshold, and even a tiny pin poke can burst it, leading to a crash in the market when wealth is eroded completely, stocks lose all their value, and the economy goes into recessions.

Why do stock prices get affected?

The prices of securities traded on the stock market get affected by various reasons such as the introduction of a liberal governmental regulation or expansionary measures undertaken by the central bank of the country, such as the reduction in the policy rate by the federal reserve. Such measures encourage people to take out money ...

What was the most popular bubble in the twentieth century?

One of the most popular bubbles in the history of the twentieth century is the crash of Wall Street in 1929, following which the great depression occurred. This was the time when the NYSE stocks crashed, leading to erosion of wealth for scores of investors; this crash followed the crash in London Stock Exchange and led to the starting of the Great Depression.

What is the Great Financial Crisis of 2007?

, and it implies that the investors are ready to forgo higher interest rates in the future because they want to keep their investments safe, and they have no faith that the economy will do well in the future.

What happens when a bubble pops?

When the bubble “pops,” rates eventually reach a ceiling and then plummet dramatically. Aside from stocks, bubbles can occur in a variety of assets, including real estate, collectibles, commodities, and cryptocurrencies.

What is a big change in the market?

A big change, or a series of changes, impacts how investors think about markets in the early stages of a bubble. This paradigm shift may be caused by a major event or breakthrough that causes people to adjust their expectations for the asset in question, with good intentions.

What happens when the asset price soars?

When the asset’s price soars, the fervor grows ever stronger. People are more motivated by enthusiasm than sound justification for the massive price increase during the peak euphoria stage. And, since new investors are eager to join, there’s a feeling that someone will always be able to pay more for the asset.

Is the price increase too good to be true?

Inevitably, the price increase proves to be too good to be true. Booms are followed by busts, and as the bubble reaches the profit-taking stage, some people begin selling to lock in profits. The bubble has burst, and those who know the warning signs will profit sooner rather than later.

Is it possible to sell an asset when the bubble hits its panic point?

Although some late-comers to the game may have held out in the past, hoping that an asset’s price will rise again, by the time the bubble hits its panic point, this is no longer a viable option. Instead, the zeal to acquire an asset has given way to a panic to sell it. The price drop wipes out profits rapidly and promotes more panic-driven selling.

What is a Bubble in the Stock Market?

In the stock market, trade, or economics, “bubble” is usually not the word anyone would want to hear. The term bubble generates fear among traders and investors as it can destroy wealth and even cause a market crash. A bubble can form in the stock market when investors push stock prices to the moon and assets become highly overvalued.

How to Identify if the Market is Overvalued and in a Bubble?

The stock market can either be overvalued or undervalued. When the demand for a particular asset increases rapidly, it creates a bubble and soon becomes overvalued. When investors invest in these assets; which are in high demand, they usually do so bearing in mind that they would be sold at a profitable price.

Steps to Identify a Bubble in the Market

There are several ways investors and traders can identify bubbles in the stock market. It is important to identify these bubbles to know when to make an investment and when to exit them. The following steps can help you identify a bubble in the market:

Stages of a Bubble

Identifying the different stages of a bubble are important as they allow you to adjust and rebalance your investments accordingly. These stages can easily be identified with a bit of careful analysis and research.

Types of Asset Bubbles

There are several different kinds of bubbles. However, bubbles are classified based on the kind of assets that witness an increase in their value over time. When an asset bubble bursts, it usually becomes weaker on an average recovery. There are, however, significant differences in the effect of these bubbles.

How to Avoid Getting Trapped in a Bubble

Getting trapped in a bubble and losing all your hard-earned money is something you should avoid at all costs. However, it is not enough to only identify a bubble at an early or late stage. As an investor, you need to protect your investments from these bubbles to avoid wealth destruction and losses.

Conclusion

Market bubbles are also referred to as asset or speculative bubbles. These bubbles can occur in all kinds of assets and are usually a result of excessive speculation and greed amongst market participants. This often leads to irrational exuberance which shows a collective excitement among investors and traders.

What Is a Stock Market Bubble?

Market bubbles–when prices become extremely detached from an asset’s fundamental value–tend to be a fixation for stock investors.

