When the reverse stock split is effective, every eight shares of GE common stock issued and outstanding or held as treasury

United States Secretary of the Treasury

The secretary of the treasury is the head of the United States Department of the Treasury which is concerned with all financial and monetary matters relating to the federal government, and, until 2003, also included several major federal law enforcement agencies. This position in the feder…

Did GE have a reverse stock split?

Nov 13, 2021 · What General Electric will do The key points of the plan are as follows: GE Healthcare will be spun off in early 2023, with GE retaining a 19.9% stake. The GE Power, GE Renewable Energy, and GE...

When will GE split into 3 companies?

Nov 17, 2021 · Current investors should get shares in the new entities. These spin-offs are not totally unlike what happens when a company splits its …

When was the last time GE stock split?

Nov 09, 2021 · In March of this year it closed the books on GE Capital as a standalone unit with the sale of its aircraft leasing arm. The company expects one …

When is GE reverse split effective date?

Nov 10, 2021 · GE stock is expected to fall immediately after the spin-off, as the assets that now belong to the subsidiary will have been removed from the …

What happens to GE stock when it splits into 3 companies?

Current GE shareholders will likely receive shares in the new GE Health, GE Power and GE itself will become an aviation-only company, at least at first.Nov 23, 2021

What happens to your stock when a company splits?

Stock splits divide a company's shares into more shares, which in turn lowers a share's price and increases the number of shares available. For existing shareholders of that company's stock, this means that they'll receive additional shares for every one share that they already hold.Mar 13, 2022

What is the future of GE stock?

General Electric's shares appear to be poised for a rebound, based on an analysis of the stock's sell-side analyst price targets. The mean consensus target price for GE is $124.71, which is +25% higher than the company's last traded share price of $99.95 as of January 6, 2022.Jan 7, 2022

Does GE have a future?

Big GE Split Caps Long Restructuring In 2024, GE will emerge as an aviation-focused company after a three-way breakup. The American industrial icon plans to spin off its lower-growth health and energy businesses to focus on aviation.Apr 6, 2022

Is it better to buy stock before or after a split?

Each individual stock is now worth $5. If this company pays stock dividends, the dividend amount is also reduced due to the split. So, technically, there's no real advantage of buying shares either before or after the split.

Are stock splits good for shareholders?

Typically, stock splits are neither good nor bad, especially in the long run. When a stock splits, investors usually see an uptick in interest in that stock but everything should settle down in a few days when the fuss is over.Mar 31, 2022

Is GE going out of business?

This morning, CEO Larry Culp announced that GE is going to split into three separate companies. The healthcare unit is going to be spun-off in early 2023, the energy division will be spun-off in early 2024, and the aviation business will be the remaining company.Nov 16, 2021

Why GE shares are falling?

General Electric shares fell after the company reported better-than-expected fourth-quarter earnings and cash flow, while sales missed expectations. Management's financial guidance for 2022 was mixed.Jan 25, 2022

Is GE stock a buy hold or sell?

The Historical Cash Flow Growth is the longer-term (3-5 year annualized) growth rate of the cash flow change....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.93%2Buy18.44%3Hold9.99%4Sell5.61%2 more rows

Is GE still paying a dividend?

-September 10, 2021-The Board of Directors of GE (NYSE: GE) today declared a $0.08 per share dividend on the outstanding common stock of the Company. The dividend is payable October 25, 2021 to shareholders of record at the close of business on September 27, 2021. The ex-dividend date is September 24, 2021.Oct 9, 2021

Is GE stock expected to rise?

Stock Price Forecast The 17 analysts offering 12-month price forecasts for General Electric Co have a median target of 116.00, with a high estimate of 132.00 and a low estimate of 95.00. The median estimate represents a +28.38% increase from the last price of 90.36.

What is the highest GE stock has ever been?

The General Electric Company's stock cost 10.8 U.S. dollars per share in 2020, down from a high of 51.56 U.S. dollars in 1999.Jan 11, 2022

General Electric is splitting into three companies

On Nov. 9, GE announced plans to break up into three public companies focused on healthcare, energy, and aviation, respectively. A tax-free spin-off of the healthcare unit is planned for early 2023.

What will happen to GE stock after the spin-off?

When the GE spin-off happens, existing shareholders of the parent company get equivalent shares in the new company. New investors can buy shares of one or all three companies.

Referenced Symbols

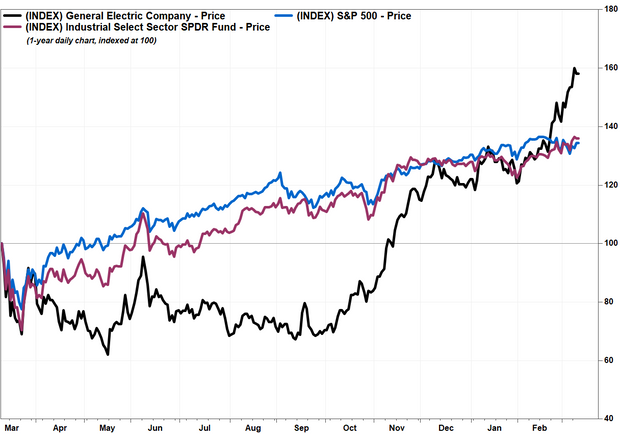

Shares of General Electric Co. GE, +0.70% soared 15.5% in premarket trading Tuesday toward the highest levels seen since January 2018, after the industrial conglomerate announced plans to split up into three publicly traded companies. The company said it plans to spin off its GE Healthcare business in early 2023, with GE retaining a 19.9% stake.

About the Author

Tomi Kilgore is MarketWatch's deputy investing and corporate news editor and is based in New York. You can follow him on Twitter @TomiKilgore.

GE stock split

Unlike a traditional stock split, in which a company increases its number of outstanding shares to make individual shares more affordable, GE is splitting into three unique companies. The company will conduct tax-free spin-offs of the healthcare and energy segments.

GE healthcare spin-off

The move to spin off GE’s healthcare business has been a topic of discussion for the past several years. Now, with the news of the trio of companies, GE says it plans to complete the healthcare spin-off by early 2023.

GE Power

GE’s energy segment will combine GE Renewable Energy, GE Power, and GE Digital into one company. The tax-free spin-off is planned for 2024. Scott Strazik will be the CEO of the newly combined energy business.