What does it mean to 'short' a stock?

Shorting stock, also known as "short selling," involves the sale of stock that the seller does not own or has taken on loan from a broker. 1 Investors who short stock must be willing to take on the risk that their gamble might not work. Short stock trades occur because sellers believe a stock's price is headed downward.

What is shorting a stock mean?

What Does the Term Shorting a Stock Mean?

- Shorting Basics. If a stock currently trades at $52 per share and you believe the price has peaked, you may want to short it to profit when the price falls.

- Margin Requirements. When you short-sell, you incur a liability with the broker from whom you borrow shares. ...

- Short Sale Market Risks. ...

- Additional Short Sale Risks. ...

How to short a stock?

The company’s revenue is forecast to drop by -2.40% over what it did in 2021. A company’s earnings reviews provide a brief indication of a stock’s direction in the short term, where in the case of Banco Santander S.A. No upward and no downward ...

What does short selling stocks mean?

Worked example of a loss-making short sale

- A short seller borrows 100 shares of ACME Inc., and sells them for a total of $1,000.

- Subsequently, the price of the shares rises to $25 per share.

- Short seller is required to return the shares, and is compelled to buy 100 shares of ACME Inc. ...

What happens to stock price when it is shorted?

Short sellers are wagering that the stock they are short selling will drop in price. If the stock does drop after selling, the short seller buys it back at a lower price and returns it to the lender. The difference between the sell price and the buy price is the short seller's profit.

Do shorted stocks go up?

A short squeeze is when a heavily shorted stock begins to rise in price due to buyers rushing in to purchase shares. This might force the short sellers to cover their positions or face a margin call. The buying of the short sellers can exasperate the popularity of the stock and cause it to rise even further.

How high can a shorted stock go?

If you short a stock at $10, it can't go lower than zero, so you can't make more than $10 per share on the trade. But there's no ceiling on the stock. You can sell it at $10 and then be forced to buy it back at $20 … or $200 … or $2 million. There is no theoretical limit on how high a stock can go.

How do shorts manipulate a stock?

A short seller, who profits by buying the shares to cover her short position at lower prices than the selling prices, can drive the price of a stock lower by selling short a larger number of shares.

Does short selling hurt a company?

It is widely agreed that excessive short sale activity can cause sudden price declines, which can undermine investor confidence, depress the market value of a company's shares and make it more difficult for that company to raise capital, expand and create jobs.

When should I sell my short squeeze?

A short interest ratio of five or better is a good indicator that short sellers might panic, and this may be a good time to try to trade a potential short squeeze.

What was the biggest short squeeze in history?

What Was the Bigggest Short Squeeze in History? The biggest short squeeze in history happened to Volkswagen stock in 2008. Although the auto maker's prospects seemed dismal, the company's outlook suddenly reversed when Porsche revealed a controlling stake.

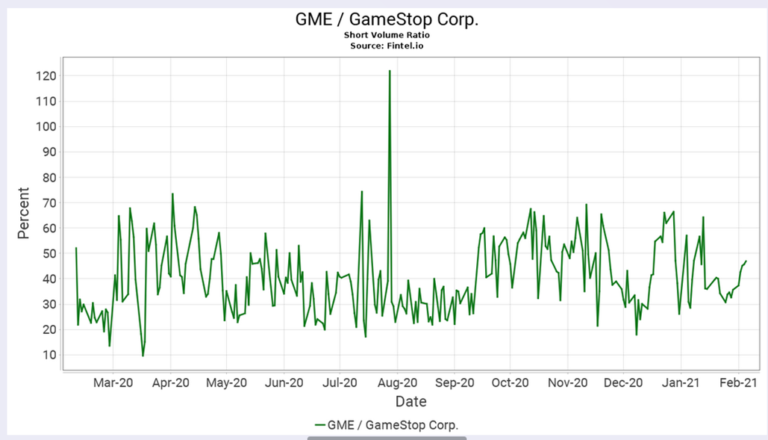

Is the GME short squeeze real?