Five Stages of a Market Bubble

Modern-day investors and market observers typically categorize market bubbles based on the principles of Hyman P. Minsky, a 20th century economist whose financial-instability hypothesis became widely cited after the 2008 financial crisis.

The Takeaway

One of the prevailing beliefs in the financial world is that markets are efficient. This means that asset prices have already accounted for all the information available. But market bubbles show that sometimes actors can discount or misread signs that asset values have become inflated.

What is bubble in economics?

– In the economic context, a bubble is when the price for something – a stock, financial asset class or even the entire market is grossly overpriced compared to its fundamental value.

What is the third stage of the stock market bubble?

The third stage in a stock market bubble is exuberance. Right now, using the bubble model, it appears we are in this stage, maybe even the tail-end. In this stage, there is an unsustainable euphoria. People claim that certain stocks will 10x with no risk.

What is the first stage of a bubble?

The first stage of a bubble is displacement. Displacement occurs when investors and speculators become entranced by new technologies and paradigms. Say, for example, bitcoin or historically low or rock-bottom interest rates we are currently experiencing. In turn, the value of assets starts increasing here as the seeds for the bubble begin to sow.

What is the second stage of the investment boom?

The second stage is take-off. Interest in investing begins to increase as more and more people start to enter the market. Consequently, because of the demand, the price of assets start to gain momentum, setting up the boom.

Explanation

How Does It Work?

- Following are the steps of the eruption and inflation of the stock market bubble: You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked For eg: Source: Stock Market Bubble(wallstreetmojo.com) The above image shows the steps in the bubble formation process…

Example of The Stock Market Bubble

- One of the most popular bubbles in the history of the twentieth century is the crash of Wall Street in 1929, following which the great depression occurred. This was when the NYSE stocks crashed, le...

- WWI had just ended, and there was over-optimism in the population, which was migrating to urban areas to find high-paying work in the industrial expansion. There was very high specula…

- One of the most popular bubbles in the history of the twentieth century is the crash of Wall Street in 1929, following which the great depression occurred. This was when the NYSE stocks crashed, le...

- WWI had just ended, and there was over-optimism in the population, which was migrating to urban areas to find high-paying work in the industrial expansion. There was very high speculation, leading...

- Bankers gave easy credit that fundamentals couldn’t back. The Dow Jones industrial average was still climbing greater heights. These were signals that the bubble had inflated way too much and would...

Consequences of Stock Market Bubble

- Crash of Market:As explained above, there comes a time when the bubble inflates beyond the threshold, and even a tiny pin poke can burst it, leading to a crash in the market when wealth is eroded c...

- Recession: As the market crashes, it becomes explicit that the economy has not been doing well for a while, and therefore, recession sets in, people get laid off, and austerity measures s…

- Crash of Market:As explained above, there comes a time when the bubble inflates beyond the threshold, and even a tiny pin poke can burst it, leading to a crash in the market when wealth is eroded c...

- Recession: As the market crashes, it becomes explicit that the economy has not been doing well for a while, and therefore, recession sets in, people get laid off, and austerity measures set in. It...

- Widespread Discontent: When the economy doesn’t do well, people’s savings get eaten up, and the future starts looking bleak, people lose hope and motivation leading to instability in the economy.

How to Spot Stock Market Bubble?

- Yield curve analysisYield Curve AnalysisA yield curve is a plot of bond yields of a particular issuer on the vertical axis (Y-axis) against various tenors/maturities on the horizontal axis (X-axis). The slope of the yield curve provides an estimate of expected interest rate fluctuations in the future and the level of economic activity.read more is a popular tool for analyzing the economic situati…

Conclusion

- We can say that the market participants need to be aware of the sector’s performance before increasing their investments in any sector. Suppose the divide between the financial and real economy is not taken care of promptly. In that case, a bubble is inevitable, and so is a crash because once the bubble is too large, no monetary or fiscal measures can stop it from bursting.

Recommended Articles

- This article has guided what Stock Market Bubble and its definition is. Here we discuss how to spot the stock market bubble and an example, chart, and causes. You can learn more about it from the following articles – 1. Stock Market Books 2. Equity Market 3. Black Tuesday 4. Boom and Bust Cycles