If the stock reaches a value of zero, trading can cease and the company can continue to operate as a privately held company, or the company may file for bankruptcy. A company's stock reaching zero value does not mean that the company must file for bankruptcy.

What happens when a stock price drops to zero?

Will I Owe Money If My Stock Goes Below Zero?

- Stock Price Basics. By holding shares of common stock in a publicly traded company, you own a portion of the common equity in that company.

- The Corporate Shield. ...

- Delisting and Bankruptcy. ...

- Margin Calls. ...

What happens when a stock falls under $1?

One of the listing requirements these exchanges share is that if a company's stock price falls below $1 per share for 30 consecutive business days, it will receive a notice from the exchange stating that the company has six months to remedy the situation. If the shares continue to lose value, the company eventually will be delisted entirely.

What happens when an OTC stock is halted?

When a trading halt is implemented, the listing exchange notifies the market that trading is not allowed in that stock. Other U.S. markets trading the stock must observe the trading halt as well. While the halt is in effect, brokers are prohibited from publishing quotations or indications of interest and from trading the stock.

What happens when you short a stock?

Key Takeaways

- Shorting stocks is a way to profit from falling stock prices.

- A fundamental problem with short selling is the potential for unlimited losses.

- Shorting is typically done using margin and these margin loans come with interest charges, which you have pay for as long as the position is in place.

What Makes a Stock Go to Zero?

The foundation of the free market economy is supply and demand. A business thrives when it manufactures something that people want, and those people buy it. If the business continues to do that successfully, it grows and becomes more valuable.

What Happens to the Company When Their Stock Goes to Zero?

Most big corporations are fairly immune to standard stock market fluctuations. It doesn’t really matter to Amazon if their stock price drops $100 in one day. For one thing, they’re currently worth over $3,200 a share. For another, they’re earning over $600 million a day.

What Happens to Shareholders When a Stock Hits Zero?

So, let’s say the public startup you invested in a few months or years ago goes belly-up and loses all its value. Its stock price hits zero. What happens to you?

How to Avoid Heavy Losses When a Stock Goes to Zero

A stock hitting zero value is an extremely rare event. Chances are, if you have a nicely diversified portfolio and have a healthy number of bedrock, dependable stocks, you really don’t have too much to fear in that department.

Gorilla Trades: Keeping Your Head Above Water

Gorilla Trades helps our customers do more than stay afloat in times of economic uncertainty. We don’t just provide data-centric stock picks — we identify the precise points to enter and exit positions to reap maximum profits. Sign up for a free trial to find out more.

What happens when a stock hovers at a zero level?

In some cases, if a company's stock hovers at a zero level, speculative investors will offer to buy shares at extremely low prices , such as a thousandth of a penny per share. These investors are hoping that when the company returns to profitability or re-issues new common shares, it will perhaps compensate the previous class of equity shareholders.

Which stock exchanges have listing requirements?

By Robert Shaftoe. Public stock exchanges such as the New York Stock Exchange and Nasdaq have listing requirements that companies must meet in order for their stock to continue trading publicly.

Do stocks move in the same direction?

Common stocks tend to move in the same general direction as the overall market. The degree to which a company's stock moves in tandem with the overall market is measured by beta.

Can you trade stocks over the counter?

Eventually, as the stock's market value falls below a certain threshold, it only can be traded over-the-counter, through informal networks of broker-dealers willing to buy and sell stocks in companies with no listing requirements, and those that are not required to disclose financial information.

What happens if a stock reaches zero?

If the stock reaches a value of zero, trading can cease and the company can continue to operate as a privately held company, or the company may file for bankruptcy. A company's stock reaching zero value does not mean that the company must file for bankruptcy.

What happens if you short sell a stock and it goes to zero?

This is just one of the many risks investors bare in the market. If you’re short selling a stock and it goes to zero, you’d probably be dancing and cheering. However, it is highly unlikely that a stock will go to zero. If the company is still making money people will buy the stock.

What does zero equity mean?

Zero equity means the debt holders claim the assets completely leaving nothing for equity holders. From a stock exchange perspective the shares will likely get delisted well before shares actually get to zero. 49.1K views.

What does it mean when a stock vale drops to zero?

If the stock vale drops to zero it means the equity value of the company is zero. Equity = Assets - Liabilities. So if the equity is zero, either liabilities are greater than assets therefore company is bankrupt or assets have shrunk and cannot maintain liabilities. The company will still have staff, plant and machinery, ...