GME Is Still Heavily Shorted, A Squeeze Could Be Imminent To sum up, and to repeat what we've said in many of our GME articles over the past few months, short sellers are still playing with fire. And they know it. GameStop's short interest is currently at 21% of its float, with about 14.13 million shares being shorted.

What happens when you sell a stock short?

Selling a stock short is essentially a bet that the stock will go down. If it goes up, the short seller loses money. Interestingly enough, most investments limit your loss the amount of your investment. In a short sale the amount you can lose is limited only by how high the stock goes.

What does shorting a stock mean?

Shorting a stock requires that you borrow shares from someone else and sell them. You have entered into a debt agreement whereby you agree to provide shares to the lender at some point in the future.

What is a short sale strategy?

In a short sale the amount you can lose is limited only by how high the stock goes. A speculative strategy that preys on mindless short sellers involves watching the short interest. When the short interest is excessive, buy the stock aggressively. In doing so the strategy is making three assumptions:

What happens if you lose all your collateral?

If your loss manages to use up all the collateral anyway, the Firm will try to collect it by suing you. This doesn’t happen much because brokerage firms have been doing this kind of thing for a hundred years.

What happens if a short goes up?

If it goes up, the short seller loses money. Interestingly enough, most investments limit your loss the amount of your investment. In a short sale the amount you can lose is limited only by how high the stock goes. A speculative strategy that preys on mindless short sellers involves watching the short interest. When th.

What happens if you owe more than 10 dollars?

In other words, if you owe $10 more, you have lost $10.

What happens if you don't buy shares?

If you can’t purchase them now, they’d probably assess damages based on the value of the shares and setup payments or something until the plaintiff gets their money. Promoted by Masterworks.

What happens when you short a stock?

When you short a stock, you expose yourself to a large financial risk. One famous example of losing money due to shorting a stock is the Northern Pacific Corner of 1901. Shares of the Northern Pacific Railroad shot up to $1,000.

How does shorting stock work?

How Shorting Stock Works. Usually, when you short stock, you are trading shares that you do not own. For example, if you think the price of a stock is overvalued, you may decide to borrow 10 shares of ABC stock from your broker. If you sell them at $50 each, you can pocket $500 in cash.

Why Sell Short?

Usually, you would short stock because you believe a stock's price is headed downward. The idea is that if you sell the stock today, you'll be able to buy it back at a lower price in the near future.

How Is Short Selling Different From Regular Investing?

Shorting a stock has its own set of rules, which are different from regular stock investing, including a rule designed to restrict short selling from further driving down the price of a stock that has dropped more than 10% in one day, compared to the previous day's closing price. 4

How to profit from a stock decline?

Two of the most common ways to profit from a stock's decline without shorting are options and inverse ETFs. Buying a put option gives you the right to sell a stock at a given "strike price," so the buyer hopes the stock goes down and they can make more money by selling at the strike price. Inverse ETFs contain swaps and contracts that effectively replicate a short position. For example, SQQQ is an inverse ETF that moves in the opposite direction of QQQ. If you believe the price of QQQ shares will go down, then shorting QQQ, buying a put option on QQQ, and buying shares in SQQQ will all allow you to profit from a move down.

What happens if you buy 10 shares of a stock for $250?

If the price of the stock goes down to $25 per share, you can buy the 10 shares again for only $250. Your total profit would be $250: the $500 profit you made at first, minus the $250 you spend to buy the shares back. But if the stock goes up above the $50 price, you'll lose money.

Why did the richest man go bankrupt?

Some of the wealthiest men in the United States went bankrupt as they tried to repurchase shares and return them to the lenders from whom they had borrowed them. 2. If you want to sell stock short, do not assume you'll always be able to repurchase it whenever you want, at a price you want. Stock prices can be volatile .

Why do people short sell stocks?

The motivation behind short selling stocks is that the investor makes money when the stock price falls in value. This is the opposite of the "normal" process, in which the investor buys a stock with the idea that it will rise in price and be sold at a profit.