What happens when a company goes bust?

If a company goes bust the debts are paid off based on the level of claim to the company assets. What usually happens is that any back taxes are taken out first, then different grades of creditor get a percentage of their money. If there’s anything left over the stock holders get a share of it.

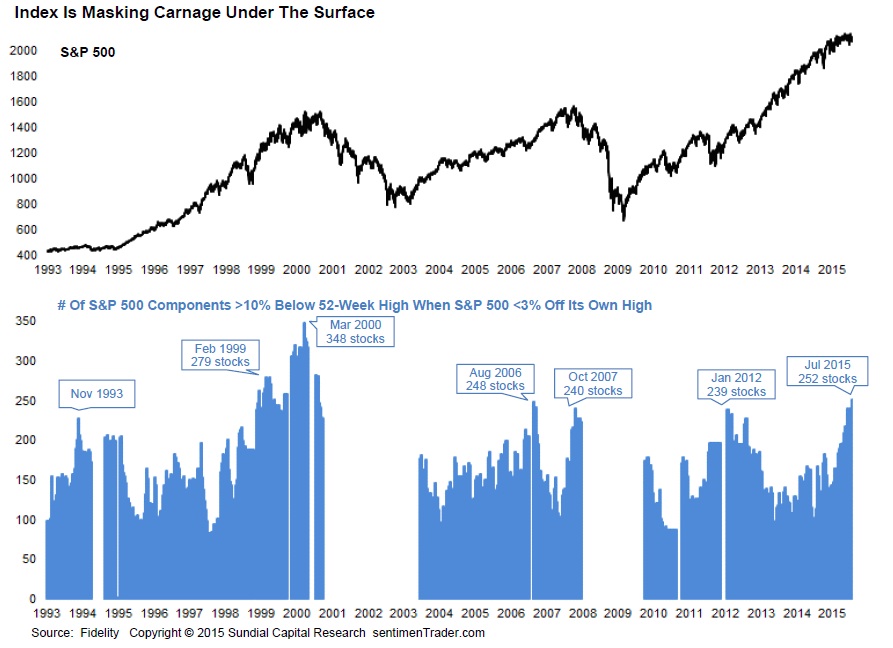

What happens to a stock when demand sinks?

If a stock's demand sinks dramatically, it will lose much (if not all) of its value. The main factor determining the demand for a stock is the quality of the company itself. If the company is fundamentally strong, that is, if it is generating positive income, its stock is less likely to lose value.

Why are stocks worthless?

Common reasons include operating problems, product availability, delivery or quality issues and, of course, mismanagement. When a stock's value falls to zero, many of the major exchanges will delist the particular security in question.

What happens if a stock price falls to zero?

If a stock price falls to zero, you lose all of your investment in the company. However, stock prices don't usually fall to zero even if the company goes bankrupt. The company still has some value. One example of a stock that has fallen to almost zero is Helios and Matheson Analytics.

What is reverse stock split?

In a reverse stock split, the company lowers its outstanding shares by consolidating them. In June, Office Depot announced a reverse stock split. In 2019, Blue Apron also announced a reverse stock split. In contrast, companies with high stock prices split them to increase liquidity.

When did Amazon split its stock?

Many people think that even Amazon should split its stock. The last time Amazon split its stock was in 1999.

Can a stock go negative?

The simple answer to whether the stock price of a listed company can go negative is no. It's based on the concept of limited liability. Your liability can't be higher than your invested amount. However, a stock’s book value can be negative. There are many examples where a company's book value goes negative as accumulated losses surpass ...

What happens if a stock drops to zero?

A drop in price to zero means the investor loses his or her entire investment – a return of -100%.

How does supply and demand affect stock price?

Supply and demand determine the value of a stock, with higher demand driving the price higher in turn. Lower demand causes a stock to lose some value—and plummeting demand could cause it to lose all value.

What happens if demand is high?

If a lot of people don't want a stock (demand is low), then the price will fall. If a stock's demand sinks dramatically, it will lose much (if not all) of its value.

Can a stock lose its value?

To summarize, yes, a stock can lose its entire value. However, depending on the investor's position, the drop to worthlessness can be either good (short positions) or bad (long positions).

Is a loss in a stock arbitrary?

So, although stocks carry some risk, it would not be accurate to say that a loss in a stock's value is completely arbitrary. There are other factors that drive supply and demand for companies.