What is short selling in stocks?

If you've ever lost money on a stock, you've probably wondered if there's a way to make money when stocks fall. There is, and it's called short selling. Even though it seems to be the perfect strategy for capitalizing on declining stock prices, it comes with even more risk than buying stocks the traditional way.

What is shorting a company?

Shorting is typically done using margin and these margin loans come with interest charges, which you have pay for as long as the position is in place. With shorting, no matter how bad a company's prospects may be, there are several events that could cause a sudden reversal of fortunes.

What is the problem with short selling?

A fundamental problem with short selling is the potential for unlimited losses. When you buy a stock (go long), you can never lose more than your invested capital. Thus, your potential gain, in theory, has no limit.

What is a short sale?

A change in legislation that affects the company or its industry in a positive way. These are just some examples of events that could unfold that could cause the price of the stock to rise, despite the fact that extensive research indicated that the company was a perfect candidate for a short sale.

How long can you hold a short position on a stock?

There's no time limit on how long you can hold a short position on a stock. The problem, however, is that they are typically purchased using margin for at least part of the position. Those margin loans come with interest charges, and you will have to keep paying them for as long as you have your position in place.

How much money can you lose on a short sale?

But if the stock goes up to $100, you'll have to pay $100 to close out the position. There's no limit on how much money you could lose on a short sale.

Why Would a Company Let You Short Its Stock?

A short seller's ability to profit from a company's bankruptcy naturally raises other questions. How are investors able to short stocks in the first place? Don't companies have a duty to maintain value for their shareholders? Shouldn't they be doing something to stop short sellers from bankrupting their company?

How does short selling work?

Understanding the short selling process also helps to explain how it can help markets work more efficiently. When investors short sell stocks, they borrow the shares, sell them on the market, and then collect the proceeds as cash. For example, let's say an investor wants to short sell one share of ABC Bank. That investor can borrow one share of ABC bank for $100 and sell it for $100. The stock then drops to a price of $70. The investor can then buy a share for $70 and return it, netting $30 in the process.

How does a short seller make money?

A short seller makes a profit by borrowing shares, selling them on the market at a specific value, and then repurchasing the shares at a lower price.

Why don't governments ban short selling forever?

Why don't governments ban short selling forever? The main argument is that bears, who believe a stock's price will fall, have useful information to contribute. Short sellers can be particularly helpful in reducing the impact of financial bubbles. By short selling near the top, the short sellers reduce the maximum prices reached when asset prices go too high. Furthermore, short sellers must eventually buy back shares. That creates some buying later on when most investors are afraid to buy. As a result, short sellers can actually reduce losses after a market crash .

Why are short sellers banned?

For example, several EU states temporarily banned short selling during the coronavirus crisis in March 2020.

What happens if you don't buy back a stock?

A short seller who didn't buy back the stock before trading stopped may have to wait until the company is liquidated to take a profit. However, the short seller owes nothing. That is the best possible scenario for a short seller. Eventually, the broker will declare a total loss on the loaned stock. At that point, the broker cancels ...

Why are short sellers important?

Short sellers can be particularly helpful in reducing the impact of financial bubbles. By short selling near the top, the short sellers reduce the maximum prices reached when asset prices go too high. Furthermore, short sellers must eventually buy back shares.

What happens if a shorted stock surges in value?

According to Johnson, if the heavily shorted stock surges in value it’ll be a better windfall than other shares.

Who said fundies who short a stock are usually pretty public about their concerns?

Johnson said fundies who short a stock are usually pretty public about their concerns. Perhaps they’re motivated to speak out in order to push the price down. “You can go and get the report, you can read it, do your own research and work out whether you think they are right or not.”.

What is shorting in 2021?

Shorting is an investment activity that’s usually the domain of professionals and the bane of retail shareholders. Fund managers who short a stock will make money if the price goes down. It’s hardly an endorsement for the company.